BNPL took the world by storm – and regulators have started to notice.

Let’s see what that entails in terms of KYC and AML checks, and how your BNPL company can meet compliance without sacrificing user experience.

What Is KYC and AML for Buy Now Pay Later?

In BNPL, as well as other finance-related sectors, KYC and AML are closely linked to legislation in place to prevent illegal practices on behalf of BNPL customers – including money laundering and terrorism funding.

KYC stands for Know Your Customer. AML stands for Anti Money Laundering.

Both are practices designed by government regulators. They define processes that certain types of businesses must go through in order to:

- verify their customers’ identities so they can be accountable

- ensure the customers aren’t facilitating money laundering

- ensure the customers aren’t partaking in illegal funding, including of terrorism

What makes KYC and AML unique in the world of Buy Now Pay Later companies, is that the regulations are still being developed.

The BNPL craze took the world by storm following the COVID-19 pandemic. The BNPL market is expected to double by 2023, according to Which 50. Regulators were slow to act, which has led to some confusion in the industry.

To make matters worse, BNPL companies are a complex vertical. This kind of business blurs the lines between payment processors, credit providers and fintech, which means that the legal requirements might not necessarily be the most adapted to their day-to-day operations.

Still, every BNPL company can agree that KYC and AML checks aren’t likely to go away.

In fact, BNPL providers are expected to see an increase in the number of checks they will have to perform in the future.

Why Are KYC and AML Important for BNPL?

If you run a BNPL company, you have to stay on top of KYC and AML requirements. It’s not just a matter of preference; it is now a legal requirement.

And while every jurisdiction has its own idea as to what constitutes a proper KYC or AML check, the consequences of not performing them are the same:

- Heavy fines: Regulators impose punishing penalties on companies that do not meet KYC and AML requirements. This is true in every vertical – and BNPL is no different. Some reports go as far as saying that KYC/AML fines in the banking world, for instance, can be more costly than financial crime itself.

- Legal issues: A compliance fine isn’t just costly. It’s also a drain on your legal team. These issues can create a bottleneck for them, which could last weeks or even months.

- Negative PR: KYC and AML fines tend to be noticed by business publications, which means that your company will be seen in a bad light by potential clients, customers, and investors.

- Business risk: In spite of adding friction, KYC and AML checks can actually help you develop safer business practices. By identifying who your users are, you protect yourself against fraudsters. Failing to do so may put your business at risk.

The Risks of BNPL Fraud

BNPL companies deploy as few barriers as possible in the onboarding process. They essentially offer microloans, or a kind of credit card auto-topping, which has proved incredibly popular with Gen-Z users and those with no credit history.

The first issue, however, is that the accounts themselves can be stolen and used like e-wallets. BNPL is a veritable magnet for fraud.

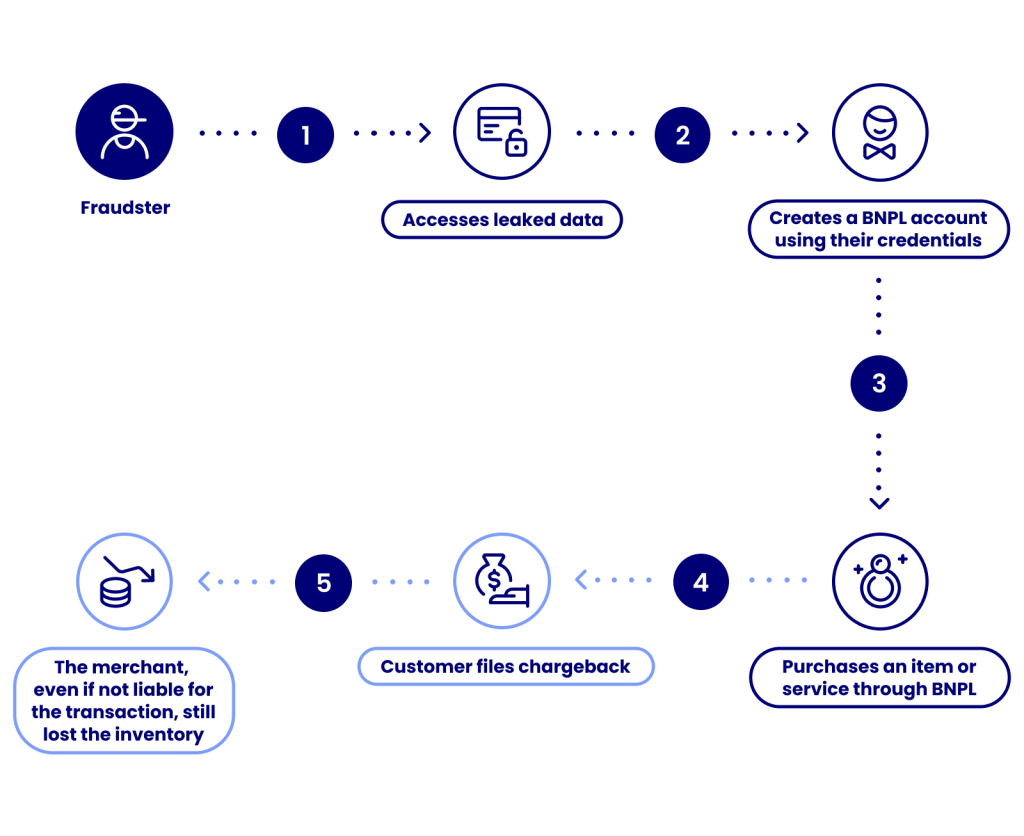

An example of BNPL fraud

At SEON, we have prepared a full guide on BNPL fraud, but the gist of it is that fraudsters can:

- create accounts with stolen identities

- purchase items using stolen credit cards

- leave you at the mercy of chargebacks

- attract the ire of payment processors and merchants – and unhappy cardholders

And more to the point, in the context of KYC and AML, you will be under scrutiny from regulators.

The good news is that combating fraud and meeting legal requirements can both be done with the same tools, if done right. Let’s dive into more detail below.

How to Deploy Better KYC and AML Checks for BNPL

In the world of Buy Now Pay Later, KYC and AML checks are essentially identity verification checks, also known as IDV. The goal is always the same: to get a clearer idea of who’s on your platform – whether it’s to reduce chargeback rates or to improve compliance.

Here is a list of steps you can take today:

1. Create a KYC and AML Checklist

Did you know that not all KYC requirements are the same worldwide? Or that you will need to accept at least a dozen of different kinds of ID documents to operate globally? The way to deal with that logistical headache is to plan well in advance.

Luckily for you, we’ve created two relevant articles with downloadable KYC and AML checklist templates to help you get started:

2. Deploy Identity Verification Software

Identity verification software has plenty of advantages. It can help you meet KYC requirements. It’s automated by a third-party provider. And, if it’s set up the right way, you can scale its use as your BNPL company grows.

However, be aware that not all identity verification software is created equal. Some live video checks, for instance, can be prohibitively costly. Fraudsters, meanwhile, have growing access to deepfake technology, SIM-swapped phones and synthetic identities, allowing them to pass the checks and perform attacks such as synthetic identity fraud.

To make matters worse, you’ll have to carefully consider the issue of friction.

One of the reasons BNPL companies have been so successful is that they manage to remove payment and credit check friction.

A quick onboarding process, few verification steps, and 24/7 access are what make it the payment preference of younger generations and Gen-Z in particular.

Do you really want to sacrifice that UX at the risk of creating churn and sending users toward competitors?

Fortunately, there is a solution, and it comes from digital footprint analysis and dynamic friction.

3. Look at Users’ Digital Footprint to Leverage Dynamic Friction

Dynamic friction is a concept that is perfectly suited for BNPL companies. The idea is simple: You gauge risk and trigger different actions based on educated guesses. The way to guess how risky they are is to look at social and digital signals, what we call a digital footprint.

For instance, a new user downloads your app. SEON’s console tells you that:

- they are using a VPN

- their email address was created recently

- the credit card number points to a pre-paid card

- their phone number is not from the same country as their IP address

- they have never registered for any social networks using this email

All the above are big, red flags. So, do you really want to proceed with expensive KYC checks for this customer?

Everything points to the fact that you are dealing with a fraudster. It’s much more efficient and affordable to simply block the onboarding process for such an individual.

But what if it’s not as clear-cut?

Then you can use a risk score to decide on the next step – for instance, asking for ID verification.

The same risk score can also be a strong signal to spend more time on a manual review or to fine-tune your credit scoring system with alternative credit scoring data.

4. Integrate Real-Time Transaction Monitoring

Transaction monitoring is a key feature of AML. It helps companies flag suspicious transactions, usually by targeting those over a certain threshold.

You can also look at transaction volume and history to try to understand if your user is on a shopping spree or up to something more sinister.

As a BNPL company, for instance, you want to use transaction monitoring software to ensure money launderers aren’t going through your service to hide large purchases made from illegal sources of funds.

5. Understand User Behavior With Velocity Rules and ML

Strictly speaking, velocity rules go above and beyond what you’d expect from simple due diligence. But they could be the key to protecting your business in the long run.

Here’s the idea:

- You gather the data of users on your BNPL platform

- That data is filtered through complex rules, including behavior and velocity checks

- It helps you classify types of behavior (suspicious, legitimate, medium-risk, etc.)

- This allows you to predict more unwanted behavior, refining your KYC and AML processes.

Machine learning, meanwhile, adds another dimension to analysis, by letting artificial intelligence suggest risk rules. A robust fraud scoring engine powered by hundreds of data points can significantly boost your KYC and AML efforts, as we’ll see below.

How SEON Can Augment Your BNPL KYC and AML Checks

SEON is first and foremost a fraud detection solution. But that means that we know how to help you identify your customers.

Whether it’s to understand who you’re dealing with at the onboarding stage, or throughout their actions on your platform, here’s where our features are a perfect fit for BNPL KYC and AML:

- Pre-filter junk users before your checks: If someone is obviously a fraudster, you don’t even need to go through the onboarding process, saving you money and time on KYC and AML checks.

- Augment your KYC with alternative data: SEON is the only fraud detection platform to deliver hundreds of data points related to device, browser, and even social media profiles to help you complete your identity verification.

- Deploy real-time transaction monitoring: SEON lets you immediately flag suspicious transactions based on their amount, volume, frequency increase, etc…

- Refine your KYC and AML strategy with ML: The idea behind deploying machine learning, is simple. You’re creating a system that learns from good and bad KYC and improves over time. Plug the onboarding data into SEON and get suggestions on how to improve your process in the long run.

Best of all, you can deploy it all with complete flexibility. Whether you only need data enrichment modules or a full end-to-end solution, we let you integrate SEON into your BNPL platform however it makes sense for your business.

Partner with SEON to reduce fraud rates in your BNPL and save money with pre-KYC checks and machine learning

Ask an Expert

KYC and AML for BNPL FAQ

Yes. While the success of the BNPL industry took everyone by surprise, regulators have now realized that it could facilitate fraud and money laundering. You now have to meet local KYC and AML checks.

To remain competitive, BNPL companies need to reduce user friction as much as possible. This is why KYC and AML checks would ideally be performed behind the scenes, using alternative data. By deploying data enrichment modules at the onboarding stage, you can learn more about users using a single email address, phone number, or IP address.

AML Transaction monitoring is a key feature of the anti-money laundering process, which ensures you check how much your customers spend. Transaction monitoring software logs large purchases over a certain amount, to decrease the risk of money laundering.

Learn more about:

- SEON: Understanding AML in Banking & How it Works

- SEON: AML Fraud Detection: How to Choose a Solution for Fraud Prevention

- SEON: Top 10 Anti Money Laundering (AML) Software & Tools

Sources

- Which 50: Buy Now Pay Later market to double by 2023: Report

- Fintech Times: Regulatory Fines Can Be More Costly Than Financial Crime Itself Finds Themis