In a world where over 1.4 billion adults remain unbanked and 7.1 million households in the United States lack access to traditional financial services, the challenge of assessing creditworthiness is more pressing than ever. The gap is particularly pronounced in low and middle-income countries, where fewer than 10% of individuals are on file in public credit registries3.

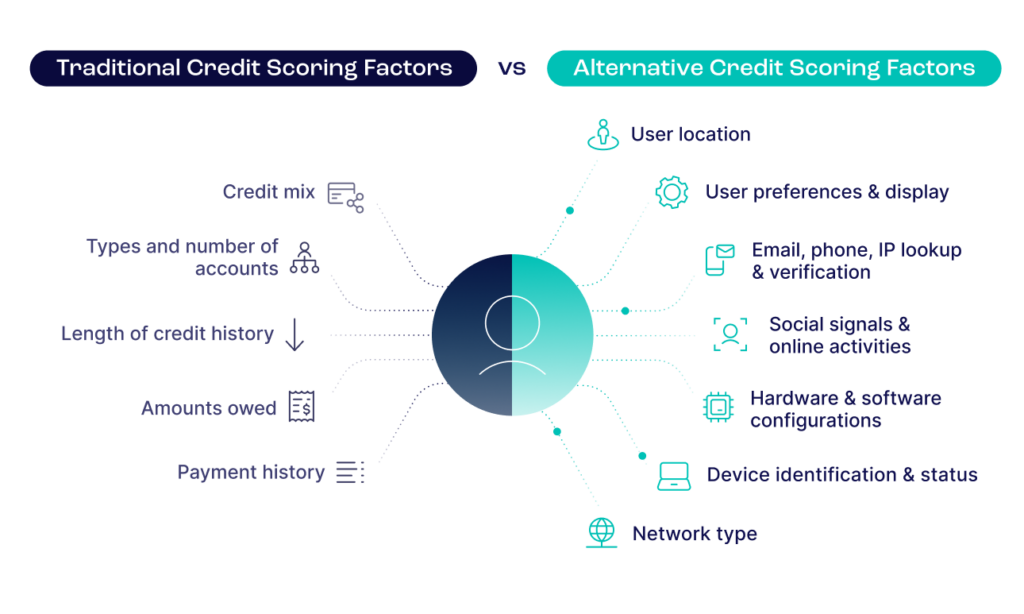

The reliance on conventional credit data to evaluate financial trustworthiness is fraught with limitations, from scarcity to the inability to reflect rapidly changing financial behaviors. Traditional metrics often fail to predict future financial stability, as they hinge on historical data that may no longer be relevant due to swift changes in an individual’s economic circumstances, such as job loss or significant life transitions. The advent of cryptocurrency has also introduced a new layer of complexity and uncertainty in evaluating financial risk.

This context sets the stage for exploring how alternative data can provide deeper insights into creditworthiness, especially for those traditionally underserved by banking institutions.

Using Digital Footprint Data as a Credit Signal

In today’s interconnected world, a physical bank account or traditional credit history is no longer the sole measure of an individual’s financial reliability. Surprisingly, a more universal and accessible indicator exists: digital footprinting. As of January 2024, there were 5.35 billion internet users worldwide, equating to 66% of the global population. Of this number, 5.04 billion are social media users.

Digital footprinting, or digital footprint monitoring or assessment, is the process of gathering and interpreting information from an individual’s online activities and presence alongside a vast array of real-time digital, social and behavioral signals. This approach streamlines customer information verification, aiding financial institutions in examining alternative markers of economic stability and adding a critical layer of fraud prevention that allows organizations to discern genuine, qualifying applicants from ineligible or deceitful ones.

Leveraging a comprehensive view of their customers’ activities online, financial institutions can achieve a new level of precision, agility and accuracy derived from comprehensive insights into a customer’s digital behavior – while minimizing disruption to the user experience.

Leverage digital footprinting to gain a comprehensive view of financial reliability to enhance decision-making.

Speak with an Expert

Most Popular Socials

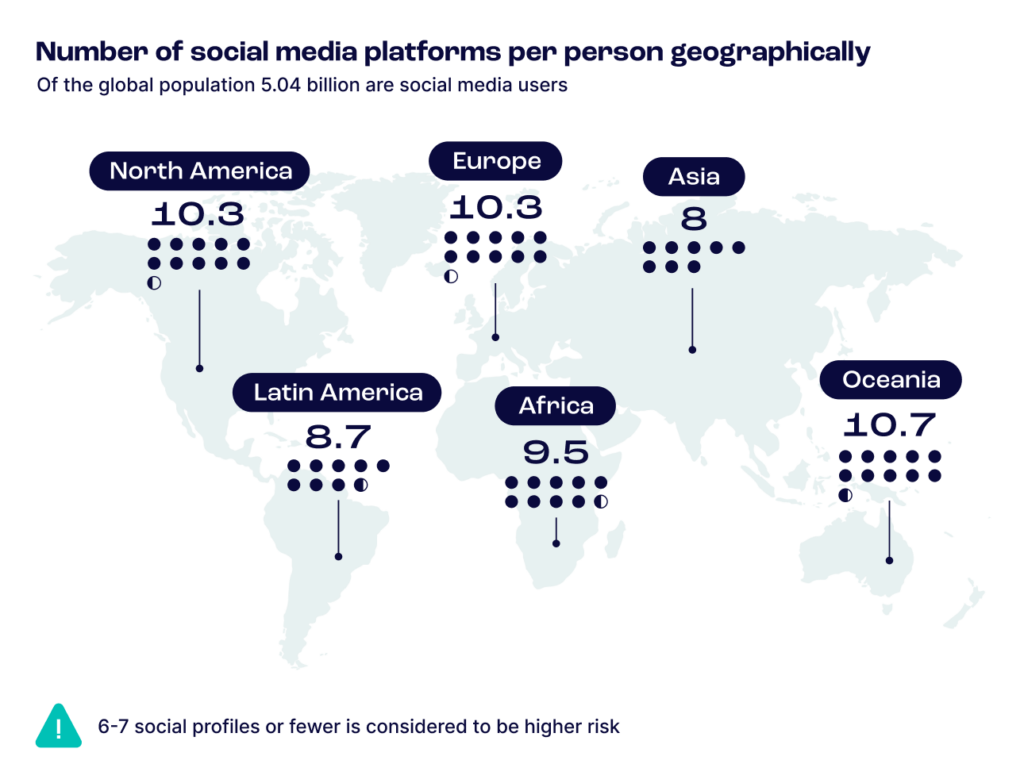

The average person has an email account and a phone number and is connected to digital platforms. To gain a deeper understanding of digital footprinting, let’s look at the average number of social profiles associated with users across various global regions, excluding ubiquitous platforms like Google, Microsoft and Facebook, to focus on more distinctive signals.

In Latin America, for example, the average is 8.7 social profiles per user, while Asia shows a slightly lower average of 8. Africa’s average stands at 9.5, with Europe and North America both at 10.3, and Oceania leading with an average of 10.7. A closer look at the types of platforms reveals regional preferences. For instance, in North America, top platforms include Apple, Amazon and Spotify, while in Africa, users favor Twitter, Instagram and Pinterest. Asia shows a diverse range, with Instagram, Pinterest and Apple being prominent. Such variations offer insights into regional digital behaviors and preferences. Phone usage also varies, with WhatsApp and Telegram being universally popular, yet each region has unique choices, like Flipkart in Asia and Line in Oceania.

These statistics are not just numbers but indicators of digital engagement and potential risk factors. A significant drop, such as having fewer than 6-7 social profiles or fewer, is considered a higher risk, indicating fewer digital signals. This data helps paint a picture of what to expect from customers in different regions, aiding in the detection of potential fraud and assessing loan default risks. The nuanced understanding of digital footprints across areas and the consideration of individual variables underscores the importance of alternative data for evaluating creditworthiness. It’s a testament to the evolving landscape of financial assessment, where digital presence provides a dynamic and insightful lens into an individual’s financial behavior.

Markers of Financial Stability

Certain digital and social signals can serve as indicators of financial stability, an individual’s potential affordability and economic behaviors. Regular engagements with subscription-based services like Spotify, Disney+ and Netflix suggest a level of disposable income and financial management that aligns with consistent payments. Often shared on platforms like LinkedIn, employment details signal steady income and professional stability.

An affinity for high-value technology brands like Apple and Samsung can indicate an individual’s purchasing power and financial priorities. Additionally, transactions involving services that require Know Your Customer (KYC) checks, such as Airbnb, demonstrate a higher level of financial engagement and responsibility.

Analyzing data across various regions shows that while indicators are prevalent, they exhibit regional nuances. For instance, in Latin America, Spotify and Apple are common among users, suggesting a widespread culture of investing in digital entertainment and high-value technology. Similarly, platforms like Airbnb and LinkedIn are prominent in Europe and North America, highlighting a trend toward services that necessitate financial reliability and professional engagement.

This cross-regional analysis highlights commonalities in financial stability markers and underscores the importance of understanding regional digital behaviors. By recognizing these patterns, financial institutions can better assess individuals’ creditworthiness and financial health across different global markets, enhancing their ability to tailor services and offers to meet nuanced needs.

Discover creditworthiness beyond traditional metrics with alternative data for a more inclusive and precise financial assessment.

Speak with an Expert

Credit Worthiness in a Connected World

In an era where cash-based economies and a lack of traditional credit histories are prevalent, digital footprinting – leaning on social signals and behavioral data – is emerging as an innovative method to not only quantify digital citizenship but to enhance the global financial ecosystem’s resilience. By leveraging various data sources, the financial sector can extend its reach, refine risk assessments, drive innovation, foster financial inclusion and adapt to the changing economic landscape.

A more granular and dynamic understanding of an individual’s financial behavior and position enables financial institutions to customize their services and products more effectively, offering solutions in line with the needs (and risks) associated with each customer – making choices not solely based on past financial actions but on a comprehensive view of a person’s digital life.

Sources: