Have you ever signed up for a service with different accounts? You might have, without noticing, broken their terms and conditions by performing what is known as multi accounting.

Of course, it doesn’t make you a fraudster but those who purposefully create multiple accounts to abuse a system are crossing a fine line between customer benefits and company damage and hence, perpetuating iGaming fraud.

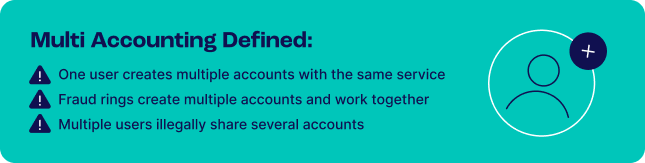

What Is Multi Accounting?

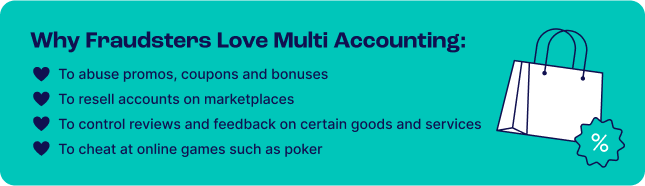

Multi-accounting fraud is a practice that consists of creating or using multiple accounts under different identities on a single platform to manipulate services, evade detection and engage in activities typically prohibited by the terms of service.

In fraudulent scenarios, multi-accounting can be particularly problematic as it allows one individual to control numerous accounts simultaneously, leading to a magnified ability to deceive, scam and disrupt. Multi-accounting can also be used to bypass account-level penalties and restrictions, such as bans or limits imposed by each platform on its single accounts – and as a result, poses significant challenges for online security and fraud detection.

In its most advanced form, this behavior can evolve into more elaborate techniques, where organized fraudsters use emulators, virtual machines and sophisticated proxy services to create seemingly authentic user profiles. This leads to financial losses, distorted platform data and various negative impacts for operators and companies.

SEON helped EZY Gaming prevent multi-accounting by using real-time device intelligence to detect and block fraudulent behavior, including bonus abuse, during sign-up.

Read More

3 Examples of Multi Accounting Fraud

To understand the different faces multi-accounting fraud can take, here are three ways that this type of fraud can manifest:

Promo Abuse:

Also called coupon or bonus abuse, fraudsters create multiple accounts in promo abuse to take advantage of incentives, free trials, coupons and other offers. This activity is driven by the intent to disproportionately benefit from special introductory offers typically designed to be used once per new user to encourage them to try a new service or product.

The process often involves sophisticated tactics to conceal the true identity of the abusers, like using VPNs to mask IP addresses, creating fake email accounts or employing bots to automate sign-ups. Fraudsters who commit promo abuse manipulate offers by registering several times under different identities or through various contact details to sidestep limitations set by the companies. This not only results in undue financial gains for the abusers at the expense of the company but also skews marketing data and can lead to losses in revenue. Additionally, this kind of abuse can undermine the trust of genuine customers and dilute the perceived value of the company’s offering.

Fake Reviews:

Common in ecommerce, online dating and travel industries, fake reviews involve fraudulent activities where individuals or coordinated groups use multiple accounts to generate positive (or sometimes negative) reviews, ratings or feedback to impact the reputation of a product or service. This deceptive practice is intended to manipulate the perceived quality or popularity of an offering.

In ecommerce, fake reviews can make a product appear more reliable or popular than it is, leading to increased sales. In online dating, it may be used to enhance the attractiveness of a profile, increasing its visibility and interactions. Hotels, restaurants and tourist attractions may appear more appealing or less desirable in the travel industry based on manipulated feedback, influencing booking rates and business reputations.

Fraudsters typically create or buy multiple fake accounts or hire individuals to post reviews praising or disparaging competitors’ products. These reviews are crafted to seem authentic, mimicking the language and style of genuine customers to evade detection by both users and platforms’ automated systems. The impact of fake reviews extends beyond misleading consumers; it can distort fair competition, degrade trust in online platforms and result in financial losses for consumers and legitimate businesses.

Affiliate Fraud

Affiliate fraud in the context of multi-accounting is a deceptive practice where individuals or groups exploit affiliate marketing programs by creating multiple accounts. Affiliate marketing involves companies paying commissions to external sites or affiliates for directing traffic or sales through referrals. This fraud typically occurs when fraudsters illegally simulate fake transactions or referrals to claim these commissions.

Common methods include fake transactions where multiple accounts are used to appear as genuine purchases, using stolen credit card details or making actual purchases that are later canceled to generate commissions. Fraudsters may also self-referral, sign up as affiliates, and use other accounts to purchase through their referral links. They may also commit click fraud by generating excessive clicks on affiliate links without intending to make purchases. Some even manipulate tracking systems to inflate commissions unfairly.

The impact of multi-accounting in affiliate fraud is profound, draining financial resources by paying out unwarranted commissions and skewing analytics, leading to inaccurate business insights.

But there’s more; below we’ll look at some examples of multi accounting that are specific to different verticals.

Industries Impacted by Multi Accounting Fraud

The following industries are the most affected when it comes to multi accounting scams:

- Ecommerce: Companies face significant challenges in this sector with multi-account payment fraud and promo abuse. Fraudsters exploit these platforms to initiate chargebacks and abuse discount codes or special offers on a large scale, creating substantial financial burdens for merchants.

- Loan Providers: Online loan providers are particularly vulnerable to fraudsters who use multiple accounts to secure loans fraudulently and disappear without repayment. Similarly, financial institutions must vigilantly prevent these actors from accessing promotional offers or manipulating payment methods for illegal purposes.

- Online Dating: In the social media and online dating world, users will create multiple accounts to reach more people – often to scam or spam users.

- Travel: The travel industry faces challenges from fake bookings and fraudulent reviews, which can be perpetrated by scammers or competitors seeking to damage the reputations of legitimate businesses.

- Gambling / iGaming: Players in digital gaming often create secondary accounts to test strategies without jeopardizing the statistics of their leading accounts – a practice known as smurfing that, while seemingly benign, can destabilize the gaming ecosystem. Other tactics like arbitrage and matched betting involve users, including some high-profile gamblers, opening multiple accounts to unfairly influence game outcomes and betting odds, thereby compromising the fairness and integrity of the platforms.

Solutions for Multi Accounting Fraud

Multi-accounting fraud persists due to the potential for illicit profits by exploiting system vulnerabilities. In response, many companies have begun investing in advanced detection techniques, such as machine learning algorithms capable of analyzing patterns and stricter verification processes to confirm users’ authenticity and feedback.

- Digital Footprinting: By tracking an individual’s digital interactions and online presence, digital footprinting gathers extensive data that includes social and digital indicators, forming a comprehensive social profile from details acquired during initial user onboarding, such as email and phone numbers. This process aids in accurately distinguishing between legitimate and suspicious activities, enhancing the accuracy of fraud prevention measures.

- Device Intelligence: This anti-fraud method analyzes thousands of real-time attributes of hardware and software on desktop and mobile platforms and examines user behavior patterns that may indicate fraud.

- Email analysis: Through data enrichment techniques, this approach involves a detailed examination of email addresses, assessing factors like domain authenticity, registration date, and linkages to social media, which can indicate the legitimacy of a user account. Notably, many fraudsters tend to use newly created emails from free service providers with no history of data breaches.

- IP analysis: Advanced IP analysis extends beyond basic checks to include geolocation services, monitoring VPNs, Tor networks and other methods that mask a user’s actual location, often employed in multi-accounting fraud schemes.

Key Takeaways for Multi Accounting

Multi-accounting is a pervasive problem that poses significant challenges across various sectors. Advanced detection techniques and rigorous verification processes are critical to combat deceptive practices.

Utilizing tools like device intelligence, digital footprinting, IP analysis, email analysis and phone number analysis helps identify and mitigate fraudulent activities. These methods collect and analyze a vast array of real-time data points to distinguish between legitimate users and potential fraudsters, ensuring that platforms can maintain the integrity of their operations and protect genuine customers.

Frequently Asked Questions

There are multiple options to detect multi accounting which you can layer up, some include: cookies, local storage, geolocation and IP address information, device fingerprinting.

Any industry that offers some form of sign up bonus is likely to be a target of multi accounting as well as websites that might ban / blacklist users due to cheating or illegal activities.

Technically the act itself is not illegal, unless using another REAL persons identity, however many businesses will state that multi accounting is a direct violation of their terms and conditions.

Partner with SEON to reduce fraud rates in your business with real time data enrichment and advanced APIs

Ask an Expert

You might also be interested in reading about:

- SEON: How to Prevent iGaming Fraud

- SEON: Online Gambling Fraud: Detection & Prevention

- SEON: Transaction Monitoring in iGaming: How It’s Used to Fight Fraud

Further Reading

Learn more about:

Digital Footprinting | Device Fingerprinting | Fraud Detection Machine Learning | Fraud Detection & Prevention