Fraud Risk Management: How to Implement It and Advanced Technologies

by Bence Jendruszak

The digital frontier is poised for exponential growth as advanced technologies reshape our world with innovation, convenience and efficiency. However, this expansion brings a corresponding need to evolve fraud prevention strategies to keep pace with advancing threats. Traditional anti-fraud methods, like one-time passwords (OTP), static passwords, two-factor authentication (2FA), physical biometrics and security questions, practices that once formed the cornerstone of fraud prevention efforts, now falter under the increasingly sophisticated tactics and emerging technologies being leveraged by cybercriminal and fraudsters today.

Compounding this challenge is the competitive pressure on companies to provide a seamless digital experience. Today’s digital-native generation expects their web and application interactions to be fast, instant and frictionless – setting a high bar for companies to ensure both security and that user experience remains uncompromised. These changes signal a need for a paradigm shift toward a digital-centric fraud prevention approach attuned to a digital-native generation, relying on the contemporary signals of today’s world – digital footprinting.

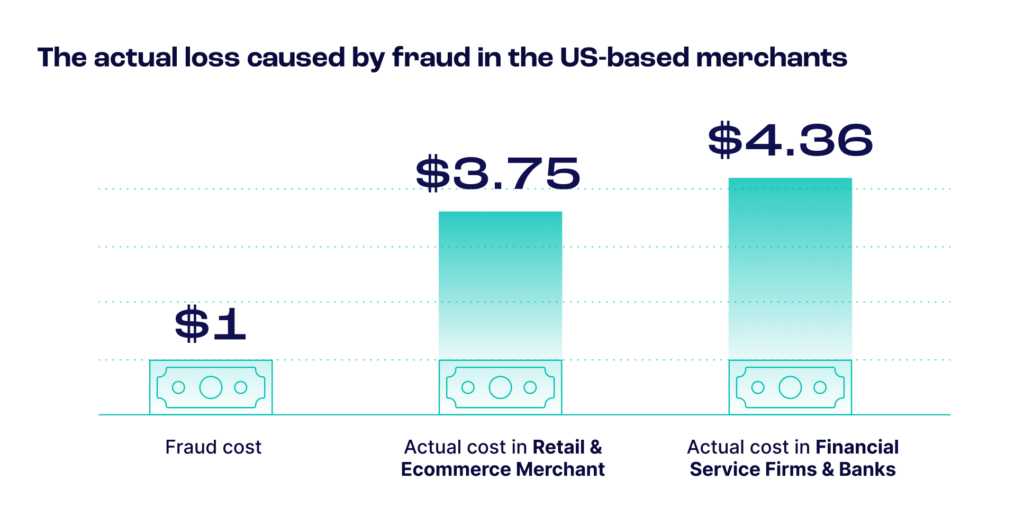

The digital age has ushered in a seismic shift in fraud, marked by increased costs and volume of fraudulent activities. For US-based retail and ecommerce merchants, every dollar lost to fraud now costs $3.75, which climbs to $4.36 for financial service firms and banks. With global fraud expenses soaring to $5.13 trillion annually, reflecting a 56% increase over the past decade, the urgency to address digital fraud has never been more acute.

This escalation is not merely a reflection of economic cycles but a direct consequence of advanced techniques cybercriminals employ to exploit digital vulnerabilities. For example, artificial intelligence (AI), machine learning (ML) and generative tools used alongside advanced data analysis can forge new, difficult-to-detect fraudulent schemes, including AI-based scams like creating synthetic identities, generating false information and sending out large-batch impersonation-based phishing messages. Digital footprint monitoring plays a crucial role in identifying and mitigating such schemes, enabling a proactive approach to fraud prevention.

Fraudsters now have various tools to creatively combine accurate data with manufactured information to avoid suspicion, elude credit monitoring or fly under the radar of human analysts and risk teams. Additionally, the volume, variety and sophistication of fraud attacks can be attributed to modern technology fueling old scams while simultaneously making targeting more individuals online straightforward and lucrative.

As businesses bleed five percent of their annual revenues to fraud, the imperative to reassess and fortify their fraud prevention strategies mounts. The rise in fraud, including the growth of phishing attacks and synthetic identity fraud, demands more than what conventional fraud prevention techniques can offer.

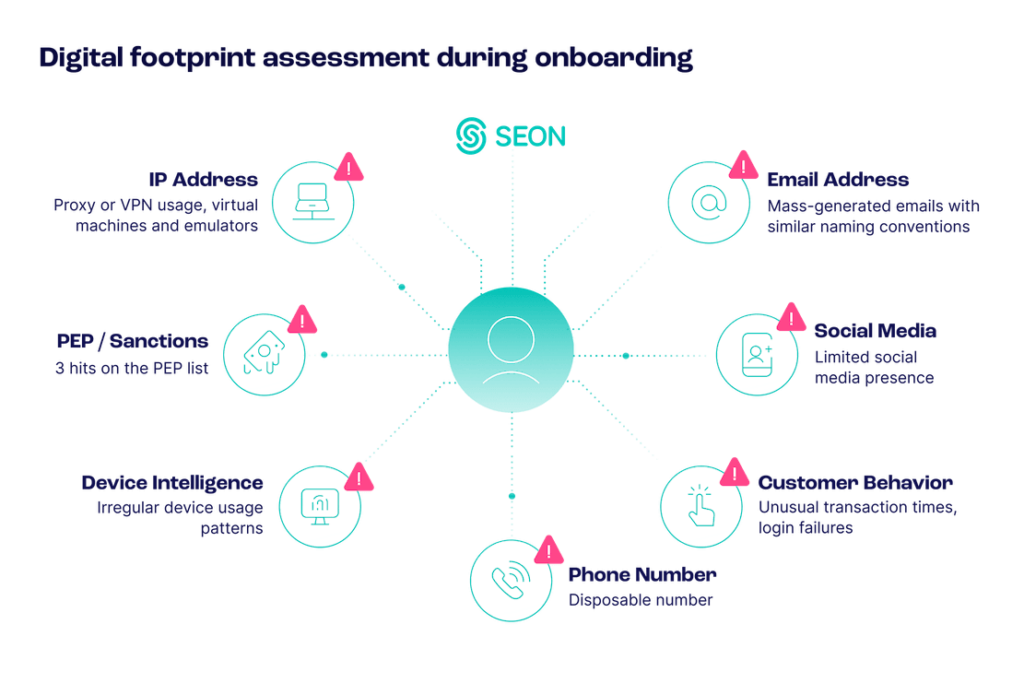

At the heart of this new era of fraud prevention lies digital footprinting, a pivotal solution to these challenges. Digital footprinting involves collecting and analyzing information generated by an individual’s online presence and activities, utilizing real-time data and a broad spectrum of social and digital signals. This layer of fraud prevention enhances the validation of customer details, allowing for more effective and efficient differentiation between legitimate and fraudulent transactions. By conducting a digital footprint assessment, companies can achieve unprecedented accuracy, speed and precision with their fraud prevention, stopping fraud earlier in the journey by leveraging unmatched customer insights without introducing friction.

Transcending traditional verification methods by leveraging the complex web of digital traces that individuals leave online, digital footprinting holds a variety of applications to combat and mitigate fraud. From email and phone lookup to verification, IP lookup to device fingerprinting, digital footprint monitoring is the most comprehensive online identity check, incorporating real-time behavioral data for quicker detection.

For instance, digital footprint assessment during the onboarding process can scrutinize patterns that may indicate fraudulent behavior, such as the use of mass-generated emails with similar naming conventions or the recurrence of shared password hashes among different users – indicators that are often overlooked by conventional systems but are red flags for fraud rings attempting to infiltrate a platform.

Beyond detecting fraud in onboarding circumstances, digital footprinting offers profound insights into risk assessment by facilitating a deeper data-driven understanding of a user’s digital behavior. This enables companies to determine the likelihood of fraudulent intent and to assess the financial affordability of a customer with greater precision. Fraudsters play a game with time, and if access is too hard or not a worthwhile exercise, they’ll move on to defraud a more readily available target. Relying on digital footprinting creates a friction barrier that makes it more difficult for fraudsters to penetrate, forcing them to move on to lower-hanging fruit.

In cash-based countries that do not rely on traditional credit trail histories, leaning on social signals and behavioral data is another way to consider affordability. With over 1.4 billion unbanked adults – and 7.1 million households in the US alone – digital footprinting presents an innovative way to establish the veracity of a customer while rooting out bad actors with as little information as an email address or phone number.

Leverage digital footprinting to combat the rise in fraud and protect your business’s bottom line.

See Solution

Technologies such as AI and ML are essential in effectively utilizing the copious amount of data captured by digital footprint monitoring. These tools – the same ones used to orchestrate more complex fraud schemes – can now be harnessed to detect fraud more quickly, identify patterns with greater accuracy and enhance overall efficacy in the fraud prevention lifecycle.

Blackbox machine learning is common today, referring to the decision-making process where data inputs are processed and outputs generated without revealing the underlying logic or rationale. While blackbox ML can deliver rapid fraud scores, its opaque nature offers little insight into the decision-making process, making refining or adjusting risk thresholds challenging. Conversely, whitebox machine learning provides a transparent and interpretable approach. It delivers decisions and explains the logic behind them and a breakdown of the process followed to reach them. This clarity underpins the ability for fraud prevention measures to be customized to align with the company’s specific risk tolerance, ensuring that security measures do not hinder the user experience.

By integrating blackbox and whitebox ML – an approach championed by SEON – organizations can achieve a balanced approach that prioritizes transparency and adaptability. This dual strategy leverages the power of digital footprinting to fuel a customizable rules engine, enhancing the capacity for real-time analysis and comprehensive decision-making. Such a methodology mitigates the risk of false positives and contextless correlations typically associated with blackbox models and fosters trust and engagement in digital platforms by aligning the imperative for security measures with the modern consumer’s expectation for a seamless digital experience.

The future of fraud prevention is not static; it is a continuous battle against evolving threats. As digital natives produce more robust digital footprints and new technologies emerge in lockstep, fraud prevention solutions must remain agile, adapting to the increasing signals of our digital-first world.

Additional Sources:

Showing all with `` tag

Get anti-fraud and compliance insights and tips from SEONs experts.

Bence Jendruszák is the Chief Operating Officer and co-founder of SEON. Thanks to his leadership, the company received the biggest Series A in Hungarian history in 2021. Bence is passionate about cybersecurity and its overlap with business success. You can find him leading webinars with industry leaders on topics such as iGaming fraud, identity proofing or machine learning (when he’s not brewing questionable coffee for his colleagues).