The world of fraud detection is changing fast, and machine learning (ML) is at the forefront of this transformation. Financial institutions, e-commerce platforms and other industries are turning to ML to tackle fraud more effectively. For instance, ML algorithms have significantly cut down credit card fraud in the financial sector by analyzing transaction patterns and spotting anomalies with remarkable precision. Citibank has slashed phishing attacks by 70% thanks to ML, while Walmart has reduced shoplifting by 25% through real-time video analysis.

In this article, we’ll dive into the benefits and challenges of using machine learning for fraud detection, explain how the technology works, and provide you with essential insights to help protect your business.

What Is Fraud Detection with Machine Learning?

In online fraud detection and prevention, machine learning is a collection of artificial intelligence (AI) algorithms trained with your historical data to suggest risk rules. You can then implement the rules to block or allow certain user actions, such as suspicious logins, identity theft, or fraudulent transactions.

When training the machine learning engine, you must flag previous cases of fraud and non-fraud to avoid false positives and to improve your risk rules’ precision. The longer the algorithms run, the more accurate the rule suggestions will be.

The Difference Between Machine Learning and Artificial Intelligence

The terms AI and machine learning are often used interchangeably. However, while every form of machine learning counts as AI, not every AI uses machine learning.

AI is a bigger concept designed to create machines that simulate human thinking. Machine learning is a subset of AI that allows machines to learn from data without being reprogrammed.

It’s also worth noting that machine learning has its own subset, called deep learning. It employs algorithms and structures modeled after the human brain.

Benefits of Machine Learning for Fraud Detection

Because machines have a much easier job processing a large dataset than humans, what you get is the ability to slice and dice huge amounts of information. That means:

- Faster and more efficient detection: The system gets to quickly identify suspicious patterns and behaviors that might have taken human agents months to establish.

- Reduced manual review time: Similarly, the amount of time spent on manually reviewing information can be drastically reduced when you let machines analyze all the data points for you.

- Better predictions with large datasets: The more data you feed a machine learning engine, the more trained it becomes. That is to say, while large datasets can sometimes make it challenging for humans to find patterns, it’s actually the opposite with an AI-driven system.

- Cost-effective solution: Unlike hiring more RiskOps agents, you only need one machine-learning system to go through all the data you throw at it, regardless of the volume. This is ideal for businesses with seasonal ebbs and flows in traffic, checkouts, or signups. A machine learning system is a great ally to scale up your company without increasing risk management costs drastically at the same time.

Last but not least, algorithms don’t need breaks, holidays, or sleep. Fraud attacks can happen 24/7, but even the best fraud managers might come to work on Monday morning with a backlog of manual reviews. Machines can ease up the process by sorting through the obviously fraudulent or acceptable cases.

According to a whitepaper by computer scientists from the University of Jakarta, machine learning algorithms achieved up to 96% accuracy in reducing fraud for eCommerce businesses.

Discover here how your business can leverage powerful, ML-enhanced fraud detection.

ML Solution

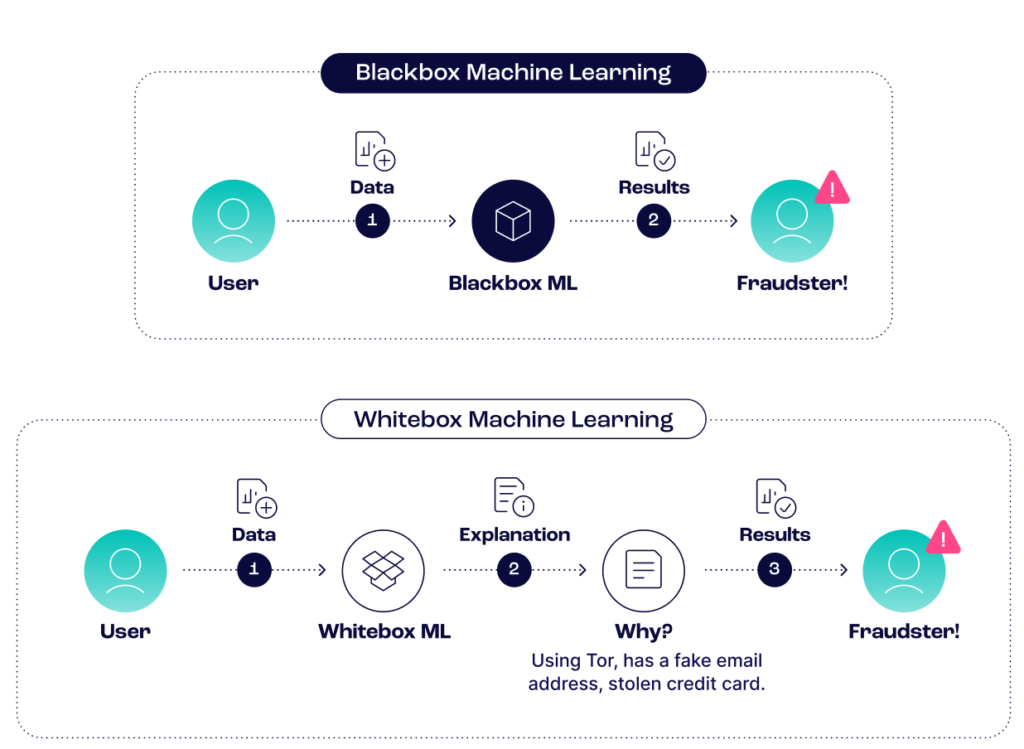

Differences Between Blackbox and Whitebox Machine Learning

While machine learning tends to be a selling point for most fraud prevention vendors, not all solutions are created equal. Notably, there is a key difference between whitebox and blackbox machine learning:

- Blackbox machine learning: The system is designed to work in a “set and forget” mode, where the decisions are opaque and automated. It can be great for small businesses that do not need to dive into the nitty-gritty of tweaking their risk rules.

- Whitebox machine learning: The system will give you clear explanations as to why a risk rule was suggested. This makes it easier to understand where the risk is and gives fraud managers more flexibility to improve their fraud prevention strategy.

Both systems have their pros and cons. However, at SEON, we opted for a whitebox system, which allows risk managers to gain more control over the engine in order to tweak, test, and measure the results of each risk rule.

How to Use Machine Learning for Fraud Prevention

The term machine learning may seem intimidating, but getting started with an algorithmic system is actually straightforward.

In this example, we’ll be looking at reducing transaction fraud (and therefore chargeback costs).

1. Feeding the input data

Every AI or ML system needs data to get started. In this scenario, it will be transaction data such as:

- transaction value

- product SKU

- type of credit card

- etc.

But we’ll also add data relating to how the customers connect to the site:

- IP data

- device type

- VPN, proxy or Tor usage

- etc.

Note that the more data you have to start with, the more accurate your results will be. This is particularly important if your fraud prevention software does not allow custom fields, as you could be missing out on crucial information.

2. Generating the rules

SEON’s machine learning can generate two main types of rules:

- Single parameter rules, also known as heuristic rules: an example of a single parameter rule would be: block if the IP is X.

- Complex rules: including multiple parameters.

Each listed rule shows an accuracy score. You can adjust accuracy thresholds to tighten or loosen triggering conditions.

Note that the rule names are extremely descriptive, allowing you to understand why it was generated at a glance. You can clearly see how all the rules are designed to understand how the customer logged in could affect the transaction value lost to fraud.

3. Reviewing and activating the rule

SEON allows you to filter the rules by any data point, including its type and predicted accuracy. The accuracy part is particularly useful, and it is calculated using a complex confusion matrix.

By default, machine-learning suggestions are switched off. You can quickly enable them using the ON/OFF switch. It’s also possible to manually create and adjust thresholds for the rule to be triggered.

4. Training the algorithm

Providing feedback data is the key to refining rules and getting better accuracy. With SEON, there are two ways to provide feedback and label the actions:

- Via the GUI: a simple, visually-friendly way to mark actions

- Using the Label API: you can mark actions programmatically via API calls

However you do it, the actions should be marked as either APPROVED, REVIEWED, or DECLINED.

The algorithms retrain themselves every day based on the last 180 days worth of data. You can access them at any time in your backend and scoring engine (where you manage all the risk rules).

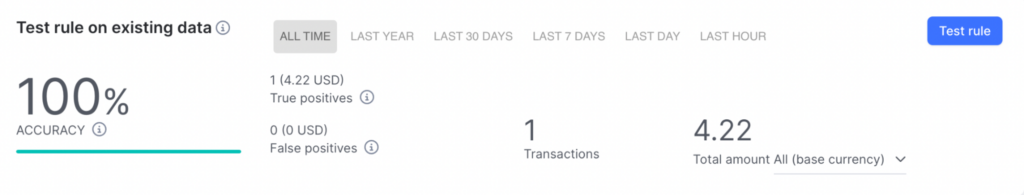

5. Testing rules on historical data

Good fraud prevention software should allow you to revisit past cases to see if the rules would have helped. This is done in a sandbox environment, where you can switch the rules on and off and witness their accuracy in person.

Running a test will create a confusion matrix based on previous transactions over the selected time frame, which highlights the rule’s estimated accuracy rate.

In machine learning, a confusion matrix, or error matrix, is a table layout that visualizes an algorithm’s performance. It allows you to calculate accuracy over a specific date range—selectable from the last hour through to the last year.

In the right hands, this gives fraud managers complete control over their risk strategy, allowing them not only to reduce but also to monitor, test, and tweak results at will.

5 Use Cases of Machine Learning for Fraud Detection

AI-driven fraud prevention is industry-agnostic. It only needs data to work, which is why you’ll find it has been deployed in a variety of verticals such as:

- Retail stores: Analyzing thousands of transactions can be challenging, prompting eCommerce sites to use machine learning to identify unflagged fraudulent transactions. Juniper Research predicts a $50.5B fraud loss for online retailers by 2024. ML systems help identify targeted items, risky shipping information, and questionable card payments to reduce chargebacks.

- Financial institutions: Fintech companies and insurers must meet compliance requirements to avoid fines while processing quickly to stay competitive. Machine learning helps distinguish legitimate users from fraudsters, preventing fraudulent profiles from slipping through.

- iGaming companies: Online gaming platforms must ensure player authenticity and manage high-value rewards. In 2021, online gambling identity fraud increased by 43%. Machine learning detects suspicious behavior, identifying poker bots, cheating players, and low-quality affiliates.

- BNPL: Buy Now Pay Later accounts function like digital wallets, vulnerable to account takeover attacks. Machine learning analyzes login data to enhance user authentication, preventing unauthorized purchases.

- Payment gateways: Payment gateways must quickly process transactions, making manual reviews impractical. Machine learning detects fraudulent transactions, reducing chargeback costs.

Outsourced vs On-Site Machine Learning Fraud Detection

While building machine learning models in-house with a skilled team is possible, it’s important to consider the significant time, effort, and costs involved:

- Talent acquisition costs: Hiring data scientists, engineers, and machine learning specialists is necessary to develop the models.

- Data preparation time: Cleaning and preparing raw data is a time-consuming process, taking up 60 – 80% of the entire timeline from receiving input to suggesting risk rules.

- Benefit of shared data: Outsourced machine learning engines can leverage shared data from multiple clients. While rules aren’t universally applied, vendors can use industry knowledge to develop highly accurate rules that benefit all parties.

- Integration challenges: Integrating machine learning into a risk management strategy can require substantial time and investment.

On the other hand, outsourced machine learning fraud detection leverages shared industry data for better accuracy and offers easier integration.

How SEON’s Machine Learning Is Used Against Fraud and Money Laundering

Embracing a machine learning system for fraud and money laundering prevention offers numerous advantages. However, the goal isn’t always to simply approve or block actions but to equip risk analysts with timely and comprehensive information. There are situations that fall into grey areas where algorithms alone may struggle.

This is where SEON’s whitebox machine learning system excels by suggesting new rules for you to implement based on your historical data. The Scoring Engine, enriched with powerful data capabilities, ensures full transparency, allowing human oversight in decision-making.

SEON’s approach provides transparency that empowers analysts to gain a holistic understanding of issues and their potential solutions. They can refine and test rules using historical data in a controlled environment to optimize outcomes.

In essence, SEON’s fraud prevention platform combines the strengths of AI-driven fraud detection with human intelligence, offering a balanced approach. While machines excel in processing and retaining vast amounts of information, humans bring nuanced decision-making skills. This integration is pivotal in combating online fraudsters effectively.

In summary, SEON advocates for merging insights and machine learning as the optimal fraud detection and AML strategy against malicious online activities.

Discover how we can help you grow your business with whitebox and blackbox AI, custom rules, and granular control.

Speak with an Expert

Frequently Asked Questions

A fraud detection system with machine learning will be able to detect risk based on your historical data. It can then suggest or implement rules to reduce the fraud risk automatically.

Machine learning excels at detecting anomalous behaviors that indicate money laundering. By analyzing transaction amounts, frequency, parties, and timing, it establishes customer baselines and swiftly flags deviations for investigation, enhancing AML compliance. AI strengthens defenses against financial crime and adapts to evolving threats, with its effectiveness and sophistication in transaction monitoring continually advancing.

A blackbox machine learning system is designed to run automatically with little human supervision. A whitebox system, however, offers clearly readable suggestions so that you can accept, update or reject the risk rules it found based on your data.

You might also be interested in reading about:

- SEON: The 6 Best Transaction Monitoring Software & Tools

- SEON: What Is Whitebox Machine Learning?

- SEON: Guide to Fraud Scoring: What Is It and How Does It Work?

Related Source for this article

- Data Preprocessing vs Data Wrangling in Machine Learning Projects

- Juniper Research forecasts a $50.5B loss to fraud for online retailers by 2024

- TransUnion gaming report: 2021 saw a 43% increase in online gambling identity fraud

- GetOnData: The Future Of Security: Impact Of Machine Learning In Fraud Detection