As the global online gambling market continues to surge — projected to reach over $153 billion by 2030 — iGaming operators face intensifying challenges in fraud prevention. With the increasing volume and velocity of digital transactions, fraudsters are evolving rapidly, exploiting any opportunity to disrupt operations, exploit vulnerabilities and launder illicit funds.

According to industry estimates, up to 5% of global digital transactions are suspected to be fraudulent, with risky transaction rates climbing by 14% year-on-year. These trends pose significant threats, not only to profitability but to the regulatory standing and trustworthiness of gaming platforms.To combat this, transaction monitoring has emerged as a vital line of defense. By tracking both monetary and non-monetary activities in real time, from logins and deposits to account changes and withdrawals, operators can uncover suspicious patterns, maintain AML compliance and deliver a secure, responsible gaming experience.

10 Reasons Why Transaction Monitoring is Important in iGaming

Transaction monitoring helps uphold the integrity of their platforms, serving not only as a compliance mechanism but also as a strategic asset for managing the complex risks associated with digital gaming environments:

- Preventing Money Laundering: Transaction monitoring flags behaviors consistent with money laundering, such as rapid deposit and withdrawal cycles or high-frequency low-value transfers. These insights support AML programs and help operators meet regulatory expectations.

- Regulatory Compliance: iGaming companies are required to comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. Effective transaction monitoring enables businesses to detect violations early, avoiding hefty fines and potential license suspensions.

- Fraud Detection: Sophisticated monitoring tools help detect fraud tactics like bonus abuse, multi-accounting and player collusion by analyzing behavior patterns and anomalies across accounts.

- Responsible Gambling: By identifying extreme spending, unusual betting habits or compulsive activity, operators can intervene proactively, promoting safer gambling practices and supporting at-risk players.

- Sanctions Screening: Transaction monitoring ensures platforms remain compliant with international sanctions, blocking transactions from or to blacklisted entities and jurisdictions.

- Improving Security: By monitoring session behavior and login patterns, operators can detect and mitigate threats such as account takeovers and credential stuffing.

- Building Customer Trust: Demonstrating proactive security measures builds player confidence and brand credibility, essential in a crowded, competitive industry.

- Operational Efficiency: Automated transaction monitoring solutions allow compliance teams to focus on the highest-risk cases, reducing manual overhead and speeding up reviews.

- Risk Management: Real-time visibility into transaction flows gives operators a sharper understanding of financial and reputational risk, supporting better strategic decisions.

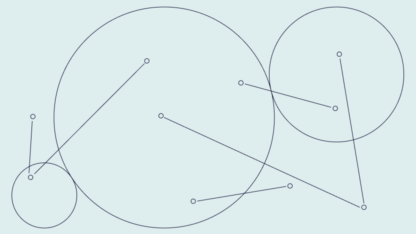

- Identifying Linked Accounts: By connecting transactional and behavioral data points, monitoring tools can reveal hidden links between accounts, uncovering fraud rings or collusion attempts.

Stop bonus abuse, multi-accounting, and account takeovers to turn fraud prevention into your competitive advantage.

See Solution

How Modern iGaming Platforms Monitor Transactions

Today’s iGaming platforms operate across devices and channels, requiring agile, scalable solutions that adapt to emerging threats. This is where AI-driven fraud prevention and behavioral analytics come into play.

By continuously analyzing user actions such as deposit frequency, withdrawal methods and bet sizing, platforms can spot red flags like sudden betting spikes or frequent cashouts. When activity deviates from expected patterns, automated systems trigger alerts, allowing for immediate investigation

Custom rules and thresholds, tailored to the operator’s risk appetite, allow platforms to act quickly without compromising speed or user experience. Crucially, transaction monitoring should integrate seamlessly with AML checks, KYC processes and responsible gambling controls for a unified risk framework.

Balancing Customer Experience and Transaction Monitoring in iGaming

The key to effective transaction monitoring lies in maintaining a delicate balance: preventing fraud and ensuring AML compliance without introducing friction that frustrates users.

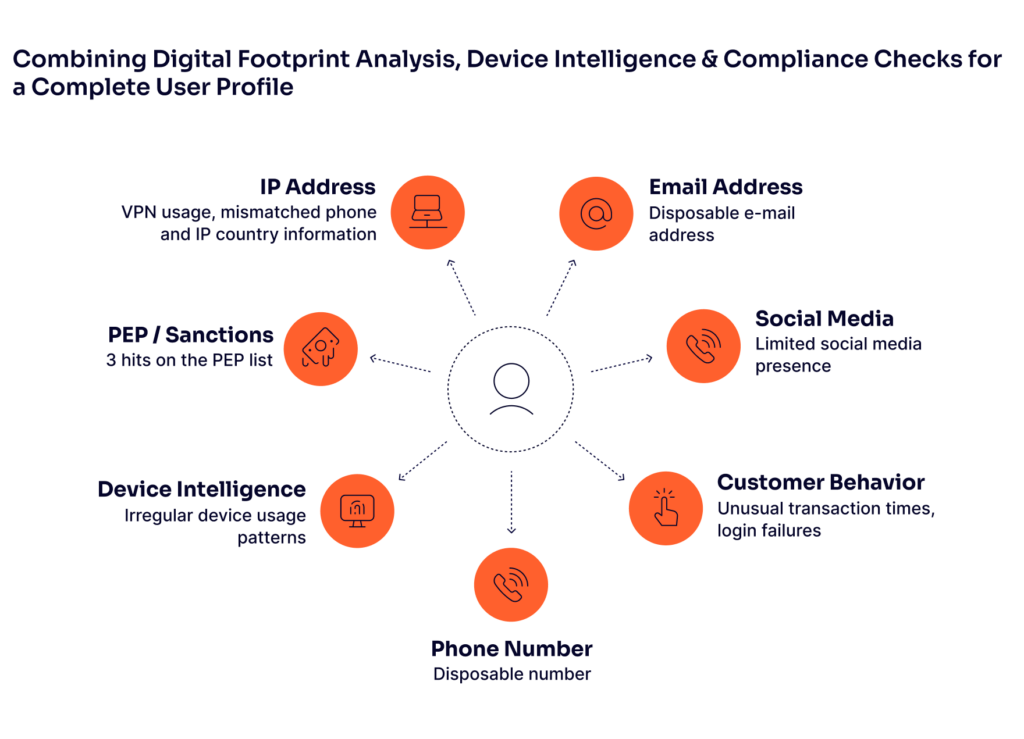

Solutions like device intelligence, digital footprint analysis and pre-KYC risk scoring enable iGaming operators to make intelligent, real-time decisions about user risk. Low-risk users enjoy a smooth onboarding and transaction experience, while high-risk signals prompt escalated checks or manual reviews.

Smart automation and adaptive systems ensure that monitoring is continuous yet unobtrusive, preserving both platform integrity and customer satisfaction.

How SEON Helps iGaming Operators with Transaction Monitoring

SEON equips iGaming operators with real-time, AI-powered transaction monitoring to detect fraud and maintain AML compliance without disrupting the player experience. Our solution analyzes millions of transaction patterns on the fly, using machine learning and customizable rules to flag suspicious behavior such as bonus abuse, account takeovers and money laundering.

By combining behavioral insights, device intelligence and digital footprint analysis, SEON helps operators build accurate risk profiles across the entire player journey from signup to withdrawal. Seamless integration with AML and KYC systems ensures consistent compliance, while reducing false positives and manual reviews.

With SEON, transaction monitoring becomes a proactive, scalable layer of protection, designed not only to stop fraud but to fuel operational efficiency, uphold regulatory integrity, and drive safer, more profitable growth.

Connect with SEON’s iGaming experts to explore how intelligent transaction monitoring can help you stay compliant, reduce risk and protect your platform.

Ask an Expert