How AML Case Management Drives Efficiency in Financial Investigations

Published on May 28, 2024 by Tamas Kadar

The importance of robust fraud prevention and anti-money laundering (AML) solutions in the iGaming sector cannot be overstated. These tools are vital for maintaining platform integrity, financial health and preserving the trust and stability of the digital gaming ecosystem. Despite advancements, considerable untapped potential remains to enhance operational strategies within the industry.

There is an opportunity to boost profitability by refining fraud prevention and AML efforts. Diving into practical, actionable recommendations, we’ll explore strategies to sharpen risk profiling capabilities and leverage innovative technologies to better identify and mitigate potential threats.

Focusing on combating key issues like bonus abuse, multi-accounting, bot activity and affiliate fraud, we’ll examine the attack vectors that can diminish trust and financial stability if they are not addressed efficiently. Then, we’ll explore the intricacies of AML, aiming to equip operators with a comprehensive toolkit to strengthen fraud detection and protection systems while safeguarding player experiences.

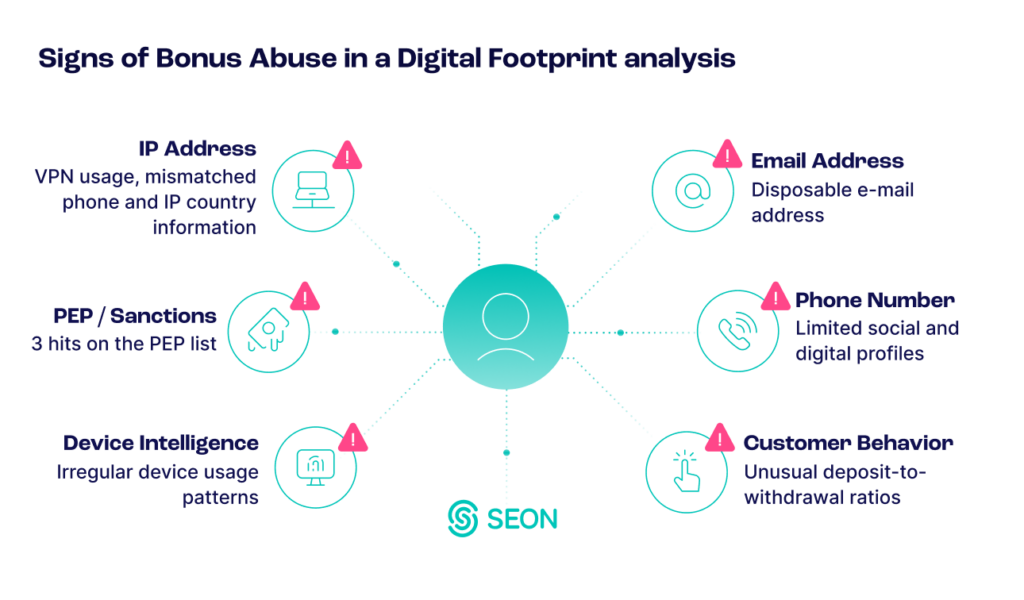

Addressing bonus abuse – a prevalent form of fraud, affects all stages of the player journey, from registration to withdrawals. Operators can counter this by employing digital footprint analysis, which scrutinizes thousands of social signals and data points to detect fake registrations, and leveraging device intelligence. This sophisticated anti-fraud method examines hardware and software configurations and user behaviors. Together, these technologies help to differentiate between legitimate and fraudulent players during onboarding processes.

Using an anti-fraud solution to detect red flags, such as disposable or non-valid email addresses, phone numbers lacking associated social and digital profiles or mismatched phone and IP country information, can result in a clearer understanding of player profiles – helping to root out bonus abuser. Additionally, implementing velocity rules makes it possible to identify payment anomalies and detect irregularities like rapid turnarounds between registration and withdrawal or unusual deposit-to-withdrawal ratios. These red flags serve as valuable indicators for proactively addressing potential bonus abuse instead of reactively, ultimately enhancing the efficacy of signup and retention promotions.

Multi-accounting, the practice in which an individual creates or manages multiple accounts to exploit certain benefits like bypassing restrictions, manipulating rankings or engaging in fraudulent activities, creates financial losses for legitimate users and can undermine the integrity of a platform. Complementing digital footprinting with device intelligence is a surefire way to beat multi-accounting – catching up to 90% more attempts. By integrating proprietary device intelligence, operators can garner actionable insights from user behaviors to detect multi-accounting attempts effortlessly. For example, companies can set up custom rules that help identify multiple registrations with the same IP address and device hash within one day, multiple registrations with the same device within one month, and devices used with different, blacklisted email addresses to weed out multi-accounting.

Distinguishing between profitable and fraudulent affiliates or bots isn’t always straightforward. However, leveraging device intelligence makes detecting suspicious behavior associated with bot activity easier – even when users clear caches, switch browsers or use emulators like FraudFox, Kameleo or AntiDetect.

By complementing signals with the detection of highly similar generated email addresses, operators can add a layer of protection to operations. SEON’s anti-fraud experts have crafted rules to identify and combat bots in a custom rules engine. Since bot activity is often intertwined with affiliate fraud, monitoring the quality of affiliates is paramount. The SEON solution simplifies evaluating the ratio of approved to declined transactions to discern between valuable partners and potential threats.

To avoid hefty fines and protect against reputational damage, operators can utilize customizable and cost-effective AML checks to bolster compliance efforts, seamlessly consolidating fraud prevention and AML into a single platform. This approach unites fraud prevention with AML screening, including players’ names against 250+ lists, including PEP & RCA, FBI’s Criminal and Fugitive lists, and other authoritative crime, sanctions, watch and blacklist databases.

By reviewing all matches in one centralized location using only one API call for both fraud and AML compliance, operators can assess their relevance to players and promptly block any individuals who pose a risk. Furthermore, automatic monitoring can be set up to rerun checks at customized intervals and against tailored list types, flagging any changes for immediate attention. SEON flags suspicious behavior indicative of money laundering activities, such as transactions surpassing legal thresholds, high-value transactions occurring within short timeframes and unusual withdrawal methods not previously associated with deposits. This combined approach ensures operators maintain compliance standards while safeguarding the integrity and profitability of their ventures.

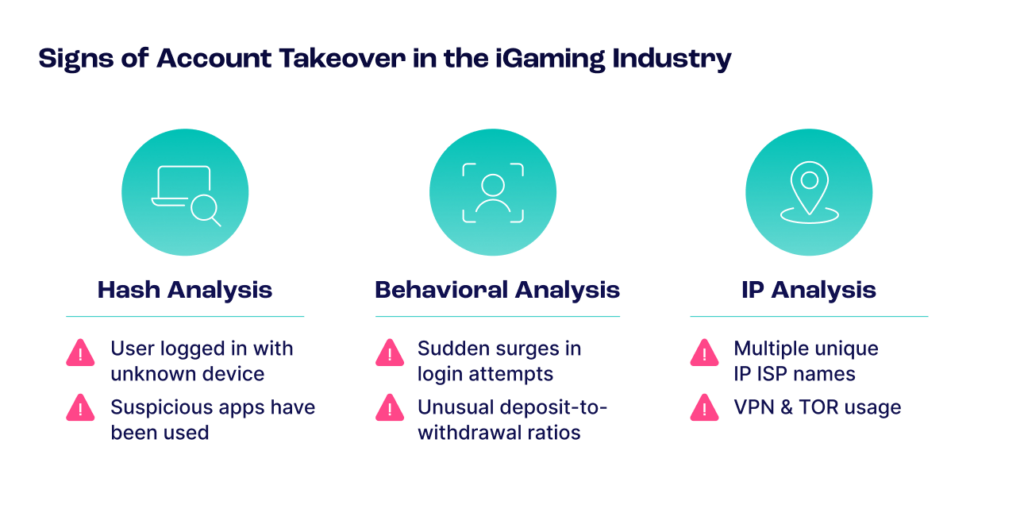

Fraudsters who gain unauthorized access to player accounts compromise trust, ultimately affecting customer loyalty and negatively impacting revenue numbers. To prevent Account Takeover (ATO) incidents, SEON’s anti-fraud experts recommend analyzing players’ software and hardware configurations to generate unique IDs – called a hash – that can aid in detecting and stopping ATO attempts.

Additionally, flagging users logging in with unknown devices or browsers, suspicious apps or plugins commonly used by fraudsters for multiple login attempts proves an effective way to uplevel defenses. Another valuable tool in a preventative tech stack is IP analysis, which can pinpoint a user’s location and identify unusual connections, such as VPN or Tor connections or multiple unique IP ISP names, within a short timeframe, which signals an ATO attempt.

Another layer for solving for ATOs includes behavior analysis to find suspicious customer behaviors, such as sudden surges in login attempts, deposits or withdrawals. Combining anti-fraud strategies like these can promptly prevent fraudulent activities while meeting each platform’s unique risk appetite.

Real-time monitoring and the analysis of transaction details are essential to reduce revenue and reputational risks associated with chargebacks, such as a transaction reversal initiated by a credit card issuer, to protect cardholders from fraudulent or disputed charges. Critical indicators of potential chargeback fraud include minimal online presence and a lack of registered social media profiles.

Email and phone lookup modules are instrumental in gathering social and digital signals to construct a comprehensive digital footprint at a player’s journey’s registration and transaction point. A player’s absence from social media raises suspicions of potential chargeback intent. Additionally, discrepancies between card and IP country are essential signs. Combining IP analysis with card BIN lookups can highlight inconsistencies, such as a transaction made with a US card from a Russian IP address. While this alone is not conclusive evidence of fraud, it is a strong indicator that may suggest a chargeback attempt, warranting further in-depth analysis.

In addition, a rapid increase in deposits over a short period, particularly within 24 hours, can signal heightened fraud risk – as this pattern can indicate that fraudsters are using exploited stolen card numbers to make large deposits and quickly withdraw winnings, posing a serious threat to financial security.

Two more ways to boost profitability and security in iGaming include recognizing the streamlining that advanced AI systems can lend across the entire journey of operators’ players, freeing up valuable time and resources for other revenue-generating activities.

With machine learning able to group similar transactions through labels, the system learns from default transaction states and further refines its accuracy and automation workflows when labels are customized. This allows for better efficiency through eradicating redundant checks. For instance, blacklisting a value that ensures future transactions containing it will be automatically flagged as suspicious. As AI is finetuned through operator feedback, the system can adapt to customized risk tolerances and improve accuracy through new rule suggestions based on historical data and the unveiling of potential new risks validated by human intelligence.

Introducing whitebox machine learning adds a layer of transparency to the decision-making process. Unlike blackbox models, which provide results without elucidating the underlying rationale, whitebox algorithms offer clear, readable rules. Users gain visibility into why and how decisions are made, facilitating verification and optimization of outcomes. This transparency enables users to adjust decision processes, refine thresholds and execute manual reviews with confidence and control.

While blackbox models may offer speed and novelty detection capabilities, they lack the configurability and interpretability inherent in whitebox systems. Leveraging machine learning in a robust fraud prevention and detection solution enables operators to achieve the ideal combination of automated efficiency and human oversight.

Enhancing profitability and security in the iGaming industry is through the strategic integration of advanced fraud prevention and AML solutions. These innovations streamline operational efficiencies and fortify defenses against a spectrum of fraudulent activities, from bonus abuse to sophisticated bot attacks. As operators embrace these comprehensive tools, they ensure a safer environment for genuine players while boosting their bottom line. The continual refinement of these systems positions the iGaming sector to tackle current challenges and effectively anticipate and counter future threats.

Showing all with `` tag

Get anti-fraud and compliance insights and tips from SEONs experts.

Tamás Kádár is the Chief Executive Officer and co-founder of SEON. His mission to create a fraud-free world began after he founded the CEE’s first crypto exchange in 2017 and found it under constant attack. The solution he built now reduces fraud for 5,000+ companies worldwide, including global leaders such as KLM, Avis, and Patreon. In his spare time, he’s devouring data visualizations and injuring himself while doing basic DIY around his London pad.