Signifyd Competitors & Alternatives in 2024

Signifyd is a popular fraud management and payments optimization platform that many organizations trust with their operations. However, just like any solution, it will not always be the perfect fit for everyone’s needs.

Today, we look at five of the most prominent and well-reviewed Signifyd alternatives, to help you reach an informed decision.

Disclaimer: Everything you’ll read in this article was gleaned from online research, including user reviews. We did not have time to manually test every tool. This article was last updated in Q3 2023. Please feel free to contact us to request an update/correction.

Best Signifyd Alternatives

| Company | Core Features | Notable Clients | Summary |

| SEON | • digital profiling • whitebox AI transaction monitoring • preset industry + customizable rules • email, IP + phone data enrichment analysis • advanced device fingerprinting • AML checks | Revolut, Air France, Kindred | Frictionless, in-depth customer profiling and flexible rules with ML insights, AML screening and free plan |

| Kount | • custom rules • MFA • chargeback guarantee model • 32bn user interactions-per-year database • policy and practice advice | New Balance, Staples, Wyze Labs | Secure end-to-end platform |

| ClearSale | • in-house manual review team • chargeback protection • ecommerce platform integrations • automatic decisions based on scoring engine • strategy/consulting suggestions | Motorola, ASUS, Under Armour | Chargeback protection with analyst support and risk strategy advice |

| NoFraud | • chargeback protection with order-specific opt-out • persona + velocity tracking • global blocklists • pre-gateway integration • phone order screening | MMA Warehouse, JackRabbit, The Sony Shop | Shopify-specific fraud solution focused on ease of use |

| Sift | • IP, email + phone analysis • device fingerprinting • identity and address verification • OTPs • biometric authentication | Doordash, Hello Fresh, Zoosk | Payment protection, account defense and dispute management |

With more than 280+ reviews, SEON is the market leader and G2’s best fraud detection solution.

Ask an Expert

What Does Signifyd Offer?

Headquartered in California, Signifyd was co-founded by two PayPal employees, Rajesh Ramanand and Michael Liberty, in 2011. The pair had identified a need for comprehensive payments protection for eshops, and decided to help stop the fraud that is targeting them.

Per the official website, it promises “guaranteed fraud protection” and “a friction-free buying experience for customers”.

Indeed, this fraud prevention software vendor has much to be proud of, counting Fortune 1000 companies within its clientele, including many household names such as Samsung, Philips, and Omega. It should be noted that Signifyd also has a separate product for payment service providers.

Automation is a central concept to the Signifyd philosophy, as it promises minimal merchant involvement in a platform built primarily for companies with high volumes of transactions. Its key products are the Commerce Protection Platform, and the Payment Optimization Platform. All of its technology is built on the Commerce Network, a shared intelligence database of global transaction data.

Covering the most frequent pain points in the industry, such as friendly fraud, return abuse, chargebacks, account takeovers, etc., the solution is also mindful of customer churn, promising not to overwhelm shoppers with security steps to the point of making them abandon their cart.

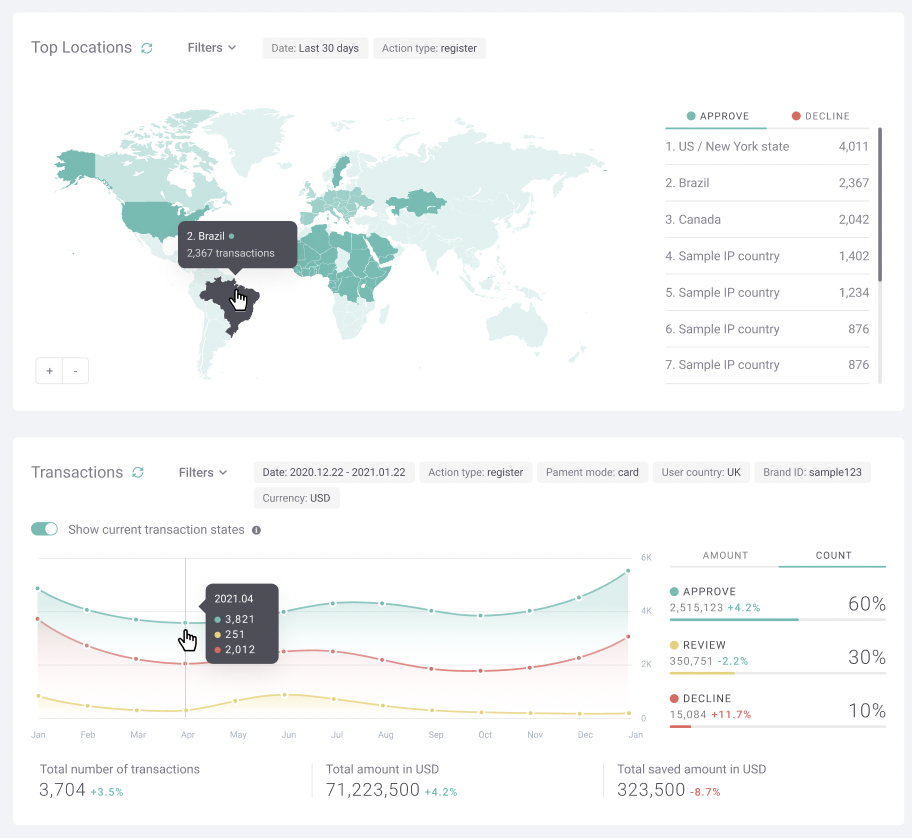

The interface provided includes the agent console, insights reporting, and decision center, which are powered by features such as real-time monitoring, risk scoring, device fingerprinting, user authentication, data enrichment, and more.

Why Look for a Signifyd Alternative?

It wouldn’t be far-fetched to consider Signifyd’s solution as crafted for the needs of US-based ecommerce companies in particular, rather than the vast range of locales and industries that are targeted by fraud today. For example, there is no real-time digital footprint lookup functionality, which can be particularly helpful in emerging markets.

Though others might be able to benefit from Signifyd, they may want to consider a solution that is more tailored to their industry. A solution that offers AML as part of the package could also be beneficial if you want to reduce the complexity of your risk management tech stack.

Beyond this, the chargeback guarantee model, though promising at first, can be detrimental to ecommerce brands. With this, Signifyd promises to pay out of pocket for any chargebacks the merchant incurs – such is its confidence in protecting you from it.

However, in practice, this can bring a higher rate of false positives, as any vendor that employs such a model has good reason to err on the side of caution. This can increase customer churn.

You can read more about the pros and cons of the chargeback guarantee model here.

Finally, one might simply be generally satisfied with Signifyd but wondering if there’s something even better available. So, what is out there?

Five Signifyd Alternatives

Today, we have selected five of the most efficient and well-regarded Signifyd alternatives. Let’s look into the functions, benefits and shortcomings of each.

SEON

Features & Use Cases

Founded in 2017, SEON was started by Tamas Kadar and Bence Jendruszak, when they realized there was no fraud fighting platform out there that fully covered their own needs.

Ever since, the company has gone from strength to strength and today has offices in London, Budapest, Austin in Texas, and Jakarta.

This anti-fraud vendor serves several industries that are highly vulnerable to fraud, including ecommerce, igaming, fintech, payment gateways, crypto, online lending, etc., with customers such as Playtech, Air France, Kindred, Home Credit, Xcoins.

SEON’s offering features some of the sector’s most advanced technology, implemented in a polished platform, with some of the functionality also available as a standalone solution.

To provide a completely frictionless shopper journey, SEON has chosen to utilize information the public expects to provide when shopping online/applying for a service, as well as data points that can be safely gleaned from their visit without any friction.

The former includes the email address and phone number, which a lookup module uses to enrich data. The latter data points have to do with a user’s IP, fingerprinting results, behavior, and so on.

From these, a detailed report is generated for each user, complete with a risk rating that can, if configured as such, trigger automatic approvals and rejections, start a manual review process, etc.

An AML module is also available. It allows companies that need to meet compliance requirements to ensure they are logging the details of individuals whose names appear on PEP lists, sanction lists or crime watchlists, among others.

Though the system is easy to set up and run, SEON has developed it to be scalable and adjustable, so that each organization can define its own rules – based on their industry (via presets) or according to their historical data (ruleset suggested by a whitebox machine engine).

Kount

Features & Use Cases

An Equifax company following its 2021 acquisition, Kount has been in the fraud fighting arena since 2006, and is headquartered in Atlanta, Georgia.

Some of its more prominent customers include ConAir, Staples, Chase, Barclays, and Purple. In total, according to this vendor, over 15,000 brands trust Kount, spanning 75+ industries in more than 200 countries.

To those it helps safeguard against fraud, Kount promises exclusive access to 13+ years of fraud marker data to help assess each user’s intentions, combined with customizable rules, behavior tracking, ID analytics and safety scoring.

The ultimate goal is to reduce chargeback rates and churn, detect and thwart ATO and bot attacks, minimize friendly fraud, and protect from loyalty/gift card fraud and similar schemes.

To achieve this, Kount heavily relies on automation, provides a chargeback guarantee model, and advises its customers on policy and practice – with additional optimization and management services also available, which is not so common for a fraud prevention provider.

In terms of negative aspects raised by reviewers, some bugs have been pointed out when it comes to Shopify integration.

There is training available, including webinars, videos, documentation, as well as 24/7 support. However, some of Kount’s customers have noted in reviews that they find parts of the rule creation process to be overcomplicated.

ClearSale

Features & Use Cases

Headquartered in Brazil and Miami, Florida, ClearSale is a veteran of the anti-fraud space, having been founded back in 2001. Some of the 6,000+ customers this vendor serves around the world, in 160+ countries, include Calvin Klein, Sony, Walmart, Asus, and OfficeMax.

ClearSale is all about preventing CNP transaction fraud in ecommerce, coming with the promise to maximize order approvals and put an end to false declines – and keep shoppers and users happy by not troubling them with unnecessary checks and requests.

To achieve this, ClearSale’s end-to-end platform brings together machine learning modules and human intelligence, utilizing powerful algorithms that power IP analysis, device fingerprinting, behavior tracking, BIN checking, and user authentication.

ClearSale integration is possible for several of the leading ecommerce platforms, such as Magento, Shopify, PrestaShop, WooCommerce, Zoey, and 3D cart, where merchants can implement custom or industry preset rules.

There is also a Chrome extension available, while fraud analysts can conduct manual queries to assist their reviews and evaluations.

There is an in-house review team provided by ClearSale, though 91% of transactions are automatically approved. While this is helpful to certain types of businesses, some online reviewers point out how it can cause delays and friction for shoppers.

NoFraud

Features & Use Cases

NoFraud is yet another fraud prevention solution known for integrating seamlessly into some of the most popular proprietary as well as open-source eshop platforms including Shopify, BigCommerce, Shift4Shop, WordPress, Volusion, and Magento, while it is also available as an API integration.

With primary offices in New York, NoFraud was established in 2014, at a time of meteoric rise in the ecommerce sector.

Fraud screening is conducted via a flexible review process, where the merchant can manage all the settings and create blacklists and whitelists.

They can also choose to manually review or automatically cancel all orders deemed suspicious based on transaction scores and risk assessments.

It should be noted that according to NoFraud’s own calculations, approximately 99.5% of orders are subject to “instant decisions”, which helps to avoid delays during busy periods, while the review process can be customized according to the merchant’s needs.

In their assessment of this vendor, NoFraud customers report very high satisfaction with the ease of use and ease of setup. As for complaints, there is some negativity regarding the price point as well as the pricing model, which does not seem to suit everybody.

Sift

Features & Use Cases

Sift belongs to the roster of companies to have come out of the prestigious Y Combinator, an accelerator that has helped many a successful startup secure funding.

“Every fraudster’s nightmare” is how Sift describes its main offering, which is called Digital Trust & Safety Suite and is as intent on preventing fraud as it is on supporting growth.

Some of the companies that make use of this American fraud vendor’s services are Doordash, Hello Fresh, Rently, and Zoosk, as well as 34,000 websites and apps from retail to ticketing, financial services, and F&B.

In fact, Sift claims to provide approximately 5 million fraud management decisions a month to its network, which are then analyzed to the benefit of the entire clientele.

The aforementioned Digital Trust & Safety Suite is marketed as a one-size-fits-all solution that can be easily deployed and picked up, but there are also standalone products available for those who don’t have a use for the full platform.

These are Payment Protection, Content Integrity, Account Defense, Passwordless Authentication, and Dispute Management, with each fairly self-explanatory thanks to its namea particular and targeting a separate pain point for online merchants, from spam and scams to dispute resolution and fake accounts.

Though the four modules integrate well with each other, customers report that they don’t play as well with tools offered by other vendors – which might, in a way, beat the purpose of offering standalone solutions.

How to Choose a Signifyd Alternative

When it comes to the selection of an anti-fraud product, it is smart to do your due diligence and research as well as possible.

After all, this is the type of digital infrastructure element that can make or break an online business, with fraudsters more daring and resourceful than ever.

If you’re looking for an alternative to Signifyd in particular, start with identifying those aspects of Signifyd that do not work as well as you would like, and make sure you ask the sales representatives of each candidate to explain exactly how and why they are better.

Hopefully, this guide has been a good starting point and you have already selected some vendors to look further into.

Further Reading

Learn more about:

Browser Fingerprinting | Data Enrichment | Device Fingerprinting | Fraud Detection API | Fraud Detection & Prevention

Try our free tools:

BIN Lookup | IP Lookup | Reverse Email Lookup | Reverse Phone Lookup | Social Media Lookup

Comparisons

Showing all with `` tag

![11 Best Risk Management Software Compared [2024]](https://assets.cdn.seon.io/uploads/2023/05/Comparisons-New-Style-Top11.png)

Subscribe to our newsletter

Get anti-fraud and compliance insights and tips from SEONs experts.