A good fraud prevention solution should aggregate data points from as many sources as possible. This is especially true when you need to reduce the risks associated with taking online payments.

In this post, we’ll see what a BIN Lookup is and how it can help secure your online transactions.

What Is BIN Lookup?

The BIN Lookup process is designed to extract as much information as possible about a card by checking its Bank Identification Number against specific databases. Try our free tool below:

Free BIN lookup!

Enter the first 6 or 8 digits of a card number (BIN/IIN)

Text here

It is especially useful to check that the card details match other data points related to the transaction, such as the location of the issuer bank versus the shipping address. In the context of fraud prevention, it helps spot suspicious data so you can mitigate risk.

What Information Can You Learn From a BIN Lookup?

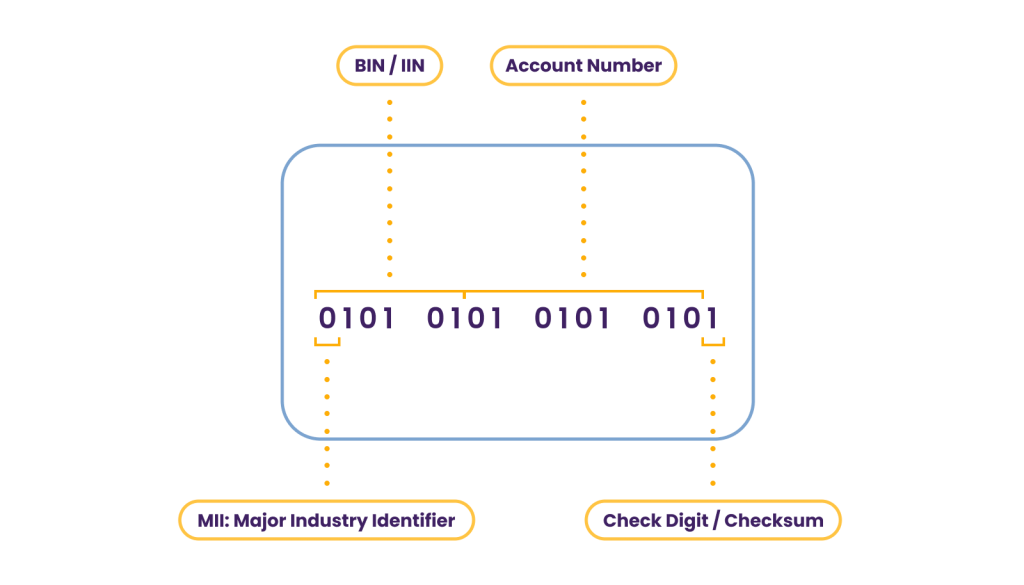

A BIN or Bank Identification Number (BIN) refers to the first 4-6 numbers on a card. It’s sometimes also known as an issuer identification number, as it is based on which bank issued the card.

Cards with a BIN Number include credit cards, charge cards, prepaid cards, gift cards, debit cards and electronic benefit cards.

A BIN lookup is helpful as it can reveal:

- The card brand: Visa, Mastercard, American Express…

- The card level: corporate, platinum, etc.

- The card type: debit, credit, or prepaid, amongst others.

- Issuing bank country: Country of the bank that issued the card

- Bank name: Name of the cardholder’s bank

- Bank website / phone number: Contact details should you need them for the issuing institution

For anyone transacting with customers online, card fraud can be a huge pain point. Find a better way to address it here.

Detect Card Fraud

How to Perform a BIN Lookup

A BIN lookup can be provided by an online third-party service or website or integrated with certain anti-fraud tools.

You can do it manually or automatically with the right software. With an online site, you simply need to enter the card information and get the results. Automatic BIN lookups tend to be done via API calls.

Prime examples are binlist.net and freebinchecker.com.

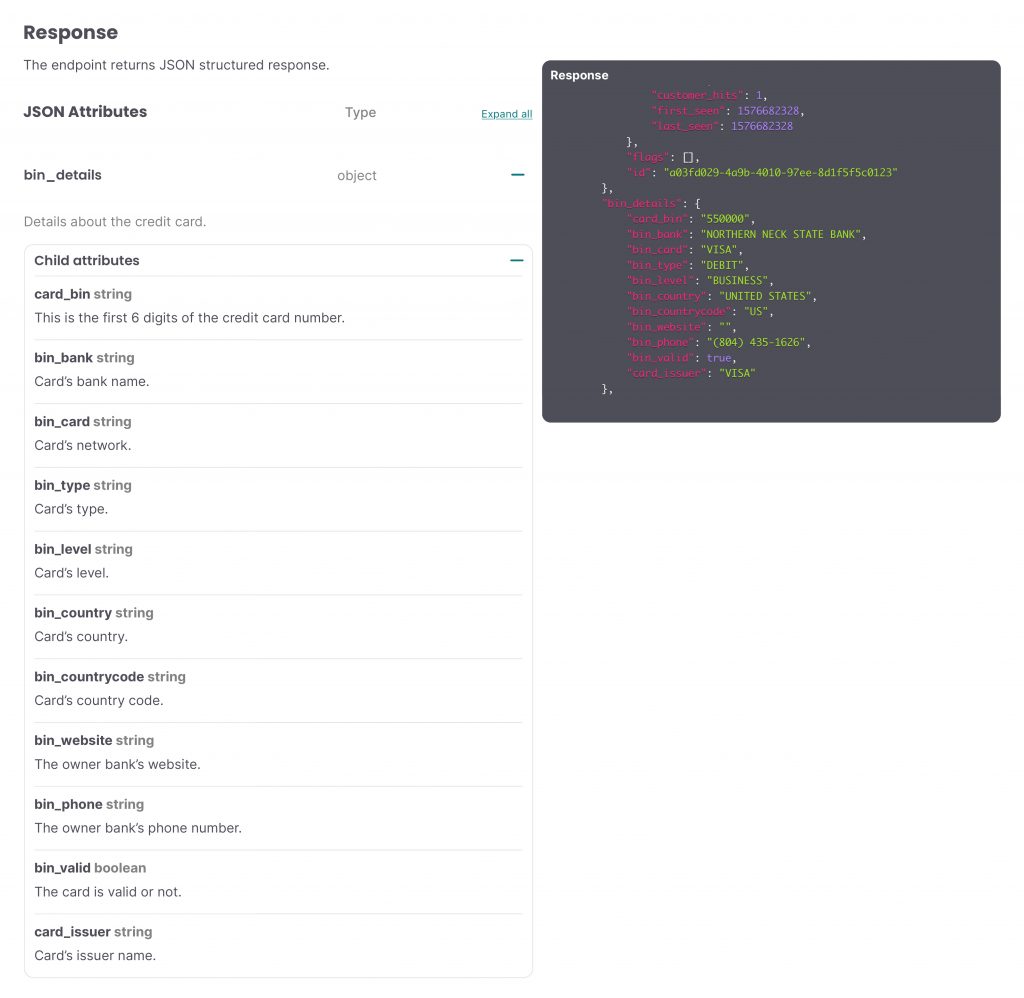

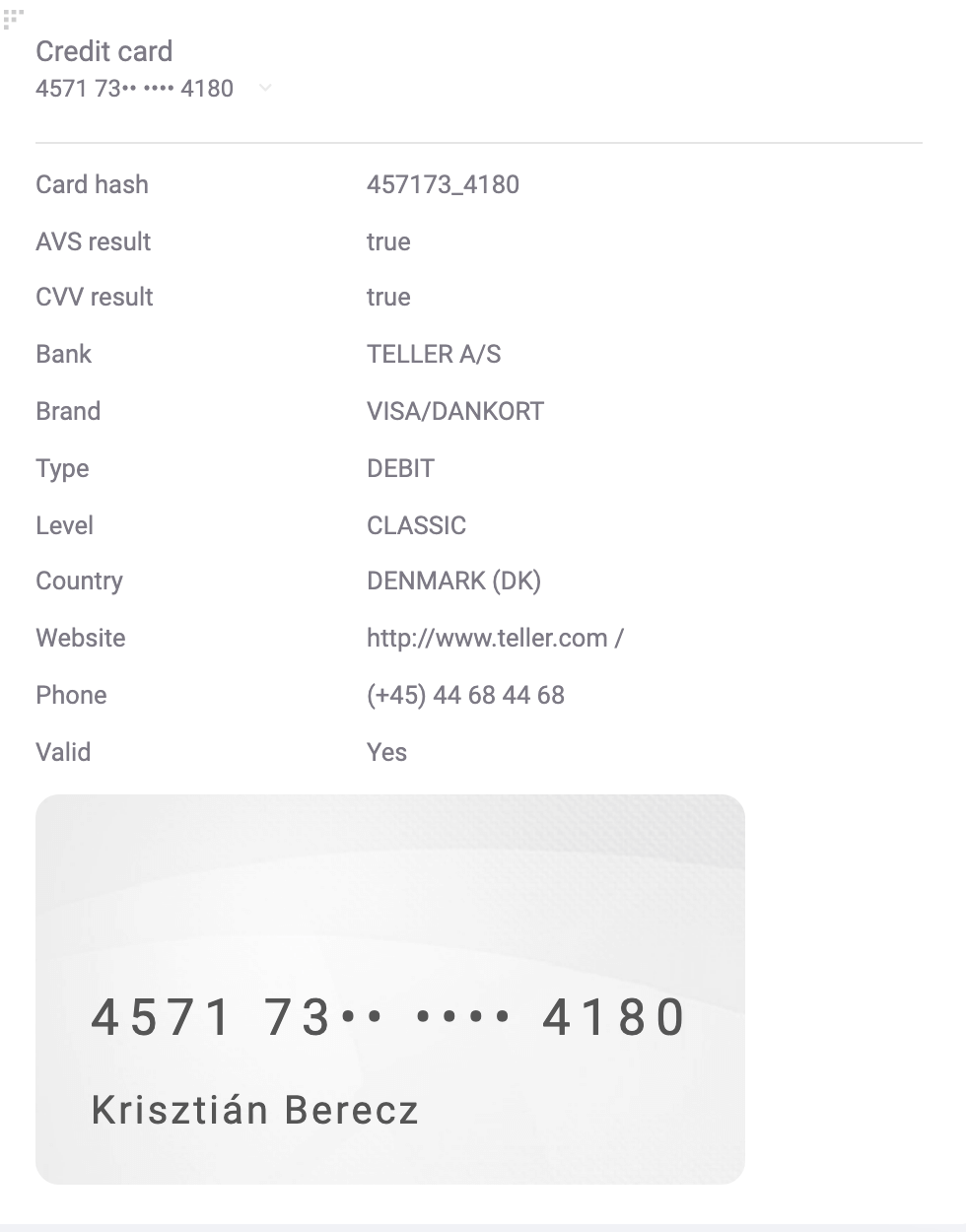

Here is an example of the kind of data you will get by calling SEON’s Fraud API (with calls for BIN).

Manual Versus Automated BIN Lookups

The key challenge is that not all the online BIN lookup sites return the same results. Some providers have access to better information than others, so you are not guaranteed to get the same data – even if you type the same credit card number into two different sites.

“We now have a constant source of truth for card BINs. If you go and type a card BIN on the internet you’ll get 50 different results because the lists are all over the place. But now with SEON we can be consistent when linking cards across the team.”

Rick Hiltbrunner SENIOR MANAGER OF FRAUD OPERATIONS at Patreon.

Now while many fraud managers have their preferred addresses for BIN lookups, the key advantage of getting it done directly with your fraud prevention is that you can easily incorporate the data in your risk rules.

For instance, you could automatically decrease the risk score if the bin_country data is clearly the same as the shipping and cardholder address.

How Does BIN Lookup Help With Fraud Prevention?

Fraudsters have to constantly find new payment details for every transaction. They can either purchase huge lists of stolen card numbers or create numbers themselves, using a BIN attack.

This is a process where they generate a card number using a known BIN. While they may accidentally stumble upon a legitimate card number, they won’t be able to guess the cardholder’s real details.

So now, it’s easy to see where a BIN lookup can point to risk:

- Does the issuing bank country match the shipping address?

- Does the card type make sense when looking at the customer’s information?

- Is the card prepaid?

- Has it appeared on a blacklist before?

By logging the information about a card BIN, you can tailor your fraud prevention risk rules. For instance, having an IP location that doesn’t match the card location should increase the risk score. Similarly, a prepaid card could raise red flags.

In that sense, it is very similar to how you should detect gift card fraud.

Note that a BIN lookup isn’t enough to know if the transaction is fraudulent or not. You also need to enrich data about the user, based on their IP address, email address, phone number, or the kind of device they use to access your website.

Other Useful Data Enrichment Tools to Consider

A BIN Lookup is a great additional help to reduce fraud, but it’s only good in combination with other tools.

For instance, you’ll need to learn as much information about the user based on:

- The IP address: is the user truly where their IP says they are? Are they using a VPN, proxy, or TOR browser?

- The email address: does it point to a free or low-friction domain for creating email addresses? Has it appeared on spam blacklists in the past?

- The phone number: is it legitimate or from a virtual SIM card? Is it pointing to the same country as the BIN card suggests?

You can learn more about data enrichment and how it can help reduce fraud rates.

Use Cases Where a BIN Lookup Can Reduce Fraud

Let’s take a look at various scenarios where a BIN lookup can help reduce fraud rates.

Chargeback Fraud

The most immediate use case is that a BIN lookup can solve transaction fraud. If the data from the card does not match that of the cardholder (wrong location, suspicious payment type), it’s easy to automatically block the payment – or at least to review it manually.

iGaming

Online gambling faces lots of bonus abuse and multi-accounting. One of the main challenges fraudsters face is having unique payment details for every one of their fake accounts. This is why prepaid cards help them build a fake identity, but they can luckily be identified by BIN checks.

Identity Fraud / Theft

If you include card payment or credit card check as part of your ID verification process, you can use the BIN lookup to help complete your user profile. Once again, a strong red flag would be to identify a prepaid card from a country that is miles away from the user’s address of residence.

Compliance

Another important example is the regulatory requirements certain vendors face. For instance, corporate cards cannot be used for gambling. If you flag a corporate card via a BIN check in your system, you can immediately reduce the risks of regulatory fines. On the other hand, corporate charge cards or credit cards are frequently used for business expenses, when booking plane tickets or when paying for accommodation.

BIN Sponsorships and Neobanks

A growing challenge with BIN Lookups are posed by neobanks and fintechs who issue their own cards (such as Monzo or Revolut). While they are very popular with consumers, these companies typically use something called a BIN Sponsorship to issue these cards, and the BIN ranges will constantly change. A BIN Lookup then might return the sponsorship partner bank, rather than the actual fintech who issued the card.

How SEON Does BIN Lookups

At SEON, we experimented with several BIN lookup solutions until we chose one to integrate within our anti-fraud software. It was selected for:

- Accuracy of the data: some BIN lookup tools return missing or confusing values. We chose one whose data we can trust. 99% accuracy.

- Fresh data: it’s not enough for the data to be accurate, it also has to be updated as frequently as possible. Monthly refresh 50 mls results.

- Fast results: in the world of automated fraud prevention, the less latency you have, the better. This is why our BIN lookup via API calls returns results in less than seconds.

This is how the results will be displayed in our GUI:

Last but not least, having a full integration between your fraud prevention system and the BIN lookup tool allows the data to stay safe from our end. No need to accidentally share a customer’s card information on an untrustworthy website.

Improve your risk management with SEON’s real time data enrichment tools

Ask an Expert

Frequently Asked Questions About BIN Lookups

Are BIN Lookup tools free?

You may find free BIN lookup tools. However, be aware of data protection issues and out-of-date databases which may return bad results.

What can I learn from a BIN lookup?

At the very least a BIN lookup will be able to let you know the card type, brand, level, and the country where it was issued. One example would be Credit card (type) Visa (brand) Platinum (level), issued in the UK (country).

How can BIN lookups reduce fraud rates?

The more you know about the card, the more you can cross-reference that information with the user data. Mismatched or suspicious data should raise red flags and trigger manual reviews.

You might also be interested in reading about:

- SEON: IBAN Lookup: What Is It And How Does It Help Reduce Fraud?

- SEON: Ecommerce Fraud Detection & Prevention

- SEON: How to Fight Return Fraud

- SEON: Friendly Fraud: How to Mitigate Chargeback Risk More Effectively

- SEON: Best Fraud Detection Software

Learn more about:

Browser Fingerprinting | Device Fingerprinting | Fraud Detection API | Fraud Detection with Machine Learning & AI

Sources used for this article:

- binlist.net: Free Bin Checker Tool

- freebinchecker.com: Free Bin Checker Tool