International Bank Account Numbers (IBANs) are used primarily for international payments. But how can an IBAN lookup tool help validate any transactions?

What Is an IBAN?

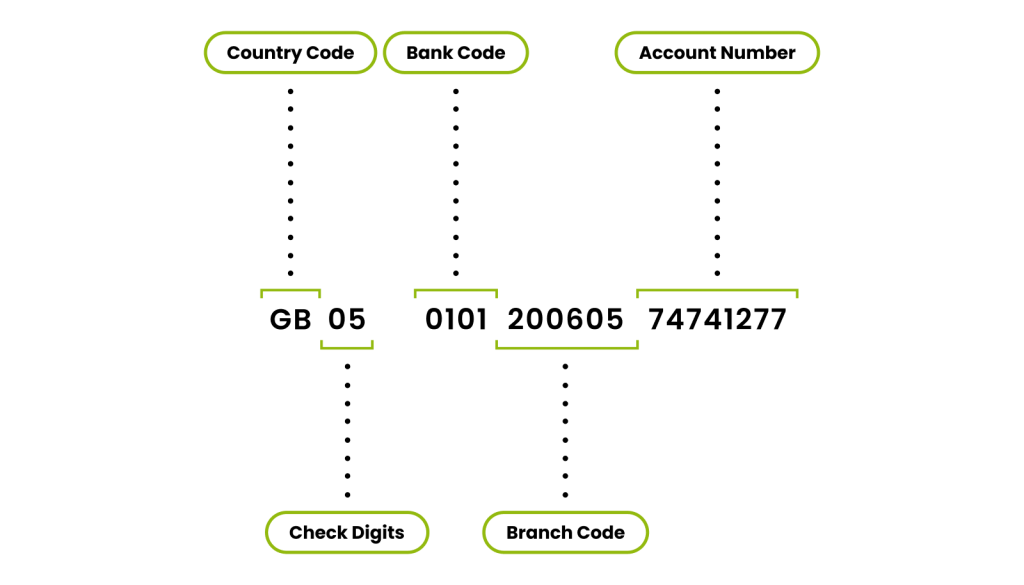

IBAN stands for International Bank Account Number. It is a standardized set of 34 letters and numbers. It is made of:

- a country code

- two check digits

- the bank code

- the branch code

- the account number

IBANs are designed to simplify international bank transfers. It’s essentially your bank account’s “address”, which is used to send or receive payments across borders.

75 countries officially support IBAN codes. They are particularly popular with European banks, but also currently under development in dozens of African countries.

What Is an IBAN Lookup?

An IBAN lookup essentially reverse engineers an IBAN to extract useful information.

The first components of an IBAN lookup all have to do with validation. That is to say, is the IBAN good or not? This is done by checking:

- IBAN checksum: Helps check if the IBAN points to a real account or not. This is done by converting the code into an integer and performing a basic mod-97 operation on it. If the remainder equals 1, the IBAN is valid.

- Country support: Detects if the IBAN country code points to a country that doesn’t use IBAN. This will invalidate the check.

- IBAN number length: Another way to check that the IBAN length is correct for the matching country.

- Account number checksum: IBANs contain a local bank account number – which you can also validate, using the right algorithm.

More crucially, an IBAN lookup allows us to learn which bank and country it is linked to. This is particularly useful when it comes to fraud detection.

What’s the Difference Between an IBAN Number and Swift Code?

A SWIFT code, which stands for Society for Worldwide Interbank Financial Telecommunication code, is also an internationally standardized way of ensuring international transfers go through seamlessly.

However, a SWIFT code, also known as a SWIFT BIC code, only helps identify the bank, not the individual account. In some cases, you might be asked for both.

How to Use IBAN Numbers for Fraud Detection

If your company deals with users of companies’ IBANs, performing a series of checks will allow you to avoid payment errors. You can also use this to flag suspicious or fraudulent payment attempts.

In that scenario, an IBAN lookup allows you to:

- know if the IBAN is valid

- verify that the location of the bank matches that of the user records

- check that the IBAN points to a high-risk bank

The last point deserves a bit of explanation. It has to do with how neobanks and challenger banks use IBANs.

Neobanks and IBANs

Neobanks, or challenger banks, allow their customers to have IBANs. However, these are given out by a sponsor bank. It works like a white label solution, where the challenger bank gets to put their own branding on an IBAN number that points to a different bank.

This may cause issues when validating an IBAN.

In the context of fraud prevention, it may be useful to identify neobanks and challenger banks because they should be considered higher risk.

A neobank’s onboarding process is designed to be as frictionless as possible. Fraudsters often open accounts with them, as it’s easier to do remotely with stolen ID documents.

The neobank accounts are then used as “bank drops”, designed to receive payments from fraudulent activities. Your company may be complicit if you allow these people to do business with you.

You can read more about the challenges of working with neobank IBANs and BINs here.

The Importance of IBAN Lookups

There is a saying in the online business world: Every company will be a fintech company. In other words, dealing with payments and understanding how they work isn’t an option; it’s a competitive advantage in the digital age.

Simply put, IBAN payments are a way of accepting more business, especially so in the EU region (and Germany in particular, where bank transfers are still the norm).

Hopefully, this post will have convinced you that although IBAN lookups are simple checks, performing them can save you a lot of trouble in the long run.