The Rise of Online Payment Method Fraud

Last Updated: February 28, 2024 by Tamas Kadar

KYC verification is lengthy, expensive, unpleasant for the customer and – let’s be realistic – easy for criminals to bypass.

In fact, the cost of Know Your Customer checks is estimated to be $60 million a year for the average bank, which isn’t surprising considering that it slows down onboarding, increases churn, and requires dedicated resources to work effectively.

The main components of the KYC process are: Customer identification program (CIP), customer due diligence, and ongoing monitoring

KYC verification is a crucial part of the customer due diligence (CDD) process and involves ensuring that a customer is who they say they are and can be trusted. Along with other KYC checks, it sees organizations cross-checking a prospective customer’s personally identifiable information (PII) with identification documents such as passports.

In other words, KYC verification is a process of identity verification that is focused on the CDD process of ensuring KYC compliance. It is also an essential part of preventing and mitigating fincrime, such as money laundering and the financing of terrorism.

To process and complete KYC verification, you need to ask your prospective customer for their details (usually their name, address and date of birth), ask for official ID documentation, and then cross-check those received items to determine if they are all in agreement.

The way the cross-checking process is carried out depends on the level of automation (if any) that’s involved. For example, some organizations may digitally scan a person’s ID documents to automatically pick up on the details printed on them, whereas others may opt to check it manually.

It is advisable that anyone doing KYC verification uses both IDV (identity verification) software and their own perception because this will increase the likelihood of spotting tampered documents.

The process is only complete once the organization doing the KYC verification has determined whether or not it deems the applicant eligible for the full Know Your Customer process.

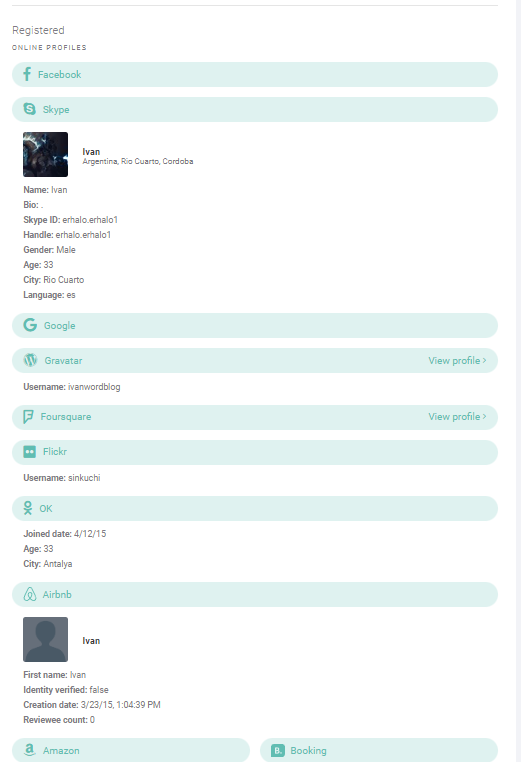

SEON’s social media lookup tool checks 90+ social media networks and messenger apps to support your KYC verification checks

Ask an Expert

All legal KYC requirements must be complied with or you could face heavy fines from regulators. Nearly $1 billion was issued in KYC and AML fines in the first half of 2021 alone. This is just one of the many reasons why KYC compliance is a must for online businesses:

The use of KYC software and authentication processes mean that criminals have to undergo a process that may build evidence against their malicious activity. And this is all assuming that those criminals aren’t put off by the identity checks in the first place.

There are three key steps for a successful KYC verification process: a customer identification program (CIP), customer due diligence, and ongoing monitoring.

The CIP requirement stems from the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism (USA PATRIOT) Act of 2001. The Act’s goal is to deter and punish terrorist acts in the US and globally, including by strengthening anti-money laundering measures.

For financial institutions, this means verifying the identity of account holders. An individual can open account with basic details (name, date of birth, address, and identification number). The financial institution must then verify those details, for example by checking the individual’s identity documents and/or looking them up on public databases, consumer reporting agencies, and similar.

The next step of the KYC verification process concerns assessing the customer’s trustworthiness. At the simplified due diligence end of the scale, it may be sufficient to verify the customer’s identity and location. Enhanced due diligence takes this further, including checking blacklists, watchlists and lists of politically exposed persons (PEPs).

Customer due diligence can also delve into an individual’s occupation, the types of transactions they make, their expected activity patterns, and more. The goal is for the financial institution to understand that particular risks associated with that individual – all while keeping detailed records of the checks undertaken.

A successful KYC verification process is not a one-time activity. Monitoring must continue throughout a customer’s time with the financial institution in question. Ongoing monitoring is there to flag up changes in activity patterns. These could include unusual cross-border payments, higher value transactions, changing payment methods, a higher volume of transactions, and/or the addition of the account holder to a sanction list.The financial institution may need to file a Suspicious Activity Report if an account holder’s behaviour changes sufficiently to warrant this.

It all starts with gathering as much information as you can about each customer. A great fraud prevention tool helps you get a 360-degree view of your users.

The way SEON’s engine does this with zero friction is by examining the customer’s digital footprint, starting with just their email address, IP address, and phone number.

The result of this search will be a comprehensive profile of their public data, sourced from 90+ social media and online services. What this tells us is whether they behave like a real person online, and thus how likely they are to be a legitimate customer.

For instance, digital footprint analysis at SEON has demonstrated that the average good user has five to six online profiles on some service or another, while they are also likely to have fallen victim to a data breach.

On the contrary, an email generated by a fraudster will have very little online presence – which means they should be funneled towards more rigorous KYC checks, if not banned outright.

Device fingerprinting paints a vivid picture of how a user connects to your platform. By examining their software and hardware configuration and generating browser, cookie and device hashes, SEON is further able to conduct velocity checks, behavior checks and real-time monitoring.

These data points add even more information to the assessment of the new user’s intentions. As a case in point, SEON’s solution gathers the following data, among others:

As we have seen, KYC checks are costly. Identity verification vendors charge anywhere between $13 and $130 per customer verified. This can very quickly add up.

The fewer fraudsters reach KYC verification, the more money the organization can save.

By implementing SEON’s solution at signup and letting it work behind the scenes, you’re introducing a traffic lights system that greatly reduces the number of junk users who reach true KYC. So you don’t have to pay up to $130 to reject each fraudster.

In other words, SEON’s solution funnels fewer bad users through, and increases the ratio of good to bad users who get verified.

Beyond compliance and costs, this also helps minimize overall fraud at your company, as fraudsters and money launderers are significantly less likely to gain access to your products.

Since anyone working in your vertical should have the same KYC risk assessment requirements, it’s all about implementing them in a smart way, for instance by using dynamic friction.

Here is how SEON can optimize your KYC to give you a competitive advantage:

This also creates the basis for further financial services functionality. For instance, loan providers trying to perform alternative credit scoring through digital ID profiling don’t have to worry so much about finding financial info: They can use digital footprinting to build their scoring models instead of using details from banks and financial institutions.

SEON lets you onboard good users as soon as possible, applying the least amount of KYC possible – while you block obvious criminals, as well as request more documentation from suspicious users.

Our solutions have allowed leading neobanks and fintechs to grow faster and serve more customers without any compromise to their safety or compliance – by filtering out bad users pre-KYC, triggering exceptions for 3DS checks, reducing transaction fraud, eradicating defaulting customers, and enjoying peace of mind in the process.

As just one case in point, fintech Felix Pago reported 90% more confidence in accepting or rejecting payments and 100% improvement in detecting multi-accounting.

SEON is more than just software; it is your business partner in fighting fraud – a customizable, flexible solution that can fit your needs.

Ask an Expert

A KYC journey can vary depending on the context but typically will consist of ID card verification, video verification, document verification, and biometric verification.

The answer should be a resounding no – not if they are going to be rejected! If you can filter out junk users, bad leads, and obvious fraudsters, you’re saving on costs and resources before the checks even begin. So even if your company is mandated by law to conduct KYC on everyone, you can avoid doing so when it’s an obvious fraudster, by applying simple pre-KYC profiling to block them before they reach KYC.

Current and predicted trends in the sector of KYC verification include:

– a bigger push towards frictionless KYC

– synthetic IDs will become more convincing due to the rise in deepfakes

– an increase in official identities that will be both digital and online

– new legal mandates will act on criminal activity in the context of modern digital currency, particularly cryptocurrency and NFTs

The easiest way to understand the difference between KYC and AML is by thinking about the goals of each:

KYC is introduced at onboarding, when a new customer is about to sign up, and it has to do with verifying who this person is. On a practical level, this could involve document verification checks or biometrics.

AML are measures taken continuously by a financial or related organization to prevent money laundering. They have to do with securing that the funds brought in by the customer have a known, legitimate source. AML involves actions such as flagging unusual transactions and/or those over a certain amount, and filing suspicious activity reports with the authorities.

Sources

Browser Fingerprinting | Device Fingerprinting | Fraud Detection API | Fraud Detection with Machine Learning & AI

Showing all with `` tag

Click here

Tamás Kádár is the Chief Executive Officer and co-founder of SEON. His mission to create a fraud-free world began after he founded the CEE’s first crypto exchange in 2017 and found it under constant attack. The solution he built now reduces fraud for 5,000+ companies worldwide, including global leaders such as KLM, Avis, and Patreon. In his spare time, he’s devouring data visualizations and injuring himself while doing basic DIY around his London pad.

The top stories of the month delivered straight to your inbox