Neobank

What Is a Neobank?

The term neobank refers to a growing number of fintech companies that offer some or most of the services of a traditional brick-and-mortar bank on a purely digital model.

The term itself has been around since about 2016, but the first digital banks, called challenger banks, started appearing on the UK fintech landscape after the financial crisis of 2008.

How Do Neobanks Operate?

From end to end, the neobanking experience is designed to be different from that of a legacy bank.

Many neobanks have radiated to focus explicitly on niche markets, as well as customers that are typically overlooked by legacy banks – financial inclusion of the underbanked is sometimes a requirement of getting a banking license, in which case there is a need for credit scoring using alternative sources.

For example, Cheese is a mobile bank that targets Asian-Americans while, in France, Nickel uses a distribution model that relies on signups at newsstands and tobacconists.

A typical customer journey might include:

- finding the neobank that caters to their demographic

- creating an account with minimum clicks and documentation required, and thus minimum friction – known as digital onboarding

- enjoying the relative convenience of a purely digital bank

How Do Neobanks Make Money?

Via interchange, credit, or ecosystem integration. As neobanks are offering a slightly different, truncated banking service compared to an incumbent bank, their business model often works differently as well. As the world’s challenger banks struggle to gain financial solvency, the ways they attempt to turn a profit generally fall into one of these categories:

- Interchange: The only physical infrastructure many neobanks provide are debit cards and ATMs. To make their margins, these neobanks will often charge a per-transaction percentage fee.

- Credit: Some neobanks only offer a credit card to new users, asking them to build credit before they are offered a digital bank account. These neobanks will charge a per-transaction fee, but also charge interest on the balances of their credit cards.

- Ecosystem integration: Some neobanks either start with a legacy financial backer or find one on their funding journey. For instance, challengers like Monzo have partnered with other fintechs to provide a complete customer banking experience, and hope to find themselves as an integral part of a profitable loop of services.

Though a recent study conducted by Simon-Kucher & Partners shows that less than 5% of all neobanks are breaking even, business models like this rely on lifetime customer retention for their profit projections, so it remains to be seen how well neobanks will be able to climb the mountain towards solvency.

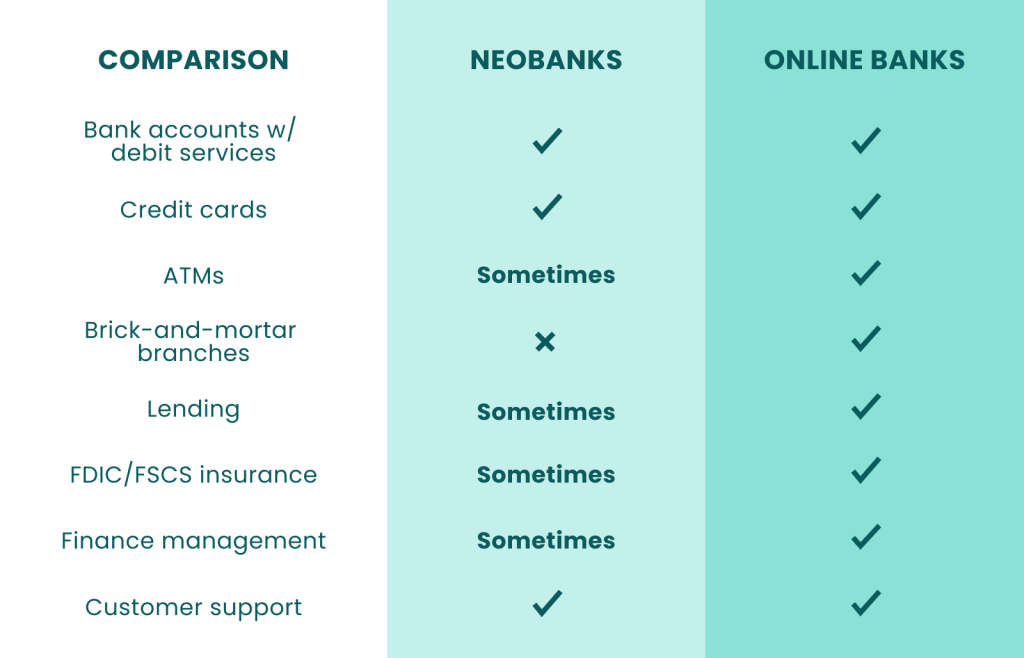

Neobanks vs Online Banks: What’s the Difference?

Neobanks shouldn’t be confused with the online version of traditional banks. In terms of the main differences, neobanks have no brick-and-mortar branches, and only sometimes subscribe to financial service compensation schemes – unlike traditional banks also operating online.

Online banks, such as Ally Bank, Fairmoney, or Capital One 360, offer almost all of the services a legacy bank would and have the financial backbone of an established bank behind them.

By comparison, most neobanks offer a section of traditional banking services. Neobanks also lack all or most of the traditional banking infrastructure.

What Are the Different Kinds of Neobanks?

As most neobanks and adjacent fintechs can be categorically thought of as startups competing with gargantuan legacy banks, financial backing is a huge part of their journey to establishment.

Generally speaking, neobanking models can be divided into two main kinds of entities: standalone banks and front-end focused banks. Which category a given neobank falls into is based on its financial independence.

Standalone neobanks are those who have their own capital to ensure their investors’ deposits and are thereafter able to acquire their own banking license.

Front-end focused neobanks are those that rely on the backing of a traditional financial institution to provide those same assurances – because, in order for a bank to be licensed, it has to be able to prove it can offer security over its customers’ deposits.

This requires a massive amount of capital or the sponsorship of a legacy bank that already has a license. Such a neobank often functions as a modern portal to more traditional bank services while adding services like digital money management to the experience.

What Advantages Do Neobanks Offer over Traditional, Legacy Banks?

The most obvious advantage that the digital model offers banks is not having to fund a network of costly physical bank branches.

From the customer perspective, the growing popularity of neobanking is spearheaded by a generation of new bank account holders who are frustrated with the friction associated with legacy banks.

Friction in this area might include:

- the relative inconvenience of having to visit a physical bank branch compared to mobile banking

- slowness of banking functions compared to instantaneous digital banking

- aging infrastructures and outdated technology like ATMs and paper checks

- overwhelming amounts of paperwork

- a generational distrust of legacy financial institutions

With these factors in mind, many neobanks have expanded to confront these points specifically, to provide their users with the most frictionless and easy experience possible on the road to lifetime customer retention.

Meanwhile, legacy banks are also recognizing these pain points, and increasingly seeking to offer digital services to compete, like Bank of America’s digital “Erica” assistant within its mobile app.

How Popular Are Neobanks?

Internationally, neobanks are a rapidly growing banking sector, currently representing a market of about $45 billion. Various estimates point toward that market growing to over $700 billion by 2028.

Particularly in the Chinese, Indian, and Brazilian markets, an increasing number of customers are growing accustomed to digital banking. In Brazil, over half of the population hold a purely digital bank account, and in China, a majority of bank account holders have used either Alipay or WeChat-integrated financial services.

The US has lagged behind these markets significantly, though there are over 30 million neobank account holders across the States.

What Are the Most Popular Neobanks?

The most popular neobanks in 2022 include Chime, Monzo and Nickel.

Chime – the US’ biggest neobank, famously making its debut on the Dr. Phil show, now boasts some 12 million users. CEO and founder Chris Britt attributes the company’s success to making money off of transactions, rather than loans and fees, and targeting a middle-income demographic that appreciates those savings.

Alipay – The integration of a mega-neobank into the massive Chinese online storefront Alipay, as well as neobank integrations into mega giants WeChat and JD Finance, means that an overwhelming majority of Chinese bank account holders have also used a neobanking-like service.

Monzo – The UK’s largest digital bank, London-based Monzo, currently has about 5 million users and boasts arms on both sides of the pond. It was founded by former executives from the respected, and uncommonly profitable, Starling Bank.

Nickel – Known for its company ethos, Nickel has become France’s most successful neobank by laying out a plan to reach customers who were previously underserved or unsatisfied. Nickel is actively expanding throughout western Europe, with its four pillars in mind: universality, utility, simplicity, and benevolence.

Are Neobanks More Susceptible to Fraud?

In some ways, yes, because innovation breeds loopholes – which fraudsters are constantly looking to take advantage of. Combined with their online-only infrastructure, it means that neobanks need to be particularly vigilant and proactive in protecting themselves from fraud.

In the face of traditional frustrations caused by long lines and glacially-paced service at a brick-and-mortar financial institution, neobanks aspire to make their customer signup as frictionless as possible. This is a delicate balance when it comes to fraud. Neobanks that don’t have a licensed charter are essentially unregulated, and so are not explicitly required to include KYC verification checks, but are naturally still concerned about security and their reputation.

Adding more layers of fraud prevention, like biometric verification or AML controls to a new customer’s onboarding process increases friction, but too few security checks lead to fraudsters and an injured reputation.

In fact, some conveniences designed to decrease churn can turn into inconveniences. For example, a neobank might offer debit and credit cards issued with the security of IBAN and BIN sponsorship, but a non-fraudulent customer might still get falsely declined at purchase because the neobank is unrecognized at a large scale.

Indeed, these BIN lookups themselves can turn into another set of security issues, when a merchant doesn’t know how to interpret them for neobanks. However, BIN lookup can actually help merchants fight fraud. You can use SEON’s BIN lookup tool below, typing in the first six digits of a bank card, to see what such a search can reveal.

Free BIN lookup!

Enter the first 6 or 8 digits of a card number (BIN/IIN)

Text here

Combined with the relative ease of falsifying an identity online, or opening a fraudulent neobank account, the online banking space is inherently more volatile when it comes to potential fraud, and should be handled accordingly.

Are Neobanks Trustworthy?

So, can you trust your money with a neobank? Probably, though it is better to choose one recognized by a deposit guarantee scheme such as the UK’s FSCS or an equivalent governing body.

Market research suggests that the main blocker of neobanking market penetration in the US is a gap in trust.

Most standalone neobanks that aren’t partnered with an incumbent bank as a financial backer will be unable to offer a chartered guarantee on deposits, and this lack of insurance understandably doesn’t foster great trust in generational American wealth.

For some consumers, the outdated infrastructure of a physical bank might be a reason to go fully digital; for others, the bricks and the window tellers are synonymous with dependability.

The convenience of neobanks is unmistakable, with transaction value across the segment projected to reach $3.84 trillion in 2022 and $8.61 trillion by 2026, per Statista.

But, for the sector to achieve its true potential, it needs to overcome questions of trust, as well as protect itself from fraud as efficiently as possible.

Neobanks and fintechs are a major target of fraudsters. We know how you can prevent it and still keep your UX great.

Learn More

Related Terms

Related Articles

Sources

Speak with one of our fraud experts

Feel free to reach out with any fraud-related questions or comments - we’ll get back to you as soon as possible.