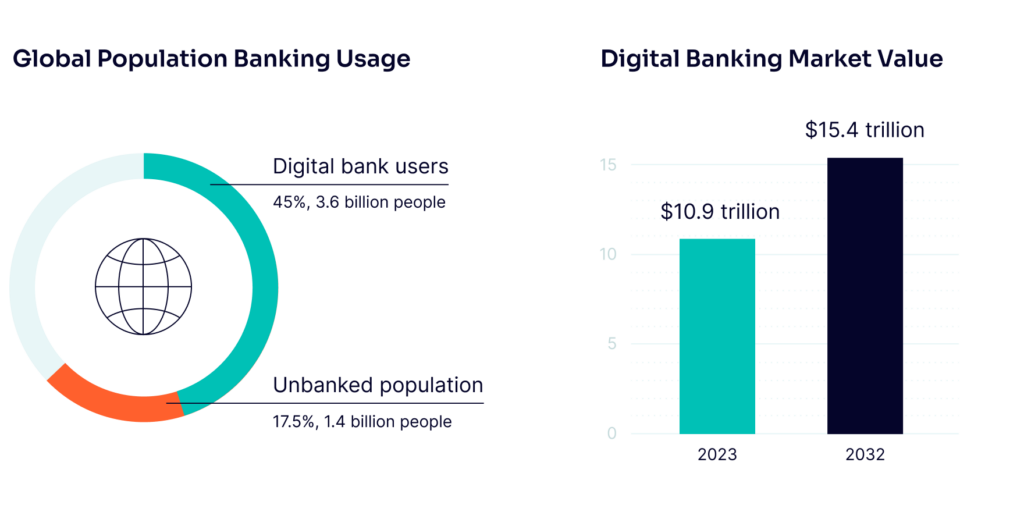

The digital banking industry has seen substantial growth and transformation in recent years, driven by the increasing demand for online financial services. The convenience of 24/7 customer support and accessible credit options make digital banks attractive to previously underserved markets. While the industry accounts for an estimated 3.6 billion users globally, approximately 1.4 billion people remain completely unbanked, presenting significant opportunities for both new and established digital banks.

The digital banking market was valued at $10.9 trillion in 2023 and is estimated to reach $15.4 trillion by 2032, reflecting a robust growth trajectory. Additionally, a survey by BAI Banking Outlook reveals that about 30% of Gen Z and Millennial customers now consider digital banks as their primary banking option, indicating a shift in consumer preferences toward more tech-savvy financial solutions.

This article examines current trends in digital banking, identifies countries leading in adoption and explores the qualities that can differentiate a digital bank in this competitive landscape.

Current Trends in Digital Banking

The landscape of digital banking is evolving rapidly as new technologies reshape customer expectations and operational capabilities. Key trends influencing this transformation include:

- Generative AI: Financial institutions are increasingly leveraging generative AI for personalized customer interactions and advanced fraud detection systems.

- Humanizing digital banking: There is a growing emphasis on creating more human-like interactions through chatbots and virtual assistants that enhance customer engagement.

- Open banking: The shift towards open data practices allows third-party providers access to customer information via APIs, fostering innovation and improving user experiences.

- Embedded finance: This trend integrates financial services into non-financial platforms, making transactions more seamless for consumers.

- Sustainability initiatives: As environmental concerns rise, many digital banks are adopting practices that align with ESG (Environmental, Social, Governance) standards.

As we look toward the future of banking in 2024 and beyond, institutions must adapt swiftly to these trends or risk falling behind in a highly competitive landscape.

Countries with the Highest Digital Banking Adoption Rates

As of 2024, Finland leads the global list with 95% of its population banking online (followed by Norway and South Korea with 91%) and both the US and the UK at around 72%, the following countries are estimated to have the most notable adoption rates over the upcoming years:

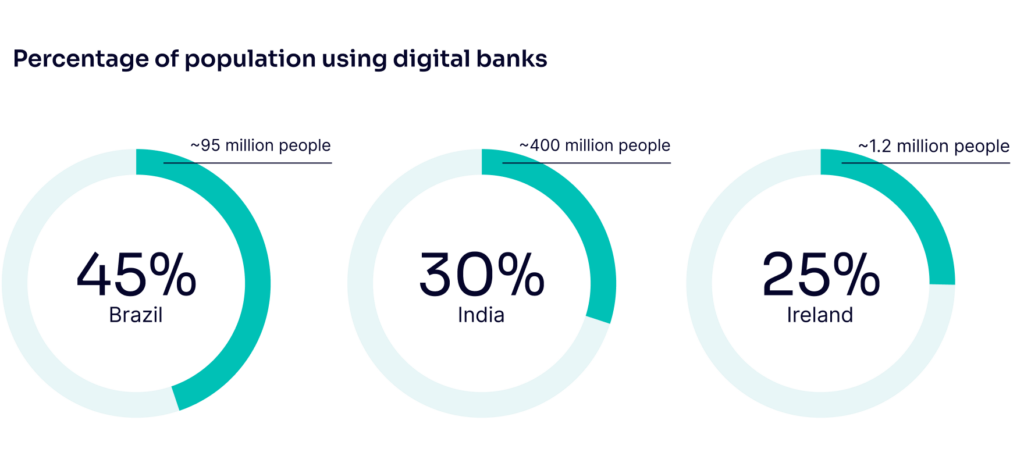

1. Brazil: 45% of the population

Brazil continues to lead in digital banking adoption, with approximately 45% of its population holding a digital bank account. The acceleration of digitization during COVID-19 restrictions has significantly contributed to this growth, forecasted to reach 57% by 2027.

2. India: 30% of the population

India ranks second with about 30% of its population using digital banks, translating to around 400 million account holders (estimated to reach 46% within the next three years). The success of Indian digital banks is largely attributed to their focus on serving unbanked and underbanked populations through alternative credit scoring methods and enhanced customer service.

3. Ireland: 25% of the population

Ireland follows closely behind, with around 25% of its residents (expected to reach 36% by 2027) utilizing digital-only banking services—approximately 1.2 million individuals.

What Will Set Top Digital Banks Apart?

In the rapidly evolving landscape of digital banking, distinguishing oneself from competitors is not merely advantageous—it’s essential. As consumer expectations shift toward more personalized, efficient, and accessible financial solutions, digital banks must leverage technology and innovative strategies to create a compelling value proposition. These are some of the key factors that set top digital banks apart – by focusing on these areas, digital banks can enhance their offerings and build lasting relationships with their customers in an increasingly competitive market.

Partnering for success

While convenience and accessibility are key differentiators for digital banks, competition remains fierce among both new entrants and traditional financial institutions. To gain an edge, ambitious digital banks must focus on strategic partnerships that enhance their service offerings.

Many digital banks lack comprehensive credit services such as loans and overdrafts typically provided by traditional banks. Consequently, forming alliances with established financial institutions can help bridge this gap and improve customer trust.

Building customer loyalty

Despite offering online support around the clock, many customers still value face-to-face interactions. This challenge can hinder brand trust development for newer players in the market. Successful strategies will prioritize seamless onboarding processes and user-friendly experiences that minimize risk during transactions.

Lowering exposure to fraud

As innovation drives rapid growth in digital banking, it also presents opportunities for fraudsters. Digital banks must proactively manage their fraud exposure through advanced prevention technologies and implement banking fraud detection software that ensures secure and efficient transactions.

How SEON Helps Digital Banks to Scale Safely

SEON’s real-time fraud prevention tools are designed to meet the evolving needs of both established and fast-growing digital banks, allowing them to expand rapidly across new geographies and product lines. Our customizable platform adapts seamlessly to each bank’s unique requirements, making it easier to scale without sacrificing security.

By enhancing existing fraud prevention and compliance systems, SEON provides efficiency without disrupting core operations. Through our pre-KYC solution, digital banks can filter out bad actors early in the onboarding process, reducing the need for costly KYC and AML checks and manual reviews.

SEON also offers simplified anti-money laundering (AML) tools and real-time transaction monitoring, helping digital banks identify suspicious activity and meet regulatory standards without overwhelming resources.

With a comprehensive suite of prevention, detection, and compliance capabilities, SEON empowers digital banks to tackle diverse threats—from account takeovers to sophisticated fraud rings—while ensuring a secure, customer-friendly experience that supports growth and expansion.

Discover the most prevalent fraud threats to digital banks and learn how you can stay ahead and protect your customers.

Learn more

Data Sources

- Share of online / mobile banking users in 56 countries & territories worldwide

- The Rise of Online Banking: What To Expect in 2024

- Digital banking in 2024: 12 trends to get yourself a leg up

- Digital Banking Market Size – By Banking, Service, Mode, End Users & Forecast, 2024 – 2032

- Why financial inclusion is the key to a thriving digital economy

- Global Digital Banking Industry Statistics: Explosive Growth and Future Projections

- Finder: Online bank adoption