According to statistics reported by eConsultancy, companies are 60–70% more likely to sell to an existing customer than a new one (where the probability is less than one-third of that, at 5–20%).

Taking this on board can have a huge impact on how you develop your business strategy, and even more so if you can verify the numbers by calculating the customer’s lifetime value, often shortened to CLV.

So what is CLV, and how do you leverage it? All the answers are here.

What Is Customer Lifetime Value (CLV)?

Customer lifetime value (CLV) lets you calculate how valuable a customer is over time. A simple formula for CLV multiplies the average purchase amount by the purchase frequency and then multiplies the total by the length of the customer relationship.

CLV = average purchase x purchase frequency x length of relationshipMonitoring CLV is a crucial part of understanding who your most valuable customers are. This is important for customer segmentation as well as for understanding how much you should spend on acquiring new customers versus focusing on old ones, or even how much discount you should offer to your most loyal user base.

Any business can calculate a CLV regardless of what they sell – be it products, goods or services. Departments that may be interested in learning a customer’s lifetime value include marketing, sales, finance, and revenue operations, among others.

Partner with SEON to stop fraudsters, optimize the customer journey, segment customers, and identify VIPs while staying compliant.

Ask an Expert

Why Is Calculating CLV Important?

Knowing your customers’ CLV helps you make better business decisions. For instance, CLV can help when you’re looking to answer the following questions:

- Should you invest in acquiring more customers or in developing older relationships?

- How much should you spend on customer acquisition (CAC – Customer Acquisition Cost)?

- Which products or services are the most profitable?

- What kind of client brings the most business in the long term?

- Should you invest in long-term loyalty discounts? And if so, how much should you offer?

Finding out the answers will help you focus on the most valuable areas of your business to boost profitability, reduce wasted marketing costs, and build stronger relationships with loyal customers and high-value customers.

How Do You Calculate Customer Lifetime Value (CLV)?

How you calculate CLV can vary greatly depending on your business model, but an example of the simplest formula is:

CLV = annual profit per customer x number of years they're a customerHere is an example using that formula for a customer who regularly purchases shoes from an online store:

3 pairs of shoes per year at $80 each x 5 years active

= $240 annually x 5 years active

= CLV of $1200Let’s now use the same formula for someone buying another item more frequently but spending a lot less each time. For example, sports socks:

12 pairs of socks per year at $5 each x 5 years active

= $60 annually x 5 years active

= CLV of $300Of course, there are many ways to improve upon this simple formula. For instance, you could:

- Subtract the customer acquisition cost (CAC): Some customers are more expensive to acquire than others.

- Take into account referral programs: Do your customers bring in more business through word-of-mouth? You may be able to measure the impact and ROI via a referral program, which can impact CLV.

- Work with averages: Some companies favor working with Average Purchase Value (APV) and Average Purchase Frequency (APF). APV is calculated by totaling revenue over a specific period and dividing it by the total number of sales. APF works by dividing the number of purchases by the number of unique customers.

- Include your churn rate: More sophisticated CLV calculations also look at churn rate to inform the average customer lifespan.

- Plug in other parameters: Some advanced calculations will take into account numbers such as inflation, margins, and retention rate to get a more nuanced picture of how CLV changes over the years.

5 Tips to Improve CLV

Regardless of how you calculate CLV, one thing is certain: Increasing the score should be at the top of your list. Here are five quick tips to do just that:

- Deliver outstanding customer service: A Zendesk study reports that 72% of consumers rank customer service as the biggest driver of loyalty. Loyalty means more purchases, which means a higher CLV.

- Reward loyalty: Garnering loyalty is one thing, but rewarding it keeps you in your customers’ good books, whether it’s thanks to discount codes, special offers, or exclusive items. You’ll want to be on the lookout for loyalty fraud, however.

- Reduce friction at every stage: Whether it’s at the checkout, transaction, or return stage, you need to make life as easy as possible for your customers. Consider implementing frictionless authentication methods, as well as other ways of reducing friction.

- Focus on your communications: Setting customer expectations is the best way to avoid cross-wires in the long run. This is true whether you’re writing your T&Cs and product descriptions or reminding users about the value of their accounts to prevent account takeover fraud.

- Surpass customer expectations: We’re wrapping up with a point that summarizes all of the above. Customer lifetime value tends to increase when you surprise and delight customers. Do as much of this as you can.

How SEON Lets You Monitor CLV

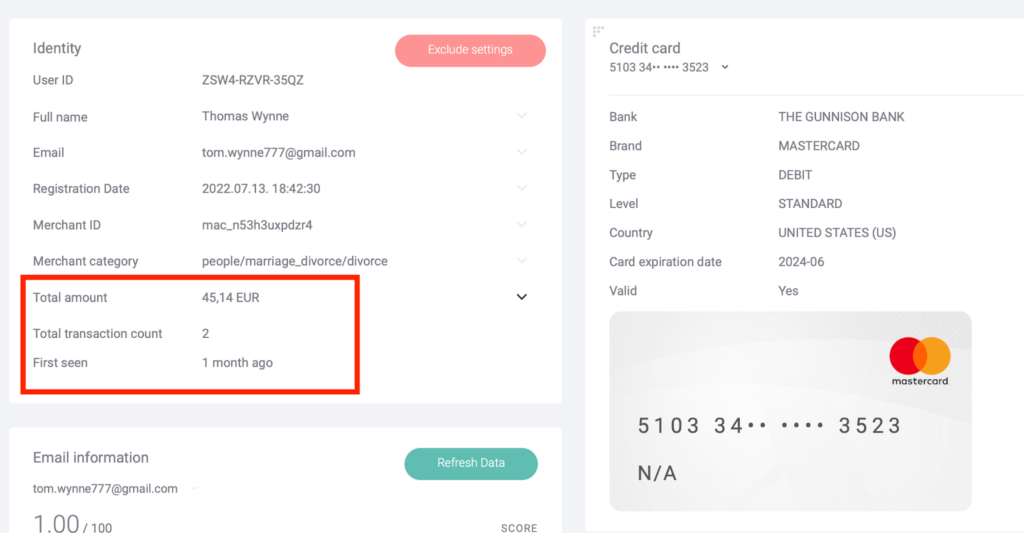

While SEON is first and foremost a fraud prevention system, we have built in specific tools designed to monitor and segment your most valuable users. This is ideal for tracking CLV and focusing on your most important customers.

The core advantage, of course, is that you’re working from a user-friendly dashboard with granular information about who you’re dealing with.

This makes SEON the ideal tool to monitor valuable opportunities, tailor your marketing and comms to user behavior, and generally learn more about your user base in order to develop more meaningful relationships.

Partner with SEON to reduce fraud rates in your business with real-time data enrichment, whitebox machine learning, and advanced APIs.

Ask an Expert

FAQ

The simplest CLV formula is Purchase Value x Purchase Frequency x Customer Lifetime. You can also calculate CLV using averages for multiple customers or your entire customer base.

Customer lifetime value varies greatly depending on your vertical, business type and customer base. There’s no precise number that is universally accepted as good or bad. The only thing to worry about is if your CLV is lower than your acquisition cost – which means you’re spending more on acquiring customers than these customers spend with you.

Customer lifetime value is affected by the duration of the customer lifespan, the average order value, and purchase frequency. Other parameters such as the cost of your products and customer acquisition can also impact CLV.

Sources

- eConsultancy: 15 ways for companies to increase customer lifetime value

- Zendesk: The Zendesk Customer Experience Trends Report 2020