AML and KYC legislation applies to all types of iGaming businesses. Operators must implement compliance solutions that ensure they meet their obligations while not introducing too much player friction.

Below, we explore this and other challenges of AML and KYC in iGaming.

What Is KYC in Online Gambling?

In iGaming, gambling and other sectors, the term KYC verification refers to a series of checks conducted to satisfy the legal obligation to request identifying documents from new customers at the sign-up stage.

These can differ depending on locale or licensing authority, but generally mean the new user will be asked to prove their name, address and age.

At online casinos, it is justifiable and fairly normal for money to be moved in ways that are unusual in other contexts – and this makes the sector more susceptible to money laundering.

Reasons for this include the fact that sizable transactions are commonplace here, as well as that it’s not unusual at all for bankrolls to be full of money one day and then completely empty the next one, and vice versa.

What Is AML for Online Gambling?

In gambling, iGaming and adjacent sectors, AML verification refers to a set of controls put in place to prevent these platforms from being used for money laundering and/or terrorism funding.

Real-money gaming, both online and offline, is considered an activity that is more likely to attract those who seek to launder money, such as money mules.

Why Are KYC & AML Important in Gambling?

KYC and AML are vital in iGaming to ensure legal compliance, protect players, prevent fraud, and maintain a trustworthy reputation within a highly regulated industry.

– Regulatory compliance: Most jurisdictions require iGaming operators to adhere to strict KYC and AML regulations. Compliance helps iGaming companies avoid legal issues, fines, and potential license revocation.

– Fraud prevention and risk mitigation: Implementing KYC procedures helps verify the identities of players, reducing the risk of fraudulent activities, including identity theft and account takeover. These measures help operators assess and manage the risk associated with their player base, which is crucial for business sustainability.

– Player protection: KYC ensures that only legitimate players can access iGaming services, protecting vulnerable individuals, such as minors and those with gambling addiction issues.

– Preventing money laundering: AML measures are essential in identifying and reporting suspicious financial transactions, making it more challenging for criminals to use iGaming platforms for money laundering activities.

– Reputation: Adherence to KYC and AML regulations enhances an iGaming operator’s reputation by demonstrating a commitment to responsible gaming and transparency.

Learn how an iGaming platform leveraged SEON to combat bonus abuse and improve efficiency by 20%

Case Study

KYC/AML Requirements for Gambling

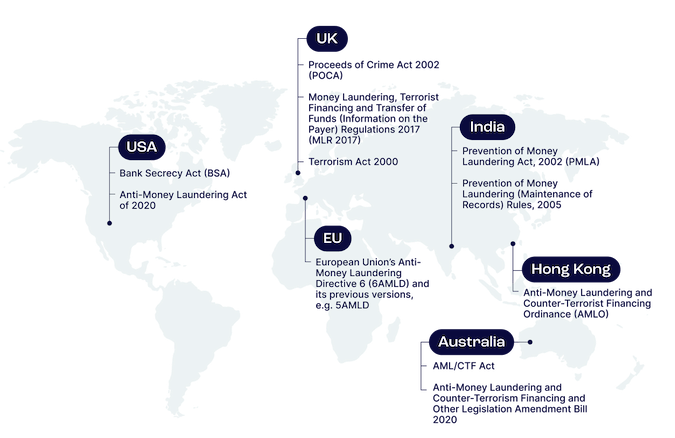

There are various KYC & AML requirements for gambling/iGaming companies around the world, depending on the operator’s country and the locale of the players who are allowed to join the casino or betting site.

However, in general terms, they include showing the iGaming operator proof of identity, proof of age, as well as proof of address.

Most countries incorporate guidance for casinos and other gambling firms within their umbrella AML bills, which tend to follow the United Nations Office on Drugs and Crime programs against money laundering.

The relevant UNDOC mandate is called Anti-Money-Laundering/Countering the Financing of Terrorism (AML/CFT), implementing “capacity building activities” that cover “both traditional and new means of money laundering techniques and illicit financial flows” – including online gambling.

Some of the legal mandates from major countries around the world are:

Challenges & Risks for AML and KYC in Gambling

There are several challenges iGaming operators face in relation to their AML and KYC obligations, and these originate both in legislation and new criminal schemes.

In terms of legislation, authorities have been ramping up their demands in recent years, with technological as well as geopolitical developments leading to a heightened need for stricter laws – in the opinion of legislators and regulators.

On the other hand, fraudsters and criminals of varying degrees of experience continue to come up with new methods and ways to circumvent legacy anti-fraud and anti-layering measures, which they either conduct themselves or instruct money mules to do. Sometimes, this involves smurfing, for example – the practice of breaking large sums to be laundered into smaller ones in order to go unnoticed.

But from there, the potential risks extend to almost every area of activity for iGaming brands:

- hefty fines impacting revenue

- closure/removal of license if found non-compliant

- player friction if asked for too much documentation

- new user churn

- bad publicity

- stalled growth

- etc.

Therefore, the key challenge for gambling brands is finding how to fully comply with all applicable legislation with minimal disruption to the customer journey, including sign-up and deposits.

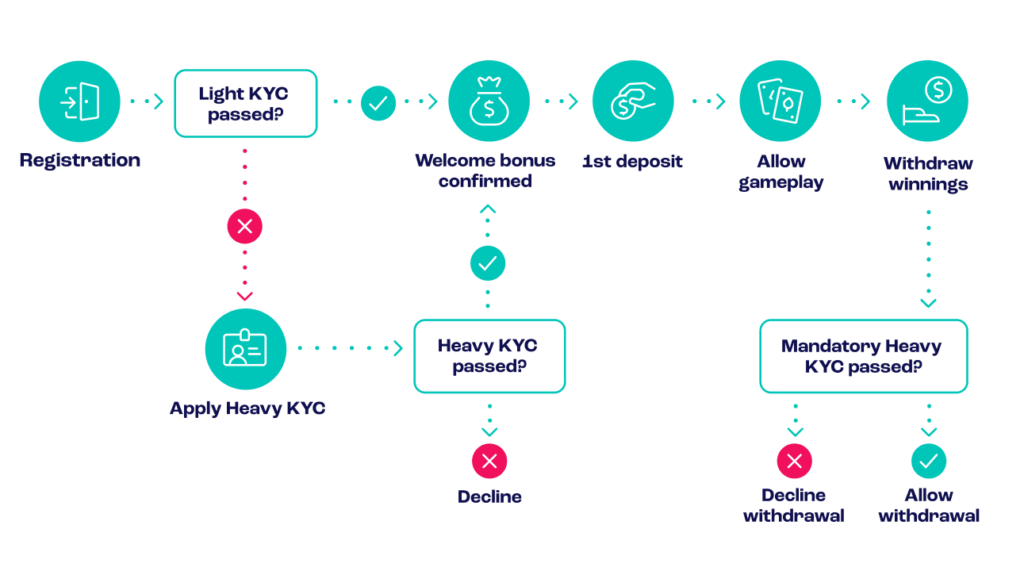

Here’s how KYC checks are implemented along the player journey:

AML/KYC Software & Tool Features to Look Out For

iGaming brands need KYC, CDD, and AML software tools that strictly comply with regulations without alienating genuine players.

Key AML and anti-fraud software features include:

- full compliance with legal obligations

- PEP and sanctions list screening

- real-time account monitoring for red flags

- strong document verification capabilities

- transaction and deposit method monitoring

- machine learning to learn from historical fraud events

- digital footprint analysis to gauge user legitimacy

- device intelligence

- blacklists shared or not shared

- consumer affordability checks

- pre-KYC checks as a first line of defense

These tools should operate discreetly, minimizing interruptions and maintaining player satisfaction and privacy, especially since many players prefer to keep their online gaming activities confidential. The smoother and less intrusive these solutions are, the lower the player dropout rate, boosting the profitability of casinos or gaming platforms. While certain regulatory steps are mandatory, finding a balance between safeguarding the iGaming company and ensuring player satisfaction is crucial for success.

SEON’s social media lookup tool checks 90+ social media networks and messenger apps to support your KYC verification checks

Ask an Expert

How SEON Complements AML & KYC for Gambling Platforms

SEON’s anti-fraud solution is customized for the iGaming industry, providing enhanced security for operators and users. It includes:

- AML screening: SEON’s AML API conducts manual and automatic checks against various PEP, RCA, criminal watchlists and sanctions lists, ensuring compliance and risk management.

- Pre-KYC checks: Using device fingerprinting, IP analysis, and digital footprinting, SEON detects potential fraudsters early, streamlining the KYC process without compromising user experience.

- Real-time transaction monitoring: SEON monitors transactions and player behavior in real-time, quickly addressing suspicious activities.

- Customizable iGaming rules: Operators can use SEON’s predefined iGaming rules or create their own for targeted fraud prevention.

- Machine learning: SEON’s AI-powered machine learning enhances fraud detection over time, adapting to new patterns and improving accuracy.

SEON helps iGaming platforms prevent account takeovers and identity fraud, ensuring a secure, trustworthy environment. It also enables operators to spot and act on money laundering indicators, with flexible rule-setting options to cater to specific platform needs.

KYC in online casinos is tailored to address the sector’s unique risks, such as frequent large transactions and rapid bankroll fluctuations, which heighten money laundering concerns. This makes the KYC process more rigorous compared to other industries, where financial activities are more stable.

Non-compliance with KYC and AML regulations can lead to severe penalties for gambling platforms, including hefty fines and license revocation, in addition to player dissatisfaction, user churn, negative publicity, and hindered growth.

Related Articles:

- SEON: KYC & AML: Key Differences and How They Work Together

- SEON: Online Gambling Fraud: How It Works & How to Stop It

Sources

- Comply Advantage: AML Regulations