Any company hoping to future-proof its operations and boost its bottom line ought to consider fraud prevention automation.

But how do you control the process, and what is automated fraud detection anyway? All the answers are in this post.

What Is Automated Fraud Detection?

Automated fraud detection works by deploying a workflow that blocks or accepts user actions based on what is considered risky. This involves setting up risk rules – which can be stricter or more permissive, per your risk appetite. For instance, you could choose to always block IP addresses associated with Tor nodes. But these rules can also be more fluid, allowing you to calculate a risk score and act on that risk score as well.

For instance, you could define that all users with risk scores over 20 out of 100 are automatically blocked from transacting on your site.

Risk scores are a key part of automated fraud detection. They allow your system to classify user actions as low, medium, or high-risk. Typically, you would accept low-risk actions, review medium-risk actions, and block high-risk actions – although sophisticated fraud prevention platforms such as SEON will allow you to change these thresholds at will.

What we call user actions may be a login, signup, transaction, or money deposit or withdrawal, among others. Your automated fraud detection software needs to gather as much information as possible during these stages to be able to effectively trigger the appropriate risk rules.

Learn how a real estate marketplace deployed SEON to automatically approve listings with 99% accuracy.

See the Case Study

An Example of Fraud Detection Automation

Let’s say that you are an online store with a common fraud problem: You have noticed customers purchasing your items using gift cards which have been topped up with stolen credit cards. When legitimate cardholders realize this, they put through chargeback requests, which are expensive and time-consuming to deal with – even for merchants who attempt to go down the chargeback recovery route.

So, you have established a pattern of fraud that commonly affects your business. The fraudsters are based in the US and pay with gift cards. This is where fraud detection automation comes in handy.

But there are two strategies you could deploy here:

- Use static rules: If you apply static rules, your anti-fraud system will automatically block all transactions from customers who are in the US and pay with gift cards. This will solve your fraud problem. But it will also create a lot false positives, where legitimate customers are blocked and frustrated by your heavy-handed security measures. In other words, everyone who tries to pay with a gift card and is based in the US will be blocked. That’s a lot of lost sales.

- Calculate a fraud score: Alternatively, you can gather payment and user data and examine it to decide if the transaction is low, medium, or high-risk. Then, you can automate the next course of action based on a traffic-lights system. For instance, you may choose to apply heavier KYC checks to medium-risk users, while another company may lose to block them instead, erring on the side of caution.

The advantage of the second option is less false positives. To achieve this, SEON applies what we call dynamic friction. It means that you can still automate your response to low-risk users (let them pay) and high-risk users (block the payments). You only have to manually review the medium-risk cases. However, this is fully customizable and easy to adjust.

In both scenarios, however, the idea is the same: To let the system automatically filter out fraudsters and allow good customers to access and interact with your business. Simply put, no company handing more than a handful of transactions a day can afford to leave out automation from its fraud prevention strategy.

The Pros and Cons of Fraud Detection Automation

Fraud detection automation is designed to be fast and effective – and to work on auto-pilot. But there could be some downsides, too. Let’s look at both the pros and the cons.

Automated Fraud Detection Pros

- Fewer manual resources: Most companies deploy automated fraud prevention solutions to alleviate the workload of existing fraud managers or staff. Otherwise, they have to manually review all user actions. The automated system takes care of a large chunk of that – although you may still need human oversight.

- Works at scale: Anti-fraud software works 24/7 and processes huge amounts of data. That means you can monitor user actions at scale without having to hire extra staff members for reviews. You can also accept payments and receive orders around-the-clock rather than just during office hours.

- Cost-effective: A direct consequence of the scaleable nature of anti-fraud software is that it’s affordable. There are caveats, of course, but most companies find that automation reduces the costs of manual reviews. Some fraud prevention companies, including SEON, will only bill you based on the number of queries or checks you conduct, too.

- Efficiency can improve over time: Thanks to the power of machine learning, you will receive suggestions for precise risk rules based on your fraud attack history – each of which is accompanied by a confidence score. Whether these will be applied automatically or not is also up to you. You could choose to automatically enable any of them that have a confidence score of more than 95%, for example.

Automated Fraud Detection Cons

- False positives or negatives: Letting software decide who gets to do what on your website, platform or app can have negative consequences – namely when it flags legitimate customers as fraudsters, or misses some fraud.

- Technical integration: While some fraud prevention systems are easier to integrate than others, the fact of the matter is that deployment and integration will require developer time and technical knowledge.

- Extra cost: Despite its high ROI, fraud detection isn’t free. You will have to factor in the price of the software, usually as a recurring monthly payment under the SaaS model.

- May still require human oversight: Even the best anti-fraud systems need to be tweaked and monitored by staff. Letting the system run entirely on auto-pilot, without any check-ins from specialists, can cause enough false positives or false declines that it may be damaging to your business.

Automated Fraud Detection and Machine Learning

There is another interesting automation worth mentioning in the context of fraud prevention: machine learning suggestions.

This is about leveraging the power of AI to help you create risk rules that are tailored to your business. Here is how it works:

- You let your ML fraud prevention system train itself on your historical and existing business data.

- You ensure that you label every accepted or declined transaction, login, or signup, so you are confident the system is receiving correct data input.

- The model will attempt to find patterns between the flagged actions.

- The model will serve up new rule recommendations.

A machine-learning algorithm will often uncover surprising patterns that a fraud analyst might have missed. You can then decide if you want to test, tweak or implement these rules as part of your risk management strategy.

The advantage of machine learning in fraud detection is of course that it can process huge amounts of data. The lack of human biases in the output of the rule suggestions can also help uncover patterns that an analyst would otherwise ignore.

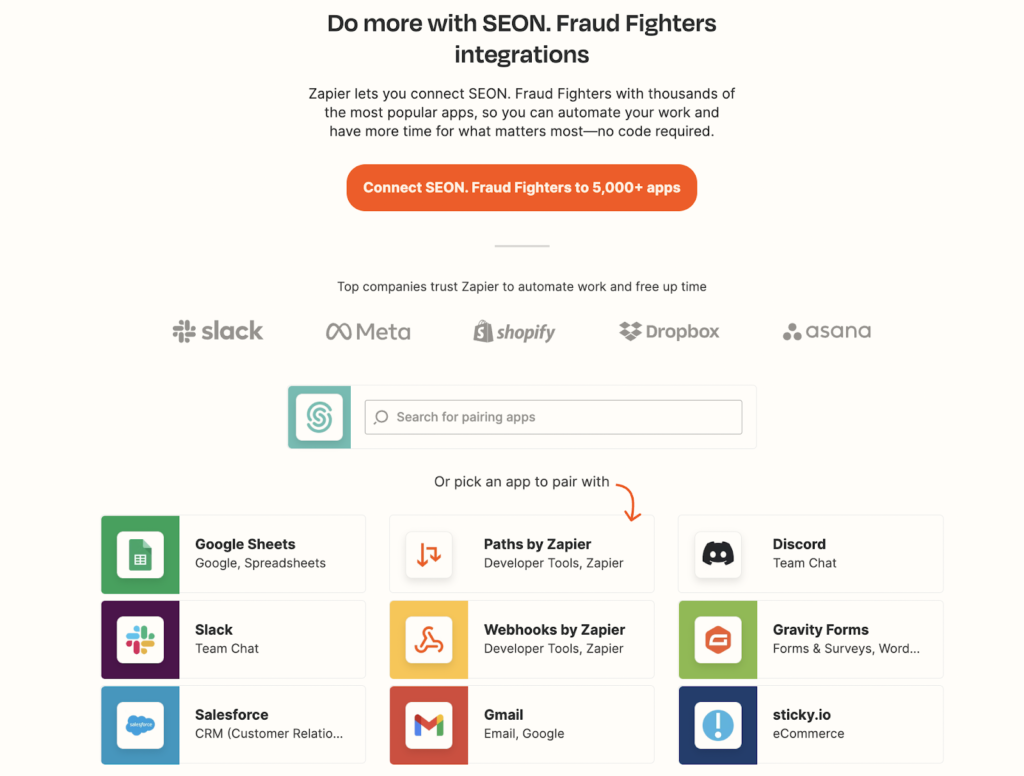

Fraud Detection Automation With Third-Party Apps

Another interesting type of automation worth mentioning when it comes to fraud detection is integration with other tools. As a result, you may be automating reporting, fraud alerts, manual review workflow and other aspects of your fraud prevention strategy.

This is handy if you want to automatically send and receive data in real time, to control user and transaction data in other apps. For instance, you could receive a Slack message any time a transaction is over a certain threshold.

How SEON Can Automate Your Fraud Detection

SEON offers fraud detection automation tailored to your business needs. You can either leverage the extra data we provide to augment your existing risk scores or further use the risk scores we calculate based on one or more of the following:

- industry preset rules designed to reduce fraud based on known risk rules

- custom rules created by you or in collaboration with our Customer Success Team manually

- machine learning rule suggestions made by our AI module, who is on the lookout for fraud patterns and trends that your fraud analysts may have missed.

The key is to gather as much user data as possible to ensure that the rules make sense to prevent your fraud challenges while minimizing false positives and making life easier for your team.

Partner with SEON to reduce fraud rates in your business with real-time data enrichment, whitebox machine learning, and advanced APIs.

Ask an Expert

Frequently Asked Questions

Fraud prevention leverages technology such as data analysis, data modeling and machine learning. The data is fed through risk rules which help you calculate how risky user behavior is. Machine learning can also suggest rules based on your business data, as well as give you a blackbox fraud score.

Fraud detection can be automated by deploying fraud detection software. For instance, SEON can automatically accept user actions deemed low-risk and block those labeled as high-risk. Some automations are based on static rules, while more sophisticated tools can score risk and deploy dynamic automation.

AI and machine learning is used in fraud detection to suggest risk rules that are relevant to your business after analyzing your business data and fraud cases. Further, machine learning can provide risk scores, though these are not always explainable.