Marketplaces are magnets for fraudsters.

Unscrupulous individuals use them to sell non-existent items, buy with stolen credit card numbers, or even scam your legitimate customers. On Facebook Marketplace, which is by no means the only popular online marketplace, one in six users say they have been scammed.

Let’s discuss how to put an end to marketplace fraud.

What Is Marketplace Fraud?

Marketplace fraud happens anytime someone buys or sells something illegally on an online marketplace. This may include listing products or services for sale that do not exist or whose qualities are exaggerated.

Fraudulent buyers, meanwhile, purchase marketplace items with stolen credit cards, which is a form of card not present (CNP) fraud and triggers chargeback requests from legitimate cardholders.

Because marketplace buyers and sellers need to reveal personal information such as shipping addresses, scammers also tend to target marketplaces with phishing and social engineering attacks. A common scam, for instance, sees fraudsters pose as a seller, only to redirect the interested buyer to a malware-ridden website.

A report by the Federal Trade Commission in 2019 found that, out of the 3.2 million marketplace complaints in that year, fraud made up 53.1% (1,697,934) of the cases. Identity theft was second with 20.3% (650,572).

Marketplaces that allow customer ratings are also under pressure to monitor and prevent fake reviews.

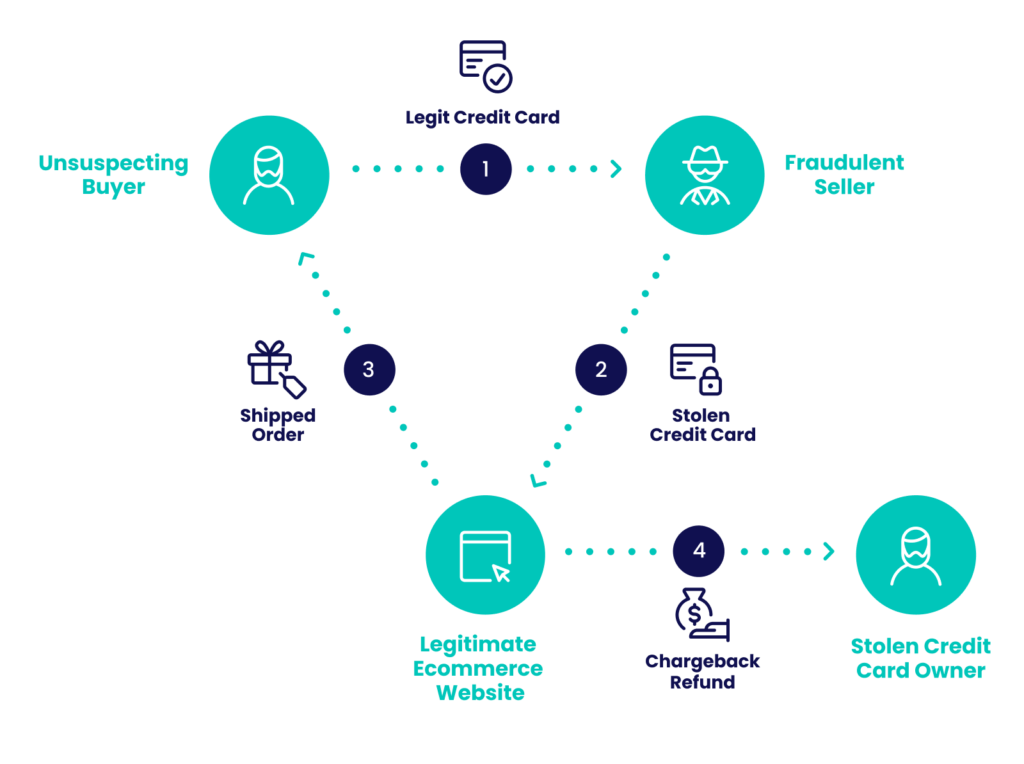

Meanwhile, a fairly new and growing worry is triangulation fraud, particularly effective on marketplaces such as eBay and Amazon.

Finally, it should also be noted that these days, marketplace fraud is almost synonymous with Facebook Marketplace fraud. The social network’s marketplace has become a favorite for fraudsters, who create fake profiles in order to go through with all the aforementioned scams.

Learn how Homegate automates listing reviews by leveraging the power of SEON’s data enrichment to reduce fraud.

Read the Case Study

6 Examples of Marketplace Scams

The most common scams feature variations on the theme of selling fake or non-existent items or buying with stolen credit cards.

But there are more sophisticated fraudulent attacks too. Here are five noteworthy examples.

#1: Triangulation Fraud

Triangulation fraud is a growing form of online fraud that takes advantage of online marketplaces’ lack of merchant profile verification. Here is how it works:

- A fraudster sets up a merchant profile on a marketplace and lists items at a discounted price.

- A legitimate customer purchases one of those items.

- The fraudster purchases the item from a legitimate shop using a stolen credit card and gives the legitimate customer’s shipping address to the legitimate shop.

- The customer receives the item and gives the fraudster a high rating.

- The legitimate cardholder, meanwhile, makes a chargeback request with the legitimate shop.

- As a result, the legitimate shop has to pay for the chargeback.

What makes triangulation fraud particularly hard to detect is that neither the original customer nor the marketplace is informed of the chargeback request.

It’s only the person whose card was stolen and the shop where it was used that have to sort out the issues created by the fraudsters.

#2: Overpayment Scam

The overpaying scam involves stolen credit card numbers. A fraudster will contact a seller and pretend to be interested in purchasing the item. They do so but overpay, so then they ask for a partial refund through another payment method.

If the merchant agrees, the fraudster pockets the refund, while the initial payment is either canceled by the legitimate cardholder or blocked. The merchant ends up paying the fraudster and not getting money for the sale.

#3: Fake Property Rental

Fake rental ads boomed during the pandemic, as many renters could not immediately visit the property. Fraudsters exploit this scenario by creating listings using photos and descriptions from other apartments – for example, found in other cities.

When the interested renter asks for more information, the fraudster explains that there is a lot of interest and recommends securing the place with a partial deposit. Of course, as soon as money changes hands, the fraudster disappears along with the fraudulent property listing.

Note that the same technique is also increasingly used for used cars, a market that has also grown drastically in recent years.

#4: Google Voice Scams

In this scenario, a fraudster steals phone numbers for phishing attacks. Here is how it works:

- A fraudster contacts a marketplace seller and asks for their phone number.

- The fraudster registers the seller’s phone number on Google Voice.

- Google Voice sends an OTP (one-time password) to the number to confirm registration.

- The fraudster claims that they are the one who sent that OTP for another reason, and asks the seller to confirm it with them.

If this has worked out, the fraudster is now in charge of a Google Voice number linked to someone else’s phone number. This allows them to call victims to defraud them, or attempt SIM swap fraud.

#5: Phishing for ID Theft

Fraudsters need personal information to create believable online profiles – for instance, to open bank accounts or take out loans. Marketplace listings are a perfect place to harvest data, as it would make sense to share personal information to arrange shipping for an item.

The fraudster will contact a seller to arrange to pick up the item instead of having it delivered. They will request the seller’s home address, email address, and phone number to confirm the pickup. This much personal information plus a full name is enough for fraudsters to steal identities for all kinds of nefarious purposes, including the creation of synthetic IDs.

Partner with SEON to reduce fraud rates in your business with real-time data enrichment, human-friendly machine learning, and advanced APIs.

Ask an Expert

#6: Bait-and-Switch

The oldest trick in the book, but still worth mentioning: Bait-and-switch fraud happens when buyers are lured with a low price, only to be asked for more and more money. The old adage applies here: If it’s too good to be true, then it probably is not true.

Also, note that fraudsters favor being paid in gift cards or cryptocurrencies, which aren’t traceable and which work like de facto internet cash.

How to Secure Your Marketplace from Fraudsters

A company like Facebook spends millions on security and still sees its marketplace riddled with fraudsters. But there are still steps you can follow to make life easier for your legitimate customers.

- Educate your users: Communicate regularly about the latest scams, which measures you’ve taken to remove fraudsters, and who to turn to if there are issues.

- Enable scam reporting: An extension of the point above is to give your customers tools to flag suspicious users and suspicious behavior themselves.

- Run better KYC checks: Most marketplace fraud happens when users can create accounts too easily. You don’t have to go all the way with ID verification, but running some basic checks, especially when they are frictionless, can go a long way in filtering out fraudsters before they get to join your platform.

- Cross-reference user data points: Fraudsters have to work at scale, which means recycling data points and multi-accounting. Maybe they use the same email address twice to log into two different accounts. Maybe it’s the same IP and device. Your goal is to monitor these data points to spot connections between bad accounts in order to block them.

- Monitor online behavior: The most sophisticated (and drastic) form of fraud prevention makes use of various data points relating to user behavior. For instance, how frequently does this person message others? Do they tend to send users to external websites? Do they mention external payment methods? And so on.

How SEON Helps Stop Marketplace Fraud

As a fully-fledged fraud prevention solution, SEON allows marketplaces and marketplace sellers to monitor, filter, and block bad agents before they can create a marketplace account, without interrupting the customer experience of good users.

Here is how it works:

- – SEON receives the customer data – what you’ve chosen to share. There is no need to ask customers for additional information, as an email address or phone number is enough, combined with the information gathered passively, through their IP address and device setup.

- – SEON enriches the data. For instance, by looking at whether there are any social media profiles linked to an email address, or if the IP is on a blacklist. By analyzing IP addresses and devices, we can get a complete digital footprint, which gives a 360° view of who is on the marketplace and how legitimate they are.

- – The enriched data and dozens more data points are all fed through risk rules, which allow you to measure, score and mitigate risk.

- – From there, you can implement a traffic lights system to benefit the customer experience:

| high risk | You decide which risk score is high enough to automatically block users. SEON recommends 20 (out of 100) but this is easy to adjust on the platform. |

| low risk | Good customers, as evidenced by their risk score, can enjoy marketplace access without having their journey interrupted by requests for extra verification. |

| medium risk | Medium-risk users could be actual fraudsters or false positives. For maximum confidence, review them manually or request additional verification from them. |

You can use the same rulesets to identify suspicious accounts and take out entire fraud rings on your platform.

All of the above is available in an affordable, modular package, with no setup or support fees. Want to learn more? Get in touch today.

FAQ

Telltale signs of marketplace fraud include accounts with no history, generic names, and stock profile pictures. Behavior-wise, watch out for people who try to get you out of the marketplace to continue the exchange elsewhere, ask to pay extra for your item, or ask for a phone number.

Marketplace fraudsters will list items for sale that do not exist. Fraudulent buyers use stolen credit card numbers and ask to pay online rather than meet in person. Others harvest personal data – for instance, by sending you a shipping form. Google Voice fraud happens when fraudsters ask for your phone number, with the goal of registering it for themselves on Google’s VoIP service, to then use it for marketplace fraud.

To avoid marketplace fraud, you should follow common sense. If a listing sounds too good to be true, it probably is. Monitor the buyer or seller account for discrepancies or suspicious data. Immediately leave if someone asks you for information that is not relevant to the sale.

Sources

- Finance Online: 57 Crucial eCommerce Fraud Statistics for 2022: Types, Cost & Protection Data

- Thinkmoney: The Facebook Marketplace scams you didn’t know about