iGaming fraud is no longer just about individual cheaters — it is a coordinated attack on operator revenue and platform integrity. From sophisticated multi-accounting and gnoming to systemic bonus abuse, fraudsters constantly evolve their tactics to bypass KYC and drain marketing budgets.

This article breaks down the prevention strategies, device intelligence and digital footprinting tools required to stop fraudulent activity before it impacts your bottom line.

Key Takeaways

- Stopping multi-accounting at the source: Modern iGaming fraud prevention uses device intelligence and digital footprinting to catch multi-accounting and gnoming before they distort platform data or lead to financial loss.

- Safeguarding promo spend: Effective bonus abuse detection ensures that sign-up incentives reach genuine players instead of professional fraud rings using synthetic identities and emulators.

- Frictionless player onboarding: By leveraging real-time risk scoring and behavioral analytics, operators can approve legitimate VIPs instantly while triggering dynamic KYC friction only for high-risk accounts.

- Global regulatory compliance: Automated AML screening and SAR filing help online casinos and sportsbooks meet UKGC and MGA mandates without slowing down the player journey.

What is iGaming Fraud?

iGaming fraud includes any kind of fraudulent attack against iGaming operators, online casinos, and online betting shops. Because of the nature of iGaming businesses, fraudsters have very specific methods of trying to abuse systems, cheat at games, and exploit loopholes.

While some of these iGaming attacks fall within grey areas, others are absolutely considered fraudulent, for instance: creating multiple accounts under different names, using stolen IDs to bypass KYC checks, and using spoofing technology to evade IP blocks.

Understanding the Scope of iGaming Fraud

Fraud in iGaming deeply impacts players, operators and the industry’s integrity and compromises the digital gaming space’s security and trust. Despite the implementation of advanced security measures, the dynamic and complex nature of iGaming fraud demands continuous innovation in fraud detection and prevention strategies, safeguarding the interests of legitimate players and operators.

Types of iGaming Fraud

- Multi-Accounting: Multi-accounting is when one person creates multiple accounts on a platform, often using different details, to exploit bonuses or influence game outcomes. It’s usually against platform rules and can lead to unfair advantages and financial losses.

- Gnoming: A subtype of multi-accounting, gnoming is where a user creates several accounts pretending they belong to different players. These accounts could be in the names of friends, family, or entirely fictitious individuals and are made primarily to abuse promotions or manipulate betting outcomes. Gnoming complicates the tracking and enforcement against such practices because the approach is designed to appear as if unique and separate individuals operate the accounts.

- Bonus Abuse: This fraud happens when users misuse a platform’s promotions in unintended ways, like signing up multiple times to claim welcome bonuses. It skews marketing results, distorts user growth data, and causes financial losses, while also hurting the user experience and fair competition.

Consequences of iGaming Fraud

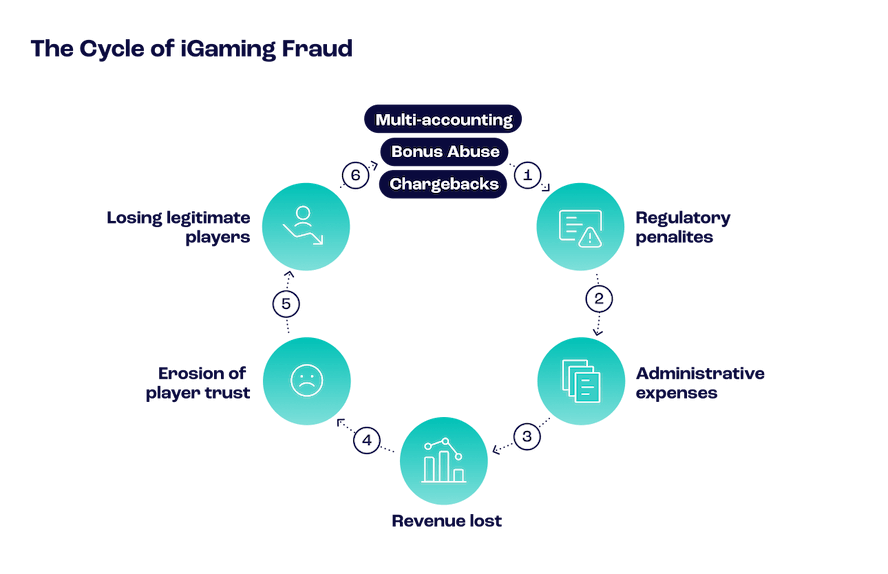

By understanding these consequences of fraud – and their ripple effects across different facets of the industry – stakeholders can better appreciate the importance of robust fraud prevention.

Financial Repercussions for Operators

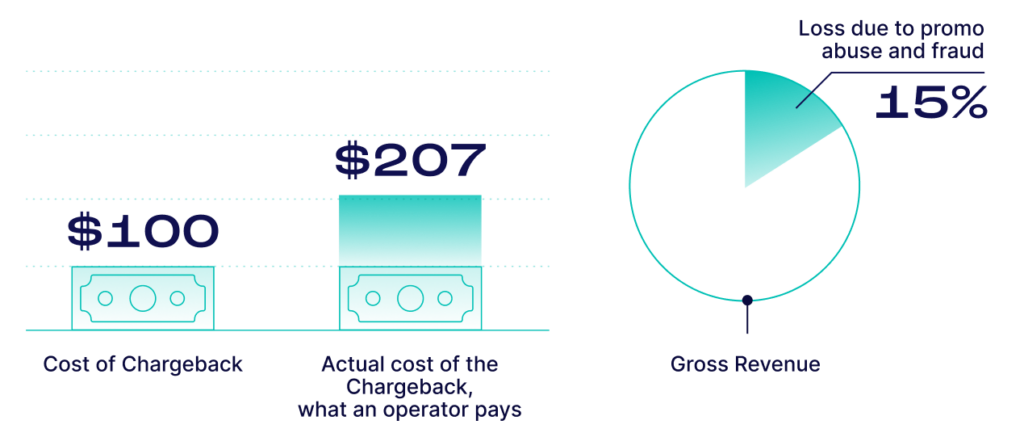

iGaming fraud costs operators millions, with up to 15% of revenue lost to promo abuse and each $100 in chargebacks costing $207 when fees and refunds are included. As fraud grows 30% year over year, losses can quickly escalate, while weak security drives away legitimate players. To stay profitable, platforms need scalable fraud prevention that keeps up with evolving threats.

Damage to Reputation & Player Trust

An operator’s reputation is its lifeline. Public incidents of fraud can severely damage an operator’s reputation, leading to diminished player trust, reduced engagement, challenges in acquiring new users and difficulties in retaining a loyal customer base. In today’s digital age, the news of fraud can spread swiftly, exacerbating damage and impeding an operator’s ability to recover and thrive.

Regulatory & Legal Implications

iGaming is tightly regulated, and failing to prevent fraud can lead to major penalties — including fines, legal issues, and license loss. Apollo Entertainment was cited for not protecting at-risk players, and the UK Gambling Commission issued a record $23.81M fine in 2023 for AML and social responsibility failures. These cases show why strong fraud detection is critical to stay compliant, protect players, and avoid costly consequences.

Impact on Player Experience & Platform Integrity

When fraud infiltrates an iGaming environment, it doesn’t merely disrupt operational metrics; it directly impairs the player’s experience. Fraudulent activities can skew the fairness of games, compromise the security of player accounts, and diminish players’ overall enjoyment and trust in the platform.

Exploitation Techniques Employed by Fraudsters

Fraudsters use advanced tools like VPNs, Tor, and incognito browsers to hide their activity and bypass detection from signup to withdrawal. They also automate account creation, betting, and gameplay, often using multiple accounts to exploit bonuses or rig outcomes.

AI and machine learning have made synthetic identity fraud more common, combining stolen personal data and credit card info to exploit payment systems and fuel chargebacks. To stay protected, operators must constantly evolve their fraud prevention tactics to keep platforms secure and fair.

Multi-Accounting in Depth

While not inherently fraudulent, deliberate multi-accounting to exploit or abuse a system crosses into unethical territory. At its simplest, it involves a user creating multiple accounts from the same device or IP address. At its most complex, the behavior can escalate to more sophisticated methods, where organized fraudsters employ emulators, virtual machines and advanced proxy services to generate seemingly legitimate user profiles, rendering financial losses, skewed platform data and other adverse outcomes for operators.

How to Prevent Multi-Accounting

Preventing multi-accounting requires a balanced approach that doesn’t overly complicate the user experience while effectively detecting and mitigating fraudulent activities. Here are critical strategies for preventing multi-accounting:

- Device Intelligence: A cutting-edge anti-fraud approach, device intelligence analyzes thousands of real-time data points to detect and prevent fraud, including scrutinizing hardware and software configurations across desktop and mobile devices and user behaviors to uncover patterns indicative of fraudulent activities. Device intelligence also enables the continuous monitoring and dynamic analysis of data points to safeguard online transactions and interactions.

- Digital Footprinting: Digital footprinting involves collecting and analyzing information generated by an individual’s online presence and activities, utilizing real-time data and a broad spectrum of social and digital signals. This layer of fraud prevention puts together a social profile by using data already collected during onboarding processes, like a phone number and email address. It can enhance the validation of customer details, allowing for more effective and efficient differentiation between legitimate and fraudulent transactions.

- IP Analysis: Beyond simple IP checks, this includes geolocation and involves monitoring for using VPNs, Tor networks and other means of obfuscating user location, which are common in multi-accounting schemes.

- Email Analysis: Leveraging data enrichment, operators can scrutinize email address details, such as domain validity, creation date and connections to social media profiles, to gauge the legitimacy of user accounts. Ninety-two percent of fraudsters use an email address that has never been involved in a data breach, with another 87% utilizing free email providers.

- Phone Number Analysis: Examining the carrier type, country of origin, and associated social media presence offers further insights into the authenticity of each account.

These strategies should be part of an integrated system that combines AI-driven analytics with human oversight to sift through vast amounts of data and pinpoint potential multi-accounting behavior. By implementing a multi-faceted approach, operators can detect and address multi-accounting efficiently, protecting their platforms from abuse while maintaining a smooth and secure user experience.

Tackling Gnoming

Gnoming accounts often masquerade as belonging to friends or fictional characters and contribute to manipulating iGaming outcomes. Addressing gnoming is crucial for maintaining the fairness and integrity of games and ensuring a level playing field for all players.

Preventative Measures & Best Practices for Gnoming

- Enhanced User Verification: Implementing rigorous verification processes at the account creation stage can help identify and prevent gnoming. This includes verifying unique user details and conducting background checks to ensure the authenticity of new accounts.

- Dynamic Friction: Apply dynamic friction measures, where additional verification is requested only for suspicious users. This approach minimizes inconvenience for legitimate users while scrutinizing those with potential gnoming indicators.

- Real-Time Data Analysis: Gathering comprehensive user information during account registration and analyzing this data can reveal connections between accounts, helping to detect and prevent gnoming practices.

- Custom Risk Rules: Develop specific risk rules to detect patterns and behaviors typical of gnoming, such as shared device or browser data, similar betting patterns, similar password hashes or irregular account activity. These rules can help identify potential gnoming activities early in the user journey.

- Continuous Monitoring: Regularly monitor and review account activities to identify unusual patterns like multiple accounts cashing out to the same beneficiary account number or other inconsistencies that may suggest gnoming. Early detection can prevent potential abuse and maintain the integrity of the platform.

- Education and Communication: Inform users about the risks and consequences of gnoming through clear communication and educational materials, including terms of service. Establishing a well-informed user base can deter individuals from attempting such fraudulent activities.

Combatting Bonus Abuse

Promo and bonus abuse perseveres as a significant issue, plaguing operators in high-risk sectors like online betting and gambling. Through deceptive practices, users compromise the platform’s financial stability and the state of fair gameplay.

Strategies to Detect & Prevent Bonus Abuse:

By implementing multi-layered strategies, operators can create a robust defense against promo abuse, protecting their platforms from financial loss, preserve the integrity of their offerings, and ensure a fair and enjoyable experience for all users:

1. More Complex Promotional Offers: Implementing intricate promotion offers with strict withdrawal conditions can aid in mitigating bonus abuse. Introducing rollover requirements ensures that bonuses must be wagered multiple times before withdrawal, reducing the feasibility of exploitation. However, balancing these rules is crucial to avoid deterring genuine users.

2. Digital Identity Profiling: Using tools for advanced digital identity profiling, including email analysis, IP analysis, device intelligence, digital footprinting, and even password hash monitoring, informs a comprehensive approach to identify and flag potential abusers and suspicious activities before registration is complete on the platform.

3. Continuous Monitoring: Continuous monitoring of user activities is employed to detect irregular patterns or anomalies that may indicate promo abuse. This can include tracking the frequency and nature of bonus claims and withdrawals and monitoring betting patterns indicative of abuse.

4. Delayed Customer Friction: While traditional ID verification plays a role, supplementing it with additional checks via delayed customer friction enables operators to leverage hard KYC checks when appropriate, as required by a user’s digital behavior. This refined process enables a holistic view of each player’s legitimacy and allows for more granular control of KYC processes, introducing check times as appropriate and necessary.

5. Use of AI and Machine Learning: AI and ML algorithms can analyze vast datasets and identify patterns of abuse. These technologies can adapt and evolve rapidly, detecting new tactics fraudsters employ to ensure that prevention and detection strategies remain effective.

6. Collaboration and Sharing: Engage in industry collaboration to share insights and strategies for combating promo abuse. Learning from the collective experience can help devise more effective methods to deter and detect abusive behaviors and report to governing bodies to forge cohesive and insightful regulations.

Balancing User Experience with Fraud Prevention

Achieving a balance between user experience and fraud prevention is crucial. SEON’s solutions are designed to maximize user convenience while maintaining rigorous security standards. By implementing intelligent, risk-based verification processes, iGaming platforms can provide a seamless experience for genuine users while deterring and detecting fraudulent activities.

Setting a Continuous Improvement Cycle Against iGaming Fraud

Adopting a continuous improvement cycle is vital in the changing landscape of iGaming fraud. This involves regularly monitoring, analyzing, and refining fraud prevention strategies based on the latest data and emerging trends. By staying proactive and responsive to new threats, operators can maintain a robust defense against fraud, ensuring their platforms’ ongoing integrity and success.

SEON’s Fraud & Money Laundering Prevention

SEON delivers a competitive edge in fraud prevention and risk mitigation by leveraging real-time AI-driven insights from its rules-based machine learning engine to empower operators to spot and prevent key fraud vectors – without impacting the player experience.

Crafted to uncover connections indicative of multi-accounting, gnoming and promo abuse, SEON enables operators to utilize insights from users’ digital footprints combined with behavioral patterns and device intelligence to thwart suspicious accounts.

SEON analyzes device, IP, email, and phone data to uncover who’s really signing up for bonuses — whether it’s a casual user or a fraud ring. It collects rich metadata and runs it through a customizable risk engine for clear, actionable insights.

With real-time checks for PEPs and sanctions, operators can stay compliant and manage risk from one unified platform.

Lottoland achieves 32x ROI

“With SEON, you can reduce bonus abuse… giving teams better visibility into campaign success.”

Frequently Asked Questions

iGaming involves rapid, high-value transactions and instant player interactions, making it uniquely susceptible to fraud like bonus abuse and multi-account schemes.

AI enables real-time detection of fraud patterns, automates responses and adapts quickly to evolving threats, helping operators stay ahead.

Balancing user convenience with security increases player satisfaction and loyalty, directly impacting long-term profitability and competitiveness.

Operators should be alert to sophisticated account takeovers, AI-generated fake identities, coordinated multi-accounting, and advanced bonus abuse tactics.

Sources:

- iGaming Operators vs. Fraud: the Stakes Have Never Been Higher

- 2024 Chargeback Fees – The True Cost of Your Chargebacks

- New FTC Data Show Consumers Reported Losing Nearly $8.8 Billion to Scams in 2022

- Evolution hit with class action lawsuit for alleged securities fraud

- Ontario iGaming Operator Slapped With Fine for Responsible Gambling Shortcomings

- William Hill fined record $23.7M for social responsibility, AML failures