Politically Exposed Person (PEP)

What Is a Politically Exposed Person (PEP)?

A politically exposed person is any person who has been entrusted with a prominent function, now or in the past – and thus has more and unique opportunities to be involved in corruption, bribery and/or money laundering.

Financial institutions are required to put in place additional anti-money laundering measures dealing with PEPs, both to identify such individuals and to assess and manage the enhanced level of risk associated with having them as clients.

This is all according to the Financial Action Task Force (FATF) Recommendations, a set of global guidelines created to combat terrorist financing, money laundering and the proliferation of weapons of mass destruction.

According to PwC estimates, $2.6 trillion is lost to corruption every year, with more than US $1 trillion paid globally in bribes. Over 6 billion of the planet’s 7.8 billion people live in countries where corruption is endemic, while 24% of the world’s businesses report being victims of corruption and bribery.

These figures demonstrate the importance of undertaking more than standard customer due diligence (CDD) on anyone whose position or influence puts them at greater risk of involvement in illegal financial practices.

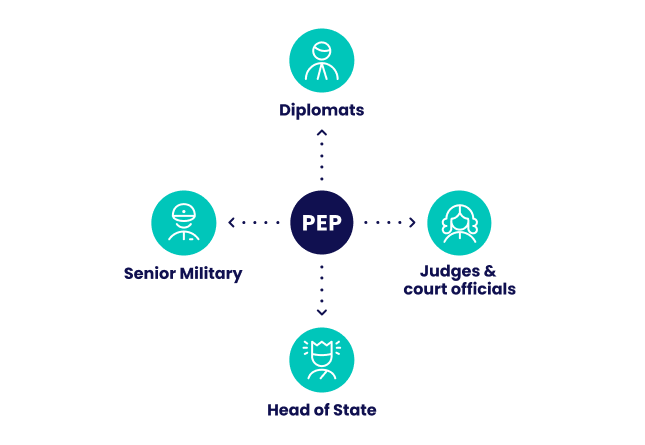

What Are the Types of Politically Exposed Persons?

There is no single, universally acceptable definition of a politically exposed person. Definitions vary between different countries. However, PEPs can be broadly identified based on certain types of roles.

For example, they can be classed as foreign PEPs, domestic PEPs, and international organization PEPs, with the types of roles that define a PEP including:

- Heads of State: Any head of state is considered to be a politically exposed person, along with other key members of executive bodies. These include heads of government, ministers, deputy ministers and assistant ministers.

- Members of Parliament: Depending on the country, MPs, Members of the House or Senate, and other members of legislative bodies fall within the definition of politically exposed persons.

- Diplomats: Ambassadors, consuls and chargés d’affaires are considered to be PEPs due to their influential positions.

- Members of the Judiciary: PEPs include senior judicial officials, such as judges and those in other key positions in the courts.

- Senior execs of state-owned enterprises: Anyone who sits on the board of a state-owned enterprise would be considered a PEP, as would the senior executives of such an enterprise. Even those who have previously fulfilled such roles should be considered politically exposed persons, as they are likely to retain considerable influence even after resigning from such posts.

- Members of key financial institutions: Board members of central banks and members of bodies such as the European Court of Auditors would all be classed as PEPs due to the nature of their positions.

- Senior military: High-ranking military officials also fall under the broad definition of PEPs, again due to their powerful influence.

- Members of international sports committees: Given the seismic impact that sports committee members can have on a city by awarding it a contract for an international event, they are PEPs.

What’s more, family members and close associates of the above can also be PEPs. These individuals are sometimes called PEPs and RCAs, with the latter being short for “relatives and close associates”.

It is not just an individual who holds a prominent role who is a politically exposed person. The term includes immediate family members (parents, children, and siblings), as well as spouses/partners, uncles, aunts, and in-laws.

Those who hold close professional, legal and social relationships with PEPs are often treated as PEPs themselves, so far as the Financial Action Task Force guidance is concerned.

How Do You Identify a Politically Exposed Person?

Financial institutions need to identify PEPs and effectively manage the risk associated with having them as clients. This requires the institution to do PEP checks and then implement an enhanced due diligence (EDD) process, including additional anti-money laundering and counter-terrorist financing checks.

PEP Criteria

The criteria for defining whether someone is a PEP include identifying whether they hold one of several types of prominent and influential roles in government, politics, finance, etc.

A financial institution could know this because the person has disclosed it or is known to be prominent in such a field. However, what happens more often is that the institution has access to long lists of politicians and diplomats, law enforcement officials, senior employees of state-linked corporations, etc., against which it checks the new customers. In fact, some AML tools automate this PEP screening and keep the lists fully up to date.

These criteria change slightly per locale but in general, anyone with enough influence to be accepting bribes and participating in high-level corruption would be a PEP.

They could be:

- a domestic politically exposed person

- a foreign politically exposed person

- an international organization politically exposed person

If an individual holds one of the types of roles we’ve described above, then it’s likely they meet the criteria for being treated as a PEP. Their close family and associates also belong to this category.

Changes in PEP Status

An individual’s PEP status can change in a variety of ways, including election or appointment to a role.

They can also become declassified from being a PEP, after they step down from such a role, though care must be taken here as an individual may retain their prominence and influence (and thus their PEP status) even after a role has finished, as PEP status can be open-ended.

PEP Status Examples

Let’s consider a few examples of PEP status:

- Is a mayor a politically exposed person? Yes, due to their prominent position, a mayor is a PEP.

- Is a celebrity a politically exposed person? No, a celebrity would not usually be considered a PEP.

- Is the head of the International Olympic Committee a PEP? Yes, those at the helm of international sporting bodies are politically exposed persons.

What Do You Do If You Have a PEP as a Customer?

The simple answer is that the company should apply Enhanced Due Diligence (EDD) measures to minimize the risk of the person being able to use the organization’s infrastructure and workflows to launder money acquired illegally – usually from bribes.

Once someone is established as a PEP, the FATF Recommendations then outline a series of steps to take.

These include obtaining approval from the financial institution’s senior management, and particularly individuals who have clearance to approve AML and CFT policies. Also, the source of the funds being deposited needs to be established, and the business relationship should be monitored.

| non-PEP customers | PEP customers | |

| sign-up and onboarding | Institution conducts standard KYC | Institution conducts KYC + ongoing EDD |

| internal approval | No additional approval needed | Approval from upper management needed |

| source of funds info | Might be needed for higher transactions, which can lead to Suspicious Activity Reports (SAR) | Always needed |

| activity monitoring | Minimal for the sector | Extended |

What Does PEP Legislation Say?

In general terms, PEP legislation defines the extended due diligence measures that need to be taken by institutions such as banks and investment firms to ensure no PEP can use their systems to launder money from bribes, finance terrorism, or support weapons of mass destruction.

PEP legislation changes by locale, though many countries’ approaches are broadly similar thanks to the FATF Guidance and Recommendations on Politically Exposed Persons.

In particular, Recommendations 12 and 22 require that countries ensure their financial institutions – along with a range of “designated non-financial businesses and professions” – put measures in place to detect and guard against any PEPs misusing their systems, products and functions.

How Do PEPs Affect Businesses?

Several types of organizations in the fintech, banking, insurance, iGaming and other sectors are already under a legal obligation to be Know Your Customer (KYC) compliant. They also need to observe anti-money laundering (AML) and counter financing of terrorism (CFT) legislation.

Adding to the above, PEP requirements mandate that companies in high-risk industries for money laundering check their customers against lists of PEPs and take specific steps if found to be a PEP.

PEP requirements take KYC work further, with additional due diligence required and ongoing for the duration of the business relationship (versus one-off KYC for non-PEPs).

Beyond PEP lists, AML software and tools that provide access to lists of PEPs also incorporate lists of sanctioned individuals and other miscellaneous blacklists. This makes it easier for businesses to ensure they comply with all relevant anti-money laundering regulations.

How to Do PEP Screening

Politically exposed person screening involves identifying individuals with PEP status. Businesses can do this by accessing information on PEPs available through:

- government, parliament and similar websites, many of which include lists of PEPs

- public registers and other OSINT sources, such as registers of companies and those with significant control of them

- commercial databases, many of which include lists of family members and close associates of politically exposed persons, as well as the PEPs themselves

- news reports from reputable sources, which can reveal new appointments

Among other features, anti-money laundering software sweeps such data sources, automating a large part of the process and making it easier for businesses to meet their obligations.

We should also note that PEPs who have malicious intentions might deliberately target neobanks and fintech startups, expecting them to be both more lenient with EDD because they’re so focused on the customer experience, and less experienced in compliance.

This is why for such digital-first organizations, robust AML and fraud prevention software is key to both steering clear of fines and keeping their own systems safe.

How Can PEP Checks Help Us Fight Fraud?

Incorporating the identification of PEPs, both when accepting new clients and as part of ongoing anti-money laundering transaction monitoring measures, is a key way for financial institutions to fight fraud and avoid hefty AML fines – while helping keep the overall economy healthy.

According to PwC, 5% of global GDP is lost to corruption each year. Enhanced due diligence in relation to PEPs can identify instances of corruption and bribery, money laundering and more, fighting against this global problem.

Related Terms

Related Articles

Sources

Speak with one of our fraud experts

Feel free to reach out with any fraud-related questions or comments - we’ll get back to you as soon as possible.