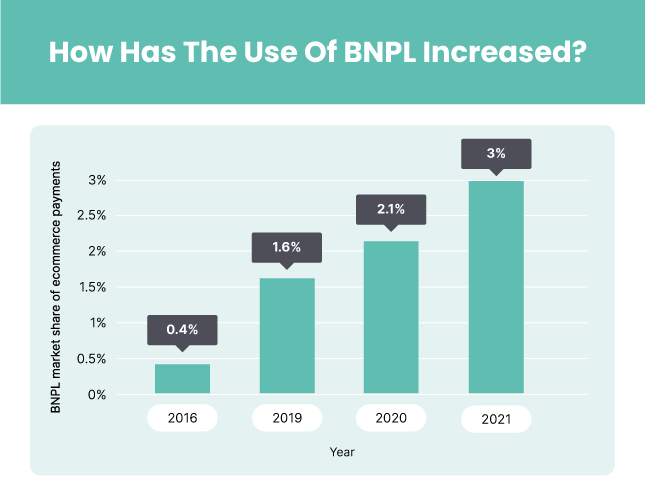

Buy Now Pay Later companies (BNPL) inherently take a risk with every new customer they onboard. And, with the sector holding a 3% market share globally and up to 25% in countries such as Sweden, the BNPLs who keep themselves safer are going to be the ones to dominate.

Here’s how to detect high-risk customers and keep them away, without slowing down the experience of good users.

Why Are High-Risk Customers a Problem for BNPL Companies?

Because they cost BNPLs in revenue, resources and even compliance fines. In fact, letting in too many fraudsters as well as bad debtors can make or break such a company, even causing it to shut down due to insufficient funds left.

BNPL companies’ growth has been supercharged in recent years. Unfortunately, that usually means accepting users who won’t be the most valuable in the long run.

In the BNPL world, these high-risk customers tend to fall within four key categories:

- Defaulting customers (never-pays): People who sign up for your BNPL service and manage to disappear without repaying the full amount they owe.

- Account thieves: Account takeover fraud is a huge problem when a BNPL service essentially operates as an e-wallet. There is a strong incentive for fraudsters to take over existing accounts to exploit them. It’s bad for your customers and even worse for your reputation.

- Transaction launderers: BNPL companies present a great opportunity for criminals who want to launder their money through approved purchases with legitimate merchants, using BNPL accounts in a similar manner to bank drops.

- Stolen credit card users: Sophisticated fraudsters will sign up to a BNPL service and link it to an illegally acquired credit card. Because the chargeback liability falls onto the BNPL company, you’re left having to deal with admin fees.

Then, of course, while not necessarily high-risk, you should also filter out junk users who sign up with fake IDs and bad data.

The good news? You can detect all of the above using the same tools.

Versatile and fully customizable, SEON helps you block high-risk customers, get alternative credit data, combat fraud, and grow faster.

Ask an Expert

How Do You Detect High-Risk BNPL Customers?

The key to detecting high-risk BNPL customers is to monitor transactions & start gathering data on them as soon as possible. This will be at the onboarding stage, where you probably already perform basic KYC checks and fast credit scoring. In come robust device fingerprinting, IP address checks, velocity rules, and so on – as well as taking advantage of digital footprint analysis to find out a wealth of information without any friction.

But why stop at the data that the users are giving you? This is where data enrichment can help you complete the picture, without adding extra friction to the onboarding process.

Put simply, it’s about using single data points to get more information. For example:

- IP address: Aside from the geolocation, we will also let you know if it’s from a VPN, Tor node, or proxy.

- Email address: Learn if the domain is trustworthy, whether it’s connected to social media accounts, and if the handle seems to match the customer’s name.

- Phone number: Is it a mobile or landline? Is it in the right country? And, more damning, is it a virtual SIM card?

- Card number: A BIN lookup will let you know if it’s from a prepaid card or from a known operator and if it’s pointing to the right country.

But what do you do with all the extra data? It’s time to feed it into the custom ruleset to detect risky users.

Top 3 Custom Rules to Detect High-Risk Customers in BNPL

Let’s look at 3 good custom rules to help you get started with identifying high-risk BNPL users.

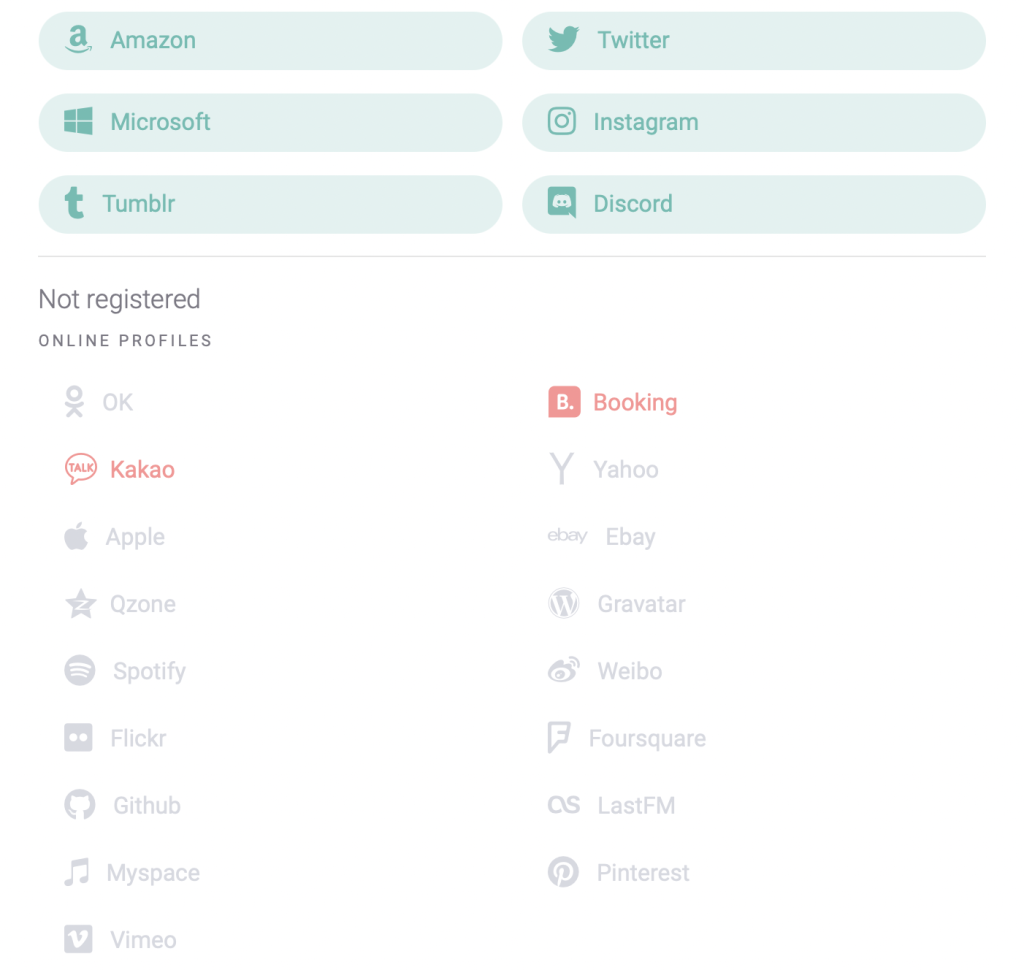

#1: User Has No Registered Social Media Profiles

The world is getting more social, not less. This is doubly true for BNPL customers, who tend to be younger Gen Zs and millennials.

This is why registered social media and other web platform profiles are a strong indicator of whether you’re dealing with a real person or not.

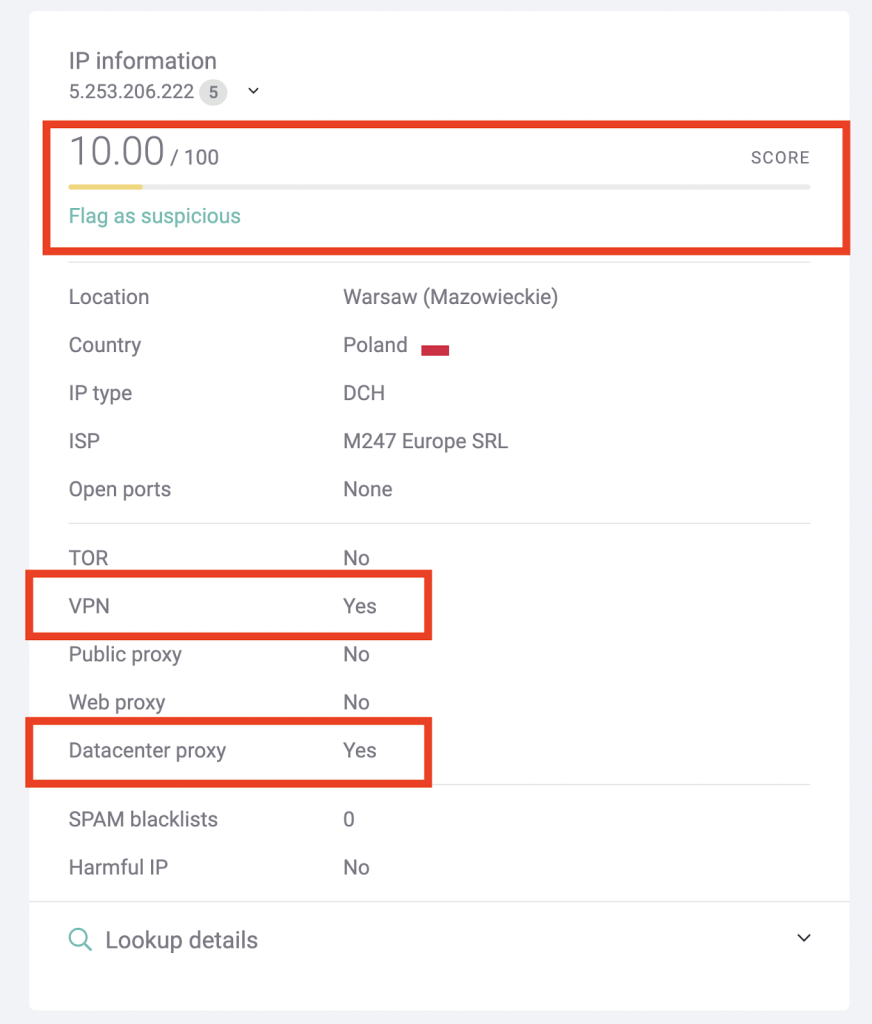

#2: IP Points to Suspicious Data

An IP address isn’t just used to gather geographic information. It’s also helpful to learn when someone is meddling with it.

In the world of high-risk users, this almost always points to fraudsters who are attempting to hide and spoof their IP addresses. They may do so with VPNs (low-risk), Tor (medium-risk) and datacenter proxies (high risk).

It’s the kind of information that can help you calculate an IP fraud score or segment customers based on how risky they might be for your BNPL company.

Best of all, it’s also a fantastic tool to highlight suspicious logins. This will help you reduce account takeovers and remove friction at the authentication stage for your most loyal and trustworthy customers.

#3: Sudden Increase in Spending

Another useful custom rule to spot potential chargeback fraud and money laundering: looking at sharp increases in spending.

This could point to a customer who is gradually increasing their credibility while planning to disappear without paying for an expensive item – or, of course, it should be a legitimate purchase. It is worth getting your fraud team to take a second look at though, always.

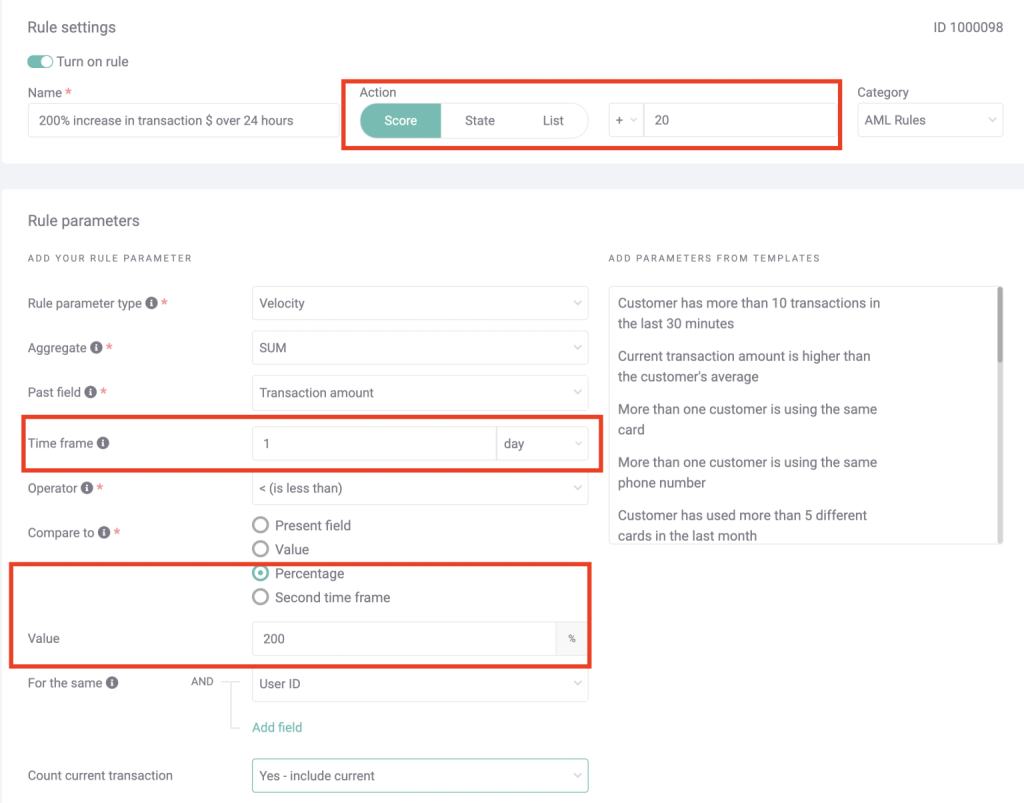

In the example below, we want to increase our risk score by 20 points when someone spends 200% more than usual within 1 day.

You could of course automatically send the transaction for review or automatically block it if you feel it’s too risky for your company.

How SEON Helps BNPL Companies Detect High-Risk Users

At SEON, we’re all about giving you as much risk management flexibility as possible.

This is true from the versatility of the dataset you can get (via specific modules), all the way to the integration method.

Perhaps more importantly, we know that our tech is loved by BNPL companies, who use it to:

- identify junk users before they onboard

- save on KYC and AML costs

- perform faster credit scoring

- reduce all fraud rates in the long run

Whether it’s by spotting connections between users or immediately flagging high-risk users, our BNPL fraud tools are guaranteed to help you grow safely – even as regulations and market forces change.

Partner with SEON to keep your BNPL safer with real-time data enrichment, unique digital footprinting, and advanced APIs.

Ask an Expert

Related Case Studies for BNPL

- Mokka Dropped Their Fraud Rates by Over 65%

- FairMoney Onboards Better Neobank Customers Thanks To Digital & Social Footprint Checks

Related Articles for BNPL

- Buy Now Pay Later (BNPL) Fraud: Risks & Prevention

- KYC and AML for Buy Now Pay Later (BNPL)

- BNPL Global Trends in 2022

- What Is User Activity Monitoring? Examples and Best Practices

Sources

- Statista: Market share of buy now, pay later (BNPL) in domestic e-commerce payments in 41 countries and territories worldwide from 2016 to 2021