What Is a Money Mule?

A money mule is someone who works to hide the origins of funds acquired via illegal activities. Mules launder money on behalf of others, in order to make the end recipients of the ill-gotten funds more difficult to trace. This is a criminal offense.

Alternative terms for money mules and muling are squaring, money laundering and layering, while there are specific techniques too, such as smurfing.

Money muling is usually deliberate, although it is possible to become a money mule without one’s knowledge.

Although money mules are not the ones who stole the money in question, and usually don’t know its exact origin, their activity is also illegitimate and they are often found complicit in money laundering schemes.

There are crime prevention authorities around the world running regular anti-laundering schemes, such as the annual European Money Mule Action, which is in its eighth year as of 2022.

How Big Is Money Muling Today?

Money muling is and will remain ever popular as long as criminals make money they need to launder. With time, its techniques adapt and change to fully take advantage of the tools offered by new technology and other opportunities.

The United Nations Office on Drugs and Crime estimates that 2–5% of the global GDP is laundered every year. That means anywhere from $800 billion to 2 trillion.

Individual numbers are on the rise, too. On 2 December 2020, Europol, working with law enforcement from 26 countries, announced the results of operation EMMA 6, which identified 4942 money mule transactions within two months, linked to 4031 individual money mules as well as 227 money mule recruiters.

The authorities went on to arrest 422 individuals worldwide, and prevent a total loss through these activities at €33.5/$28 million. In 2019, EMMA 5 had identified 3833 transactions, bringing 228 arrests and preventing €12.9/$10.7 million in losses – an increase of 88.79%.

With the financial problems and lockdowns it brought, the coronavirus pandemic offered criminals new opportunities to recruit money mules.

According to UK Finance, they even turned to social media to do so, targeting younger people, usually men. Research revealed that 17,157 cases of suspected money mule activity in the UK in 2020 involved 21-30-year-olds – which is 42% of all cases.

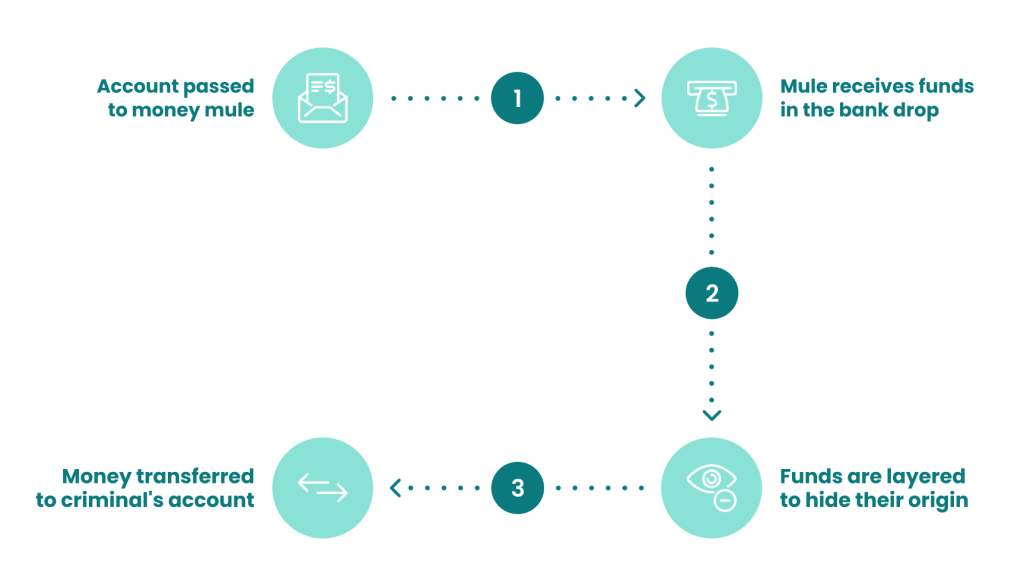

How Does Money Muling Work?

The process is fairly straightforward:

- The criminal illegally obtains funds through a variety of methods (e.g. phishing, ecommerce fraud, illegal sales, etc.)

- Criminal recruits a – witting or unwitting – money mule

- Criminal sends money to money mule’s account

- Money mule launders the money using a variety of methods, e.g.:

- The mule smurfs the money into multiple sums and accounts and then transfers it

- The mule transfers the money to a third party account

- The mule exchanges the funds into cryptocurrency, e.g. BTC or ETH before sending it forward

- The money reaches the criminal

One can also approach the question of “how do money mules work?” by considering the UN’s three stages of laundering:

- Placement: dirty money enters the financial system = the criminal sends the funds to the mule

- Layering: various activities by the money mule to obscure the funds’ origin = the mule launders the money

- Integration: laundered money reaches the criminal = now “clean”, the money is at the criminal’s disposal

According to Europol, more than 90% of money mule transactions are linked to cybercrime, but there are also links to terrorism, the illegal arms trade and drug trafficking.

What Are the Types of Money Mules?

The FBI defines three types of money mules, grouped according to their intentions and level of involvement:

- Unknowing/unwitting money mules

- Witting money mules

- Complicit money mules

Unwitting money mules are unaware they’re taking part in a larger criminal scheme. Because they are usually motivated by the trust they have in the person who asks them to do this, they could also be victims of catfishing on dating platforms, or recruited online, using social engineering.

Witting participants are understood to be somewhat aware they are involved in suspicious activity. What they are asked to do is a reason for concern for most people. For instance, to open multiple bank accounts. They may also have been given warning they are likely involved in an illegal scheme, which they have ignored. Thus, they are considered “willfully blind” to the fraud.

Complicit money mules are aware of what they are doing and take part willingly. They may advertise their muling experience and expertise. Often, they run muling rings, recruiting others and operating funnel accounts where they receive money laundered by lower-level mules. Complicit mules are usually charged with more serious crimes, due to their active participation and awareness of the illegal nature of the activities.

What Businesses Do Money Mules Target?

Any and all companies that are subject to anti-money laundering regulations are legally obliged to take steps to prevent money mule activity and money laundering in general. For example:

- Bank institutions and building societies

- Fintech and investment firms

- Cryptocurrency and forex brokers

- Estate agents

- iGaming companies

Whether an organization is required to follow AML regulations depends on local legislation. In general terms, this concerns organizations that hold, transfer or help individuals and businesses move large sums of money. This does not just mean banks. For example, iGaming websites are a frequent target of money laundering fraudsters.

There is specific AML legislation as well as regulators and supervising bodies in each jurisdiction, such as the OCC in the USA, Japan’s FSA, the EU’s EBA and the UK’s FCA.

However, there is also the FATF – the Financial Action Task Force, a global intergovernmental organization with 36 member states established in 1989. FATF sets regulations and enables collaboration to fight money laundering, money mules and financing of terrorism linked to it.

More than 200 countries and jurisdictions have committed to implementing its recommendations, whose most recent version is FATF Recommendations 2012, amended in June 2021.

Businesses that don’t comply with this legislation face prison sentences, fines as well as reputational damage.

The Warning Signs of Money Muling for Businesses

Activity that would be unreasonable or unlikely under normal standards for one’s average customer can be a warning sign of money muling. For example:

- Customer unwilling to pass KYC verification checks

- Money deposited/withdrawn unusually quickly

- User keeps logging in from different, remote geolocations

- Large spontaneous transactions

- Hundreds/thousands of small sums paid in and withdrawn in bulk

For crime-fighting authorities, “fighting money laundering goes hand in hand with investigating the crimes it is linked to”, as Interpol notes. Their efforts are big picture and mostly focused on using lower-tier money mule activity to investigate and catch criminal masterminds higher up.

However, for companies who want to ensure their users do not participate in – and they themselves are not implicated in – illegal money mule activity, there are available solutions in the form of AML fraud detection technology.

Depending on each organization’s circumstances, customizable passive monitoring of user activity can alert risk analysts about any red flags, fine-tuning and adjusting as needed. Such tools can scale up or down, while there are various niche and custom-built solutions as well.

Money mules are just one of the ways fraudsters will avoid detection when they attempt to launder money.

Read Our AML 101

Sources

Interpol: Money laundering

Europol: 422 arrested and 4,031 money mules identified in global crackdown on money laundering

Europol: Money Muling Guide

UK Finance: Money mule recruiters use fake online job adverts to target ‘Generation Covid’

FBI.gov: Don’t Be a Mule: Awareness Can Prevent Crime

UN Office on Drugs and Crime: Money Laundering

FATF: Topic: FATF Recommendations