Money laundering is in itself a concern for many obvious reasons, but what makes it an even bigger problem is when it is used in the complex, exploitable marketplace that is forex trading.

We look closer at why money laundering in forex trading is such a problem and the many ways that you can help yourself detect, and hopefully even prevent, such a criminal operation.

Why Is Money Laundering a Problem for Forex Trading?

It’s a problem for many reasons, but the key sticking point is that forex trading, as a system of exchanging ever-changing currency values, is volatile. This means that forex trading is not only poorly-equipped to prevent money laundering, but it outright prevents anti-money laundering measures from being easily managed and enforced.

Consider the countless factors that influence the exchange rates throughout every nation: political unrest, for instance, can reduce the value of a country’s currency. Meanwhile, times of prosperity for a country can rise the value of its currency. On top of this, the exchange rate of each country has an often unpredictable impact on many other parts of the world.

In fact, anti-money laundering (AML) measures against forex fraudsters – even those that combine the accuracy of automated systems with the intuition of human reasoning – are further challenged by the fact that forex trading is, by definition, decentralized, and thus hard to monitor. This makes it all the more possible for forex fraudsters to evade the authorities.

Partner with SEON to help reduce money laundering in your business with real-time data enrichment, whitebox machine learning, and advanced APIs.

Ask an Expert

Money Laundering Risk for Forex Trading

The money laundering risk for forex trading is palpable: foreign exchange rates are volatile, unpredictable, and often misunderstood. As such, the dynamic and non-static nature of forex trading makes it highly susceptible to money launderers who know how to exploit the murky waters of the industry and the anonymization that it brings.

This money laundering risk factor in forex trading becomes all the more clear when you consider how the industry is meant to work: A legitimate forex trader buys foreign currency, observes the currency exchange market, and then trades that currency for another if that other currency has a higher perceived value.

As such, the market changes quickly and unpredictably, and the speculative trading that this accommodates reflects a core reason why forex trading is such a volatile industry whose ever-changing nature can be exploited by money launderers.

In fact, this point of exchanging various currencies based on their ever-changing net worth is why the forex and cryptocurrency markets have a lot in common. Many crypto exchange platforms were modeled after the forex trading systems.

On top of the volatility of the forex market, another core money laundering risk stems from the fact that global currencies have no personal identification attached to them. This ensures that whenever people carry out forex trading, including of course money launderers, they are offered anonymization which makes their dealings far harder to trace.

On similar lines, note that the anonymization facilitated by cryptocurrency has led many criminals to commit cryptocurrency fraud.

The Effect of Regulations on Forex Trading

The effect of regulations on forex trading is not only significant but international. This is because countries’ currency values have a knock-on effect on each other due to the interconnectedness of overseas trading and other factors.

While forex trading and its regulations are indeed international, forex trading is not centralized: Naturally, countries manage their currencies differently from each other.

Due to the interdependence of foreign currencies, if one country’s forex trading regulations are to change, many other countries would have to change too, even if it’s only in the interest of maintaining a balance in global trading.

It is, however, worth reiterating the decentralized nature of forex trading. Even though new forex regulations – regardless of the country introducing them – will have wide-reaching effects, such effects will be specific to each country, its laws, and its preferences. It’s unsurprising, then, that those effects also require a rocky and time-consuming process before their implementation and legislation is finalized.

How to Prevent AML Risks in Forex Trading

AML risks are various threats that apply to the anti-money laundering systems of individuals and/or organizations. Preventing AML risks in forex trading is achieved by knowing and acting on the threats that are accommodated by the foreign exchange market, particularly at an organizational level.

In particular, if you – and let’s assume that you’re the owner of a forex trading website here – want your organization to prevent AML risks, there are three key points that you should consider and act on:

- The AML risks that are inherent to your forex trading website. For example, if your business is a popular one, its large subscriber base will make your AML risks even more problematic, so increasing your rate of KYC implementations is crucial.

- The AML risks that are inherent to forex trading. For example, the decentralized nature of forex trading means that you will not have a sole authority to report suspicious activity to. As such, your best course is to ensure that, when onboarding, your new customers input a fair, but significant, amount of personal information about themselves to help you to gauge their risk level.

- The AML risks that are compounded by your business operating as both an international organization and a user of forex trading. Consider that your forex trading website may, and often will, only become less secure as it grows in popularity and money launderers become more aware of how to exploit the forex marketplace over time. It is therefore essential that you ensure you have a multitude of context-specific, regularly-updated AML risk management systems in place – particularly customer due diligence (CDD) because this can be escalated to enhanced due diligence (EDD) when push comes to shove.

It is also worth noting that, considering the fact money launderers are an unfortunate inevitability, successfully preventing AML risks in forex trading is the best-case scenario.

To avoid anything worse – such as having to counteract money laundering after it’s already happened – proactively detect existing AML risks and thwart them. It is also important to ensure that your business is equipped with the best security software, not just at the onboarding stage, but throughout the entirety of the organization’s lifespan as an internet business.

How Do You Detect Money Laundering in Forex Trading?

To detect money laundering in forex trading, you need to be armed with up-to-date knowledge. Aside from knowing the latest tricks that forex trading fraudsters use, you need to have a strong understanding of the foreign exchange market and base your level of suspicion on the extent to which the potential forex trading fraudster is:

- carrying out transactions that don’t reflect the exchange rate at the time they were made – which is a key reason that a real-time knowledge of international currency values is so important

- favored or disfavored by AML and KYC checks – are they a politically exposed person or a high-risk individual, for example?

- displaying spending habits that are both frequent and excessive – because a sudden explosion of lavish payments may be down to the individual rushing to move, and ostensibly clean, their dirty money

On top of the above, you need to be conscious that many forex trading-based money launderers know that it’s not enough to use a forex trading platform, such as a forex website, to hide their identity and their illegal operations.

Such criminals know that, while forex trading forms a decentralized marketplace – and one that even allows a convenient level of anonymity for money launderers – there are still many systems in place that can detect their suspicious behavior.

As such, your best way to detect money laundering in forex trading is to learn what these money launderers already know, and then do your utmost to find the less well-known AML measures that are more likely to catch them out and stop them in their tracks.

Top 3 Custom Rules for Money Laundering in Forex Trading

SEON’s software enables its users to monitor its customers for potentially suspicious activity through the use of custom rules, which are various criteria that trigger fraud-fighting responses, such as DECLINE or REVIEW.

For example, if you were the business owner of an online betting website and you wanted to detect high-risk customers in iGaming, you could set SEON’s custom rules to detect transaction rates from your customers that are so high they cross a suspicious threshold, which you as the software customer can set numerically.

But owing to the fact that SEON is industry-agnostic, iGaming is just one of the many sectors that will benefit from the software’s custom rules. So let’s now take a look at our top three custom rules that can help combat money laundering in forex trading.

#1. IP Country Is AML High Risk

Forex trading money launderers can of course operate from any part of the world. However, the fact remains that forex trading is naturally an international activity and some countries are more notorious for forex-based fraud than others.

Due to this, a crucial recommendation for setting your custom rules to combat suspicious forex trading is to set SEON’s algorithms to trigger a response whenever the IP address of one of your customer’s accounts is registered to a high-risk country.

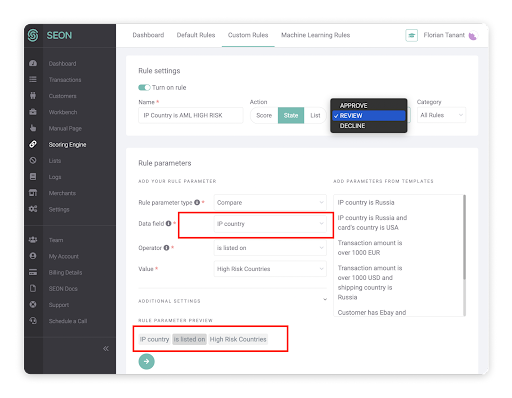

Let’s have a look at the below custom rule screengrab.

Here, a user has been flagged for the REVIEW status because their country is based in Russia, which is considered by SEON’s algorithms to have a high risk that it poses to your anti-money laundering efforts.

In fact, SEON’s Scoring Engine has yet another crucial IP search function: it tells you whether the user’s IP address doesn’t match the country that their card is registered to. This is also shown in the above screengrab.

IP results such as this are very worthwhile factors to consider when setting your SEON custom rules to combat money laundering in forex trading.

#2. Social Media Presence – or Lack Thereof

While a user’s location is a crucial factor to help detect forex-based money laundering, it is important to remember that the plain truth doesn’t change: many forex money launderers operate in the same way as any other criminals do.

As such, they simply never want to be caught. And this means that many of these criminals will consciously leave behind a digital footprint that is as small as possible, presumably having not realized that this can be suspicious in itself.

Let’s now check out the below screengrab.

This screengrab shows a result of SEON’s custom rule: one that is set to determine how high or low a person’s online presence is.

In the above result, there are 42 on-screen social profiles listed: 38 of them are marked grey, which signifies that the account is not registered to them; and four of them are marked red, which signifies that the checks were unable to be carried out at the time of the lookup.

This means that there are, at the very least, 38 social profiles, including very popular ones like Facebook and LinkedIn, which have been cross-checked with the user’s account – and that account is not assigned to a single one of them.

While having such a low online presence is by no means proof of a person’s guilt, it can certainly be evidence of it. While there are many law-abiding citizens who don’t sign up to a great number of online accounts, a social media presence this small might be cause for alarm.

To make SEON’s online profile counting system work for you when utilizing a custom rule, think about what you consider to be a suspiciously low number of online profiles and then set the number accordingly. This will then make SEON provide notifications based on online profiles that are as low as – or even lower than – that assigned number.

#3. Suspicious Browser Settings and Browser Versions

Let’s say you have your own forex trading website and want to know how your customers are using your platform. Among other things, SEON is able to detect whether each of your customers uses browser cookies and obscure browser apps.

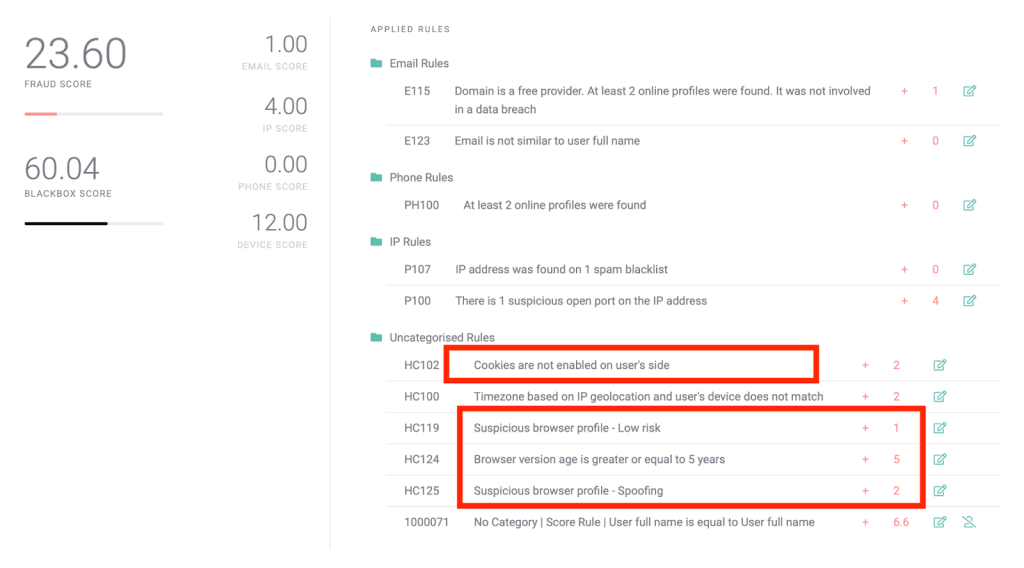

Let’s refer to the below screengrab, especially where it’s been marked with two red boxes.

Here, the user has assigned their own fraud scores to any instances of disabled cookies and three other scenarios, including signs of browser spoofing, all of which can each be considered suspicious uses of a browser.

A strong example of this is the above condition called “Browser version age is greater or equal to 5 years”. What this criterion can do is suggest that the user may have been deliberately using a browser that’s old to the point that it doesn’t have the same level of in-built security and traceability that safer, more up-to-date applications will have.

Note, however, that none of these conditions are necessarily reasons to deny a user the right to use your forex trading website. In fact, the screengrab shows that the SEON customer decided to go for a small fraud score for each condition, meaning that, even if someone were to match all four of the conditions, they’d only be given the fairly low fraud score: 10.

Nevertheless, by assigning your custom rule to give fraud scores to users showing suspicious approaches to internet browsing, you will help yourself to gauge the likelihood that they may be misusing your forex trading website for money laundering or other nefarious activities, such as account takeover fraud in forex trading.

How SEON Helps Forex Trading with Money Laundering

The fight against money laundering in forex trading is helped by SEON as the software allows customers to determine which conditions constitute suspicious behavior and set their custom rules accordingly. This can help those customers to review suspicious forex traders at best and outright cancel guilty forex money launderers at worst.

On top of this, SEON has a multitude of other online resources that help its users and readers to understand and detect signs of dubious forex trading activity. For anyone wishing to learn more, it is worth checking out the below sections that cover SEON’s related case studies and articles about forex trading, AML, and much more.

SEON’s AML solution will boost your AML compliance without friction and stop all kinds of fraud with real-time data enrichment and advanced APIs.

Ask an Expert

Related Case Studies for Forex Trading

Related Articles for Forex Trading

- AML in Banking: Its Importance & How to Remain Compliant

- AML Fraud: How to Detect & Prevent It

- Top 10 Anti Money Laundering (AML) Software

Sources

- Finance Magnates: The Importance of Regulation in Forex Trading

- Investopedia: Forex (FX): How Trading in the Foreign Exchange Market Works

- IG: Forex (FX): How Trading in the Foreign Exchange Market Works