Financial institutions worldwide are continuously evolving their strategies to combat fraud and money laundering, two threats that undermine the potential of our global financial systems. With the United Nations reporting that three to five percent of the global GDP is laundered annually and fraud costs worldwide reaching $5.13 trillion – a 56% increase over the past decade- many organizations are taking a new approach to integrating prevention and protection efforts.

As fraud gains in volume and velocity, so too will the need for fraudsters to launder their profits – and as cross-border financial crimes are here to stay, no institution or location is immune. With the complexity and scale of threats on the rise, any small chink in the armor can become a massive issue.

What is FRAML?

FRAML, or Fraud and Anti-Money Laundering, represents a holistic strategy that presents an effective way for organizations to strengthen their defenses against both fraud and risk. Uniting fraud protection and prevention with AML checks and compliance allows for better collaboration across the historically siloed operations of teams dealing with distinct but related crimes – fraud and financial crimes, terrorist financing or other nefarious intentions.

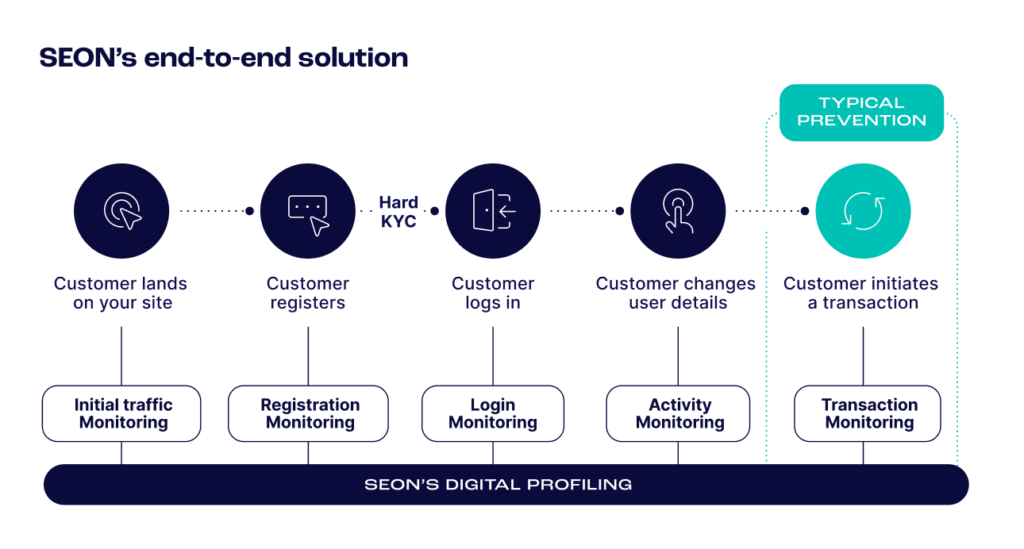

FRAML enables companies to leverage unified customer data profiles to reduce fragmented risk and fraud views, streamline operations through information sharing that can also reduce costs, support adherence to timely regulatory changes to minimize compliance risks, as well as enable better internal and more strategic decision-making across teams. This end-to-end approach closes the gaps that fraudsters and money launderers exploit to foster a more resilient, agile, consolidated defense.

Fraud Vs. Money Laundering

Fraud and compliance teams, both operating to reduce risks, have long been stuck in their swim lanes, hindering effective collaboration and all-encompassing responses to threats. The adjacent threats of fraud and money laundering are disadvantageously positioned when siloed. Fraud refers to any deceptive or dishonest activity carried out online with the intent of gaining unauthorized benefits or causing loss to others. At the same time, money laundering is the process of making illicit money generated through criminal activity appear legitimate by integrating it into the financial system without suspicion.

Both departments are crucial in identifying and mitigating fraud and reducing risk, including financial, operational, legal and reputational hazards. When operating in isolation, teams hold fragmented risk views, potentially overlooking valuable insight that could enhance their understanding and evaluation of each scenario and thus inform their choices.

Learn how FRAML fosters collaboration between fraud and compliance teams, breaking down siloes for a more robust defense.

Speak with an Expert

Enhancing Risk and Fraud Assessment Through FRAML

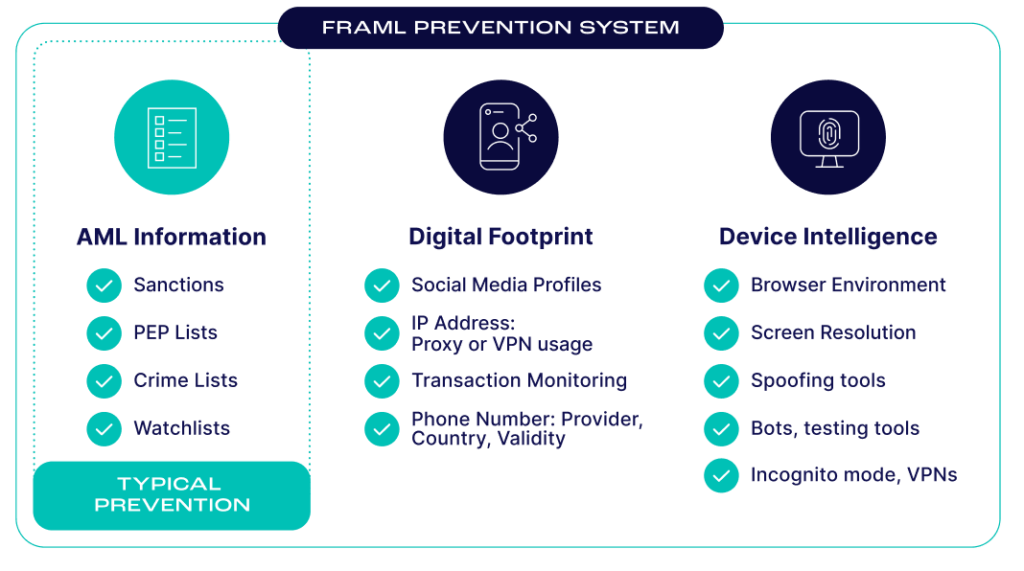

When a risk team needs to assess an individual, they would first look into traditional AML checks, such as sanctions, politically exposed persons (PEPs), and crime and financial watch lists for hits to inform their AML investigation. When taking a FRAML approach, the team would then be able to augment their understanding of the individual in question by leveraging digital footprinting data and device intelligence – such as if there are multiple email addresses attached to the name, are the person’s accounts active, what is their transaction history and online behavior indicate – to derive a comprehensive digital profile that arms them with a more profound knowledge to better understand intentions and actions. The nuanced depth available in FRAML-based approach empowers quicker decisions on whether an alert needs to be escalated into a case or can be assuredly closed out faster.

Moving in the other direction, fraud teams can leverage traditional AML information to create more robust and refined risk rulings. Cross-checking with AML data can uplevel alert systems to create more nuanced and context-rich alerts when looking at a digital footprint or device intelligence. For instance, if a user’s digital behavior seems suspicious but not overtly fraudulent, triggering dynamic friction (otherwise known as delayed customer friction) at strategic intersections adjustable to the level of user verification and security measures needed in real-time can optimize the balance between user convenience and prevention. This information also allows for the integration of AML checks, such as a match on a sanctions list or association with PEPs, to significantly alter the individual’s risk profile, thereby enhancing the overall effectiveness of fraud detection and prevention mechanisms.

This integration enables fraud teams to prevent fraudulent transactions and block potential money laundering activities, enhancing the organization’s overall security posture. Such cross-functional insights facilitate a more proactive and predictive approach to identifying and mitigating financial crime, ensuring that organizations stay one step ahead.

Technological Enablers of FRAML

FRAML streamlines fraud and money laundering detection into one system versus many systems. Advancements in data processing, machine learning and rule customization stand at the core of this approach, providing a solid foundation for institutions to refine and combine their efforts.

By harnessing technologies, organizations can process vast amounts of real-time data swiftly and accurately to meet the growing scale and volume of today’s threat landscape, enabling adaptive models that identify subtle patterns or anomalies indicative of fraudulent or laundering activities. Customizable rules allow for tailoring mechanisms to unique operational contexts, enhancing the precision of screening processes.

Moreover, using one solution for both fraud prevention and protection and AML initiatives minimizes the reliance on endpoint solutions or reliance on multiple third-party data sources while maximizing the use of trusted information, reducing potential vulnerabilities and enhancing the integrity of the risk assessment and anti-fraud measures. The collaborative insights gained from this integrated approach are both additive and exponential, offering a more profound understanding of risks and enabling more informed decision-making.

Eliminate isolated operations and unify your team’s risk views to gain comprehensive insights and make informed decisions.

Speak with an Expert

Regulatory Bodies Increasingly Endorse FRAML

The value of FRAML in fortifying the financial sector against illicit activities is increasingly registering among regulatory bodies today, with the Financial Crimes Enforcement Network (FinCEN) at the forefront, advocating for financial institutions to foster collaboration among their AML, fraud defense, legal and cybersecurity departments. This push toward an integrated strategy stems from the understanding that the convergence of expertise and information across these domains significantly enhances an organization’s ability to detect and respond to complex threats.

Regulators are beginning to promote FRAML as a best practice and a comprehensive framework that aligns with broader regulatory expectations for due diligence, risk assessment and compliance. By endorsing this approach, regulatory bodies aim to elevate the industry’s standard for combating financial crimes, ensuring that institutions are compliant and better equipped to safeguard the system’s integrity and stability.

A Greater Shift Toward End-to-End

Folding AML into fraud prevention affords a way to approach intertwined challenges that can amplify the effectiveness of each practice. Beyond sounding like a buzzword, FRAML is a strategic imperative that empowers institutions to streamline detection and response processes by leveraging a comprehensive view of risk, enabling organizations to act more decisively and proactively.

Sources: