Money laundering remains a massive global challenge, with criminals laundering an estimated 2%–5% of global GDP annually — roughly $800 billion to $2 trillion, according to the UN. One of the most critical phases of this process is layering: the stage at which illicit funds are moved through rapid, complex, and often cross-border transactions to break the audit trail.

Understanding how layering works is essential for compliance teams, as this is where most laundering activity becomes hardest to detect.

What Does Layering Mean in Money Laundering?

Layering is the stage in a money laundering scheme where criminals move illegal money through multiple transactions to hide where it came from. The goal is to create a confusing trail that makes it difficult for investigators to link the funds back to the crime or the people involved.

To achieve this, criminals often change the form, location, ownership, or currency of the money — for example, converting USD to GBP, routing it through accounts in another jurisdiction, and then converting it again. Each extra transfer or conversion adds another “layer,” making the funds harder to trace and the individuals behind them more difficult to identify.

In simple terms, layering in money laundering is:

- meant to create a trail that’s hard to link back to criminals

- designed to hide illegal money

- built around many transactions and entities

What’s the Purpose of Layering in Money Laundering?

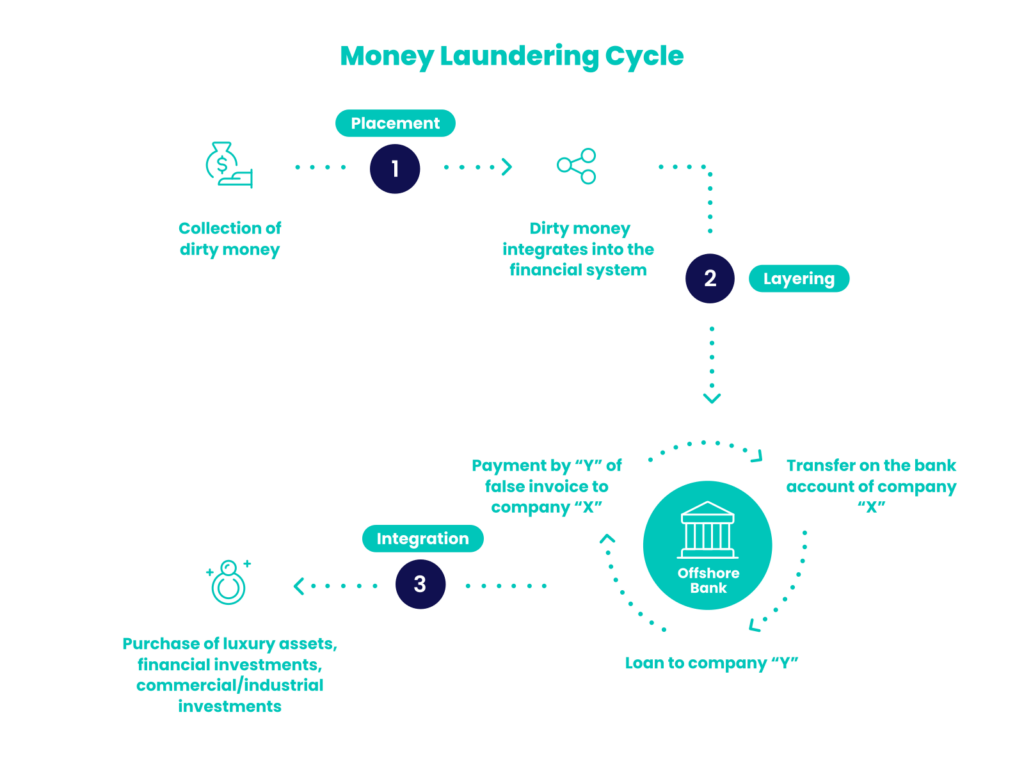

The purpose of layering is to hide the connection between illicit funds and the crimes that generated them. Once money has been deposited into the financial system during the placement stage, criminals need to ensure it cannot be traced back to them. Layering acts as the smokescreen: each added layer reduces transparency. Criminals may move funds across borders, exploit financial institutions with weak controls or convert cash into assets and back again.

By making investigators chase shifting currencies, jurisdictions and account ownership, criminals reduce the likelihood that authorities can piece together the true flow of funds. Once the funds appear sufficiently disconnected from their source, launderers can move into the integration stage, where they reintroduce the “cleaned” money into the legitimate economy.

Methods of Layering in Money Laundering

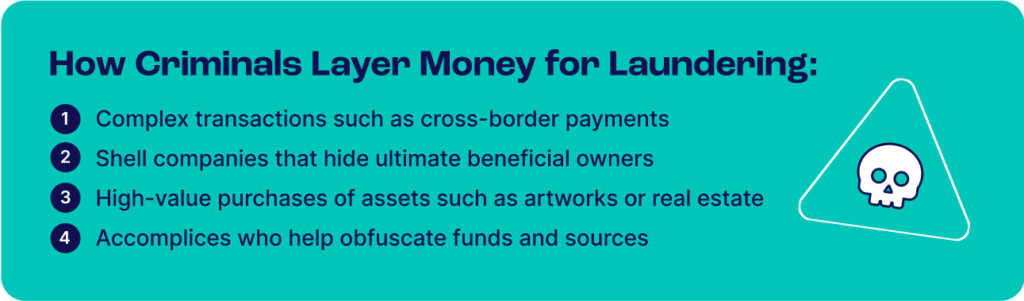

Layering can involve any action that adds complexity or obscures ownership, but certain techniques are especially common in sophisticated schemes.

- Complex transactions: Criminals use rapid, high-volume or irregular transactions to disguise the source of funds. This may involve international wire transfers, foreign exchange trading, transactions routed through high-risk jurisdictions or frequent shifts in payment amounts. The objective is to create a transaction history so dense and inconsistent that it becomes impractical to follow.

- Shell companies and front businesses: Shell companies provide a façade of legitimate activity while hiding the true ownership of funds. These entities may exist only on paper, operate minimal real business activity or be structured across multiple jurisdictions. They allow criminals to move money under the guise of corporate payments, loans, invoices or investments, adding significant opacity.

- Asset investments: High-value assets, such as real estate, fine art, luxury vehicles or precious metals, are frequently used in layering strategies. Criminals convert cash into physical or financial assets, sell them later or transfer ownership among shell entities to further obscure the audit trail. These assets can store large amounts of value while offering limited transactional visibility.

- Accomplices and money mules: Criminal networks often rely on accomplices to facilitate transfers. Some may be corrupt professionals, such as bankers or accountants, who help structure transactions. Others are everyday individuals recruited online to act as money mules. These mules receive funds into their personal accounts and move them onward, believing they are completing harmless tasks in exchange for payment. Their involvement creates additional layers of separation and complicates investigative efforts.

Unwitting participants hinder law enforcement, as they cannot provide meaningful details about the origin, purpose or beneficiaries of the funds they transferred.

How Does Layering in Money Laundering Work?

Layering is the second stage of the money laundering process — after placement and before integration — and its purpose is to make the movement of illicit funds so complex that the trail becomes nearly impossible to trace.

This stage works by constantly changing the form, location, or ownership of the money. Criminals may break large amounts of USD into smaller transfers, convert them into GBP or crypto like Bitcoin, then split and merge those funds across multiple accounts to obscure the audit trail.

They may also use money mules or forex-style schemes to push the funds through different people without their full awareness. On top of that, criminals often rely on several banks, payment methods and intermediaries to add extra layers of complexity and further hide the original source of the money.

How Do AML Tools Help Detect Layering in Money Laundering?

Layering creates fast, scattered money movements that humans can’t track at scale. AML tools detect these patterns by automatically scanning transactions, linking related accounts and highlighting unusual flows — making layering easier to spot and investigate.

- Automated pattern detection: AML tools monitor transactions in real time, using behavioral analytics, machine learning and external intelligence to identify anomalies. They surface red flags such as inconsistent payment behavior, rapid international transfers and complex routing chains linked to known layering typologies. This allows compliance teams to focus quickly on high-risk activity.

- Entity and network analysis: Layering depends on obfuscation — shell companies, money mules, straw owners and shifting ownership structures. Advanced AML platforms map relationships across accounts, devices, emails, phone numbers, IPs and corporate data. This helps uncover hidden connections between entities that appear unrelated at first glance.

- Integration of external risk data: AML tools draw on sanctions lists, PEP databases, adverse media and corporate registries to enrich internal monitoring. By cross-referencing transactions with third-party intelligence, systems can identify when layering activity overlaps with known risks or high-risk counterparties.

- Reduced false positives: Machine-learning models refine detection rules over time, reducing noise and eliminating unnecessary alerts. Instead of flagging every unusual transaction, systems adapt to evolving patterns, improving accuracy and easing operational strain.

- Stronger investigations and reporting: By surfacing risk earlier and with better context, AML tools help institutions build more detailed SARs and meet regulatory expectations efficiently. The result is faster investigations and more reliable detection of layering activity.

How SEON Can Help Combat Layering in Money Laundering

SEON helps detect layering by providing intelligence on users and devices by analyzing their digital footprints in real time. Its AML compliance solution surfaces hidden connections between accounts, identify risky behaviors and enrich customer data instantly — allowing compliance teams to spot suspicious patterns before they escalate.

By combining device fingerprinting, email and phone analysis, IP intelligence and behavioral monitoring, SEON gives organizations the visibility they need to identify layered transactions and prevent criminals from disguising the origins of illicit funds.