Why Is Multi-Accounting a Problem for Digital Banks?

Multi-accounting poses a serious challenge for digital banks, threatening growth, compliance and financial stability. As these banks rapidly acquire users through referral programs and streamlined KYC processes, they inadvertently become targets for fraudsters who exploit these systems to create multiple accounts and abuse incentives. This wastes marketing resources and skews user metrics, leading to misleading KPIs and damaged insights.

A primary concern with multi-accounting is non-compliance with KYC and AML regulations. Fraudsters often use synthetic or stolen IDs to establish fake identities, making it difficult for banks to adhere to regulatory standards. If detected during audits, these violations can result in hefty fines. Furthermore, accounts created for referral bonuses are frequently exploited for overdrafts, loan applications or cash withdrawals without intent to repay, resulting in more fraud in the long run, driving up default rates and adversely affecting financial health.

How Can Digital Banks Detect Multi-Accounting?

To combat these issues, advanced fraud detection strategies employ digital footprint analysis and device intelligence to identify patterns indicative of multi-accounting, such as repeated IP addresses and disposable email domains. By integrating automated fraud solutions, digital banks can proactively detect and block fraudulent activities, safeguarding their growth initiatives and mitigating future fraud risks. Tools like SEON’s fraud prevention solutions can reveal hidden connections between accounts, reducing false positives and enhancing overall account integrity.

Connecting the dots requires having enough data from the outset. Basic information collected during registration—such as email address, phone number and IP address—provides an initial foundation.

However, thoroughly analyzing users’ digital footprints and device information can reveal thousands of additional, often hidden data points, especially valuable for spotting users attempting to mask their real identities. This can include indicators like VPN or proxy usage, virtual SIMs, device hardware and software details, linked social media profiles and email address maturity.

These data points enable digital banks to get a comprehensive picture of their users and spot suspicious connections faster. Rather than manually comparing user similarities, an automated fraud prevention system can handle this task. Through a single API connection point, all data is gathered and analyzed in real time, enabling automatic decisions based on custom rules tailored to each business’s specific needs and usage patterns. This ensures a streamlined, proactive approach to multi-accounting detection.

Top 3 Custom Rules for Preventing Digital Bank Multi-Accounting

Here are three highly effective rules to help spot fraudsters trying to create multiple accounts:

1. Browser, Device and Cookie Hash Previously Seen

A hash is a unique string of numbers and letters that encodes specific details about the desktop or mobile device a customer uses to access your service. This string is created from multiple data points to maximize fraud detection accuracy. Here are the three most widely used hashes generated by SEON, which customers often apply in custom rules to detect multi-accounting:

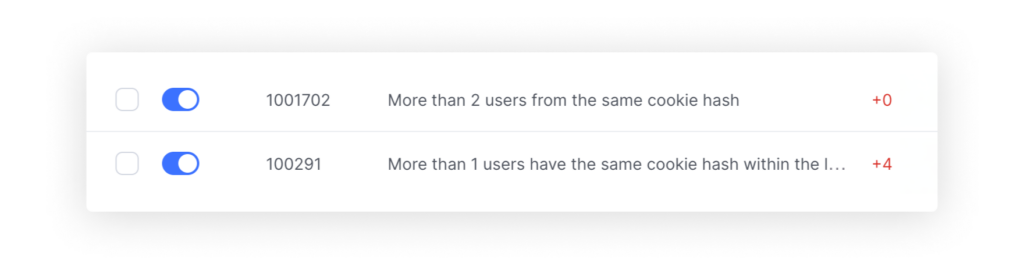

- Browser hash: A unique identifier based on a user’s complete browser profile, capturing hardware, network and software characteristics. The browser hash remains unchanged even if the user clears cookies, cache or browses in Incognito/Private mode, making it reliable for identifying shared devices.

- Cookie hash: Based on the session cookie, this hash is highly accurate for pinpointing shared browsers and devices. However, it can be more easily manipulated by malicious users.

- Device hash: Derived from specific hardware attributes, this hash tracks key details like device type and OS version, providing a stable identifier even if software settings change.

When all three hashes match across different customer accounts, it’s highly unlikely to be a coincidence. This alignment can be a strong signal of multi-accounting, as genuine users rarely share identical browser, cookie and device configurations.

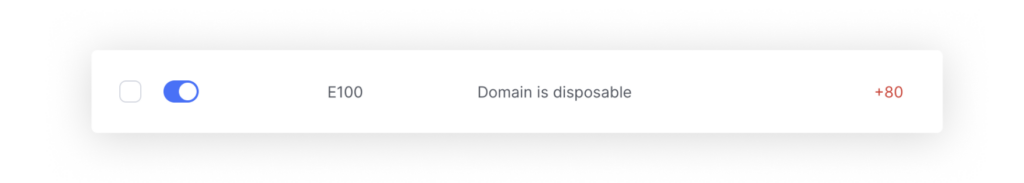

2. Email Address from a Disposable Domain Provider

Disposable email addresses indicate users who may be attempting to stay anonymous, often signaling suspicious activity. Checking for linked social media profiles can also reveal inconsistencies, as these email addresses rarely connect to legitimate, established accounts.

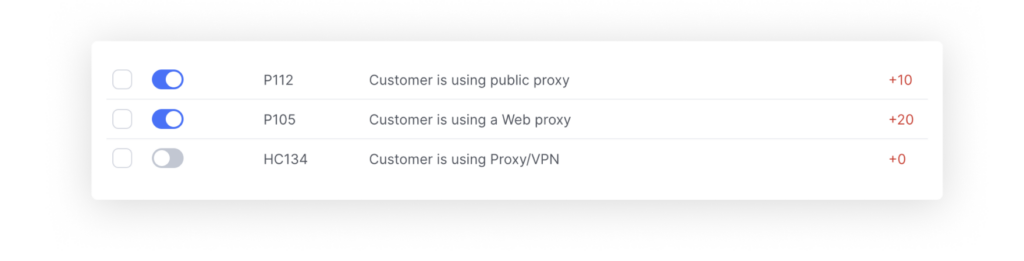

3. IP Address Points to VPN or Proxy

While VPNs have legitimate uses, they’re also a common tool for fraudsters looking to mask their location and create multiple accounts. When VPNs or proxies are detected during account creation, it’s worth a closer look to ensure the user’s authenticity.

Together, these custom rules provide a robust framework for identifying and blocking multi-accounting attempts. By leveraging browser, cookie and device hashes, tracking disposable emails and monitoring IP data, digital banks can establish patterns and flag high-risk users effectively. When combined with automated systems, these rules can operate in real time, empowering banks to make quick, accurate decisions and keep fraudsters at bay while ensuring a seamless experience for genuine customers.

More Ways SEON Can Stop Digital Bank Multi-Accounting

When it comes to detecting multi-accounting, more data means stronger, smarter insights. SEON enables you to enrich data using what’s already available and lets you customize the types of fields sent to the APIs, tailoring detection to your unique needs.

Additionally, SEON’s visualization tools reveal connections between accounts, making it easy to spot fraud rings and users attempting to manage multiple accounts.

With a combination of whitebox and blackbox machine learning algorithms, SEON uncovers complex fraud patterns and continuously enhances detection with AI-powered insights and custom rule suggestions.

SEON’s ultimate goal is to empower digital banks to take full control of their onboarding processes so they can confidently manage who gets approved and adapt fraud prevention measures to their own tolerance. By detecting multi-accounting attempts early, digital banks can save money on costly KYC and AML checks, supporting growth targets while keeping fraudulent accounts out.

Learn how SEON safeguards your digital bank from multi-accounting and other evolving fraud tactics with advanced digital footprint analysis, device intelligence and AI-powered machine learning.

Speak with an expert

Related Case Studies for Digital Banks and Multi-Accounting

- FairMoney Onboards Better Customers Thanks To Digital & Social Footprint Checks

- Leading Challenger Bank Eradicates Bonus Abuse Thanks to SEON’s Email Module