Your Complete Guide to PEP Screening

Your Complete Guide to PEP Screening

PEP screening checks are a key due diligence process designed to help with AML (anti-money laundering).

But how does it work? Who audits the results? And what should you do if one of your customers is indeed a politically exposed person? All the answers are in this in-depth guide.

What Is PEP Screening?

A PEP screening, sometimes called PEP checks, is a process designed to verify if a customer, user, or business partner appears on any Politically exposed person lists. These lists are kept and updated on government websites, public registers, and third-party databases.

The goal of a PEP check is to check whether someone is on PEP lists, with the ultimate aim of curbing money laundering. Politically exposed persons are deemed more likely to be involved in corruption, bribery, and the laundering of funds. Ensuring you keep tabs on who is a PEP is both a legal requirement and a tool to reduce money laundering and terrorist financing.

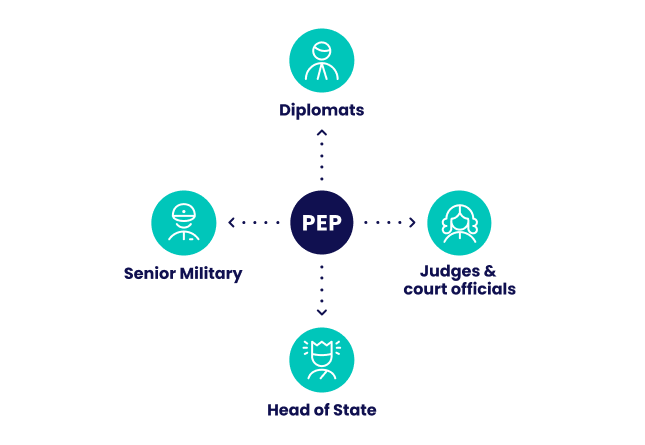

Politically exposed persons include, among others:

- heads of state

- diplomats

- senior executives of state-owned enterprises

- members of parliament

- members of the judiciary

- members of sports committees

Because someone’s PEP status can change overnight, it’s crucial to ensure you perform regular checks. A customer who was previously in a subordinate position could be promoted to a job that puts them on a politically exposed person list, and it is your legal duty to keep track.

Finally, it’s important to note that the definition of a PEP varies from one set of legislation to the next. This is why PEP checks are audited by national regulators, as we’ll see below.

Which Businesses Need to Run PEP Checks?

While, historically, only banks and financial institutions were required to ensure AML compliance, these days, a growing number of verticals are concerned, depending on the country. These may include:

- firms buying and selling property

- companies selling high-value items such as antiques or art collectives

- finance firms such as hedge funds or accountants

- gambling and online gaming companies

Note that the types of businesses subjected to AML verification law vary from one jurisdiction to the next. The best way to check if your company needs to comply with AML rules is to contact your local regulatory body.

Screen individuals and entities against PEPs, sanctions, Relatives and Close Associates, crime lists and financial watchlists

Learn More

What Happens If You Do Not Perform PEP Screening?

PEP checks are a legal requirement. Failing to perform them may cause compliance issues, such as:

- Substantial fines: In October 2022, for instance, UK financial institution Gatehouse was fined $1.8/£1.5 million by the Financial Conduct Authority for failing to perform adequate sanctions lists screenings and PEP checks.

- Reputational damage: Having your name associated with a legal fine is never good for your reputation with shareholders or customers, who may lose trust in your brand.

- Drop in stock share price: A report by Themis, a financial crime intelligence provider, found that AML scandals could cause a bank’s share price to drop by 5.2% on the day a fine is announced and a further drop up to 20.7% over the following six months.

Now, while some of the bigger financial institutions may see AML fines as a cost of doing business, a legal battle and hefty fine could have a significant impact on smaller players. This could slow their operations for months, which may reduce how competitive they can be when trying to expand.

Who Audits the PEP Screening?

PEP checks are a legal requirement, but the regulatory bodies in charge of these requirements vary from one country to the next. While this might make things confusing for what legally constitutes a PEP, most countries base their definitions on the one issued by the US’s 2013 Financial Action Task Force on Money Laundering (FATF).

However, the actual PEP audits will be performed by local authorities who are sometimes also in charge of AML verification screening. For instance:

- Australia: This will fall under Australia’s Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF).

- Singapore: The Monetary Authority of Singapore (MAS) defines PEPs and includes relatives or close associates (RCAs).

- South Africa: The Financial Intelligence Centre will audit what it calls Politically Influential Persons (PIP). The term serves the same function as PEPs.

- United Kingdom: The Financial Conduct Authority (FCA) and Joint Money Laundering Steering Group both publish guidance on PEPs along with other KYC matters.

Note that PEP definitions can also be updated and checked by international organizations, such as the EU’s 6th AML directive.

3 Ways to Perform PEP Screening

While regulators must ensure you perform your customer due diligence (CDD) and enhanced due diligence (EDD) checks, there are no strict rules on how to do PEP screening.

Here are three methods that may generally suit your organization, depending on your scale and risk appetite.

1. Manual PEP Screening

The easiest (and most resource-intensive) way to run a PEP check is simply to manually look at the right lists. Businesses can do this by accessing the information on PEPs available through official government websites, public registers, or commercial databases.

OSINT sources and OSINT tools can also accelerate the process by aggregating information about a person based on their name.

Finally, you could also monitor news reports from reputable sources in order to keep an eye on the latest political or judiciary appointments.

2. Manual PEP Checks With an AML Solution

The second option is to manually check for names by inputting them into specialist software. This has pros and cons.

The advantage is that it speeds up the searches by automatically aggregating results from a number of PEP lists around the world.

The results are sometimes processed via algorithms to give you the best estimate as to whether you are indeed dealing with the right person or not. Note that this can be a challenge as names aren’t exactly unique identifiers.

You still need to confirm the information manually to ensure you are indeed checking the identity of the right person.

3. Fully Automated PEP Checks

The most ambitious businesses subjected to AML rules will sometimes deploy fully automated checks.

This involves integrating sophisticated AML software either on-premise or via API. Automated AML verification also works by aggregating data from a number of PEP lists around the world and running it through algorithms.

The advantage of fully automated PEP checks is that you can verify the identities of large numbers of new customers in nearly real-time. The challenge is that, once again, people with similar names may be processed as false positives or negatives.

What Happens After a Positive PEP Check?

If a PEP check returns a positive result, the company should apply EDD measures to minimize the risk of the person being able to use the organization’s infrastructure and workflows to launder money acquired illegally – usually from bribes.

Once someone is established as a PEP, the FATF Recommendations outline a series of steps to take.

These include obtaining approval from the financial institution’s senior management – particularly individuals who have clearance to approve AML and CFT policies. Also, the source of the funds being deposited needs to be established, and the business relationship should be monitored.

| non-PEP customers | PEP customers | |

| sign-up and onboarding | Institution conducts standard KYC | Institution conducts KYC + ongoing EDD |

| internal approval | No additional approval needed | Approval from upper management needed |

| source of funds info | Might be needed for higher transactions, which can lead to Suspicious Activity Reports (SAR) | Always needed |

| activity monitoring | Minimal for the sector | Extended |

Partner with SEON to deploy flexible AMLs that will help you comply with AML legislation and dramatically reduce fraud in your business.

Ask an Expert

How Can PEP Screening Help Us Fight Fraud?

Incorporating the identification of PEPs, both when accepting new customers and clients and as part of ongoing anti-money laundering transaction monitoring measures, is a key way for financial institutions to fight fraud and avoid hefty AML fines while helping keep the overall economy healthy.

According to PwC, 5% of global GDP is lost to corruption each year. Enhanced due diligence in relation to PEPs can identify instances of corruption and bribery, money laundering and more, fighting against this global problem.

How SEON Does PEP Screening

Fraud fighting and customer intelligence tool SEON allows you to instantly identify suspicious profiles, behavior, or even software configuration. This profiling power extends to AML and PEP checks, allowing you to improve your compliance, avoid hefty fines, and know exactly who you are doing business with at all times.

Paired with powerful device fingerprinting, digital footprint analysis, flexible API modules, and innovative machine learning of two types, SEON is designed to provide you with a complete toolset to protect and grow your business while ensuring it is compliant.

FAQ

To check if someone is a PEP, you can manually enter their name on politically exposed persons lists found on official websites. You can also look at open-source or commercial databases or even monitor media sources. However, most online businesses rely on AML software to automatically aggregate PEP list data for them.

You are allowed to run a PEP check manually by searching for information about a person on official government PEP lists. You can also rely on AML software to automatically scan for that person’s name on dozens of aggregated databases.

PEP checks are crucial to ensure compliance with AML (anti-money laundering) and CTF (counter-terrorism financing). Failing to perform these checks when dealing with politically exposed persons could incur fines, legal battles, and reputational damage for a business.

Sources

- Financial Conduct Authority: FCA fines Gatehouse Bank £1.5m for poor anti-money laundering checks

- Global Trade Review: Share price and reputational damage: banks count cost of AML failings

- PWC: Five forces that will reshape the global landscape of anti-bribery and anti-corruption

Sign up to download

In order to download this PDF, please complete the form.

Thanks for submitting the form, click the button below to download our guide.

Click the button below to download our guide.