Money laundering poses a serious risk to eCommerce businesses. The combination of high transaction volumes, fast onboarding, digital payments and relative anonymity makes online stores and marketplaces attractive targets for criminals attempting to disguise illicit funds as legitimate revenue.

While money laundering techniques continue to evolve, the ways criminals exploit eCommerce platforms are often predictable. With the right fraud prevention infrastructure in place — particularly when supported by anti-money laundering (AML) tools — businesses can identify suspicious behavior early and reduce risk.

Why Is Money Laundering a Problem for eCommerce?

Money laundering is a problem for eCommerce because online stores can be used to turn illicit funds into “legitimate” sales, often at speed and across borders. Digital payments, refunds, and third-party sellers make it easier to move money through multiple accounts, identities, and regions with less visibility than in traditional finance.

While many eCommerce businesses aren’t held to the same AML requirements as banks, they can still be exploited by criminals seeking low-friction platforms. This creates real operational and financial risk: chargebacks and refund abuse, account takeovers, marketplace fraud, and potential regulatory or banking partner scrutiny. Both buyers and sellers can play a role, either by using compromised accounts or running storefronts as fronts for illicit activity.

How Does AML Apply to eCommerce?

Whether required by regulation or adopted as a best practice, AML measures help businesses detect sanctioned entities, identify high-risk behavior and prevent illicit funds from entering legitimate payment flows. In practice, that means screening and monitoring need to happen fast enough to catch risk before funds move.

So, how does AML apply to eCommerce in practice?

- As a necessity: Far from being just an ideal precaution, AML is a regulatory requirement for many financial institutions and for non-financial industries that regulators have identified as vulnerable to money laundering — such as high-value eCommerce, marketplaces, and real estate.

- As a scalable framework: AML is not static. Ongoing research and development are essential to help fraud teams and compliance professionals identify emerging laundering tactics and adapt controls as eCommerce ecosystems evolve.

- As a dynamic discipline: Globally, AML encompasses a wide range of sanctions lists, risk factors, and regulatory expectations. As a result, eCommerce businesses must design AML measures that reflect their specific needs, particularly how criminals might attempt to misuse their platform for laundering activity.

“Real-time screening is now the baseline for detecting suspicious activity as it occurs, instead of days or weeks later.”

Nauman Abuzar, Director of Product, AML & Risk Solutions

How eCommerce Payment Providers Detect Money Launderers

Payment providers and eCommerce platforms detect money laundering through a combination of technology, processes and expert review. Effective AML programs typically rely on layered defenses that identify suspicious behavior at scale.

Best-practice AML frameworks commonly include:

- Transaction monitoring software: Real-time analysis of payment activity to identify unusual patterns, spikes in value, or abnormal behavior.

- Customer profiling and risk scoring: Dynamic profiles built using behavioral, transactional, and contextual data to prioritize high-risk accounts for review.

- Human oversight: Fraud and compliance specialists investigate alerts, validate risk signals, and ensure regulatory obligations are met.

When planning a transaction monitoring process for retail, it’s important to continuously assess payments for unusual patterns, sudden shifts in value or behavior that falls outside a customer’s normal activity.

Top 3 Custom Rules for Money Laundering in eCommerce

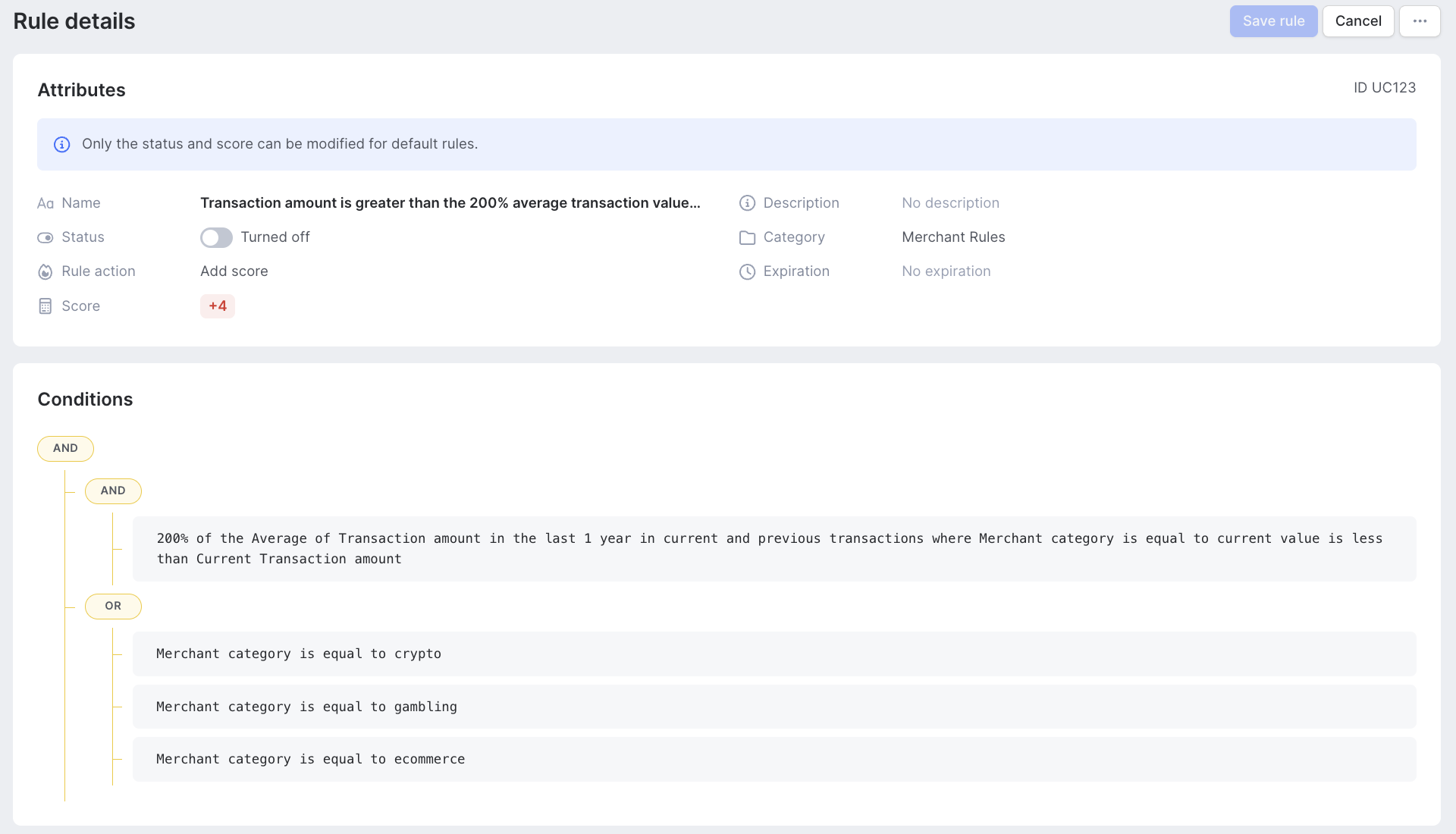

#1: Suspiciously High Transactions

Money laundering frequently involves moving large sums of money through otherwise legitimate transactions. Sudden increases in transaction value or volume can indicate laundering, money muling or account takeover.

Custom rules that flag significant deviations from a customer’s typical behavior — such as a sharp percentage increase in transaction value within a short timeframe — help identify these risks early. Thresholds can be adjusted based on each business’s risk tolerance and transaction norms.

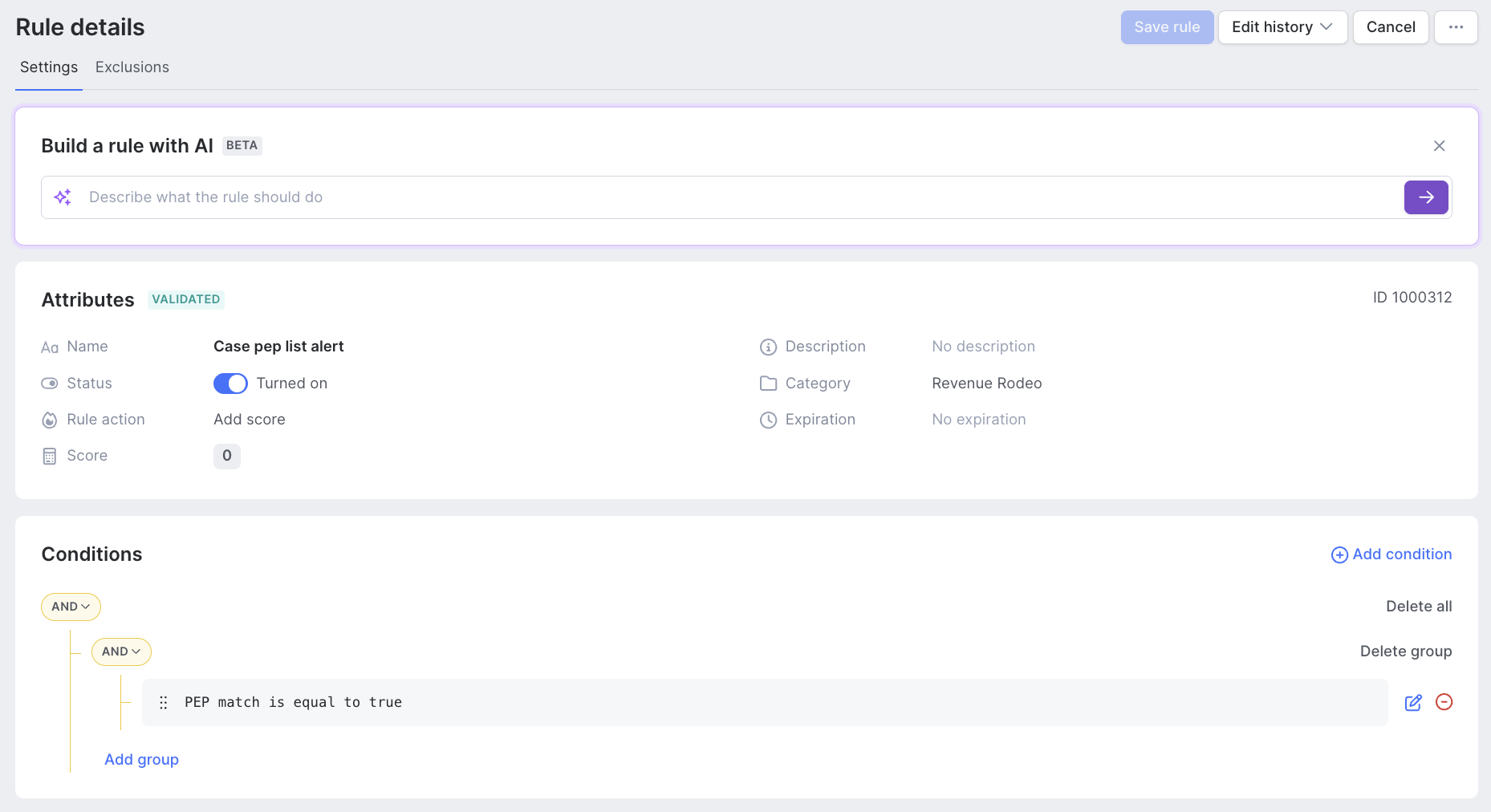

#2: One or More Individuals are Flagged by PEP Checks

Politically exposed persons may present higher money laundering risk due to their public roles, influence, or financial exposure. Screening customers against PEP and sanctions lists is a core AML requirement in many regions.

When a customer matches a PEP database entry, the account can be flagged for further review rather than automatically rejected. This risk-based approach allows businesses to conduct enhanced due diligence while maintaining legitimate customer relationships.

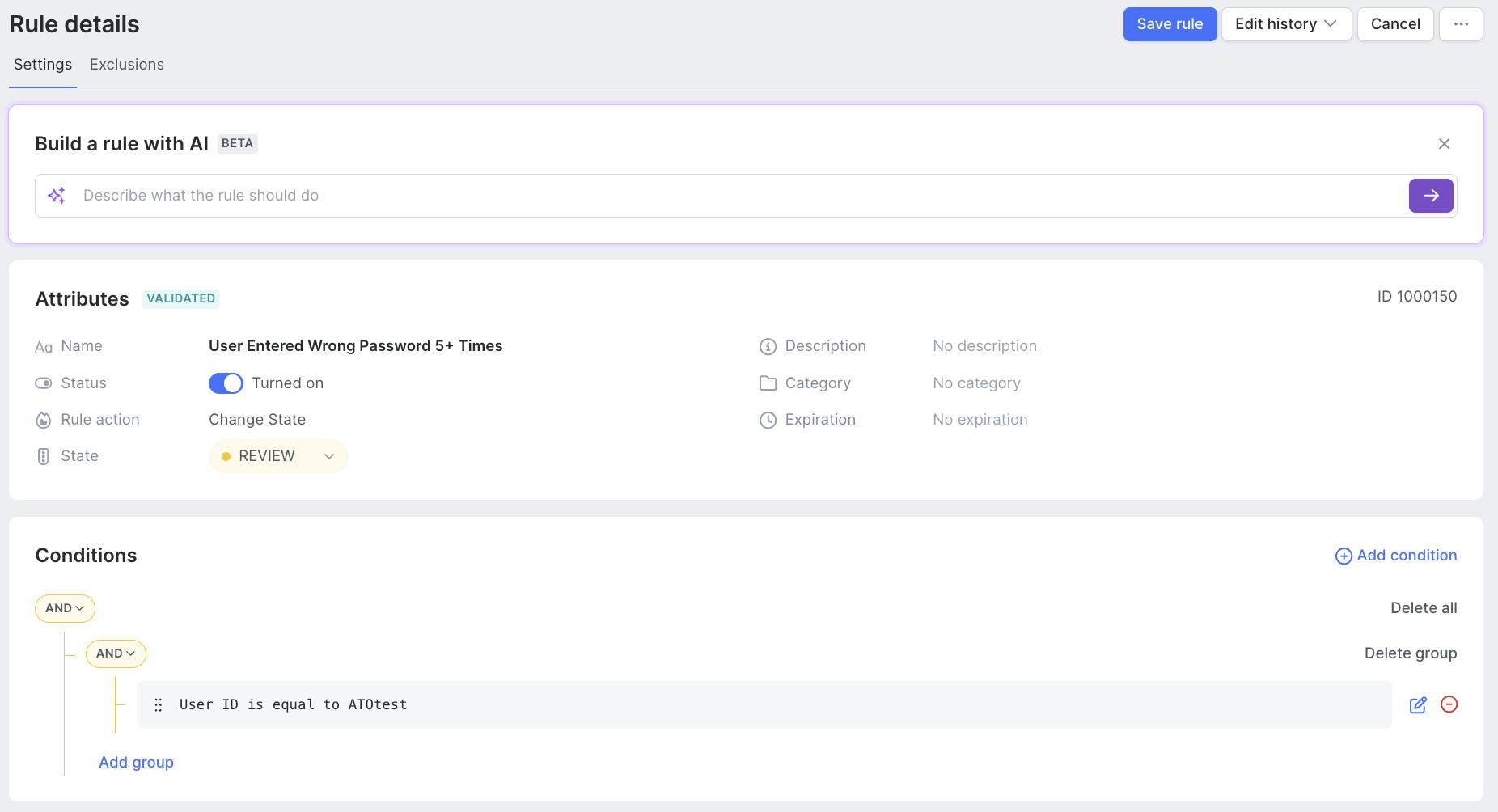

#3: Multiple Failed Password Attempts

Account compromise is a common precursor to ecommerce money laundering. Criminals may attempt to access accounts using stolen credentials obtained through phishing or data breaches.

A high number of failed login attempts—particularly in a short timeframe—can indicate credential stuffing or brute-force attacks. Custom rules that flag or block such activity help prevent unauthorized access and the subsequent misuse of accounts for laundering purposes.

SEON can be leveraged by companies in eCommerce to effectively combat money laundering through its AML capabilities, as well as behavioral and risk monitoring.

Ask an Expert

How SEON Helps eCommerce Combat Money Laundering

SEON helps businesses prevent eCommerce fraud and money laundering by analyzing digital footprints alongside AML, behavioral and risk signals. By evaluating how users interact with a platform — not just who they claim to be — SEON enables earlier and more accurate detection.

Identifying money laundering often starts with recognizing suspicious behavior patterns rather than isolated transactions. SEON’s technology analyzes a wide range of digital footprint data, including device intelligence, behavioral signals and account activity, to detect, track and flag malicious actors attempting to misuse eCommerce platforms. This allows fraud teams to distinguish legitimate customers from coordinated or high-risk activity with greater confidence.

SEON’s customizable rules engine supports a flexible, risk-based approach. As criminals adapt their techniques to obscure identities and evade traditional controls, eCommerce businesses can refine detection logic to reflect new behaviors and emerging laundering methods. This adaptability ensures that prevention strategies evolve in step with fraud methods.

Related Case Studies for eCommerce

Related Articles for Money Laundering

- How to Detect Money Laundering in Online Lending

- Learn How To Detect Money Laundering in Forex Trading

- Transaction Monitoring in Online Retail

Sources