We often hear that every customer counts – but the reality of it is that it’s often more profitable to focus on high-value customers.

Today, we are going to look into how to spot high-value customers not just after they have done business with your company but also before they’ve even bought a product.

What Is a High-Value Customer?

A high-value customer is someone whose business will significantly impact your bottom line. They rely on your product or services more than other customers and/or bring in more business in the long run.

High-value customers are labeled differently depending on your business vertical. For stores, this will be someone who purchases items or services regularly and at great volume. For a SaaS company, it could be a larger account. For marketers, it could be an affiliate who brings in high-quality traffic.

High-value customers are also loyal customers. A customer retention report collated by Review42 says that:

- 65% of a company’s business comes from repeat customers

- 80% of a company’s profit is generated by 20% of its clientele

- The top 10% of your high-value customers buy 3x more than other customers

Why Is It Important to Identify High-Value Customers?

The obvious answer is, because they generate more value for your company. If the numbers above aren’t enough to convince you that high-value customers are worth targeting, you should also take the following into consideration:

- Knowing your high-value customers helps you to plan ahead and make better decisions about future projects.

- You can upsell, cross-sell and tailor your products and services to generate more revenue.

- You can maximize their value and develop longer-lasting relationships.

- You can focus your marketing and acquisition strategies on similar customers using lookalike audiences.

- Delighting these customers can create a positive feedback loop, where they bring in more business for your company.

In short, knowing who your high-value customers are is important for numerous departments, including marketing, sales, and operations.

How to Identify High-Value Customers

There is a range of ways to identify high-value customers, including looking at historical sales, asking customers for feedback and market research.

Before we delve into the how, however, let’s first look at when to identify high-value customers. It’s a fact that most companies will only learn who their best customers are after they’ve already done business with them.

That means using techniques such as the following:

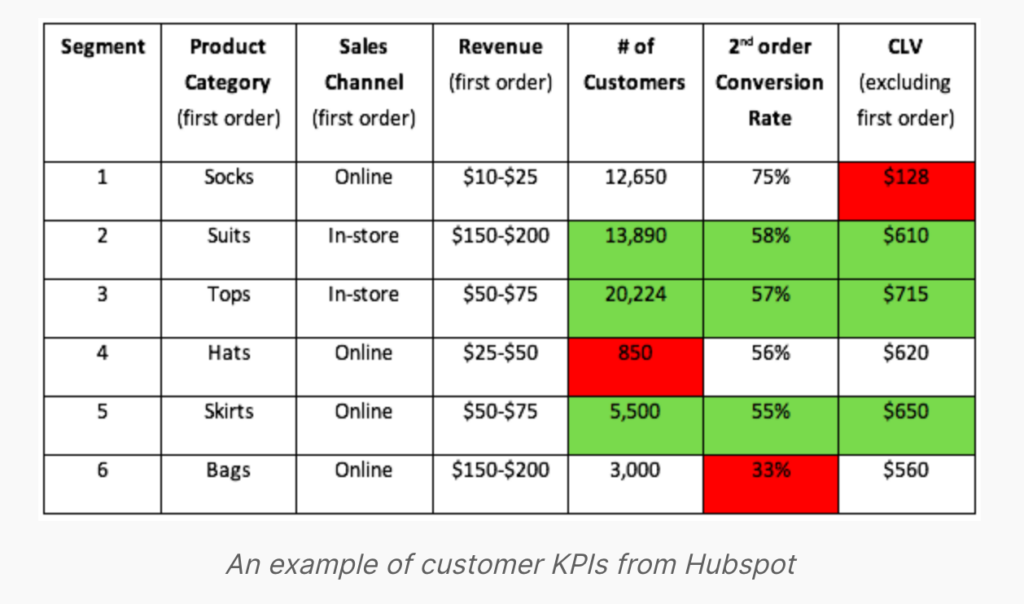

- Deploy KPIs

Key performance indicators are an objective way to measure how much value a customer brings to your company. You may use metrics such as customer lifetime value (CLV), purchases per month, or anything else that makes sense for your vertical. AAARRR, also known as Pirate Metrics, are also wonderful indicators for understanding how to strategize.

An example of customer KPIs from Hubspot

- Monitor your loyalty programs

Loyalty programs are a good marketing tool. They’re an even better indicator of who your best customers could be. A report by Paystone, for instance, states that loyalty program users spend up to 10% more than others. - Use surveys and customer feedback

Customer feedback is a good way to learn more about your customers, specifically about what they wish you would do more of. This helps you identify the gaps that could create more high-value customers, and anticipate their needs in advance. - Track social mentions

Sometimes, word of mouth is the best marketing tool at your disposal. And in a world of influencers and social media power users, you might have high-value customers that drive business simply by mentioning your product or service. Keep track of these mentions on social media and look to reward these users accordingly – or even actively encourage them with previews and freebies.

At this point, we should mention that all of these methods focus on identifying high-value customers after their interactions with your business.

But what if you can identify them before they even complete a purchase? This is where data enrichment comes in handy.

Using Data Enrichment to Spot High-Value Customers

Data enrichment is a process that allows you to learn more about a user based on just a few data points. Such a user could be a website visitor or someone who chooses to sign up for your newsletter, for instance.

An email address could point you to a LinkedIn profile. An IP address could point you to geolocation, which may be helpful for customer segmentation at the prospecting stage.

And all this can help inform you who is more likely to be high-value, so you can give them a VIP customer journey or support them in other ways.

Now let’s have a look at concrete examples of data enrichment and how you can leverage it to identify potentially high-value customers.

Email Address and Social Media Profiles

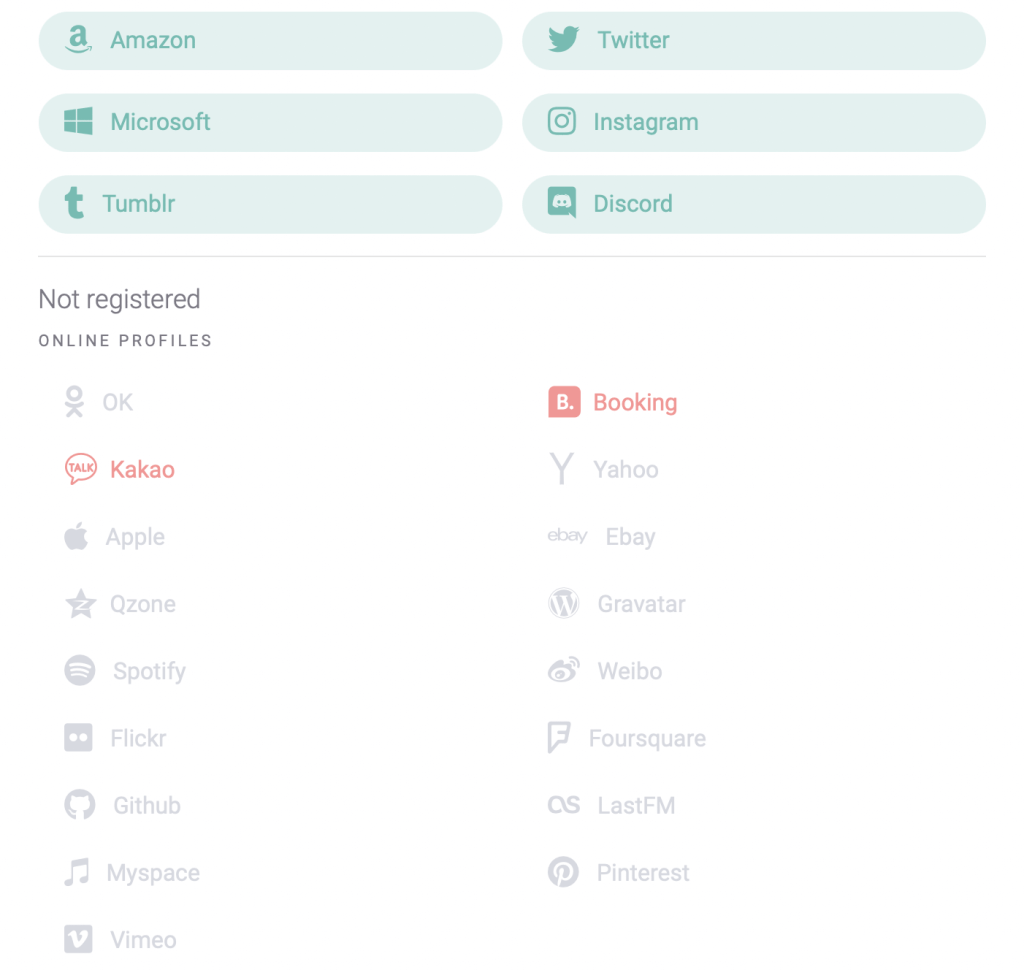

An email address can reveal all the social networks where it was registered. This is a process called reverse email lookup and it’s a powerful way to gain an idea of who you’re dealing with using just the email they provide when they create an account, or sign up to a service.

You can learn which social media profiles they regularly log onto. Conversely, an absence of social profiles could be a red flag.

Some social platforms, however, can reveal more than others.

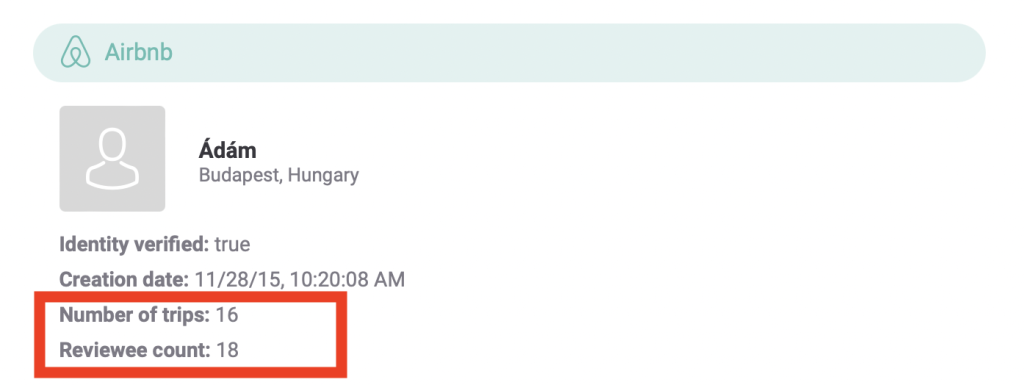

Here is an example based on an account with Airbnb.

Our user not only has a registered profile, but they also made 16 trips and wrote 18 reviews on the vacation rental platform. This will tell you that:

- our user is likely to be a legitimate person

- our user travels regularly

- they have access to a certain amount of disposable income

- they leave online feedback – which is great if you want to get the word out there

If you’re an OTA or retailer that deals with travel equipment, these small details could be a goldmine. If you’re working in data science, you could build new models and KPIs that incorporate social media data as a metric to check for interesting correlations.

As a bonus, you can also use this email check as an email verification software to ensure your marketing communications will be deliverable.

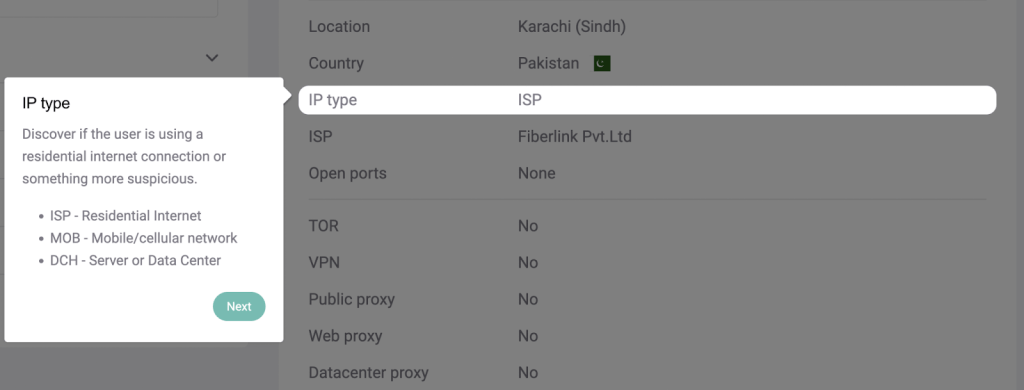

IP Address and Geolocation

An IP address can point to geolocation with a remarkable degree of precision.

When thinking about what it means about a user, you may infer that, for instance, an affluent neighborhood is likely to point to more disposable income. Same with certain cities’ office districts, which have both high-end and more frugal streets.

Then there’s the type of connection.

A residential connection is more likely to come from a legitimate, high-value customer than, say, a laptop in a public library. The server type can give you clues as to who you’re dealing with.

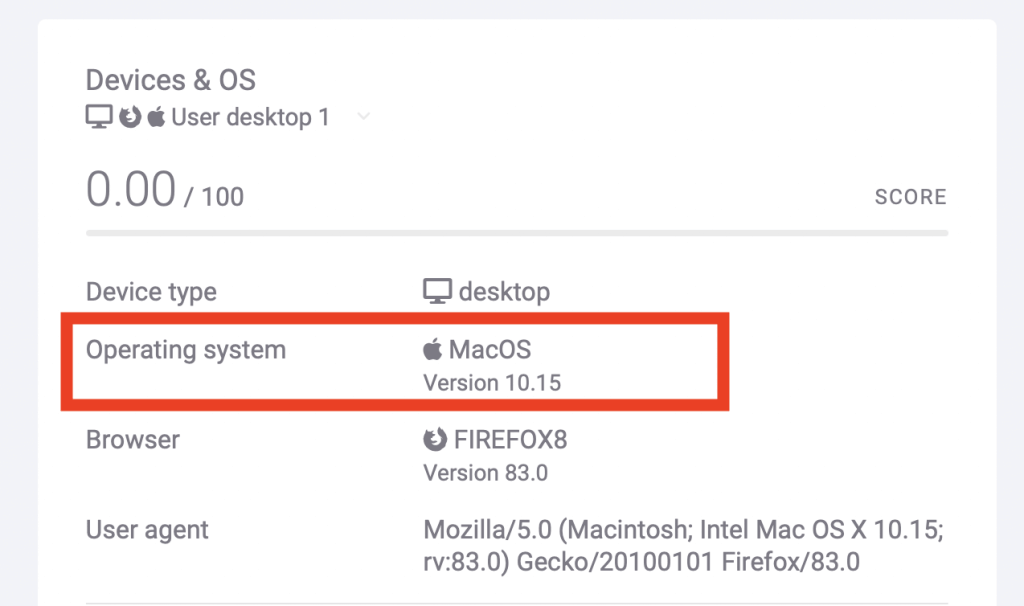

Device Fingerprinting

While device fingerprinting is a sophisticated method to catch bad actors, it is limited in the kind of valuable information we can gather about the value of a client compared to the above-mentioned methods.

Still, you may make educated guesses about the user based on their software and hardware configurations.

Someone signing on from the latest iPhone or high-end Samsung phone might be more likely to buy new technology more often.

Think about your target audience. Is a MacOS user more valuable to your company than a PC user? Well, maybe, depending on the kind of product or service you offer.

It certainly doesn’t hurt to keep that data in mind when you look at your user KPIs and reports for segmentation.

Card BIN Lookup

It’s no secret that certain credit cards are clear indicators of wealth.

A BIN lookup tool can reveal the kind of card you’re processing for your customer, which in turn may indicate that you’re dealing with an affluent individual.

Free BIN lookup!

Enter the first 6 or 8 digits of a card number (BIN/IIN)

Text here

An American Express Business Platinum Card, for instance, will set you back $695 a year. The invite-only Dubai First Royale Mastercard costs around $2000 per year. A J.P. Morgan Reserve Credit Card is a sure bet that you’re dealing with a prestigious banking client.

And so forth.

How SEON Data Enrichment Can Help Your User Segmentation

SEON is primarily a fraud prevention company. We protect companies by carefully examining hundreds of different data points about their customers.

But over the years, we’ve realized that our data enrichment modules are increasingly leveraged by additional departments – such as sales, marketing, and operations – to find out much more than just who’s likely to be a fraudster.

SEON’s frictionless data enrichment modules can provide:

- a 360 degree view of customers

- a risk scoring system

- real-time access to fresh data including social media profiles

- better data to build analytics models for KPIs

If you are looking for one or more of the above, then SEON can help.

Book a demo with us to see how we can support you in learning more about your customers – and make better, more profitable business decisions as a result.

Sources

- Review24: Customer Retention Statistics & Predictions [Updated 2022]

- Paystone: Do Loyalty Programs Cause Consumers to Spend More?

- WalletHub: Most Exclusive Credit Cards

FAQ

You can identify high-value customers by keeping data logs relating to their interactions with your business. Monitoring KPIs, transactions, social media mentions, and other metrics can help you highlight your most valuable customers in the long run.

A valued customer, or most valued customer, is a marketing term that denotes the most profitable customers for your company. However, profitability doesn’t always have to do directly with money. Sometimes, being profitable means spending money on your products or services. Sometimes it’s about the quality of the referrals a customer brings in, or other aspects of their impact.

Marketers believe that customers look at value through the prism of four different categories: functional value, monetary value, social value, and psychological value.