What Is Whitebox Machine Learning?

Whitebox machine learning refers to machine learning models that provide transparent, interpretable outputs that show the results and the steps taken to reach them. In contrast to blackbox models that operate as opaque systems (providing only results without explanations), whitebox models allow users to see inside the decision-making process.

How Does Whitebox Machine Learning Work?

Whitebox machine learning models are initially trained on large datasets that help the algorithm learn decision-making patterns. After the training is complete, the algorithm will make predictions and show how each decision is made, often through interpretable structures like decision trees, weighted factors, or clear rule-based processes.

This transparency provides three key benefits:

- Users can see exactly how each decision is reached, making it easy to verify both the results and the decision-making process.

- Whitebox models allow for easy adjustments, enabling users to optimize and improve outputs as needed.

- Human oversight enhances accuracy, as users can review and refine outcomes directly.

This is how SEON’s whitebox algorithm scores transactions while providing clear explanations.

How Can Whitebox Machine Learning Fight Fraud?

Whitebox machine learning is increasingly popular in fraud prevention as it facilitates quick decision-making by effectively processing large datasets, while also retaining a sense of control for the user.

- Customized training and tailored setup: Machine learning algorithms analyze historical data to learn from past outcomes to identify fraud patterns. This initial training combines pre-set decision trees with specific requirements, creating a foundation for the algorithm based on the unique risks and needs of the business.

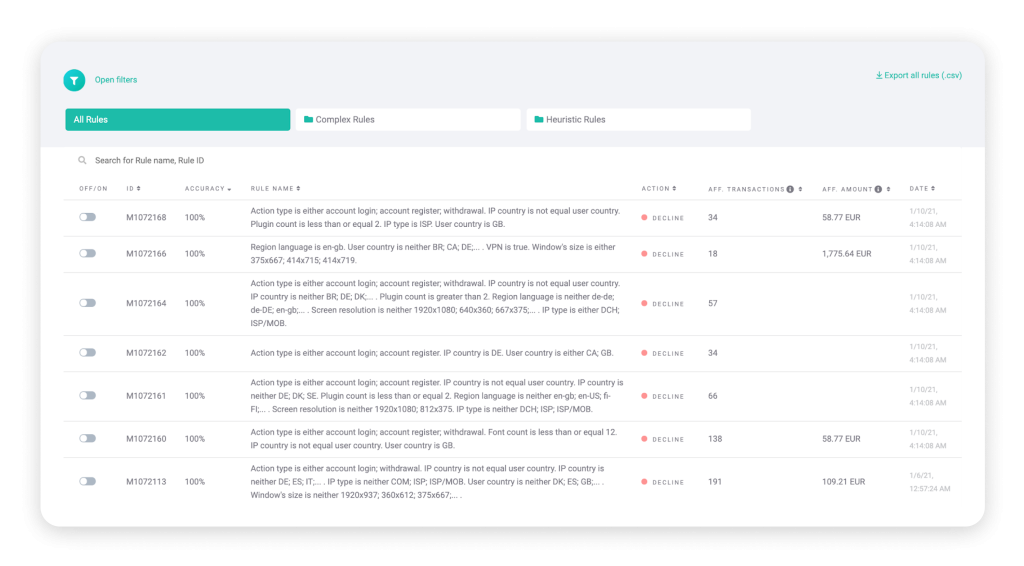

- Rule customization and fraud scoring: Whitebox models present human-readable rules as decision trees, allowing users to adjust them according to the specific questions or criteria the algorithm should address. Using these customized rules, the algorithm assigns a fraud score to each transaction — including accuracy estimates — to assess risk.

- Continuous tuning and manual review support: Fraud analysts receive insights into risk scores, weighted factors and the decision tree path, which aids in manual reviews and verification of decisions.

Users can continuously refine the system, adjusting approve/decline thresholds and rules to adapt to new fraud trends, improving detection accuracy over time.

Whitebox machine learning provides clear, actionable insights, making it ideal for manual reviews and ongoing adjustments to keep fraud defenses up-to-date. For technical details, explore our documentation on whitebox machine learning.

Machine learning (ML) is revolutionizing fraud detection, analyzing patterns to reduce risks. Read our recent article covering ML’s role, benefits, challenges, and practical applications.

Read more

Whitebox vs. Blackbox Machine Learning in Fraud Prevention

Nowadays, most machine learning models use blackbox algorithms that produce results without revealing their decision-making processes. These models are often very powerful in terms of predictive accuracy, but they work in ways that are not easily interpretable by humans.

The internal decision-making process is hidden, making it difficult to understand why a model made a specific prediction or classification. In fraud prevention, this lack of transparency makes it challenging to assess the model’s effectiveness and introduces potential compliance risks.

While a whitebox approach is ideal for fraud detection, due to its transparency and adaptability, blackbox models also add value by quickly flagging new or unusual behavior patterns. In many instances, a combination of both types of models can offer the best balance between accuracy and insight.

Fight Fraud With SEON’s Machine Learning

SEON combines the strengths of both whitebox and blackbox machine learning to provide a comprehensive approach to fraud prevention. Our whitebox machine learning algorithms allow you to implement customizable rules to block suspicious actions like fraudulent transactions or identity theft, which makes it an excellent primary tool.

At the same time, our blackbox model gives you a fraud probability score that is separate from the regular fraud score, which means that you don’t have to take risks with a non-transparent tool. Our solution also leverages explainable AI that enables us to show our customers insights into the key correlations that influence the final probability score.

This combination offers both transparency and advanced detection capabilities, making SEON a powerful tool for effectively combating fraud.

Discover complex fraud patterns and enhance detection with AI insights from whitebox and blackbox models.

See how