What Is a Manual Review?

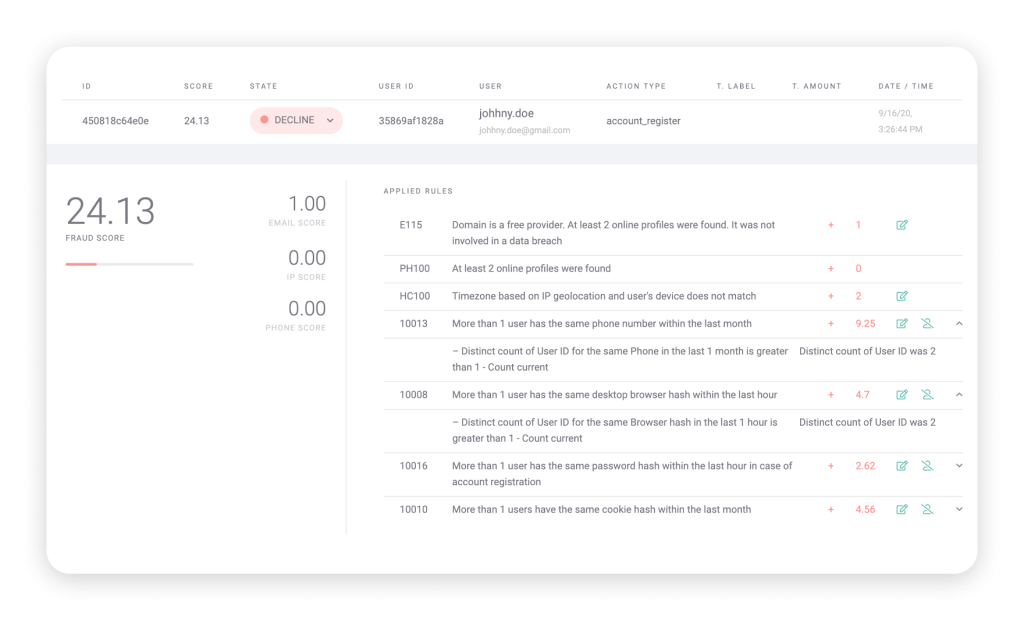

This simply means manually reviewing information. In the context of fraud prevention, a manual review is when a human – say a fraud analyst – is called to review the data and take specific actions, and/or make a decision.

These days, a manual review can take place after an algorithm has looked at the facts and decided it cannot make a confident decision or guess.

From there, the case is flagged for manual review – which will itself result in approval or decline, or even additional steps.

However, in the past, manual reviews have often been the full extent of some organizations’ anti-fraud strategy, with analysts having to deal with long queues of users and actions that required individual investigation or approval. In fact, this still happens today, albeit to a smaller extent.

How Do Manual Reviews Work?

A trained expert will look at all available data points and reach a decision. This can involve several diverse steps, including:

- Examining all the data provided by the user

- Calling the user on the phone

- Conducting searches with OSINT software to verify the user

- Sending the user an email or SMS and awaiting a reply

- Investigating the reasoning of a whitebox machine learning system

- Fine-tuning whitebox algorithms based on manual review learnings

- Approving declines and blocks by automated systems

- Reversing bad decisions made by machine learning systems

- Speaking to customers directly to explain how and why they need to take additional action

- In the case of chargeback fraud disputes, examining the user’s actions more closely

- Considering complicated cases and making decisions on grey areas

The resulting intel will mean taking action such as canceling orders or transactions, as needed, or even refunding them – as well as letting legitimate users through by approving them.

Manual Reviews vs Machine Learning: Which Is Better?

Each has its uses. Machine learning is better for instant results and large volumes, while manual reviews are ideal for improved customer experience and more complicated cases. Looking at each more specifically…

| Manual review | Machine learning |

| Time-consuming | Instant |

| Resource-heavy: workforce, work hours | One-off investment & maintenance |

| Less likely to result in false positives/false declines | More likely to result in false positives/false declines |

| Logical, personalized | Sometimes illogical – can block users with no real reason |

| Personal, polite -> happier customers | Impersonal, often lacking communication altogether -> can anger consumers |

| Works better with fewer cases/smaller workloads | Scales easily to handle bigger workloads |

| Usually only conducted during office hours | Works 24/7 |

Get AI insight into better, fully customized risk rules to apply, and leverage real-time ML to catch even more fraudsters.

Learn More

How Do Businesses Use Manual Reviews?

Manual reviews are used for various purposes, usually to do with accuracy, customer experience, complicated situations and the individual needs of each company. Some reasons why a business might use manual reviews include:

- To give a more pleasant experience for users looking to use the site/transact

- To conduct manual, infrequent reverse email lookups

- To do in-depth social profiling including judgment calls, beyond the results an algorithm returns

- A company might have not updated its legacy anti-fraud systems

- To deliver good customer service

- To combine manual reviews and automation, so as to get the best of both worlds

Which Businesses Use Manual Reviews for Fraud Prevention?

Almost every business at risk of fraud can and will use manual reviews, to some extent. In 2022 and beyond, that simply means every business that interacts with its users online – or even, in some cases, offline too.

Some examples include:

- A fintech lender that manually reviews customers after segmenting

- Travel companies sending suspicious bookings for manual review

- A challenger bank using email lookup to find fake accounts

- A leading airline using automation to speed up manual reviews

Why Are Manual Reviews Important in Anti-Fraud?

Manual reviews will always be important within risk management because nothing really is black and white, and sometimes human insight is necessary to spot fraudsters.

Machine learning and artificial intelligence have advanced by leaps and bounds. However, there are still a lot of situations when manual reviews are the best course of action and continue to have an advantage over any existing algorithm.

- Anything to do with customer service

A fraud analyst can pick up the phone and speak to your customers, which the latter will find reassuring. Even if the decision is made to block them from proceeding, this can be done fairly gently – unlike when you receive an automated message that your account has been locked or transaction rejected. - Improved precision

Simply put, machines might be smarter than humans one day – but they are not just yet. And they are easier to fool. Manual review can be a good extra step after your risk rules have flagged someone, because a human is more likely to be able to make the right decision when there are grey areas and judgment calls. - False positives can ruin your system

Machine learning feeds its results back to itself. This means that if it flags a false positive or false decline and there is no manual review to reject and reverse this decision, the bad information will be fed back to the system, effectively training it to make mistakes more often – a negative machine learning loop, if you will. - Always whitebox

If you’re utilizing blackbox machine learning, it is impossible to know why the algorithm has reached each decision. A human can always explain their reasoning and, if mistaken, learn from this. In this sense, manual reviews are always “whitebox”.

4 Free Manual Review Tools

SEON has several tools available to help with manual reviewing, including:

- Email data enrichment lookup tool

Try it out using an email address – perhaps your own.

2. Phone lookup tool

Input a phone number, with country code.

3. IP lookup tool

Fill in an IP to look it up.

4. BIN lookup tool

Just fill in the first six numbers on the card below.

Are Manual Reviews a Good Anti-Fraud Strategy?

The most effective compliance workflows combine the strengths of both automation and human oversight. Rather than relying solely on rigid rule sets or fully manual reviews, many organizations are adopting a hybrid model—one where machine learning enhances human decision-making, and risk rules are continuously refined by real-world insights.

The outcome? A smoother customer journey without compromising on fraud or AML protection.

Consumer expectations are rising, too. According to Salesforce, 80% of global consumers believe the experience a company provides is just as important as its products or services. And Accenture reports that one in three customers will leave a brand if they feel the experience lacks personalization.

Manual reviews play a critical role in balancing security with user experience—especially when it comes to reducing friction from false positives. In fact, for teams managing transaction monitoring, blending automation with targeted human intervention can dramatically reduce operational drag and customer churn.

To dive deeper into how modern teams are tackling this issue, explore these strategies for reducing false positives in AML without sacrificing compliance effectiveness.

Sources

- Salesforce: State of the Connected Customer report

- Accenture: Put your Trust in Hyper-Relevance