How to Detect Payment Fraud in Cryptocurrency Exchanges

by Bence Jendruszak

Having trouble protecting your user accounts? In this guide, we’ll see why accounts are targeted, how fraudsters acquire them, and, of course, which steps you should take to secure them.

This is your complete guide to understanding and detecting account takeover (ATO) fraud in your business.

Account takeover fraud (ATO) refers to a fraudster gaining unauthorized access to an online account by stealing login credentials. It is a form of identity theft, as the attacker exploits the account for various malicious purposes.

Users might call account takeover fraud “account hacking” when they realize someone has stolen their online credentials. This type of identity theft occurs when someone logs into an account that isn’t theirs to exploit it.

Most ATO attacks are intended for financial gain, but fraudsters may have other motives, such as:

There are many paths to successful ATO fraud. It works different depending on the attack vector:

SEON’s anti-fraud tools are designed to detect suspicious usage and uncover hidden fraudsters

Find Out More

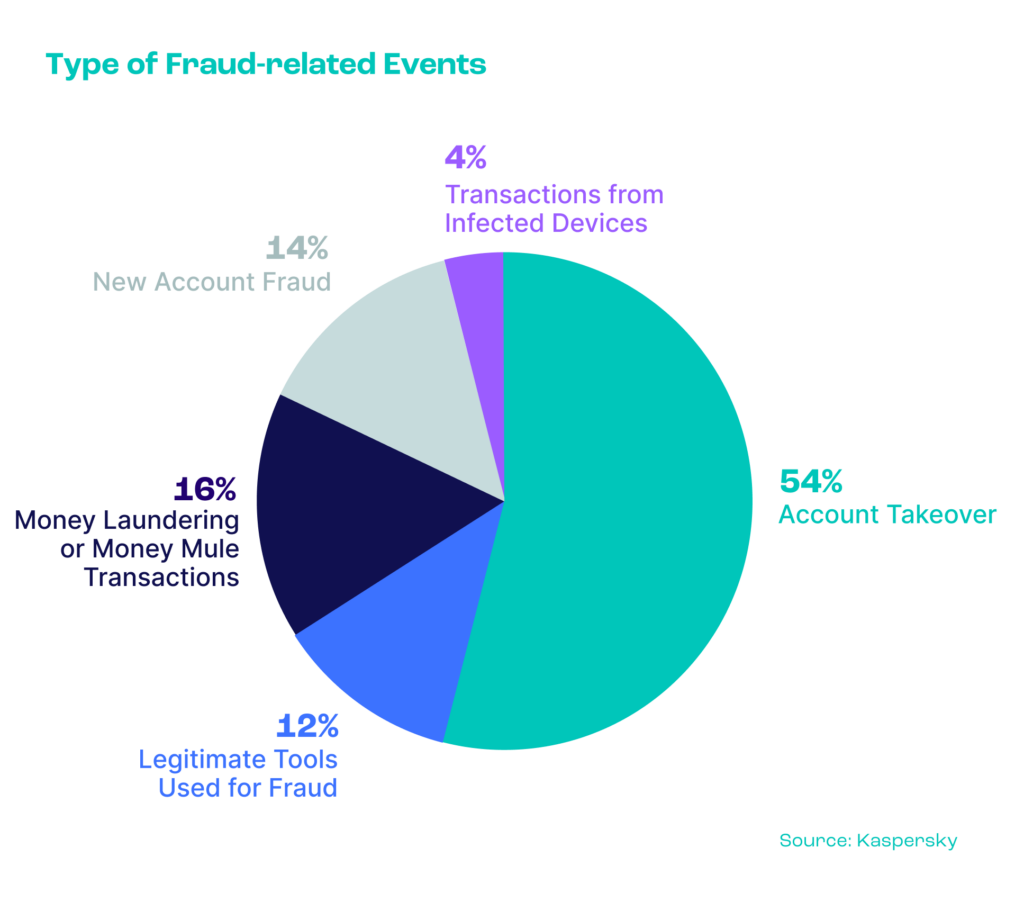

According to research from Kaspersky, more than half of all fraudulent attacks are in fact an account takeover.

While it’s harder for businesses to put a monetary value on ATO losses than, say, credit card fraud, it doesn’t mean it’s a victimless crime. There are very real consequences for affected businesses:

In the worst-case scenario, stocks can even plummet after a publicized breach. According to Bitglass research, this can be down by as much as 7.5%.

Employees, individuals, and IT teams must look out for numerous signs of account takeover. These range from unfamiliar transactions and unusual activity on an account to changes to personal details. Let’s look at some of the signs that should cause your Spidey-Senses to tingle:

Businesses should be on the lookout for all the above signs of ATO. It’s also possible to spot attempted account takeover: Repeatedly failed log-in attempts are often a sign of a fraudster trying to get into an account by brute force, so it’s crucial to be alert to this, too.

While it can be challenging to catch ATO attempts, these attacks can be detected by monitoring for out-of-the-ordinary account behavior. Deploying end-to-end fraud prevention and detection software helps you keep track of user activity and helps you spot suspicious patterns.

Implementing the right fraud prevention and detection solution equips you with the essential tools to proactively monitor user activity and swiftly identify suspicious behavior, effectively blocking account takeover attempts.

Detecting suspicious logins can be challenging due to the limited availability of data. However, deploying fraud detection software and tools can enhance your ability to extract additional information to get a better understanding of who exactly is logging into the account. This can be achieved through the following methods.

Device fingerprinting is essentially the process of collecting information about the device a customer is using to access your service, including hardware and software information. This is highly effective in preventing users from logging in with unknown devices or browsers. It can also detect the use of suspicious emulators or virtual machines, which fraudsters often use to make multiple login requests.

IP analysis pinpoints the user’s location, monitoring regular geolocation patterns and flagging unusual connections. This extends beyond the indicated location, as new VPN or Tor connections may also raise red flags. Logging this data helps in creating user whitelists to reduce false positives. For instance, if a user informs you of their travel plans in advance, their IP address can be added to the whitelist accordingly.

If an account takeover is already underway, you can still catch it by spotting suspicious user behavior. Whether it’s inspected through a dedicated fraud prevention system or through manual investigation, here are some of the signs that an ATO attack might have happened.

At SEON, we’ve built a number of ATO detection features into the core of our end-to-end fraud detection platform. We also took great care to put user experience front and center, reducing the processing time to a minimum while allowing you to leverage:

The good news is that protecting individual user accounts and your general business interests can be done using the same tools. Using the flexibility and customization options provided by both SEON risk rules and our API calls provides your business with the level of fraud protection you need.

Account takeover involves someone accessing an account owned by another individual without authorization, whereas identity theft involves the fraudulent creation of a new account using stolen identity information. Account takeovers can affect both businesses and individuals, whereas identity theft exclusively impacts individuals.

Monitoring account activity in real time, in addition to user behavior analysis and automated alerts for suspicious behavior is the best method to detect ATO. Additionally, regularly screening user credentials against known breaches and educating users about risks are essential components of an effective detection strategy.

Industries most at risk of ATO attacks include but are not limited to financial services, ecommerce, healthcare, iGaming and government and education sectors due to their access to valuable data and financial assets.

Showing all with `` tag

Get anti-fraud and compliance insights and tips from SEONs experts.

Bence Jendruszák is the Chief Operating Officer and co-founder of SEON. Thanks to his leadership, the company received the biggest Series A in Hungarian history in 2021. Bence is passionate about cybersecurity and its overlap with business success. You can find him leading webinars with industry leaders on topics such as iGaming fraud, identity proofing or machine learning (when he’s not brewing questionable coffee for his colleagues).