How Anti-Fraud Tools Can Help Your Business Prevent Chargebacks

by Tamas Kadar

In early 2010, an unknown startup with a strange name began making waves in Silicon Valley. Its goal was simple: to allow anyone to accept card payments.

Here is what an early adopter had to say about it on the Y Combinator forum:

“I’ve been using it for a few months and honestly it’s the best API I’ve ever used. The documentation is clear and concise. It’s customized to your account so you can literally copy and paste and see the result. Just like it says, it gets out of your way. I was up and running and accepting recurring payments in less than an hour or so. Looking forward to them eating every other payment processor’s lunch.”

You’ve guessed it: the company in question is Stripe. Fast forward a decade, and the company has indeed become one of the most trusted, powerful, and profitable payment processors on the planet.

The early adopter’s words sound more true than ever. And as they put it, the company’s success had everything to do with its ability to simplify the integration process. As we’ll see, it’s also something that can be done with fraud detection.

Most newer online businesses experience fraud prevention as part of their default payment system. These one-stop-shops do offer a level of protection, but often fail to really cover specific use cases. They take a one-size-fits-all approach, which cannot be tailored to your own fraud needs.

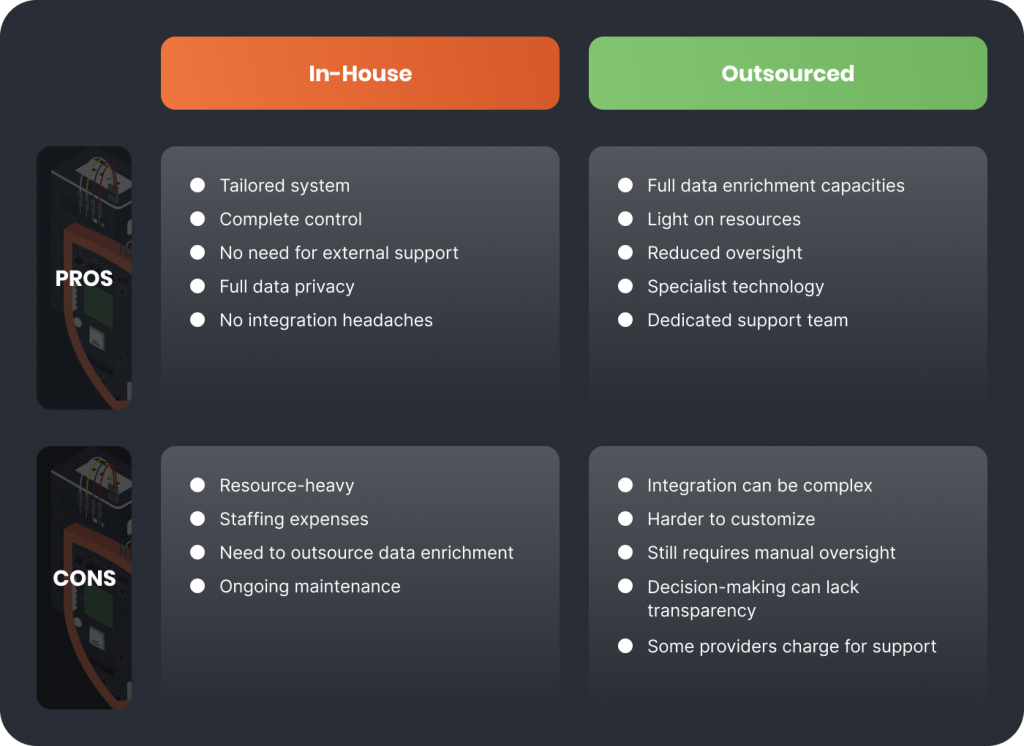

You then find yourself at a crossroad: should you build a layer of protection in-house, or outsource the tech to a third party company? Each provider has its pros and cons.

And to add to the list against outsourced solutions: relying on a third party provider is always risky. Even something as highly regulated as payments, where trust is primordial, can backfire if things go wrong, as exemplified by the recent Wirecard failure.

But what if we told you that all the cons of outsourced fraud detection had been anticipated by more modern vendors? Let’s break down each point and see if they still stand.

In many cases, integrating a fraud detection solution is still a huge obstacle for online businesses – and for good reasons.

This is because when people think of fraud prevention, they tend to gravitate towards legacy solutions, which are convoluted by design. Their business model is to insert themselves into your business operations so that discontinuing the service would eventually become too painful to consider. And their marketing and sales budgets ensure they will convince your business that they’re the only alternative.

Certain providers also target industries like banking with multi-billion dollar yearly deals. The integrations are measured in years, providing a plethora of professional services, and complicated project timeframes.

In fact, the incentive is to drag the integration process out for as long as possible. But what if newer, innovative vendors wanted to disrupt that model?

In essence, the biggest challenge of integrating fraud systems is in understanding where the system should go. Should it communicate with the frontend, backend or payment system?

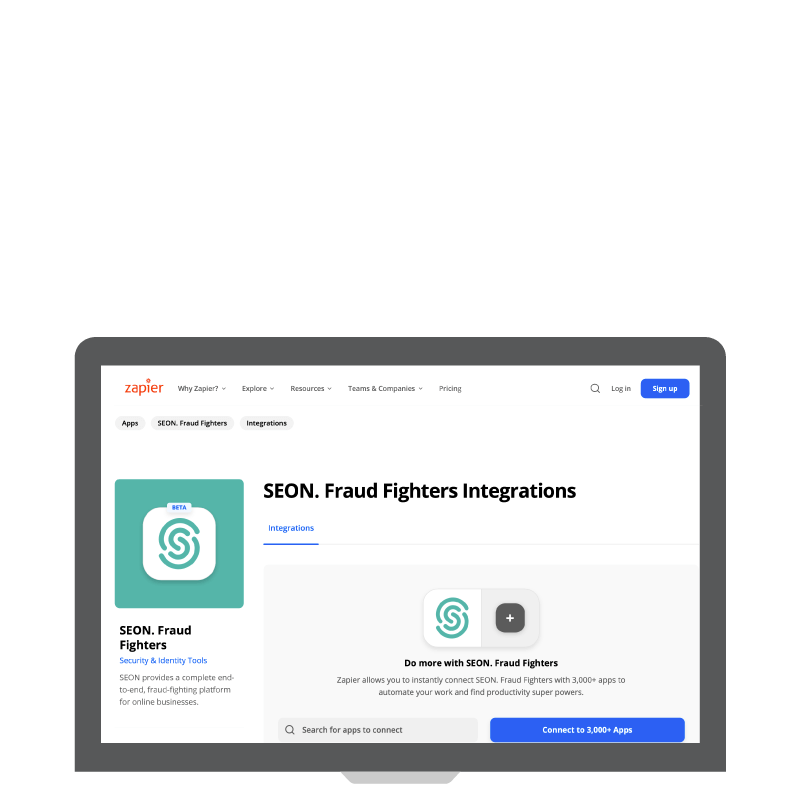

To answer that question, many modern fraud prevention vendors are now offering innovative plug and play solutions. And the integrations come in many shape and forms, all purpose-built with the goal of simplifying life for developers:

And best of all, businesses needn’t be entrapped by the old “rip and replace” mentality, thanks to a new approach to multi-layered protection.

The most innovative anti fraud software companies know and understand that risk needs to be reduced with tailored tools.

This is why you will find more and more solutions breaking down their features into modules, which you can add or remove as needed, based on your business model:

The goal is to let fraud managers pick and choose the best tools for their needs. No need to install on a full platform. This reduces integration cost and effort, and combined with a transparent API-call-based-fee, gives your company complete control over the fraud reduction ROI.

It depends a lot on the kind of solution you choose. As previously mentioned, integration of a legacy solution with a financial institution’s internal systems can take years, and cost hundreds of thousands.

At the other end of the spectrum, using a plugin like SEON’s Chrome Extension only takes minutes.

For more complex platform integrations, things can be just as seamless. Here is what our integration timeline says about getting started with the platform.

The entire process can take 1-2 days.

Of course, it’s important to remember that the longer the system runs, the more precise the results will be. But in terms of integration time and effort, a modern fraud management system won’t stop your operations, neither will it eat into your budget by creating too much business downtime.

At its core, the SEON fraud prevention platform operates in three simple steps.

Regarding step 1: all the user, transaction and device data is sent via the Fraud API. Your first step is to define payloads for the API, populating it with as many relevant data points as possible. All the fields are optional, but the more you fill, the more precise our results will be.

For more information, please see our developer page here.

Circling back to our initial story about the success of Stripe, we can now see many parallels between the innovative payment provider and modern fraud prevention vendors.

At SEON, for instance, our developer-focused approach has earned us the nickname of “the Stripe of fraud prevention”, due in part thanks to:

Still unsure about integrating an anti fraud system into your business? You can speak to our team today, and see how SEON could benefit your business in days, not months.

Showing all with `` tag

Get anti-fraud and compliance insights and tips from SEONs experts.

Tamás Kádár is the Chief Executive Officer and co-founder of SEON. His mission to create a fraud-free world began after he founded the CEE’s first crypto exchange in 2017 and found it under constant attack. The solution he built now reduces fraud for 5,000+ companies worldwide, including global leaders such as KLM, Avis, and Patreon. In his spare time, he’s devouring data visualizations and injuring himself while doing basic DIY around his London pad.