It may lack the flashy headlines that chargeback fraud and account takeovers generate, but property fraud is a topic of real concern for both homebuyers and renters, as well as real estate agents and adjacent companies around the world.

Real estate fraud in its different guises has been shown to be on the rise. The FBI reports that 11,578 people fell victim in 2021 alone while, in the UK, requests and reports received by the Land Registry services have doubled in ten years.

Today, we’re looking more closely at property fraud and rental fraud.

And we’re also talking about a real-life example of how SEON helped a property marketplace identify and block a criminal looking to defraud visitors to its real-estate portal.

What Is Real Estate Fraud?

More of an umbrella designation than a technical term, real estate fraud occurs whenever someone uses deception to extract money, valuable information, or items of value from a person or a company using a scheme that involves buying, renting or otherwise owning a property.

In fact, the item to be extracted could even be the property itself.

Victims of real estate fraud can include:

- existing homeowners

- renters

- homebuyers

- companies that own, rent or lease property

- property managers, including companies and associations

- companies adjacent to the real estate and rentals sector

As for its consequences, they include lost funds (sometimes big sums as these are common during property transactions), reputational damage for companies, loss of licensing, AML and other fines, and general harm to the local and national economy.

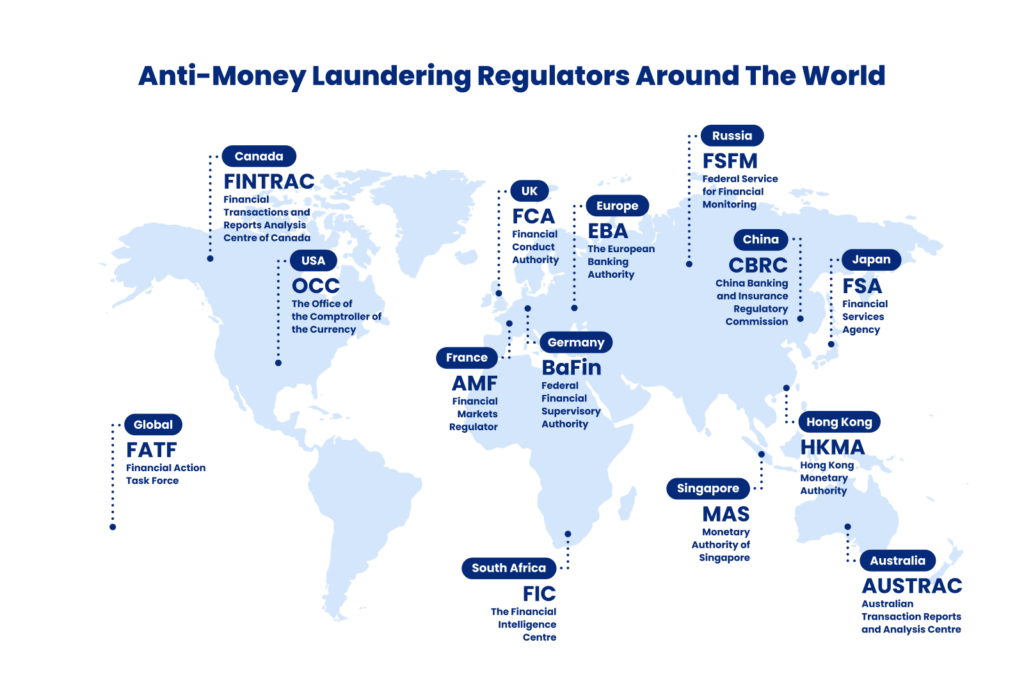

Real Estate Fraud and AML

Unfortunately, money laundering and real estate have very close ties, thanks to the opportunities that the housing market offers to layer large sums of money in a single transaction. This means that the reward for criminals is high for just one successful scheme.

Indeed, in early 2022, Transparency International revealed that an estimated £6.7/$8.20 billion in property has been bought around the world using “questionable” funds.

In the States, the past five years have seen over $2.3 billion laundered through the real estate industry, per GFI.

What this proves is that money laundering through real estate is a very real problem. And it’s very closely linked to corruption and politically exposed persons (PEP) scandals as well.

In addition to harming the economy and leading to further fraud, money laundering through property sales also affects real estate agents, solicitors and other parties that assist in such purchases.

Companies that enable, even unwittingly, money laundering via real estate face fines as well as regulation and licensing issues. A company can be shut down if found to be an avenue for crime by competent authorities – so there is very good reason to conduct enhanced due diligence (EDD) wherever possible and always be AML compliant.

Types of Real Estate Fraud

There are various types of real estate fraud, some of which are exclusive to certain locales and others universal. They can be related to payments and wire fraud, identity fraud, mortgage underwriting or any number of other schemes. Here is a non-exhaustive list:

Listings fraud: A tale as old as classified ads, or perhaps even older. Fake listings for great offers grab the attention of individuals looking to buy or rent a place, though the “seller” is a fraudster. Perhaps the best-known example was perpetrated by Victor Lustig, an Austro-Hungarian con artist who managed to sell the Eiffel Tower twice, in 1925, before he fled to the US to continue his lucrative criminal career.

Drop addresses: This takes place when someone rents a property, usually only in the short term, and uses it as a drop address for fraudulent exchanges of goods, or fraudster/criminal meetups.

Bait and switch scam: This type of fraud usually targets renters. A real estate company advertises a very appealing opportunity to get people to express their interest and/or sign up – only to be told that there’s a problem with the previous listing. The agent then attempts to convince them to take on a more expensive or lower quality offer, now that they’ve been hooked.

Housing scam: Another umbrella term, this often refers to any and all rental scams – in other words, every case where a landlord or a tenant misrepresents themselves, the property discussed, or even the terms of the rental agreement they are looking to reach. Alternatively, “housing scam” can sometimes describe scams related to housing benefits.

Wire fraud: Buying real estate involves transferring sizeable sums of money to lawyers or agents, and bad actors are looking to take advantage of this. They send spear-phishing emails to homebuyers, giving them the wrong account information, in an attempt to receive these deposits and other payments into their own bank drop accounts instead.

Mortgage fraud: An unfortunately common pitfall for lenders and banks is mortgage fraud, where someone will apply for credit with a fake or synthetic identity, or even falsify evidence to influence their credit score, in order to get a mortgage approved using false pretenses. Alternative credit scoring can help identify and stop these fraudsters.

Money laundering: Money laundering via property buying is classed as a type of real estate fraud, as it involves a person concealing their real identity (a money mule) who is purchasing property using illegally acquired funds. If successful, this allows them to launder the money, integrating it into the economy and obscuring its true origins.

Loan flipping: This type of fraud targets borrowers and is conducted by unscrupulous, if not outright illegal, lenders or mortgage brokers and advisors. Loan flipping is when one convinces a borrower to refinance a loan secured by their primary residence for no real benefit to the borrower – solely for the purpose of the intermediary or institution receiving fees for this.

Airbnb scams: A bit of a grey area, but many consider that Airbnb and similar short-term rental scams fall under real estate fraud. They can be one of several diverse types of schemes, including advance fees that are neither returned nor recognized, third-party bookings paid via stolen cards, overpayment scams that are perpetrated by guests, and so on.

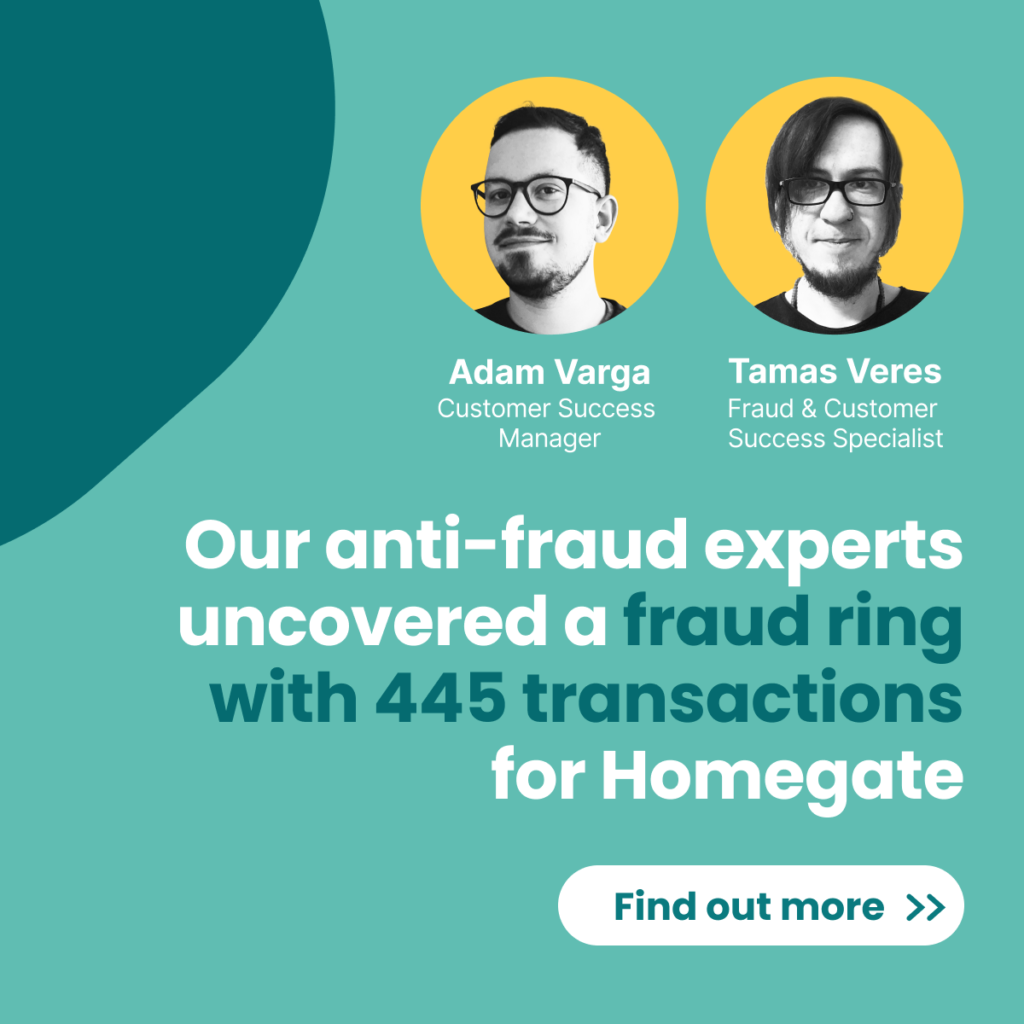

How SEON Stopped Real-Estate Fraud at Homegate

SEON provides industry-agnostic fraud prevention services for online companies and one of our customers is Homegate, a real estate marketplace based in Switzerland that boasts over 9 million visits per month.

Recently, we were able to detect and block a huge property fraud ring on the Homegate website, which had generated at least 445 false user actions.

Homegate has been using SEON’s fraud prevention system for a few years, and reports 99% accuracy.

As part of the service, customer accounts at SEON frequently get reviewed by the Customer Success team, to help companies get the most out of our fraud prevention and data enrichment solutions.

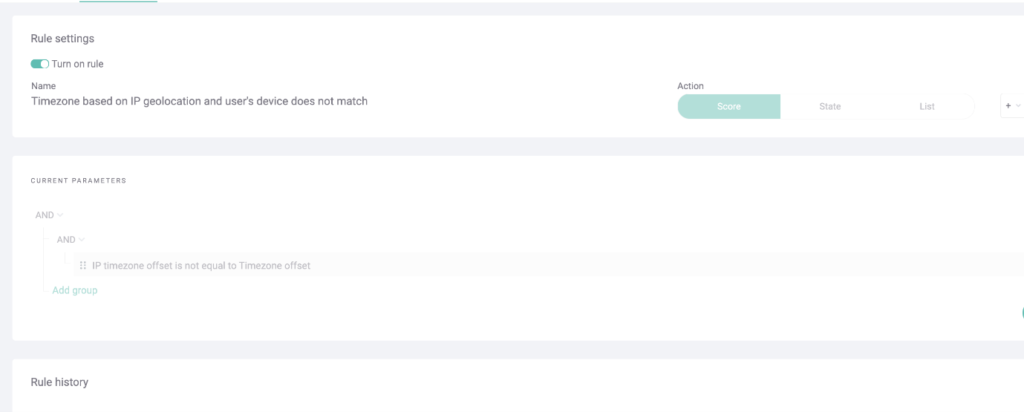

When one of the CS team, which is exclusively made up of fraud analysts and managers, reviewed the latest Homegate transactions logged in the system, something gave them cause for suspicion:

- There were several new users signing up from locations unrelated to Switzerland, which the company serves.

- All these accounts had their device language set to non-Swiss languages.

- Their timezone was also very unusual, always at GMT +8.

Of course, there are always legitimate users whose device might return such data.

That is why we went further: The team coordinated to confirm this suspicion and investigate the incident. They ensured that there were no false positives reported, examined more closely the associated risk scores, and finally spoke to Homegate.

The result? SEON stopped this fraud ring from publishing approximately 445 fake property sale listings, which sought to defraud Homegate’s good users – and which could have had an impact on the portal’s reputation.

Above, you can see the rule on SEON’s Admin Panel that flagged these accounts.

It’s one of the default fraud prevention rules provided out-of-the-box, looking to identify those users whose device geolocation and IP geolocation are suspiciously inconsistent.

How to Avoid Real Estate Scams

As a consumer, avoiding real estate scams involves doing your best to triple-check whether the person you are transacting with is who they claim to be.

Sometimes, this is as simple as not taking their word for granted when they call you on the phone to request that you make an urgent transfer or other suspicious action. You can instead tell them you will call them back, find the phone number for the organization they claim to represent, and make a call to see if they indeed work there.

Tools such as SEON can also help figure out more about the owner of an email address or phone number and whether they are legitimate, using OSINT data.

To try out this reverse social lookup tool, type an email address or phone number below and hit the arrow. You will be shown dozens of publicly available data points that are linked to its owner, giving valuable evidence of whether they are who they claim to be.

For companies who are buying or renting property, real estate scam prevention would be similar.

However, for those companies that manage or assist in the buying, leasing and renting of property, the situation is more complicated, and involves deploying sophisticated fraud prevention, AML and risk mitigation software modules, as well as the strategies to support them.

Watch our tool in action and see how we can help you keep fraudsters at bay, enriching your data to keep your operations safer and customers happier.

Ask an Expert

How to Report Real Estate Scams

The indicated method to report a property scam depends on whether you are a company or individual, as well as your location. In the US, you can both file a report with the FBI Internet Crime Complaint Center as well as turn to your State Consumer Protection authority.

In the UK, the Citizens Advice Bureau advises speaking to the police as well as to Action Fraud and/or themselves.

If you have reason to believe the scam was perpetrated by a licensed company rather than a fraudster masquerading as such, consider turning to the Ombudsman for that industry, too.

How to Stop Fraud as a Property or Rentals Company

Thoroughly vetting homebuyers and renters you do business with is key to keeping safe as a real estate agent or other property company.

From there, AML tools & software created to satisfy legal mandates in your area will go a long way to ensuring you are compliant and not at risk of being fined for lack of due diligence.

Depending on the type of company you run, it is worth looking into SEON’s digital footprint analysis, which will give you unique insight into the individuals you’re dealing with, and whether they are who they claim to be, all in real-time via API calls, from 300+ social media and digital platforms, as well as other sources.

What’s more, staples of fraud prevention such as velocity checks, IP analysis, and device fingerprinting complete the picture, especially if you have an online portal to help serve your customers.

How Can SEON Stop Real Estate Fraud?

SEON is a fraud prevention platform made for businesses, so it cannot help private individuals. That said, one could use SEON’s free reverse email lookup module and reverse phone lookup module to get a sense of whether they are transacting with a real person.

For businesses and organizations, there are several types of property fraud SEON can help with, including:

- listings fraud

- account takeovers

- supplementary credit scoring for lending

- customer due diligence using alternative data

- aspects of money laundering prevention (AML)

- streamlining KYC checks

and so on, as well as all transaction and onboarding-related digital fraud that might be perpetrated on a property-related portal.

FAQ

The term “negative fraud” describes instances of dishonest behavior when a real estate agent is obliged to share specific information with a buyer or renter but chooses not to do so for their own benefit. It is a case of lying through omission, and it’s punishable by law.

Listings fraud is all fraudulent behavior connected to publishing classified or other ads, such as property ads. For example, it could be fake listings designed to swindle homebuyers, as we saw above. Or, it can be about illegally subletting when a contract does not allow you to do so.

In general terms, if it sounds too good to be true, it is. Airbnb scams are almost always perpetrated after the scammer convinces you to transact off the official platform, such as to send a payment. They can target either property owners or guests, depending on the method. The company has several defenses in place, including official guidelines and star ratings for its users, which can go a long way. Beyond this, there is support from Airbnb and official means of resolution of issues.

This is a type of scam that more often refers to vacation rentals, including rooms to let and hotels. The simplest version is when a fake website is set up for people to book their vacation at non-existent accommodation, or simply set up by someone who isn’t affiliated with an existing hotel or company. In this case, they’ll ask for money upfront and never return it.

Sources

- ABC Finance: Is the UK In a Property Fraud Crisis?

- Internet Crime Complaint Center: FBI Internet Crime Report 2021

- Transparency International: Transparency International UK Welcomes New Measures to Tackle Dirty Money

- Pideeco: How is real estate used for money laundering?