Your online social life says a lot about what kind of consumer you are. It’s no wonder lenders want to leverage that social media data for credit scoring.

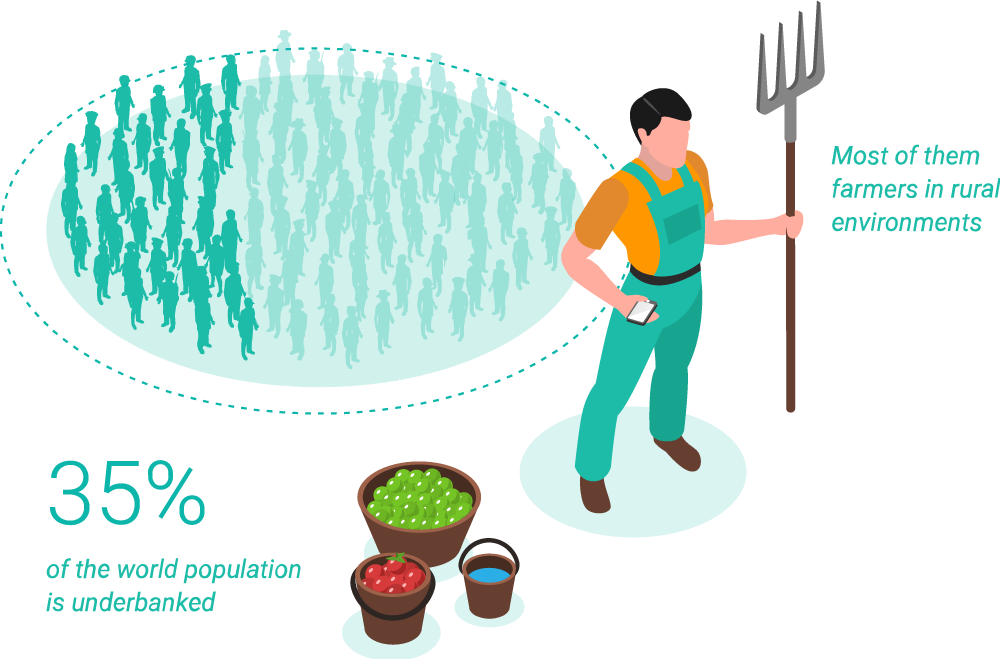

In fact, it is one of the methods allowing for the world’s unbanked or underbanked – more than 1.4 billion people according to the World Bank – access to credit and financial services.

Let’s see how it works, whether you should use it, and how to do it right.

What Is Social Media Credit Scoring?

Social media credit scoring uses social data to calculate the creditworthiness of someone applying for a loan. By checking social media activity, registered profiles, and even the reputation of specific social media networks, lenders can get a better idea of the kind of borrower you could be.

They can also cross-reference social data with other information on the form for additional peace of mind.

Just like with standard credit scoring, lenders may use social data as part of their affordability and underwriting algorithms, to reduce risk.

Social data is considered alternative data for credit scoring purposes. Note that it isn’t solely reserved for lending money either. Alternative data is often used to decide whether you should be able to purchase certain financial products and services or even as part of the digital onboarding process.

While social media credit scoring seems like a logical step to determine the creditworthiness of individuals, it is not without its controversies. There are data privacy issues, and researchers have pointed out that social data may also be used to target vulnerable consumers – for instance, by offering predatory loans to people who already appear to be financially struggling.

Adding to the matter is the fact that social data is varied and complex to analyze. People lie about themselves online, so attempting to quantify their spending habits based on social posts may result in higher numbers of false negatives.

The right social media credit scoring strategy will complement rather than replace traditional methods. A sophisticated solution will aggregate hundreds of data points and use them in combination with other information, rather than trusting any social account as a single source of truth.

See how SEON’s social media profiling helps FairMoney offer 10,000 loans daily – fast and with reduced risk.

Learn How

The Pros and Cons of Social Media Credit Scoring

The first thing to point out is that social media platforms have previously attempted to leverage user data to create their own credit scoring models. This is the most contentious aspect of social media credit scoring.

However, you can also gather open-source social information to vet borrowers as part of their digital footprint analysis, which is particularly difficult for fraudsters to duplicate or mimic.

Let’s examine the best use cases and when you should look at other alternative data sources.

Pros

- Real-time data: It is possible to gather social data in real-time. This is helpful when you want to approve loans fast or you are worried about stale databases – for instance, as a payday loan provider or BNPL company.

- Good for unbanked or thin-file customers: The key advantage of social data is that most people around the world have some, even in markets where banking information is scarce. This makes social media credit scoring a favorite of financial companies in emerging economies or countries like the US, which have a large underbanked population.

- Strong signal to catch fraudsters: A complete absence of social signals is a strong indication that you may be dealing with someone who does not exist. This increases the chance of them being a persona a fraudster made up in order to take out a loan and then default.

Cons:

- Limited information: Gathering data from social media can be hit and miss. At best, you may get a social account avatar and bio. But because social media networks don’t provide APIs for that data, it takes considerable effort to gather all of it in real-time and at scale. However, there are solutions provided by vendors such as SEON that will collate information from several platforms and create more complete social media risk profiles.

- Data privacy concerns: Even if you can perform social media checks, your customers may not like it. And as social media platforms increase their data-privacy policies, it can be hard to gather information while remaining compliant with data protection rules.

- Concerns with accuracy: Social data can help point out red flags, but many experts worry about its accuracy when it comes to evaluating creditworthiness. While you can certainly use some social data to complement scoring, it would be foolhardy to decide whether you should approve a loan or not solely based on someone’s social history.

Partner with SEON to reduce fraud rates in your business with real-time data enrichment, human-readable machine learning, and advanced APIs.

Ask an Expert

How to Use Social Media for Credit Scoring

Social media can be used for credit scoring by having software or humans gather data points from social platforms and study them to reach informed conclusions – similar to how other companies can leverage them to identify high-risk customers. These data points can be anything from someone’s job title on LinkedIn to how often they fly with Airbnb, or even whether they have any social media presence at all.

A traditional credit scoring method will look at financial information such as proof of income statements, proof of payment of phone or utility bills, debt trail, and credit card usage.

But here are some examples of how social media data could play into the equation:

- No social media profiles at all registered: This is a strong indication that you could be dealing with a fraudster who plans to default on a loan. Because creating social media profiles takes time and effort, many fraudsters do not bother, it should at least increase risk as part of your credit scoring calculation.

- Data mismatch: While people do lie about themselves online, there is also a chance you might find customer information in social profiles that does not match that of the credit application. You may find all sorts of discrepancies relating to their line of work, lifestyle, or even geolocation. For instance, a mortgage application for an apartment in the UK from a person who, according to their social profiles, clearly spends the majority of their time on a different continent.

- Only registered on certain platforms: A rather more controversial use sees creditors rate the reputation of social networks based on their core user base. Since social media use is so segmented worldwide, it may also help with geolocation customer segmentation. Simply put, this means that a creditor may choose to approve someone who has a profile on GitHub, for example, but look down on those who only have WhatsApp or Facebook profiles.

As it can happen, the shortcomings sometimes involved with social signal use for alternative credit scoring are more closely linked to their interpretation than their collection – though any privacy concerns can be addressed by ascertaining that the anti-fraud platform is GDPR compliant and/or complies with other privacy legislation and certification.

How SEON Leverages Social Signals

SEON aggregates alternative data from 90+ sources by enriching readily available information such as the customer’s IP address, email address, or phone number.

Whether it’s to offer faster loans, onboard more trustworthy customers, or reduce defaulting risk, the idea is to give you the tools you need to get a complete view of your customers so you can make better decisions.

More importantly, we help you get that data reliably, in real-time, and at scale, thanks to simple API integration and manual query checks.

Despite adding hundreds of data points to help you make better-informed decisions, SEON’s data enrichment does not add any friction to the customer journey. This is because it searches and cross-references publicly available information rather than asking customers to fill out additional forms or submit more documentation.

The result is a better customer experience without compromises to security – all leading to growth for lenders and fintechs.

FAQ

As creditors increasingly look for alternative credit scoring methods, social media may eventually start affecting your credit score. Your social presence can be used as a sign to calculate such a score, but not your credit rating in the traditional sense. Also note that they can only glean information that is public.

Traditional credit scoring works by looking at a person’s financial information. However, lenders may also consult alternative data, such as social information. The kind of networks where you have an account, your public information, or even the kind of lifestyle you appear to live online (in any public posts) may affect how lenders calculate your credit score.

In practice, this complementary method of credit scoring allows underwriters and other professionals to make better-informed decisions about applicants. It is reliable and trustworthy because it’s based on real-time data and combines hundreds of data points into one profile. Fraudsters cannot replicate the online activity of legitimate customers – and where they can approximate it, it is impossible for them to scale up.

Sources

- World Bank: COVID-19 Boosted the Adoption of Digital Financial Services