Chinese payday loan company Qudian made a splash in 2017 with its $900M IPO. Whether in Southeast Asia, Europe or Latin America, there sure is money to be made in personal credit. But there’s also money to be lost due to fraud.

It is all part of a larger increase in attacks against online businesses in any vertical. As we’ll see, payday loan companies are a particularly high target. This post examines why and tries to offer a solution to the problem.

How Does Payday Loan Fraud Work?

A key challenge for payday loan companies is flagging real from stolen IDs. These stolen documents tend to originate from four different places:

- Criminal marketplaces: Clear and dark web sites offer plenty of platforms where you can sign in anonymously, pay with untraceable crypto, and bulk buy IDs to use for any of your fraudulent goals.

- Data breaches: While cybercrime isn’t necessarily organized, fraudsters benefit from actions by other hackers as a data breach means access to legitimate IDs and passwords. These can be used to recover other information to create a full stolen ID profile.

- Phishing: The old days of mass-sending emails are over. These days, fraudsters use increasingly sophisticated methods, such as creating fake job posts to steal ID, targeting the clean credit history of children profiles, and personalised phishing – also referred to as spear phishing.

- Rent and ID service: We’ve seen an increase in individuals willingly renting out their official documents (in exchange for payment). This goes directly to fraudsters and makes it very hard to track.

Even more specific: fraudsters can filter stolen IDs based on credit score. It’s also easy to check it manually, using sites that let you consult a credit score by making a card payment.

How Can You Spot These Payday Loan Scams?

We all know how creative fraudsters can be but some of the more common ways to detect a potential loan fraud include:

- Payments – if the lender requests some form of payment/deposit/insurance, this is a clear red flag.

- Suspicious processes – there is a clear lack of emphasis in verifying your identity or your credit history.

- Their communication and threats – are they pressuring you to act immediately? Are they aggressively chasing you across different channels and threatening legal action?

- Customer due diligence – simply checking to see if the lender is located in your area and if they a registered/licensed company.

- Spelling and grammar – quite an obvious sign to any scam!

What Are the Consequences of Payday Loan Fraud?

The immediate consequence of lending money out to a fraudster is that you’ll never see it back. These criminals are adept at building trust, sometimes paying back initial loans to lull you into a false sense of security. Then one day, they vanish from the face of the earth. You’re left in debt, and collection agencies fail to contact an individual.

There are worse issues. In terms of compliance, you’re essentially putting yourself at the mercy of regulators, and in danger of paying hefty KYC or AML fines.

Last but not least, an afflux of fraudsters on your platform will damage your bottom line. Some of our customers in the vertical almost had to cancel launching their products in fraudster-heavy markets – until they managed to mitigate risk with financial risk management tools.

SEON is more than just a software solution, it is your business partner in fraud fighting

Ask an Expert

How to Protect Yourself from Payday Loan Scams

Research. Often payday loan scams will look to manipulate victims and pressure them into making a decision however asking for specific information can quickly uncover a fraudulent scheme.

Asking for written, verified confirmation of the company as well as getting the name, phone number and other personal information of the person who is calling can help gauge the legitimacy. A fraudster will categorically not want people checking on them so they won’t give you this information.

Due diligence through authorized registers, such as the FCA in the UK or The Consumer Financial Protection Bureau in the US, and online information/reviews might help you spot potential risks.

Why Are Payday Loans Companies Highly Targeted by Fraud?

Fraudsters flow towards money. And in the criminal world, very few industries offer as quick an access to money as online lending. But there’s more to it than simply smelling blood. Fraudsters also take advantage of a competitive market, new technologies and access to more data than ever before. Let’s break it down below.

PayDay Loan Companies Are Increasingly Numerous and Competitive

As more and more companies compete for their slice of the pie, there’s only one way to stand out: offering fast, frictionless lending. This means accelerating credit scoring, at the risk of losing customers if it takes too long to process.

As you can imagine, this is the perfect opportunity for fraudsters. Faster credit scoring means fewer verifications. Fewer verifications mean more ways to take advantage of the lender.

Lending Industry = Immediate Cash Access

Lending is a 100% financial service. There are therefore fewer barriers between fraudsters and their access to money. While, say, cloning credit cards incurs numerous steps, the results from targeting a payday loan company are immediate. If it works, they get paid. If it doesn’t they move on.

Risk-Free Applications

Wider Internet access, worldwide increase in mobile use, and cheaper consumer tech all contribute to a growing market for online lending companies. It also creates a fruitful and risk-free environment for fraudsters, who can switch devices, IDs or even IP addresses as they please to multiply their loan applications.

Easy Access to Stolen IDs

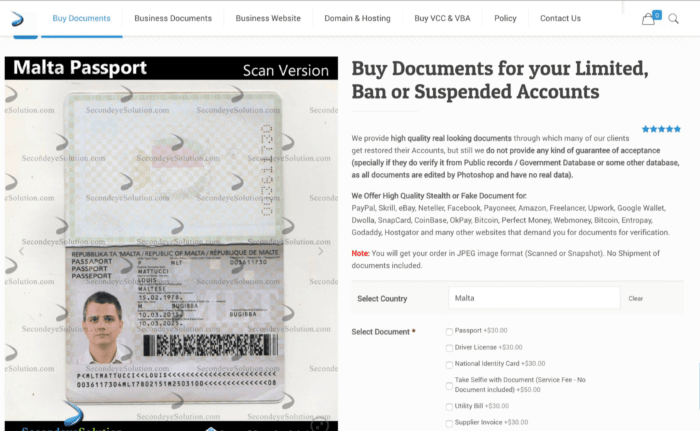

Do you believe photo ID verification works? For fraudsters, it is but a minor inconvenience. They can Simply log into a service like Secondeye, order a tailored, photoshopped document, and bypass secondary ID checks in no time.

Then there are all the other options we mentioned in our introduction: phishing, rent-an-ID services, and, of course, huge data leaks.

Ineffective ID Verification Process

You wouldn’t dream of setting up a lending company without some kind of verification. The problem is that most thirds party services rely on stale database, built from previously shared blacklists. Yes, they may catch the less sophisticated fraudulent attempts, but criminals are fast, agile and wise to most KYC checks.

To make matters worse, you’re often left relying on credit bureaus. But how does it work in a market with a high percentage of unbanked people? Or in a country where financial information is scarce? In short, it’s not a lack of verification steps that makes lending a target, but often relying on ineffective tools instead.

More Digital Banking Options to Store Funds

Historically, receiving and storing funds was one of the biggest headaches for fraudsters who managed to successfully apply for a loan. This is now a thing of the past as modern digital banking solutions have created a market for cheap, disposable accounts.

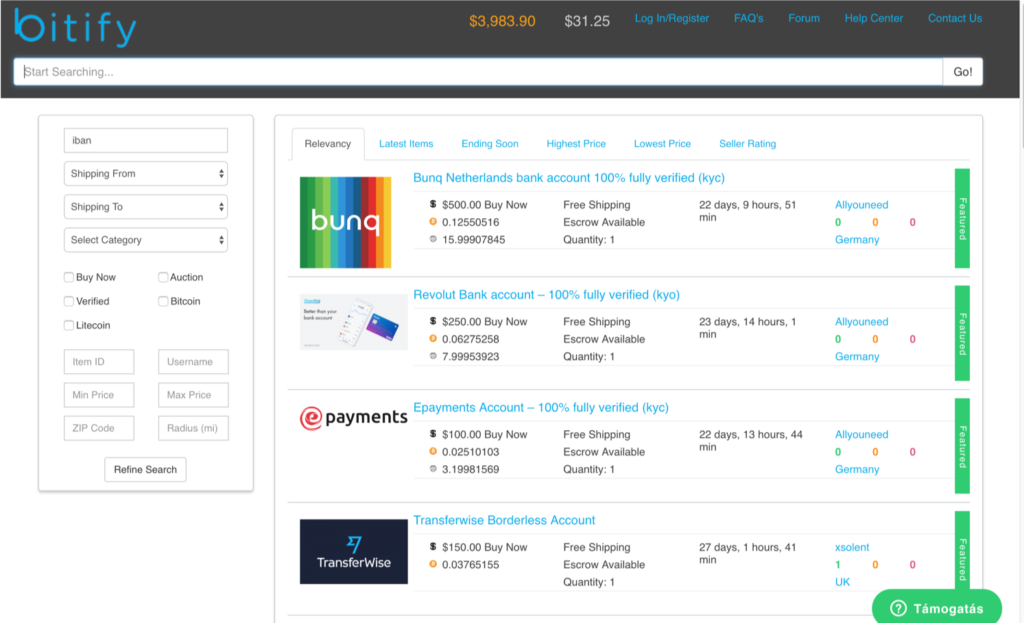

Fraudsters can simply purchase a legitimate online bank account from TransferWise, Revolut, or any other fintech to store the fiat. It’s then easier than ever to buy cryptocurrencies, which can then fund their next fraudulent venture.

A Solution to Prevent Fraud and Mitigate Risk

The lending industry is intrinsically based on risk. Interest rates are calculated on risk. Credit scores evaluate risk. Taking risks increases competitive advantage.

Modern fraud prevention tools can be integrated both as KYC processes and risk-model management solutions. Four of the top features include:

- Full digital ID profiling solutions to improve accuracy using an alternative credit scoring

- Device fingerprinting to flag suspicious connections

- Email profiling (email lookup) to get an accurate view of your borrowers

- Phone Number analysis for even better risk scores.

The good news is that risk is a measurable factor. This makes it easier to integrate services or processes that mitigate it, while calculating your ROI.

SEON offers a complete set of fraud fighting tools that grow with your business

Ask an Expert

Frequently Asked Questions

Payday loans are a form of immediate credit from an organization. Fraudsters use techniques such as making fake domains to gain personal information about you and then use that data in some form of manipulation. Examples would include demanding repayment for a fake debt or selling the information on the dark web.

A key solution is to rely on alternative user data as well as credit bureau data. OSINT tools and live data enrichment solutions offer useful alternative data such as their digital footprint.

Fraudsters target loan companies because it’s a quick route to access money. Companies sacrifice security over onboarding more users, which fraudsters see as an opportunity to pass KYC verification with stolen or falsified documents.

You might also be interested in reading about:

Sources used for this article