As KYC checks become increasingly common for a number of online businesses, many owners question how they can reduce their costs and make them more efficient.

The answer could lie with KYC API integrations. Let’s explain it all below.

What Is KYC Integration?

A KYC integration allows businesses to meet Know Your Customer requirements with the help of third-party identity verification providers. This helps automate identity verification and run KYC checks, and tends to be easier than building a KYC solution from scratch.

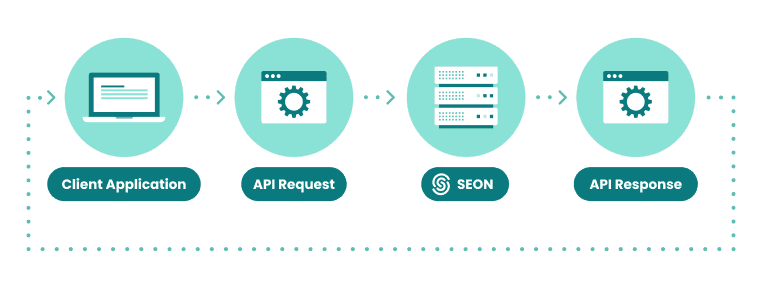

KYC integrations usually work via APIs. Application Programming Interfaces help applications communicate with one another, which is how an external identity verification software can receive your customer’s data and send a useful response back – such as an approve, decline, or review state.

One advantage is that you do not need to store the data on your end. Plus, third-party providers can handle huge volumes of it.

KYC checks, meanwhile, are increasingly important to remain compliant and competitive in a number of verticals. A survey on ultimate beneficial ownership (UBO), which overlaps with KYC in the case of companies, found that 42% of respondents described the process as extremely challenging.

Note that a KYC integration is the umbrella term for a number of customer due diligence processes, including:

- Simplified Due Diligence (SDD)

- Enhanced Due Diligence (EDD)

- Ultimate Beneficial Ownership (UBO)

- Know Your Business (KYB)

Partner with SEON to stop losing money to fraud, streamline your operations, and save money with pre-KYC checks.

Ask an Expert

What to Consider Before Automating Your KYC Process

KYC checks are designed to let you confirm identities.

You will need, at the very least, a full name and address, and ID documents for the person you are checking. Typically, this is a time-consuming process and requires manual effort from dedicated staff members.

This is where KYC software and tools can help.

By relying on third-party software, you can save on manual resources, check identities at scale 24/7, and reduce the cost of each manual verification.

Some companies who are legally required to perform KYC checks stack up KYC tools to perform preliminary pre-KYC tests. Because document checks can be prohibitively expensive in certain markets, it helps them reduce the cost of KYC by only verifying the identities of medium and low-risk customers. High-risk users who are thus provably fraudulent or undesirable are stopped at the gates.

As a result, fewer checks are conducted, with a higher pass rate.

However, automation isn’t always the magic bullet it claims to be. Relying on automated software could create false positives, where legitimate customers cannot verify their identities. KYC software does not remove friction, and, in fact, some of the more heavy-handed solutions, such as video selfies and document scans, are introducing extra friction, frustrating your users.

Finally, automated KYC checks via API integration still require developer time, not to mention human oversight, to ensure that the process is running smoothly.

Understanding KYC Integration APIs

APIs are a quick and painless way to integrate a KYC solution with your business. Regardless of which KYC or pre-KYC API you use, the basics are the same:

- You send data to your third-party solution. It can be a user’s phone number, email address, or full name.

- The KYC tool receives that data (via an API request) and processes it based on its own features. SEON, for instance, will investigate a phone number or an email address to let you know if it’s been used to register to any online services or social media sites. This is a great way to ensure you are dealing with a legitimate customer versus a hastily-crated fake profile.

- The response is sent to you via API. With SEON, this can be a risk score you can use to decide if the customer is likely to be legitimate. You can then decide if they should go through the ID validation process.

- You can automate the entire KYC workflow in a similar way, deciding if people should be able to onboard your platform or not or even dynamically asking for extra verification – especially when it comes to providing better documents to confirm identities.

Note that businesses can rely on multiple KYC APIs to double-check the quality of the identity verification.

Others use pre-KYC checks to instantly filter out junk users before moving medium and low-risk customers onto the next KYC stage, which can be an automated ID document check or a manual one.

KYC Integrations and Data Protection

While most businesses want to perform KYC verification checks for high-risk customers, not all of them are the results of legal requirements. Some companies run these to secure their business by filtering out potential bad actors.

However, in either case, there are legal details to consider, notably when it comes to data protection.

Processing KYC checks with a third-party integration is perfectly legal. In that situation, your company is a data controller. The third-party company will be a data processor. This is covered, for instance, by the GDPR, which states:

“The processing of personal data strictly necessary for the purposes of preventing fraud also constitutes a legitimate interest of the data controller concerned.”

GDPR, Article 4 (1)

However, you also want to ensure that your KYC integration connects to a secure and trustworthy platform. The seal of approval will come in the form of a certification, such as SOC 2 or ISO/IEC 27001.

Partner with SEON to reduce fraud rates in your business with real-time data enrichment, whitebox machine learning, and advanced APIs.

Ask an Expert

SEON APIs for Faster, More Cost-Effective KYC Checks

SEON offers a way to understand who your users are that is based on digital data. We do not offer document verification or biometrics checks.

However, SEON’s alternative data analysis has numerous advantages:

- It works in real-time with dozens of different sources – 90+ online platforms and social media, at the moment.

- It is incredibly low friction. The customer does not need to fill anything in or take any action beyond sharing with you an email address and/or phone number, as they would normally do.

- It’s much more cost-effective than a full KYC check.

- When you still need to do a full KYC check, it helps weed out obvious fraudsters, so you don’t have to pay to get them verified (and they can’t slip through the cracks).

This is why so many companies deploy SEON’s solution as part of their KYC stack, to instantly filter out junk users before sending medium and low-risk users on to the KYC check stage – itself provided by other software.

As for the integration, you can connect to our fraud prevention and risk scoring tools via REST APIs. The integration is free and fully detailed in our online docs to make the developer’s work as effortless as possible.

Ready to get started? Read all about it in the SEON integration guide.

FAQ

A KYC API allows your company to send and receive identity verification data from a KYC software application. In simpler terms, it’s the connection between your company and a service that allows you to accept or reject user actions and requests based on identity verification.

It depends on the software you use. Most third-party KYC tools work via APIs, which can take between a few hours to months to integrate, depending on their complexity.

Many third-party KYC software vendors should make their API documentation public so that your developers can easily learn how to integrate, send and receive data as seamlessly as possible.

Sources

- Citywire Asia: Five KYC Statistics You Should Know