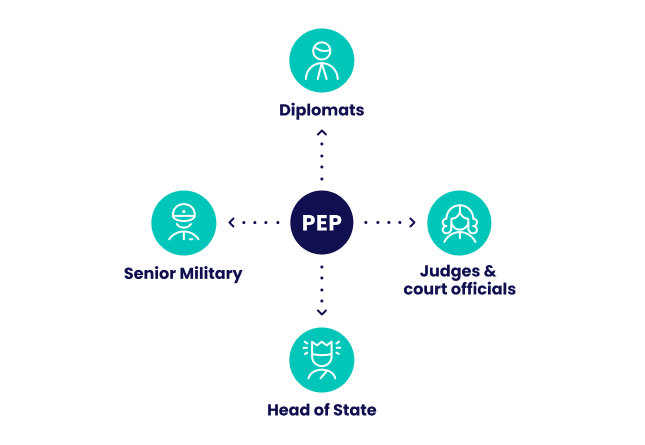

Financial institutions are under constant pressure to prevent illicit transactions, and one of the most critical safeguards is Politically Exposed Person (PEP) screening. Designed to flag individuals with heightened financial crime risks due to their political connections, PEP screening is a key part of anti-money laundering (AML) compliance.

The stakes for getting it right are getting exponentially higher. In October 2024, TD Bank became the largest U.S. bank in history to plead guilty to violating federal AML laws, agreeing to pay a record-breaking $3.1 billion in penalties. Cases like this highlight why financial institutions must have strong due diligence measures in place.

This guide breaks down how PEP screening works, the key compliance requirements, and the best practices for managing high-risk individuals effectively.

What Is PEP Screening?

PEP (Politically Exposed Person) screening, often referred to as PEP checks, is a process used to determine whether a customer, user, or business partner appears on any official PEP list. These lists are maintained and regularly updated by government agencies, public registries and third-party databases. The purpose of PEP checks is to identify individuals in prominent public roles or those closely connected to them who are considered at higher risk for activities such as corruption, bribery and money laundering.

The screening process typically involves comparing customer data against PEP databases using advanced algorithms and data-matching techniques to account for variations like name spellings or aliases. Once a potential PEP is flagged, enhanced due diligence (EDD) may be conducted to gather more information about their source of wealth, business relationships, and transaction history. This thorough evaluation helps compliance teams assess risk levels and ensures adherence to legal obligations aimed at reducing money laundering and terrorist financing.

Learn more about the term PEP here.

The Importance of PEP Checks for Businesses

PEP checks, a key component of Anti-Money Laundering (AML) compliance, were once primarily mandated for banks and financial institutions. Today, however, the scope of these regulations has expanded to include a variety of industries, depending on the jurisdiction. As more sectors become subject to these requirements, businesses across different verticals must ensure they are in compliance to protect against financial crime risks. Industries that may need to conduct PEP checks include:

- iGaming: Online gaming companies handling substantial financial transactions need to mitigate risks associated with high-stakes gambling.

- Fintech: Financial technology firms offering services such as digital wallets, lending and peer-to-peer payments face regulatory scrutiny around customer identity.

- Financial Services: Firms such as hedge funds, investment managers and accountancy businesses manage large sums of money and therefore face increased potential for financial crimes.

- Payments: Payment processors and gateways that facilitate cross-border transactions need to ensure compliance with anti-money laundering laws.

- eCommerce: Online retailers, particularly those handling high-value goods must protect themselves from fraud and money laundering risks in their customer transactions.

As AML regulations differ between jurisdictions, businesses must consult local regulatory bodies to determine whether PEP checks are required within their specific industry and region.

Consequences of Failing to Perform PEP Checks

Conducting PEP (Politically Exposed Persons) checks is a legal obligation in many jurisdictions, and failing to do so can lead to serious repercussions:

- Substantial fines: Regulatory bodies are increasingly strict. In November 2024, the Financial Conduct Authority fined Starling Bank £28.96 million (approximately $36 million) for inadequate PEP and sanctions screenings.

- Reputational damage: Non-compliance can erode trust among shareholders and customers, leading to long-lasting harm to a company’s brand.

- Decline in stock value: Research from Fenergo indicates that regulatory penalties significantly disrupt investor confidence, negatively impacting share prices. In 2024, financial institutions faced an average stock drop of 6.5% on the day a fine was announced, with losses persisting for months afterward.

For smaller businesses, the impact can be even more severe, as legal battles and fines may disrupt operations and hinder growth. In summary, rigorous PEP checks are essential not only for regulatory compliance but also for protecting against financial penalties and reputational damage.

Compare sanction screening tools to protect your business and choose the best fit.

Explore this list

Who Audits the PEP Screening?

PEP checks are a legal requirement, but the regulatory bodies in charge of these requirements vary from one country to the next. While this might make things confusing for what legally constitutes a PEP, most countries base their definitions on the one issued by the US’s 2013 Financial Action Task Force on Money Laundering (FATF).

However, the actual PEP audits will be performed by local authorities who are sometimes also in charge of AML verification screening. For instance:

- Australia: This will fall under Australia’s Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF).

- Singapore: The Monetary Authority of Singapore (MAS) defines PEPs and includes relatives or close associates (RCAs).

- South Africa: The Financial Intelligence Centre will audit what it calls Politically Influential Persons (PIP). The term serves the same function as PEPs.

- United Kingdom: The Financial Conduct Authority (FCA) and Joint Money Laundering Steering Group both publish guidance on PEPs along with other KYC matters.

Note that international organizations, such as the EU’s 6th AML directive, can also update and check PEP definitions.

3 Ways to Perform PEP Screening

While regulators must ensure you perform your customer due diligence (CDD) and enhanced due diligence (EDD) checks, there are no strict rules on how to do PEP screening.

Here are three methods that may generally suit your organization, depending on your scale and risk appetite.

Manual PEP Screening

The easiest (and most resource-intensive) way to run a PEP check is simply to manually look at the right lists. Businesses can do this by accessing the information on PEPs available through official government websites, public registers, or commercial databases.

OSINT sources and OSINT tools can also accelerate the process by aggregating information about a person based on their name.

Finally, you could also monitor news reports from reputable sources to monitor the latest political or judiciary appointments.

Manual PEP Checks With an AML Solution

The second option is to manually check for names by inputting them into specialist software. This has pros and cons. The advantage is that it speeds up searches by automatically aggregating results from several PEP lists worldwide. The results are sometimes processed via algorithms to provide the best estimate of whether you are dealing with the right person or not.

However, this can be challenging since names are not unique identifiers. You still need to confirm the information manually to ensure you are verifying the correct identity.

Fully Automated PEP Checks

The most ambitious businesses subjected to AML rules will sometimes deploy fully automated checks.

This involves integrating sophisticated AML software, either on-premise or via API. Automated AML verification also works by aggregating data from several PEP lists around the world and running it through algorithms.

The advantage of fully automated PEP checks is that you can verify the identities of large numbers of new customers in nearly real-time. The challenge is that, once again, people with similar names may be processed as false positives or negatives.

What Happens After a Positive PEP Check?

If a PEP check returns a positive result, the company should apply EDD measures to minimize the risk that the person can use the organization’s infrastructure and workflows to launder money acquired illegally—usually from bribes.

Once someone is established as a PEP, the FATF Recommendations outline a series of steps to take.

These include obtaining approval from the financial institution’s senior management—particularly individuals who have clearance to approve AML and CFT policies. The source of the funds being deposited needs to be established, and the business relationship should be monitored.

| non-PEP customers | PEP customers | |

| sign-up and onboarding | Institution conducts standard KYC | Institution conducts KYC + ongoing EDD |

| internal approval | No additional approval needed | Approval from upper management needed |

| source of funds info | Might be needed for higher transactions, which can lead to Suspicious Activity Reports (SAR) | Always needed |

| activity monitoring | Minimal for the sector | Extended |

Partner with SEON to deploy flexible AMLs that will help you comply with AML legislation and dramatically reduce fraud in your business.

Ask an Expert

How Can PEP Screening Help Us Fight Fraud?

Incorporating the identification of PEPs, both when accepting new customers and clients and as part of ongoing anti-money laundering transaction monitoring measures, is a key way for financial institutions to fight fraud and avoid hefty AML fines while helping keep the overall economy healthy.

According to PwC, 5% of global GDP is lost to corruption each year. Enhanced due diligence in relation to PEPs can identify instances of corruption and bribery, money laundering and more, fighting against this global problem.

How SEON Does PEP Screening

SEON’s fraud detection platform is a powerful tool for compliance teams to streamline PEP screening and ensure full AML compliance. By providing access to a continuously updated portfolio of PEP lists, sanctions lists and watchlists, SEON automates the flagging of potential risks during the KYC and EDD process, simplifying manual reviews.

Leveraging real-time digital footprint analysis and device intelligence, SEON creates detailed profiles of flagged individuals, helping compliance teams assess whether a match is legitimate. SEON integrates seamlessly into existing workflows, offering comprehensive compliance support from onboarding to ongoing monitoring.

By combining real-time behavioral monitoring, advanced digital footprint analysis and AI-driven fraud prevention, SEON helps organizations mitigate risks, reduce false positives, and maintain compliance without compromising customer experience.

FAQ

To check if someone is a PEP, you can manually enter their name on politically exposed persons lists found on official websites. You can also look at open-source or commercial databases or even monitor media sources. However, most online businesses rely on AML software to automatically aggregate PEP list data for them.

You are allowed to run a PEP check manually by searching for information about a person on official government PEP lists. You can also rely on AML software to automatically scan for that person’s name on dozens of aggregated databases.

PEP checks are crucial to ensure compliance with AML (anti-money laundering) and CTF (counter-terrorism financing). Failing to perform these checks when dealing with politically exposed persons could incur fines, legal battles, and reputational damage for a business.

Sources

- Financial Conduct Authority: FCA fines Gatehouse Bank £1.5m for poor anti-money laundering checks

- Global Trade Review: Share price and reputational damage: banks count cost of AML failings

- PWC: Five forces that will reshape the global landscape of anti-bribery and anti-corruption