What Is KYC (Know Your Customer)?

KYC stands for Know Your Customer (or Client). It is used by financial, fintech, banking, online lending and other organizations to verify the identity of their customers, for a wide array of reasons.

The term KYC is also used to refer to the specific laws and standards introduced by authorities to describe how companies ought to verify client and customer identity when their activities could constitute risks linked to money laundering, bribery and other illegal or unlawful activity.

KYC is closely linked to the due diligence principle and requirements for each sector, as KYC checks are the practical means through which banks, insurers, online casinos, creditors and others not only know but can also prove they have conducted the checks law or industry standards require them to.

What’s the Point of KYC Checks?

KYC protocols ensure that a business has taken all reasonable steps to verify that a new customer:

- is who they claim to be

- is eligible to receive their services

- is not a money-laundering, bribery or corruption risk

Money laundering is a major issue in an increasingly globalized world, with almost 5% of global GDP laundered each year, per United Nations Office on Drugs and Crime (UNODC) estimates. That is equivalent to $2-4 trillion annually. This is a major concern for stakeholders, including the UN, governments, as well as companies who can lose revenue or be fined for not following KYC regulations and legislation.

Moreover, individual companies want to know they provide their services to trustworthy individuals, while this also helps adjust and adapt their offering to suit their clientele.

Partner with SEON to reduce fraud rates in your business with real-time digital footprinting, custom rules and machine learning

Speak with an Expert

Who Uses KYC?

There are certain sectors of the economy that are mandated by law to use KYC processes. These include, depending on the country and local laws:

- bank institutions and building societies

- lenders, including credit unions

- fintech firms

- digital wallets

- crypto exchanges and wallets

- BNPL services

- iGaming/real money online games & betting

- investment firms

- real estate agents

- telecommunications e.g. mobile networks

The primary reason for this is anti money laundering and the prevention of terrorism funding.

However, the principle of knowing who your customer is can be useful even to merchants and organizations who are not obliged to follow KYC, because it helps ensure your business and customers are better protected against fraud.

By checking users at signup, one can reduce the chances they are bad actors.

What Is a KYC Fraud Check?

For a KYC verification, an organization asks a user or customer for proof of their identity, age and place of residence. Depending on the particulars, they may also have to provide additional evidence, such as business activity or source of funds.

By verifying the identity of an individual about to become their customer or client, businesses can ascertain the customer is who they say, and a business relationship with them is not a legal liability.

How Does KYC Work?

In general terms, the steps are as follows:

- A business consults the legislation and standards and puts in place KYC processes to use when onboarding customers – and sometimes at frequent intervals.

- From there, the system may ask a new customer for:

- Proof of their identity: passport, driver’s license, ID card…

- Proof of their age: passport, ID card, certificate of birth…

- Proof of address/location: utility bill, lease, official correspondence…

- Verification of the above: video call, “selfie”, video recording…

- Proof of their business activity and/or employment

- The system authenticates the documents if they are satisfactory, and completes the onboarding process.

What Are the Types of KYC?

Types of KYC available generally depend on the methods and strategy employed:

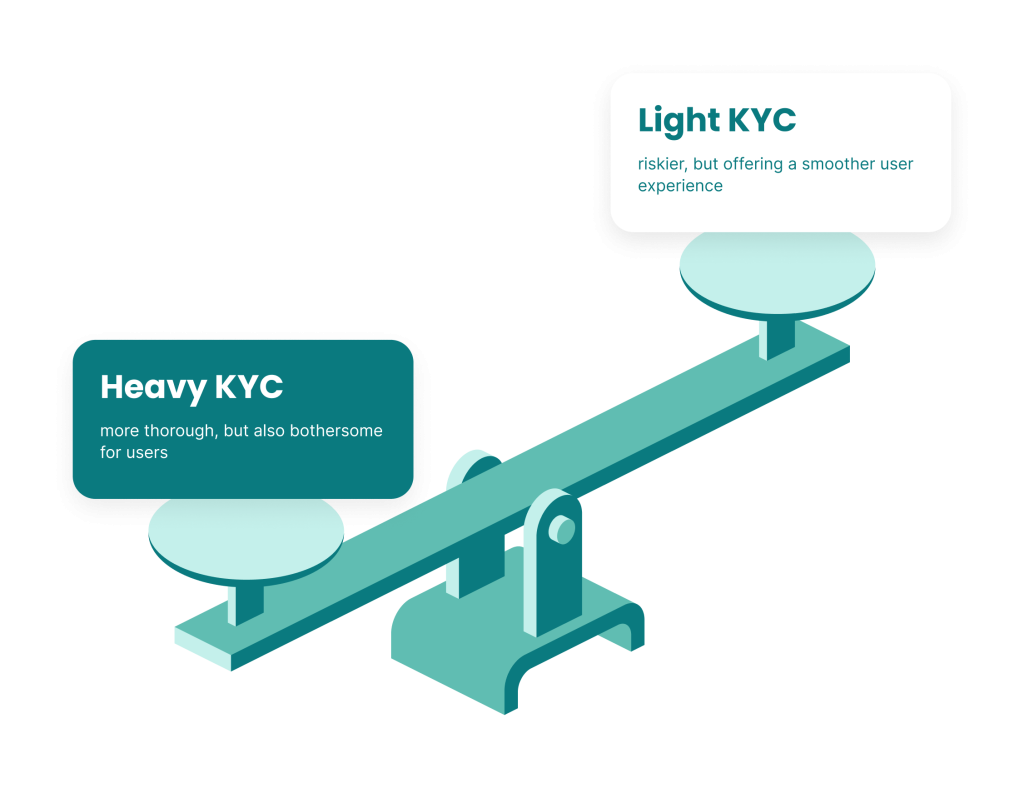

- Light KYC is less intrusive for the customer, and less time-consuming.

- Heavy KYC requires the customer to take extra steps but is more effective.

Beyond this, KYC is categorized based on what it asks for:

- Paper-based KYC asks the customers for hard copies of physical documents.

- Video KYC has customers record video or connect via video.

- Digital KYC allows for digital copies of official proof of identification.

- Social KYC utilizes a customer’s social media footprint for social media profiling.

- Central KYC relies on a central repository of KYC records – e.g. a government database.

- Offline KYC is sometimes used as a synonym of paper KYC but in fact refers to any method that does not need access to a central database.

Is Light or Heavy KYC Better?

Light or heavy KYC? The best type of KYC for a certain company, customer account or type of business relationship depends on the risks involved in the activity and service provided – and also adapts from customer to customer.

A business that uses KYC to abide by its own internal code of ethics does not have as much to lose by letting a liability slip through the cracks as one who will be fined or shut down if found to not do due diligence.

However, sophisticated KYC software tools for fraud prevention and other purposes are not just configured based on the organization that will deploy them.

They are flexible and adaptable, gauging each customer’s risk rating via digital footprint analysis and other factors and triggering the appropriate KYC scenarios that correspond to light or heavy KYC.

Learn where the real costs of KYC are hidden, and how to minimize them while staying compliant.

Find a Better Way

What’s the Difference Between KYC and CDD?

Know your customer (KYC) checks are used when onboarding a new customer, right before starting a new relationship, while Customer Due Diligence (CDD) checks are ongoing and also verify the source of funds exchanged.

| KYC protocols | CDD protocols | |

| When? | Customer or client onboarding | At onboarding & regular intervals throughout the relationship |

| What? | Name, age, address verification (at a minimum) | Name, age, address verification & source of funds (or more) |

| How? | Various digital and/or offline means | Various digital and/or offline means |

| Who? | All organizations obliged by law or by certification standards to know the name, age and/or address of their customers/clients | Finance and fintech organizations who need to stay compliant with anti-money laundering, corruption and bribery laws |

However, it is useful to keep in mind that these two terms are sometimes used interchangeably, and recent years have seen the addition of several new factors and methods in both KYC and CDD.

What Is Aadhaar KYC?

Aadhaar KYC, or Aadhaar-based KYC, is a specific to India solution based on data and databases provided and maintained by UIDAI – the Unique Authentication Authority of the country.

Aadhaar KYC makes use of unique, 12-digit identity numbers that can be obtained by India’s citizens and residents. It comes with an Aadhaar Card, which is considered a proof of identification document.

For businesses with activities in India, there are several government-endorsed ways to conduct KYC verification using Aadhaar – from digital KYC to offline and central (using a central repository of KYC records). However, only those who serve customers in India can benefit from these protocols.

How Is KYC Used in Fraud Detection?

Transforming legislation, technology, expectations as well as the fraud landscape has resulted in more companies than ever implementing KYC procedures.

Increasingly complex and sophisticated fraud detection uses data points gathered from social media profiling, IP tracking, data enrichment and risk assessment principles to initially gauge the risk profile of a customer and then implement personalized KYC that corresponds to how statistically likely it is for a customer to pose a risk.

This might entail asking customer A to provide more documentation than customer B, or a combination of other requests.

You can try out SEON’s social media and web platform profiling tool below.

Check your IP fraud score here:

If looking up a phone number, please include its country code without plus signs, spaces or hyphens. By trying this tool, you’re agreeing to our Privacy Policy, General Terms of Service and Data Processing Agreement.

Efficient KYC mitigates a series of different types of risks for a company, including legal, reputational, profitability, and even customer satisfaction. Importantly, knowing your customer means you can weed out (or simply shut out) many of those looking to commit fraud against the company or its customers and partners.

KYC and anti-money laundering platforms and tools at large are increasingly appreciated as well as required worldwide. In fact, Statista reports a market size of $1.77bn, with North America being the largest regional market in the sector, with 31.31% in 2017, expected to be slightly reduced by 2023 due to projected growth in Asia-Pacific.

The Biggest Challenges of KYC

The biggest challenge for companies who do KYC is the way it affects the customer relationship, as the latter prefer quick signup and are mindful of their privacy.

Companies have to solve the conundrum of finding just the right balance between asking every new customer to go through the motions that will lead to authenticating their identity and ensuring minimal friction, high customer satisfaction, and a positive brand image.

Because they require someone to gather documents, share videos or pictures and even take phone calls, KYC processes are largely unpleasant for customers who lack the time or patience to complete them, while they can also inspire privacy and security concerns.

Moreover, customers tend to remember what they had to do to join competitors or sign up for services in related sectors, and this comparison will inform their opinion about a brand.

It is telling that according to a 2019 survey, customers tend to abandon applications that take too long to complete, with it listed as their second biggest sign-up pain point at 28%, after the amount of information required (31%).

In fact, 40% of users will abandon an onboarding process after just 10 minutes – and a whopping 86% will abandon anything that takes over half an hour. Yet, estimates show that 29% of applications in financial services take more than 20 minutes to complete. Admittedly, the KYC process can make or break a company.

A solution to this that does not sacrifice security and compliance involves adaptable KYC triggers based on customer digital footprint analysis. Different customer profiles will be asked to follow different KYC procedures, ultimately providing bespoke protection for the company.

Sources

- Unique Authentication Authority of India: Get Aadhaar

- Statista: Anti-money laundering software market share worldwide in 2017 and 2023, by region

United Nations Office on Drugs and Crime: UNODC estimates that criminals may have laundered US$ 1.6 trillion in 2009 - Europol: Crime Area: Money Laundering

- The Paypers: FIs have 14 minutes and 20 seconds to onboard customers, Signicat finds