Global online payment fraud is set to exceed $343 billion in the short timespan from 2023 to 2027. In an era where digital transitions are omnipresent, the menace of online fraud and money laundering is continuously escalating, necessitating advanced solutions that enable organizations to stay ahead and mitigate activities across diverse industries.

As an umbrella term, fraud risk management encompasses the systematic processes of identifying, assessing and responding to an organization’s fraud risk. Management often involves the tools and solutions deployed to detect, prevent and reduce fraudulent activities, a prerequisite amplified by today’s digital-heavy landscape – where businesses are continually challenged to safeguard their operations, reputation and stakeholders against nefarious online activities.

Understanding Fraud Risk Management

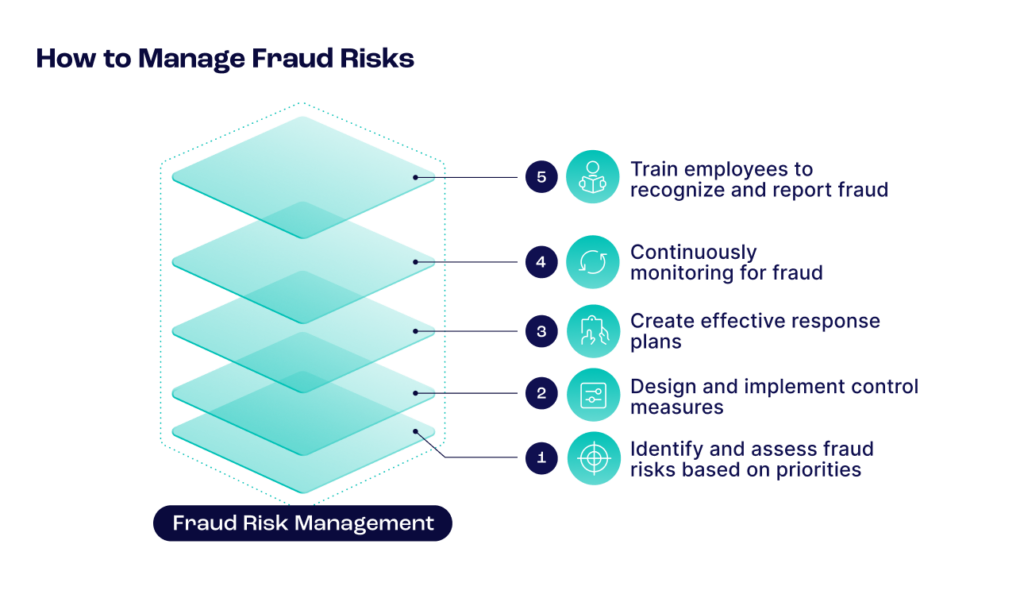

Management is predicated upon a multifaceted approach that includes identifying fraud risks unique to the organization, assessing risks to prioritize them based on their potential impact, designing and implementing robust control measures, continuously monitoring to prevent and detect fraud with advanced analytical tools and responding effectively to fraudulent incidents.

Additionally, fraud and risk management involves training employees to recognize and report fraud and continuously updating and improving practices to adapt to evolving threats.

In the digital age, leveraging technology in fraud risk management is beneficial and essential in protecting an organization to ensure its long-term viability and success. By enhancing the ability to detect and prevent fraud more efficiently and effectively, technology emerges as indispensable, enabling organizations to navigate the increasing velocity and volume of fraud adeptly.

How Does Fraud Risk Management Work?

Managing fraud risk today is marked by transitioning from a detection-centric to a prevention-focused fraud management strategy. Modern fraud risk management systems aim to proactively identify and thwart fraudulent activities before they occur or at the earliest juncture possible, ensuring the integrity of transactions without hindering the user experience – an approach that aligns with the growing expectations for seamless and secure digital transactions.

Advanced technologies, including artificial intelligence (AI), blackbox and whitebox machine learning (ML), digital footprinting and device intelligence, collectively transform the real-time fraud detection and prevention paradigm. These innovations enhance the speed and precision organizations can adeptly intercept and stop fraud without impeding legitimate transactions. As the fraud landscape evolves, so must risk management solutions, stepping up agility and innovation to stay ahead of digital fraud.

Monitor transactions to stop fraudsters from using fast payment systems to launder money and hide suspicious activity.

Read Key Takeaways

Adapting to Regulatory Changes and Global Shifts

Fraud and anti-money laundering (AML) initiatives continually evolve under the influence of global events and regulatory changes. In light of recent geopolitical developments, such as international conflicts, there is an increased emphasis on broadening AML measures beyond traditional financial institutions to encompass a more comprehensive array of sectors.

This broadening of scope is a testament to the increasing recognition of financial crimes as economic threats and national and global security issues. Organizations must evolve their compliance strategies, ensuring they are comprehensive, flexible and aligned with the latest regulatory standards. This includes adhering to the current mandates, anticipating future changes and preparing for various scenarios to maintain compliance and operational integrity. As regulations become more stringent and encompassing, integrating sophisticated technologies in compliance processes – like AML transaction monitoring and AML case management – provides the necessary insight to navigate more effectively.

As the emergence of real-time digital payments drives the increase in fraud volume and speed, it is critical to monitor transactions to prevent fraudsters from exploiting the immediate nature of today’s payment systems to launder money, conceal activities and avoid detection.

Five Steps to Implement a Fraud Risk Management Strategy

Here’s a structured approach to developing and enhancing a fraud risk management program in five steps:

- Fraud Risk Assessment: Conduct a thorough evaluation to pinpoint potential fraud risks, including internal and external threats. For each risk, assess the probability and likely severity, then align the identified risks with the organization’s appetite for risk, classifying them in order of priority.

- Fraud Risk Governance: Develop a comprehensive fraud risk management framework, detailing policies, procedures and responsibilities, delineating internal controls and segregation of duties to diminish fraud risk. Engage senior leadership in the governance and oversight of fraud risk management efforts.

- Fraud Prevention and Detection: Design and implement fraud prevention and detection measures like the continuous monitoring of transactions and advanced analytics for anomaly detection. Regularly evaluate the effectiveness and refine efforts as necessary to keep pace with the evolving fraud landscape.

- Monitoring and Reporting: Establish a routine for ensuring that the fraud management program remains effective and responsive to new challenges and evolve procedures for reporting and managing suspected fraud incidents with swift and appropriate actions.

- Continuous Enhancement: Fraud risk management is a dynamic process. Regularly review the program’s performance, soliciting stakeholder feedback to identify improvement areas, and stay abreast of emerging fraud trends and advancements in fraud prevention and detection technology to maintain resilience against evolving threats.

Simplify workflows, enhance collaboration, and accelerate reporting with our AI-powered case management solution. Tackle alerts faster and improve efficiency with no hidden costs or user limits.

AML Case Management Software

Embracing the Future of Managing Fraud Risk

The conversation around technology’s role in fraud risk management is not just about combating fraud; it’s about shaping a secure, resilient and trustworthy digital environment. As the digital ecosystem changes, the significance of technology in detecting, preventing and responding to online fraud becomes ever more crucial. Organizations that leverage these technological advancements position themselves at the forefront of fraud risk management, equipped to navigate the complexities of the digital age with confidence and strategic foresight.

Frequently Asked Questions:

Fraud risk management refers to the structured process of identifying, assessing, and mitigating the risk of fraud within an organization. It involves using advanced tools and technologies to detect and prevent fraudulent activities across operations.

Investing in solutions like SEON that leverage advanced technologies to enhance fraud detection and prevention capabilities provides a seamless way to stay ahead of fraudsters’ changing tactics and methods, stay updated on global regulatory changes and adapt compliance strategies accordingly.

As online fraud and money laundering escalate, fraud risk management helps organizations protect their assets, reputation, and stakeholders. It ensures resilience against cyber threats and enables compliance with evolving global regulations.

Technology plays a pivotal role in enhancing fraud risk management by providing sophisticated tools for real-time detection and prevention of fraudulent activities, including AI, machine learning, digital footprinting and device intelligence to enable organizations to swiftly identify and thwart potential fraud, ensuring transaction integrity and maintaining a secure digital environment for both the organization and its users.

An effective fraud risk management program combines risk assessment, strong controls, advanced detection tech, continuous monitoring, employee training, and adaptability to evolving threats, creating a resilient, proactive defense against fraud.

Sources: