Money laundering exists to do one thing: to disguise dirty money as clean. But in doing so, it quietly erodes trust in the global financial system. For regulated institutions, the sheer complexity of laundering schemes makes it notoriously difficult to detect, investigate and report.

To stay ahead, financial organizations and other regulated entities rely on anti-money laundering (AML) measures like customer and payment screening, transaction monitoring and real-time tracking to do more than strictly comply — they are essential to identifying and stopping everything from organized crime to terrorist financing.

By the end of last year, AML and sanctions-related fines topped $45.7 billion since the start of the 21st century. Regulated entities are responding with real-time AML case management systems that streamline investigations, improve efficiency, and make compliance a proactive defense against financial crime.

What is AML Case Management?

AML case management offers regulated organizations a structured, real-time approach to identifying, investigating, and reporting suspicious activities directly to regulatory bodies like FinCEN. By centralizing alerts and customer data, modern systems help compliance teams move away from outdated manual processes and spreadsheet-driven tasks, enabling analysts to focus more efficiently on critical compliance matters. The shift to intuitive, user-friendly interfaces marks a key improvement in compliance operations, significantly reducing manual workload and allowing teams to concentrate on high-risk cases with greater strategic focus.

How Does an AML Case Management System Work?

SEON’s AML case management software centralizes all relevant customer information, linking alerts, transactions and risk profiles within one unified platform. Utilizing real-time digital footprint analysis, device intelligence and precise fraud signals, SEON enables informed risk decisions that give analysts the insight to close out alerts and cases faster.

Compliance teams can efficiently detect suspicious behaviors through a transparent and customizable alert dashboard, managing investigations collaboratively with built-in notes and tailored checklists.

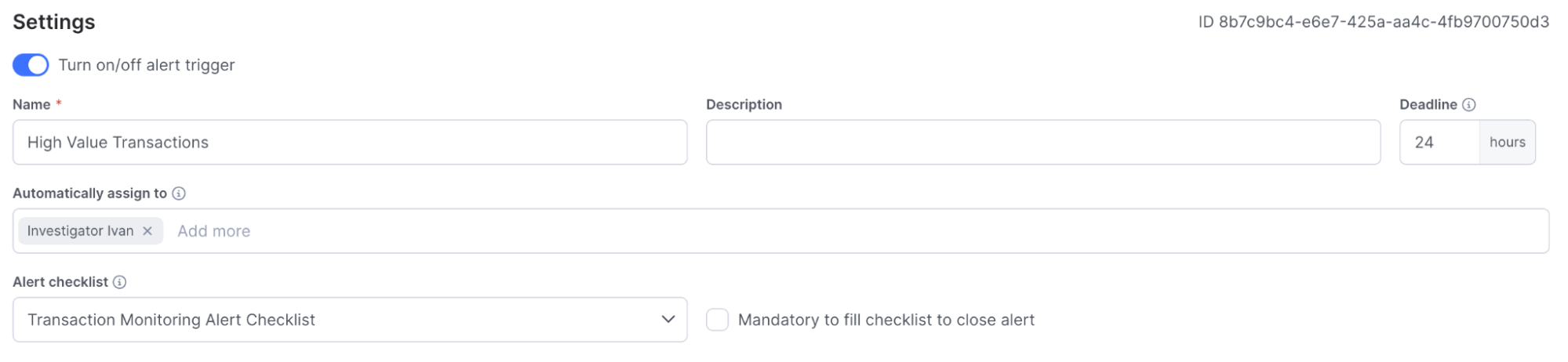

Alerts can be assigned directly to analysts with specific skill sets or automatically balanced across team members, ensuring timely reviews and reducing alert fatigue.

Moreover, SEON’s highly granular, no-code rule capabilities allow precise detection and easy adjustment of thresholds, risk signals and alert triggers, significantly reducing false positives.

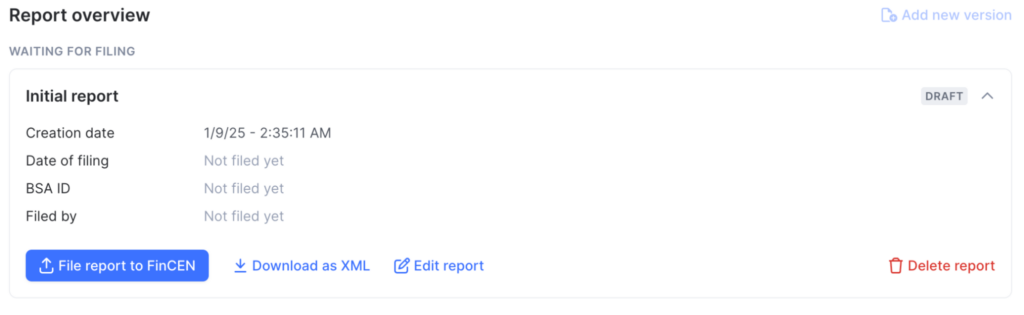

When regulatory reporting is required, SEON simplifies the process by auto-populating SARs, CTRs, and Form 8300, ensuring direct, timely filing with authorities like FinCEN, thus eliminating manual data entry and minimizing compliance risks.

Streamline alerts, investigations, and workflows with SEON’s AML tools for faster case resolution and SAR filings.

Explore the Software

Defining an Efficient AML Case Management Solution

An efficient AML case management software combines real-time, direct-to-source data with advanced technological innovation, uniting AML and fraud detection and prevention within one solution – often under the beloved or polarizing ‘FRAML’ moniker. With fraud and compliance data in one place, teams can connect the dots faster to quickly unveil potential risks and patterns that might otherwise remain obscured.

Integrating transparent artificial intelligence (AI), along with device intelligence, digital footprint analysis and customizable machine learning algorithms, not only identifies irregularities but also provides transparent rationales based on rules triggered behind the generated alerts to demystify decision-making processes, allowing analysts to understand and trust the AI’s recommendations, transitioning from cumbersome, manual processes to streamlined, intelligent systems.

Case management systems should also incorporate intuitive workflow optimization. For instance, when creating an alert trigger, analysts can assign alerts directly to individuals with the appropriate skill sets, ensuring immediate expert review. If an alert isn’t explicitly assigned, the system intelligently auto-assigns it to the analyst with the fewest active alerts, maintaining balanced workloads.

These workflow enhancements, alongside other features like pre-populated SARs, CTRs and Form 8300s, detailed investigative insights, generative AI-driven SAR narratives and direct one-click filing with FinCEN, ensure both efficiency and rigorous regulatory compliance.

What is AML Compliance?

AML compliance is the framework that enables regulated entities to detect, prevent and report financial crimes. At its core, AML compliance includes four critical components: AML screening, ongoing monitoring, payment screening and transaction monitoring. Together, these functions form a comprehensive defense against illicit financial activities.

AML screening begins with Customer Due Diligence (CDD), where essential customer information — full names, addresses, dates of birth and government-issued identifiers — is collected and verified. This data is then used to screen individuals against sanctions lists, politically exposed persons (PEPs) and other high-risk designations. Enhanced Due Diligence (EDD) adds further layers to surface hidden compliance risks, including in-depth background checks and adverse media monitoring.

However, screening is just the start. Robust AML compliance also demands ongoing monitoring of behavior and transactions, watchlist screening, and tracking risk changes. Case management ties it all together, enabling teams to investigate, document, and report suspicious activity.

Digging Deeper: AML Compliance Screening and Monitoring

AML compliance screening goes beyond initial identity verification into a risk assessment process. Customers are screened against risk indicators, including PEPs, Relatives and Close Associates (RCAs), sanctions lists and criminal watchlists. Adverse media screening supplements these checks by surfacing negative information from news reports, regulatory disclosures and public records. These insights help compliance teams assess reputational risk and potential ties to financial crime.

But screening can’t stop after a customer signs up. Ongoing monitoring is essential, ensuring institutions remain alert to any shifts in risk over time. As part of regular compliance programs, customers must be rescreened periodically to account for changes in their status or affiliations. Geographic movement, evolving ownership structures and suspicious financial behavior can all trigger the need for review. Automated tools help flag anomalies in real time, while robust case management systems give teams the structure to investigate, escalate, and resolve issues — all while maintaining a clear audit trail for regulators.

Transaction Monitoring & Payment Screening

Transaction monitoring isn’t just a compliance checkbox; it’s a proactive defense against financial crime. Regulated entities aim to uncover activities that deviate from what’s considered normal or lawful by continuously tracking transaction size, frequency and behavioral patterns. When suspicious activity surfaces and alerts are triggered within a case management system, deeper investigation is required.

Payment screening complements this effort, proactively checking transactions against sanctions lists, crime watchlists and high-risk individuals. If anything raises red flags, compliance teams can quickly escalate these alerts to cases, gather additional evidence and file regulatory reports with authorities like FinCEN, Fintrac, NCA or goAML. Regulated entities must keep AML records — including client identities, account files and monitoring findings — for at least five years to support future investigations.

AML Case Management Workflow Challenges Solved

AML case management transforms how regulated entities investigate potentially illicit activities, providing a streamlined, efficient workflow from the beginning to the end of an investigation. This enables analysts to enhance the speed and accuracy with which they respond to suspicious activities, facilitating a quicker close or escalation of cases. These systems foster enhanced productivity by managing lengthy investigations within a unified fraud and AML platform, allowing teams across organizational structures to create effective, collaborative workflows.

Centralizing data and automating the aggregation, information sharing and analysis processes, AML case management significantly reduces the time and resources previously devoted to manual tasks – speeding up investigative processes while minimizing human error. By breaking from traditional fragmented approaches, AML case management supports a holistic and adaptable strategy for financial institutions, modern fintechs and other regulated organizations to swiftly adapt to new threats and regulatory changes while maintaining the highest standards of integrity and accountability – safeguarding their interests, those of their clients and the broader economic ecosystem against the detrimental impacts of money laundering.

Uncover how case management propels efficiency in powering a comprehensive AML and anti-fraud strategy.

Speak with an Expert

Frequently Asked Questions

Measuring the effectiveness of AML case management involves assessing its ability to streamline processes, enhance risk detection and ensure regulatory compliance. Key indicators include the speed of case resolution, reduction in false positives and the accuracy of suspicious activity reporting. Additionally, measuring user satisfaction with the system’s usability and efficiency provides insights into its effectiveness in optimizing workflow and resource utilization.

AML case management software supports compliance by centralizing investigations, automating alert handling and to assist with timely regulatory reporting. It uses real-time data and AI analytics to enhance accuracy and reduce false positives, helping regulated organizations streamline compliance operations, maintain clear audit trails and meet AML requirements effectively.

An AML case management system is a comprehensive solution financial institutions and regulated industries use to track, investigate and report suspicious activities related to money laundering and other financial crimes. It provides a structured approach for managing the lifecycle of cases, from initial alert through escalation or resolution, enabling efficient allocation of resources and ensuring compliance with regulatory requirements. Modern systems

integrate real-time data, advanced analytics and artificial intelligence (AI) to streamline processes, enhance risk detection and improve operational efficiency.

Sources: