By the end of 2025, financial institutions worldwide are expected to invest $33.9 billion in anti-money laundering (AML) systems. Banks alone account for nearly 64% of that spend, reflecting their increased exposure to financial crime.

Without an effective AML system in place, banks risk becoming conduits for criminal activity, leading to multi-million-dollar fines, loss of licenses and reputational damage.

In this guide, we’ll explain what AML in banking means, why it matters and how to build a strong compliance framework.

Key Takeaways

- Understand what AML in banking means and how a money laundering scheme plays out.

- Recognize who regulates AML compliance globally and how their standards shape internal processes in banking.

- Learn how to build an effective AML compliance program, covering essential elements such as risk assessments, AML screening, customer due diligence (CDD), transaction monitoring, record keeping and employee training.

- Discover how AML tools like SEON enhance compliance by automating monitoring, enriching customer data through digital footprint analysis and providing real-time alerts.

What is AML in Banking?

Anti-money laundering (AML) in banking refers to the laws, regulations and internal controls that help detect and report the movement of illicit funds. Strong AML frameworks ensure that financial systems are not exploited for criminal or terrorist activities.

Money laundering itself involves disguising illegally obtained money by moving it through layers of transactions and legitimate financial channels. Once integrated back into the economy, these “cleaned” funds can be used freely, making their criminal origins difficult to trace.

Banks must adhere to regulations and frameworks that set global and national standards for AML compliance. These include the Financial Action Task Force (FATF) Recommendations, the EU’s Anti-Money Laundering Directives (AMLDs) and the USA’s Bank Secrecy Act (BSA) and the USA PATRIOT Act.

How Does Money Laundering Happen in Banking?

During a money laundering operation, a criminal moves illicit funds through the financial system in three steps:

- Placement: At this stage, the goal is to convert the dirty money into legitimate assets. This is often the riskiest phase, as it involves moving large amounts of money (usually cash) into circulation where the origin can be easily traced. Detecting and disrupting placement often relies on strict cash-handling controls, teller training and transaction monitoring.

- Layering: Layering introduces distance and complexity between the final recipient and the source. Criminals do this by routing money through multiple accounts and jurisdictions, often using shell companies, brokers, correspondent banks or cryptocurrency exchanges. They may use multiple wire transfers, currency conversions and rapid buy-and-sell orders.

- Integration: Once the paper trail is messy enough, the launderer brings the money back into the economy as seemingly lawful wealth. Common integration moves include buying real estate, luxury goods and vehicles or making investments in legitimate businesses. Integration is often the least risky step for the launderer because at this stage, the money already looks “clean”.

Who Regulates the AML in Banking?

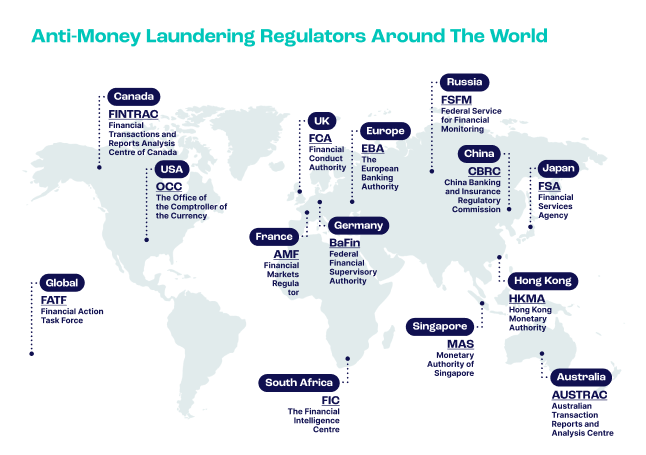

AML in banking is regulated by a large number of organizations worldwide:

- The FATF sets international AML/CTF standards and monitors global implementation.

- In the US, the BSA was the first major federal law targeting money laundering through banks. Oversight is carried out by the Financial Crimes Enforcement Network (FinCEN) under the US Treasury.

- In the European Union, the European Banking Authority (EBA) enforces the AMLDs.

- Other national regulators and frameworks exist globally, such as the Financial Conduct Authority (FCA) in the UK, Singapore’s Monetary Authority of Singapore (MAS) and the Swiss Financial Market Supervisory Authority (FINMA).

These regulatory bodies oversee the global application of AML measures, including customer due diligence (CDD), ongoing transaction monitoring and suspicious activity reporting (SAR).

How Do AML Policies Affect Financial Institutions?

Although financial institutions are all legally obligated to follow AML regulations, many of them believe that implementing policies is costly, time-consuming and ineffective, especially as the requirements change constantly. However, audits and AML-related fines have been increasing significantly in recent years, and it’s not merely penalties organizations have to consider: non-compliance can also damage their reputation and eventually result in the loss of customers.

Banks and other financial institutions are required to follow strict procedures to detect and prevent money laundering. In the US, compliance falls under the Bank Secrecy Act (BSA), which mandates that institutions implement robust BSA AML monitoring programs to detect and flag suspicious activity early. Globally, organizations also follow standards set by bodies such as the Financial Action Task Force (FATF) and the European Banking Authority (EBA), which enforces the EU’s Anti-Money Laundering Directives (AMLDs).

Employees play a central role in compliance, requiring regular training to identify and report suspicious customer behavior. Institutions must also maintain comprehensive records of transactions and internal processes to support investigations and meet regulatory requirements.

The Importance of AML in Banking

The scale of money laundering is hard to gauge. According to UN estimates, it reaches 2–5% of the world’s entire GDP each year. In 2025, that equates to roughly $800 billion to $2 trillion moving through the financial system illicitly.

But why is it a problem for banks? On an organizational scale, failing to control that flow of dirty money into your system could:

- Incur hefty compliance fines: Failing to meet AML regulations will be extremely costly for your financial institution.

- Damage your business reputation: You may face a PR disaster if your bank or neobank is found to be helping terrorists or criminals.

- Incentivize crime: An indirect consequence of allowing money laundering to take place is the fact you’re giving criminals figurative permission to continue with their illegal activities – if not emboldening them to use your organization for these schemes.

- Help finance terrorism: A key goal of AML is to reduce terrorist financing. Terrorist organizations rely on money to sustain themselves, but accessing that money can be challenging, especially for large, cross-border amounts. Money coming from both legitimate and criminal sources funds terrorism worldwide.

Understand how financial institutions spot and manage suspicious activity effectively.

Read more

How to Remain Compliant with AML in Banking

An effective AML compliance program is essential for any bank wishing to manage risks related to money laundering and keep regulators happy. There are several elements to remaining compliant with banking AML obligations:

1. Appointing an AML Compliance Officer

An AML compliance officer will be able to oversee your compliance program. This should be a senior team member who understands the compliance landscape, the risks associated with money laundering and the company’s compliance obligations. They should also liaise with regulators and other financial authorities when required.

2. Risk Assessments

During a risk assessment, banks pinpoint where they are most vulnerable to financial crime. This will serve as a foundation for the AML strategy initially, but it shouldn’t be treated as a one-time exercise. Instead, financial institutions must make it a priority to continuously monitor user behavior, transactions and the businesses they work with (including their beneficial owners).

3. AML Screening

During AML screening, customers and transactions are checked against global sanctions lists, politically exposed persons (PEP) databases and other watchlists maintained by governments and regulatory bodies. Sanctions lists include individuals, organizations and countries subject to trade restrictions and asset freezes, while watchlists monitor suspicious or high-risk parties. Automated tools like SEON flag watchlist hits in real time, enabling businesses to make faster, more informed decisions and maintain regulatory compliance efficiently.

4. Customer Due Diligence (CDD)

Customer Due Diligence (CDD) is a core compliance practice used by financial institutions, fintechs and other regulated businesses to confirm who their customers are and understand the potential risks they pose.

5. AML Transaction Monitoring

During AML transaction monitoring, customer transactions are evaluated in real time to detect unusual patterns or behaviors that may indicate money laundering or other financial crimes. Financial institutions are required by law to monitor transactions that exceed certain thresholds and flag them for further review.

Tools like SEON automate this process by using customizable rules and risk scoring to identify high-risk activity efficiently. For instance, SEON can flag all transactions over $3,000 as potentially higher risk or apply more granular logic — such as alerting on transactions above that threshold where both the user’s IP address and payment card originate from high-risk regions. Automating transaction monitoring not only improves accuracy and speed but also helps financial institutions stay compliant and reduce operational workload.

How to Boost Your Banking AML with SEON

SEON supports AML efforts in banking by combining screening, behavioral monitoring, and data enrichment to improve how institutions identify and manage risk. Its tools help verify customers against key watchlists such as PEP, sanctions, and criminal databases, ensuring compliance with global standards.

Beyond initial screening, SEON enables continuous monitoring of user behavior to detect unusual activity or transactions that may indicate financial crime. By enriching data through digital footprint analysis — including signals from emails, phone numbers, IPs, and devices — SEON helps financial institutions build a more complete picture of customer risk while maintaining a smooth onboarding experience.

Frequently Asked Questions

AML in banking involves verifying the identity of your banking customers, checking that they do not appear on PEP or sanctions lists, and monitoring transactions over a certain threshold.

AML policies are a set of policies that your bank or neobank must clearly state regarding anti-money-laundering checks. You must write and publish an AML policy statement on your website.

Banking AML checks can be performed with identity verification tools, transaction monitoring tools, and risk rating and alert solutions. Machine learning tools can also help suggest rules that reduce the risk of dealing with money laundering customers.

Sources

- UNODC: Money Laundering

- FATF: The FATF Recommendations

- Juniper Research: Anti-money Laundering Systems Market: 2025-2030

- Compliance Week: Fines against financial institutions hit $10.4B in 2020