Payment Screening

Stop Illicit Payments Before Money Moves

Screen transactions against global sanctions, bank identifiers, and crypto wallets in real time with payment screening software. Catch threats in milliseconds, stay compliant, and protect your business without slowing payments

Trusted by the World’s Most Ambitious Companies

REAL-TIME PROTECTION FOR EVERY PAYMENT

Unauthorized transactions don’t wait — and neither should your payments screening

Traditional payment screening systems struggle to keep up with real-time flows, and lack precision in high-risk scenarios, delaying decision-making and exposing businesses to compliance penalties and risk. SEON’s payment screening enables real-time monitoring, targeted alerts and a unified workflow to detect threats faster and reduce compliance risk.

INSTANT INSIGHTS, LOWER RISK

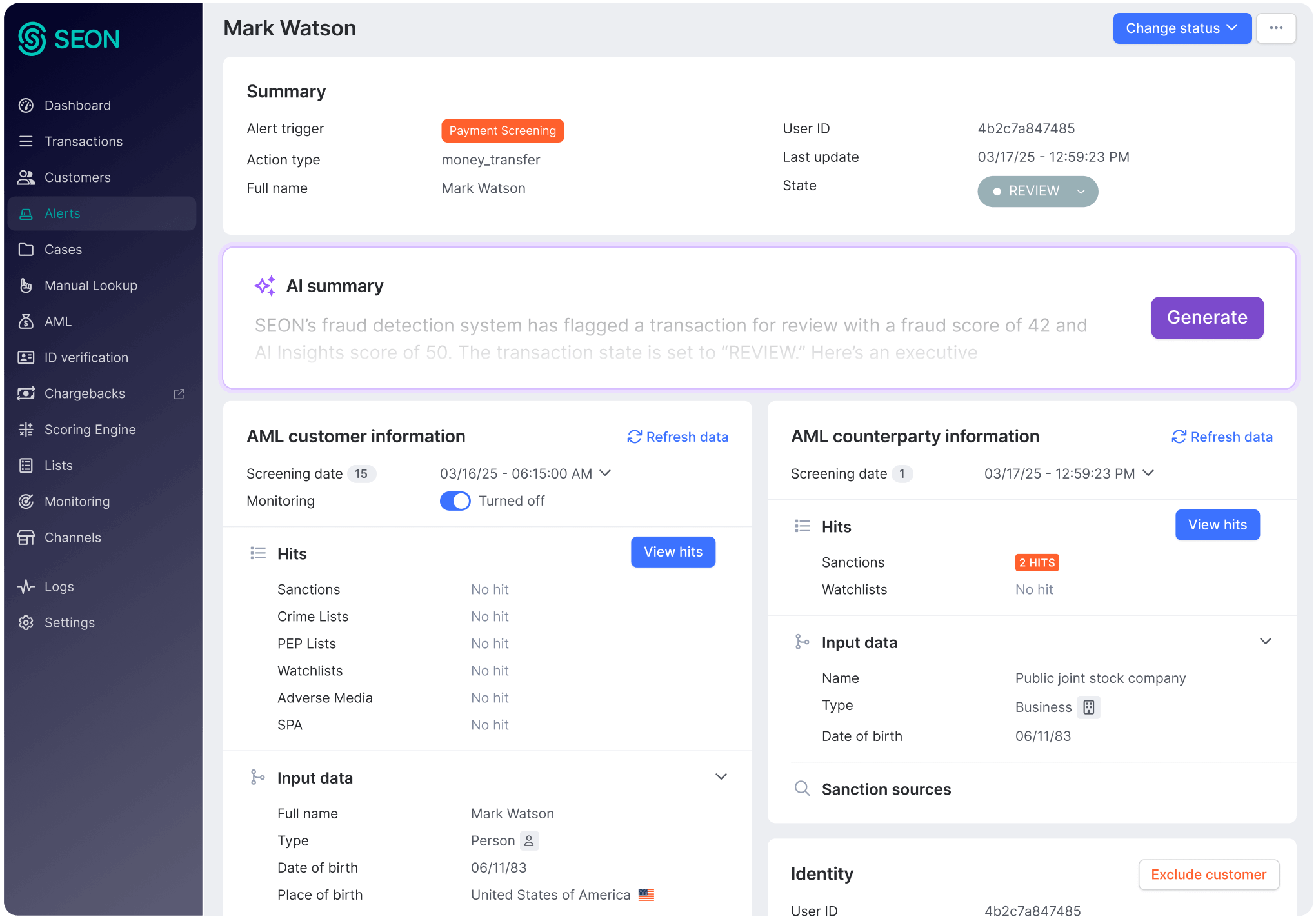

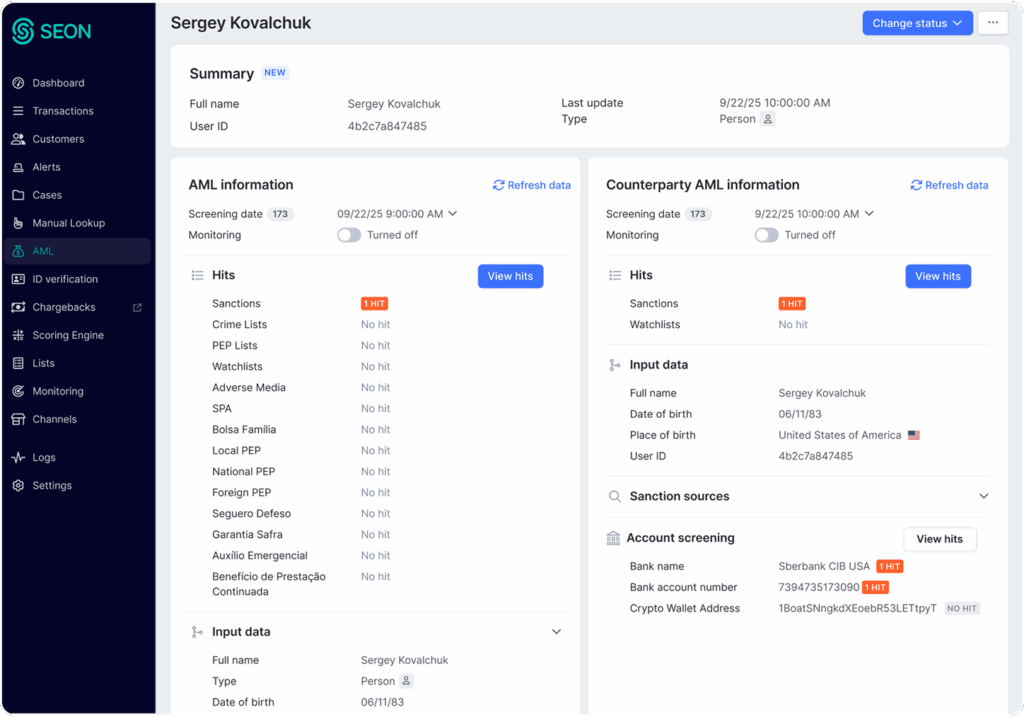

Reduce Compliance Risk With Instant Payment Screening

Screen Transactions in Milliseconds

Validate Global Banking Identifiers & Crypto Wallets

Block High-Risk Transactions with Precision

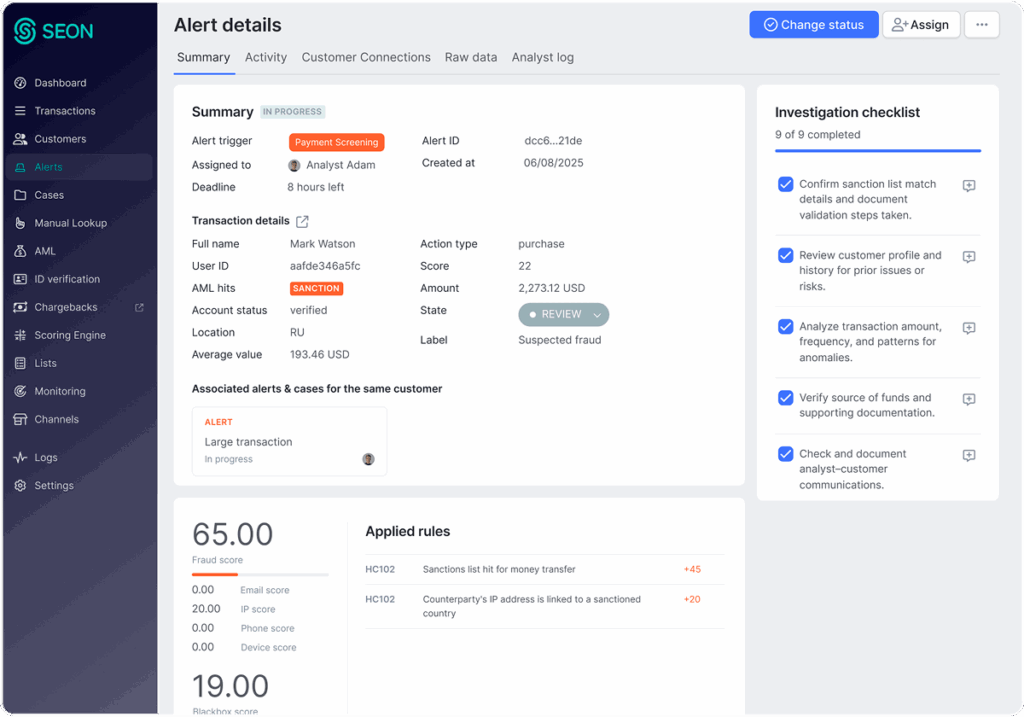

Investigate and Escalate in One Dashboard

Integration

Quickly Integrate Using a Single API

Launch AML screening, transaction monitoring and case management using a single API. All solutions are natively integrated to deliver full compliance functionality in one solution.

Take a Tour of Our Real-Time Solution

Learn More About Payment Screening

-

Discover how high-growth payments companies manage real-time payments through faster decisions, better signals and scalable automation.

-

Discover how top PSPs build baseline and transaction rules to detect fraud in milliseconds and protect digital payment trust.

-

Discover how crypto casinos are transforming gambling, with rapid growth and new global risks.

-

Discover how payment screening works, why it’s vital for AML compliance, and how modern tools help block high-risk transactions in…

-

See how risk and fraud monitoring detects suspicious payments, stops fraud in real time, and reduces losses.

-

Transaction monitoring is an essential process for any crypto exchange.

Payment Screening FAQs

Yes. You can screen both the sender and receiver of every transaction in real time. SEON checks against any list you need before funds are transferred, helping you catch risks regardless of payment direction.

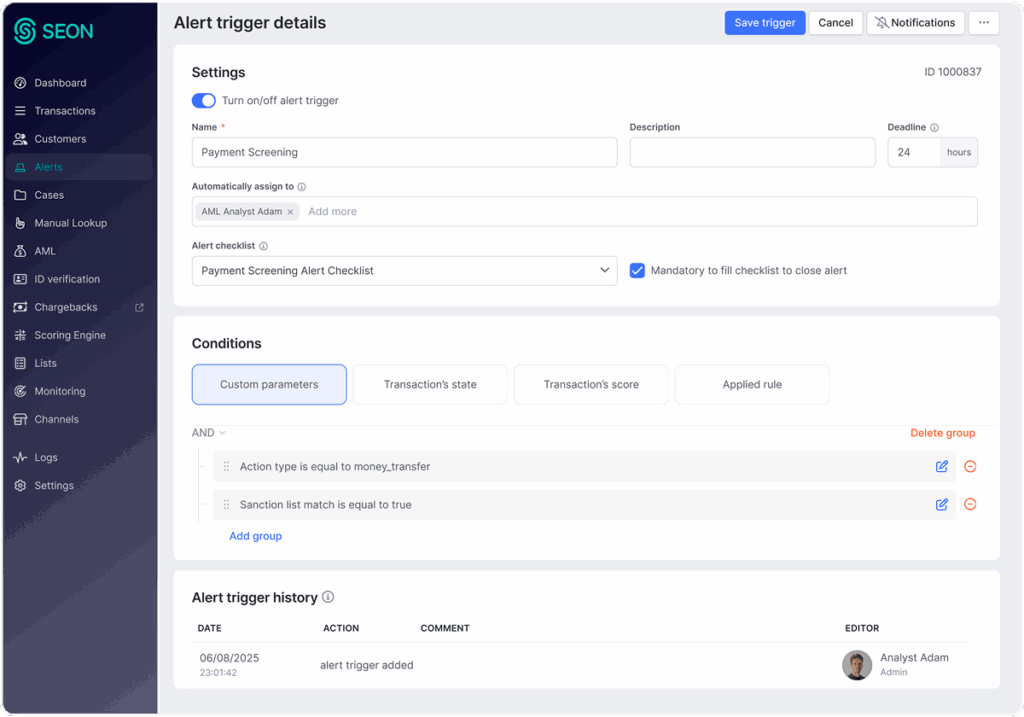

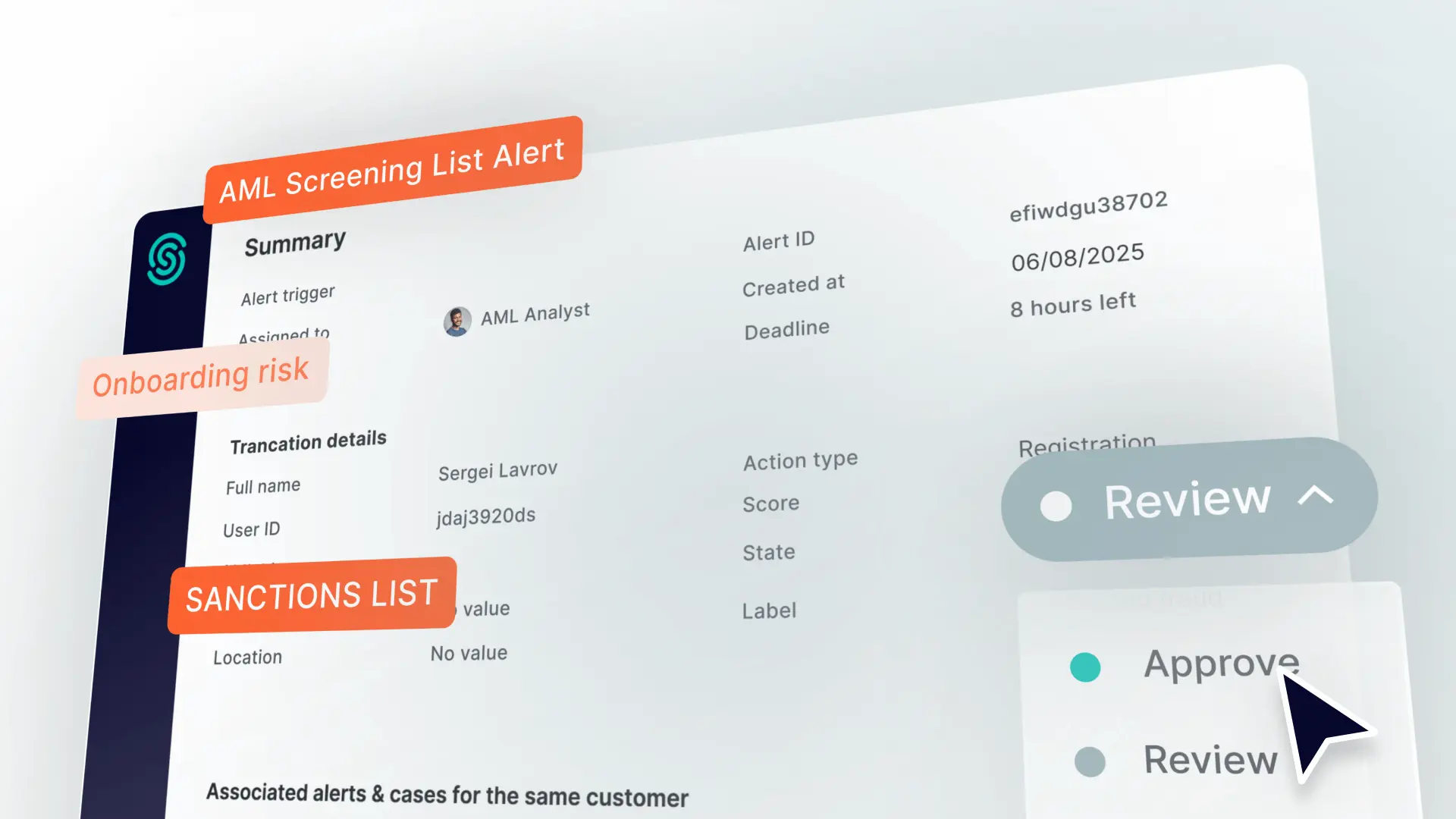

SEON’s alert trigger engine uses granular detection logic, allowing you to fine-tune how matches are flagged. You can select exact lists to screen transactions against and configure fuzzy matching to avoid noise, surfacing only the high-risk transactions that actually need review. You can also read more on how to reduce false positives in AML here.

Yes. SEON’s payment screening supports compliance with FATF guidelines and AML regulations across jurisdictions. It helps meet requirements for identifying high-risk transactions, maintaining audit trails and acting on suspicious activity before settlement.

Yes. Flagged transactions automatically appear as alerts in your dashboard, based on the detection logic and thresholds you configure. You can review context, document decisions, escalate alerts to a case and file regulatory reports all in one place.

Yes. SEON offers a single API that gives you access to 900+ real-time fraud signals, alongside AML data sources, enabling you to assess risk at every stage of the customer journey, from registration monitoring and payment screening to transaction monitoring and regulatory reporting, all without managing multiple tools or integrations.

Stop Risky Payments Before They’re Processed

Act in real time with payment screening that adapts to your workflow, not the other way around.

Trusted by 5,000+ global organizations:

Speak With a Risk Expert

This form may not be visible due to adblockers, or JavaScript not being enabled.