Fraud Prevention

Fraud Prevention Software to Protect Your Business Growth

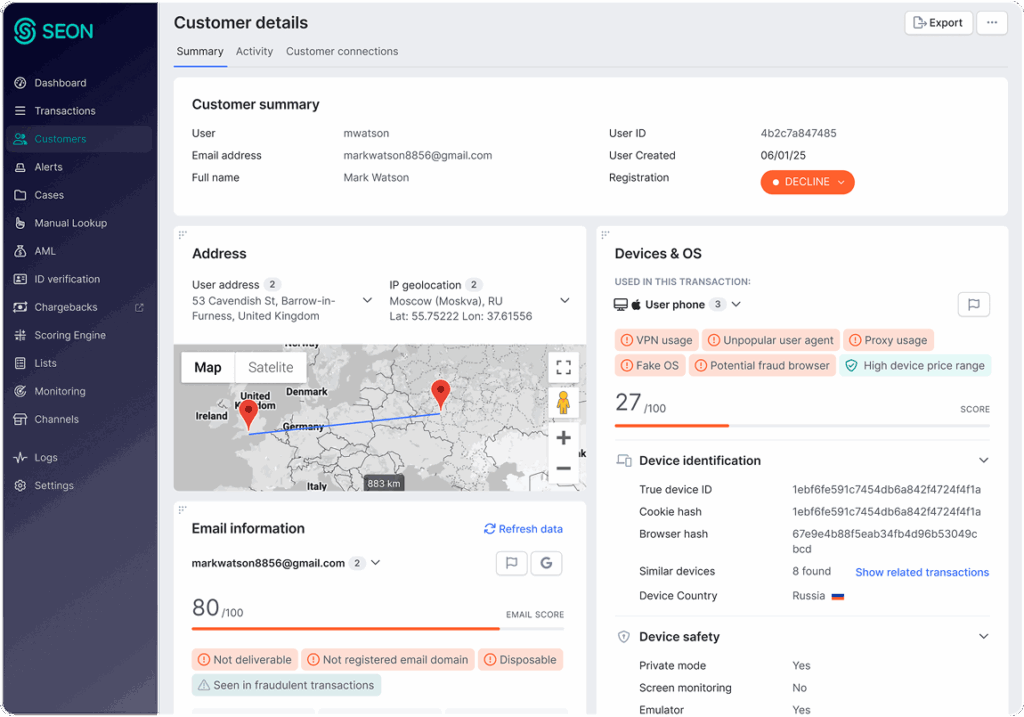

SEON is the leading fraud prevention solution that connects 900+ first-party data signals to detect, stop and prevent fraud in real time across your entire customer journey.

Trusted by the World’s Most Ambitious Companies

Fraud Prevention with SEON

Unified Fraud Prevention Approach

Pre-Screening Bad Actors Through Digital Footprint Analysis Before KYC

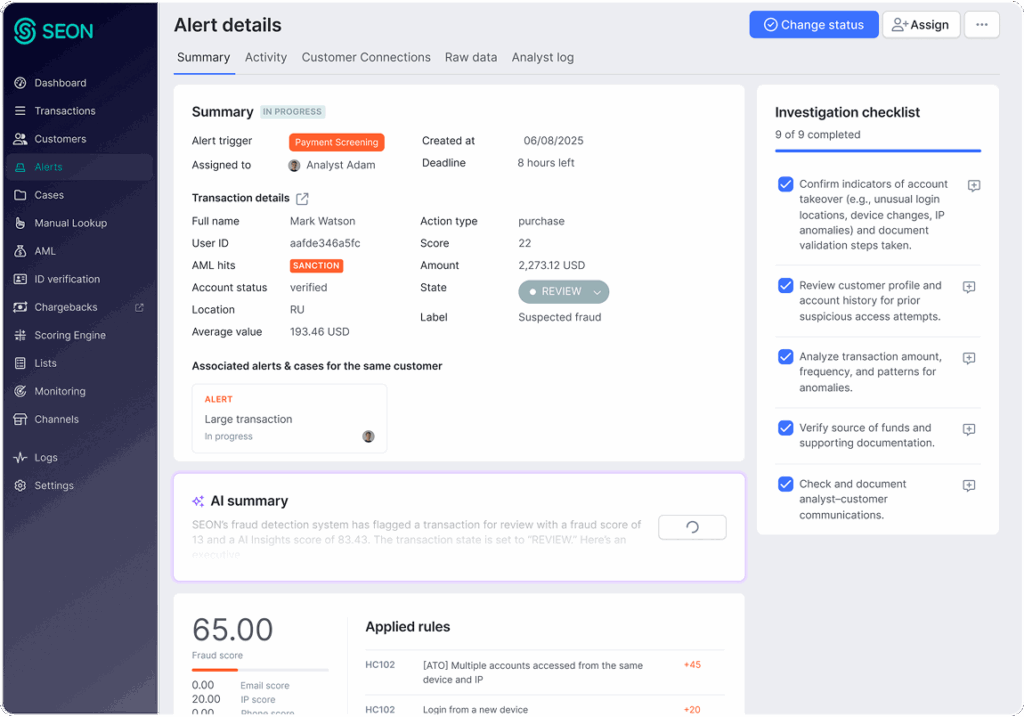

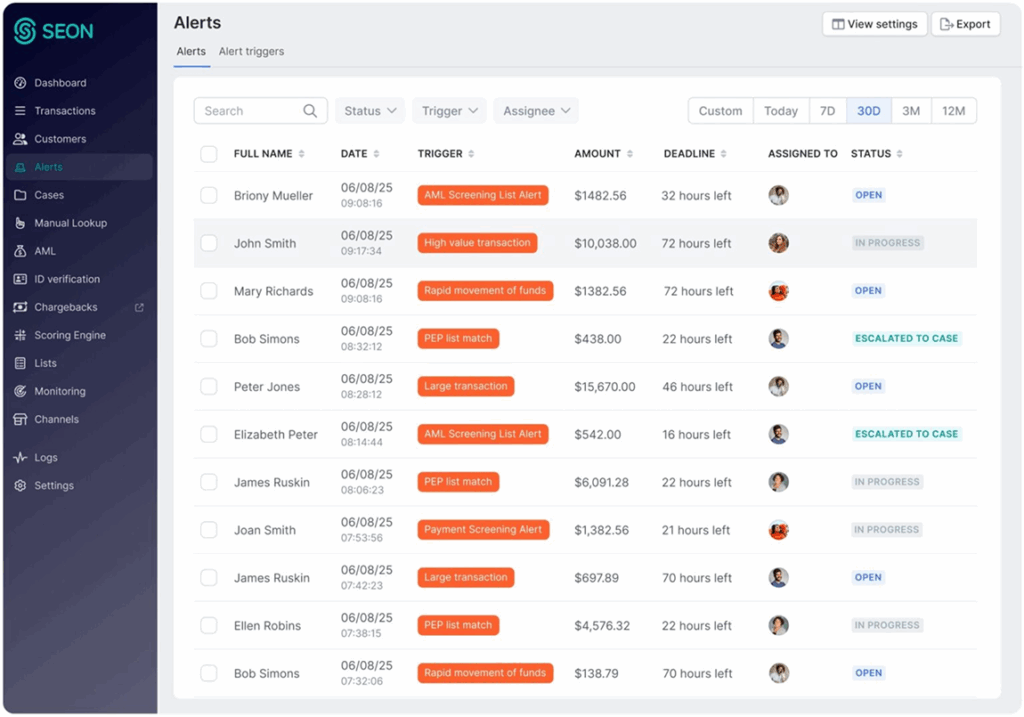

Real-Time Detection of Payment Fraud and Account Takeovers

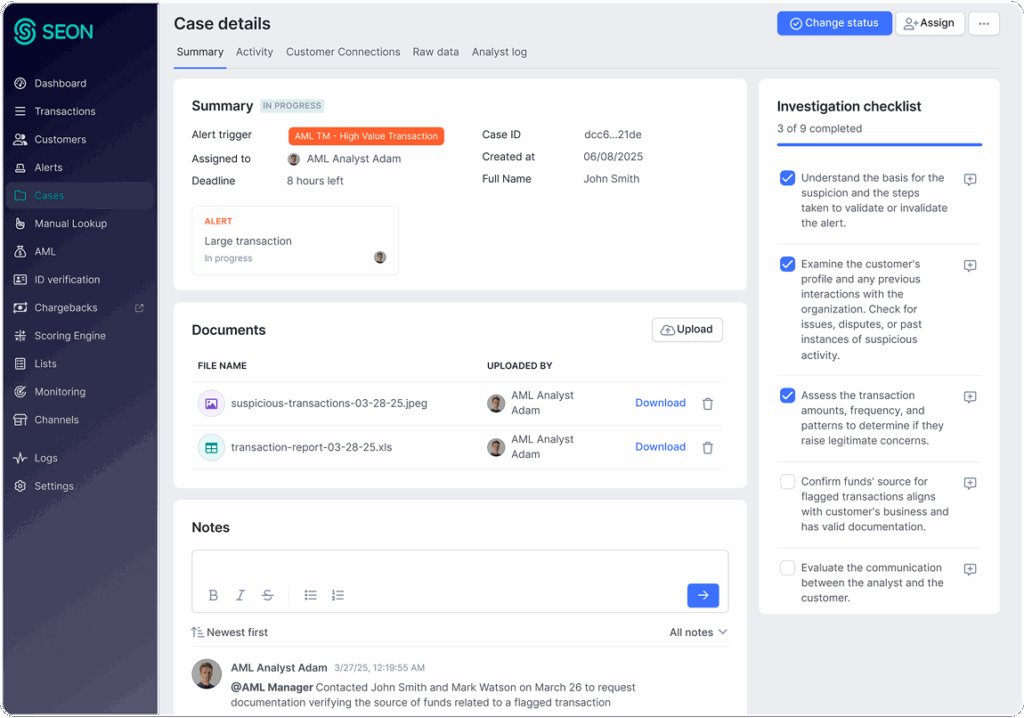

Faster Case Investigation Through Contextual Data

Unified Compliance and Fraud Prevention Solution

Fraud Prevention Across Different Risk Scenarios

Bonus Abuse

Real-time screening detects repeated or coordinated bonus misuse to protect revenue.

Fake & Synthetic IDs

Digital footprint analysis uncovers fake or synthetic identities before registration.

Account Takeover

Device and behavioral monitoring highlights unusual logins to block unauthorized access.

Payment Fraud

Adaptive scoring detects high-risk payments without blocking genuine users.

Registration & Onboarding

Data-driven checks identify fake users early, protecting growth and customer experience.

Login & Activity Monitoring

Social engineering attacks happen, but you can keep customer accounts safe.

Transaction Monitoring

AI-driven analysis detects fraud and risk in real time across millions of transactions.

Chargeback Fraud

Automated workflows manage chargebacks efficiently, reducing effort and recovering more revenue.

Choose How You Want To Integrate SEON

The choice is up to you: integrate directly with SEON’s APIs or through the AWS Marketplace.

in-house expertise

How Leading Teams Prevent Fraud at Scale

Learn More About Fraud Prevention

-

Get our free guide to reduce chargebacks, prevent fraud, and protect your revenue.

-

Download our iGaming fraud guide to stop threats early, stay compliant, and protect revenue.

-

APP fraud is rising, driven by real-time payments. Businesses must use AI, ML, and digital intelligence to prevent scams.

-

Explore AI-driven fraud detection, key fraud types, and strategies to choose the right system for real-time protection.

-

Discover tools to detect and prevent payment fraud. Protect your business and secure transactions effectively.

-

Learn how payment gateway fraud works and compare detection tools to stop BIN attacks, fake transactions, and account takeovers.

Fraud Prevention FAQs

SEON analyzes over 900 real-time signals from device, IP, email, phone, and behavior to build a risk profile at every customer interaction. These signals are scored and evaluated through customizable rules and machine learning. Fraud is prevented across the entire customer journey. This includes registration, login, transactions, and escalations. All risk events are tied together through a unified scoring engine with transparent explanations for every decision.

Yes. SEON flags account takeover attempts by detecting unusual login behavior, device changes, and Remote Access Tool (RAT) usage. Device intelligence identifies mismatches in browser hashes, spoofed environments, and emulators. SEON also uncovers synthetic identities using digital footprint gaps, behavioral anomalies, and missing social signals. This helps you catch fake or manipulated identities both before and after onboarding.

Yes. SEON is built to minimize false positives without sacrificing accuracy. It combines real-time enrichment, adaptive scoring, and machine learning to distinguish legitimate users from fraudsters with greater precision. You can also label transaction outcomes like approve, decline, or review. These labels train SEON’s ML model using your own data, improving accuracy over time.

Yes. SEON’s rule engine lets you create, adjust, or clone rules using a no-code interface. You can control scoring thresholds, add exceptions, or test changes live. SEON also provides AI-suggested rules based on fraud patterns observed in your environment. This helps you optimize detection with less manual effort.

Digital footprint analysis verifies whether a user’s identity is real and consistent. SEON checks online signals tied to email, phone, and IP, including social media presence and domain history across 250+ platforms. These signals are extremely hard to fake. Combined with device intelligence like browser fingerprinting and spoof detection, SEON delivers a layered approach that improves accuracy and catches hidden fraud.

SEON helps stop card testing, stolen card abuse, bonus abuse, and transaction laundering. It detects suspicious patterns in withdrawals, top-ups, and purchases using behavioral signals, device fingerprinting, and velocity rules. These tools work in real time to prevent losses and reduce chargeback rates.

Take the First Step Toward a Transformative Fraud Prevention System

Book time with fraud specialists who understand your industry and map your clear path forward.

Trusted by 5,000+ global organizations:

Speak With a Risk Expert

This form may not be visible due to adblockers, or JavaScript not being enabled.