Sanctions screening is essential for financial institutions and regulated sectors, forming a crucial component of comprehensive Know Your Customer (KYC) programs. This process underscores an organization’s commitment to due diligence in preventing money laundering, terrorism, and other financial crimes.

Financial entities must keep an eye on numerous sanctions lists dictated by various national jurisdictions to avoid severe legal and operational repercussions. Despite the challenges posed by constantly expanding sanctions lists and the financial mechanisms in place to hide ultimate beneficial ownership, with adequate resources, there is a way businesses can effectively develop a robust Financial Crime Compliance (FCC) program.

What Is Sanctions Screening?

Sanctions screening is a key Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) measure, mandatory for regulated businesses to ensure effective sanctions compliance. It forms an integral part of the Know Your Customer (KYC) process, which involves thorough due diligence and risk mitigation to prevent financial crime.

As regulations and the sanctions landscape continually evolve, businesses must stay informed about operational and regulatory changes. Sanctions screening will generally be part of a risk-based due diligence and financial compliance program. Though there are small differences in sanctions regulations from country to country, they tend to align to facilitate the international business machine better.

How Does the Sanctions Screening Process Work?

Sanction screening works by comparing customer data against government sanction lists to confirm that individuals or entities are not prohibited from conducting transactions. This process involves screening details like names, birthdates, and social security numbers to ensure compliance before transaction approval.

An effective sanctions screening program typically includes:

- Customer identity verification: Confirming customer identities during onboarding as part of KYC requirements.

- Cross-checking against multiple lists: Matching confirmed identities against relevant lists such as sanctions, politically exposed persons (PEP), adverse media, crime lists, watchlists, and other specific jurisdiction lists.

- Manual verification of matches: Carefully verifying any hits to prevent false positives due to similar names.

- Transaction suspension and reporting: Blocking transactions for confirmed matches and reporting these to the designated compliance officer.

- Risk labeling and monitoring: Tagging high-risk customers based on cross-check results and continuously monitoring their activities.

- Monitoring customers at the transaction level: Ensuring that no transactions involve sanctioned entities.

- Internal auditing: Conducting thorough audits to document and verify all screening protocols and their execution.

This comprehensive approach helps align global business practices and mitigate the risks associated with financial crime.

Why Is Sanctions Screening Important?

For businesses in regulated verticals like money services and real estate, the importance of an effective sanctions screening process is twofold: being part of the effort against terrorism and international money laundering, and minimizing risk from noncompliance punishments.

In the case of the former, the benefits of not being a part of criminal or terrorist money laundering should be self-evident. The potential for reputational damage is extremely severe if, for example, a legacy bank were to be publicized as being instrumental in processing funds that ended up in the hands of the Russian war effort.

In terms of direct impact on a company’s bottom line, the risk of noncompliance punishments looms much larger. In 2022 alone, two of the major international arbiters of sanctions regulations – the Financial Conduct Authority (FCA) in the UK and the Office of Foreign Assets Control (OFAC) in the US – handed out to offenders over $266 million and $42 million in fines respectively.

These fines, however, can be just the tip of the legal iceberg. Severe and repeat offenders who maintain business contacts with sanctioned entities risk becoming sanctioned entities themselves – the worst-case scenario for any business.

The importance of a strong FCC or Sanctions Compliance Program (SCP) is thus directly tied to the importance of business operations. Developing a business model that does not incorporate such a program – with capabilities commensurate to the mandated requirements – may result in either crippling fines or, potentially, the ceasing of all business operations.

SEON provides compliance teams with all the tools needed to help minimize risk and perform AML due diligence.

Ask an Expert

What Is Sanctions Screening in AML?

In anti-money laundering practices, sanctions screening consists of cross-checking valid customer onboarding data against numerous sanctions lists and other watchlists. The collection of personal data that is cross-referenced with the sanctions lists is part of meeting KYC requirements.

The majority of these companies will be in the financial sector, monitoring account opening and transactional behavior for signs of suspicious activity.

New sectors are being folded into this group all the time as regulators identify more verticals that sanctioned entities are leaning on to launder illicit funds. These include high-end real estate, art dealerships, investment companies, auction houses, cryptocurrency operators, and building societies.

PEP Screening

Based on individual companies’ respective risk appetites, lists of politically exposed persons should factor into a strong sanctions screening process. Keep in mind that, due to their proximity to the name on the PEP list, the relatives and close associates (RCAs) of the individual on the list are also subject to the same requirements.

Individuals named on the PEP list are usually in a position that makes them likely to be targeted by bribes, coercion, and blackmail. This includes entities like world leaders and their families, as well as people with adverse media coverage.

In many cases, businesses may want the custom of individuals on PEP lists. However, customers that constitute a high risk require more costly Enhanced Due Diligence checks, while best AML practice also suggests that they are consistently monitored, to ensure that high-risk individuals’ transactions do not go from ordinary to suspicious.

How to Perform Effective Sanctions Screening

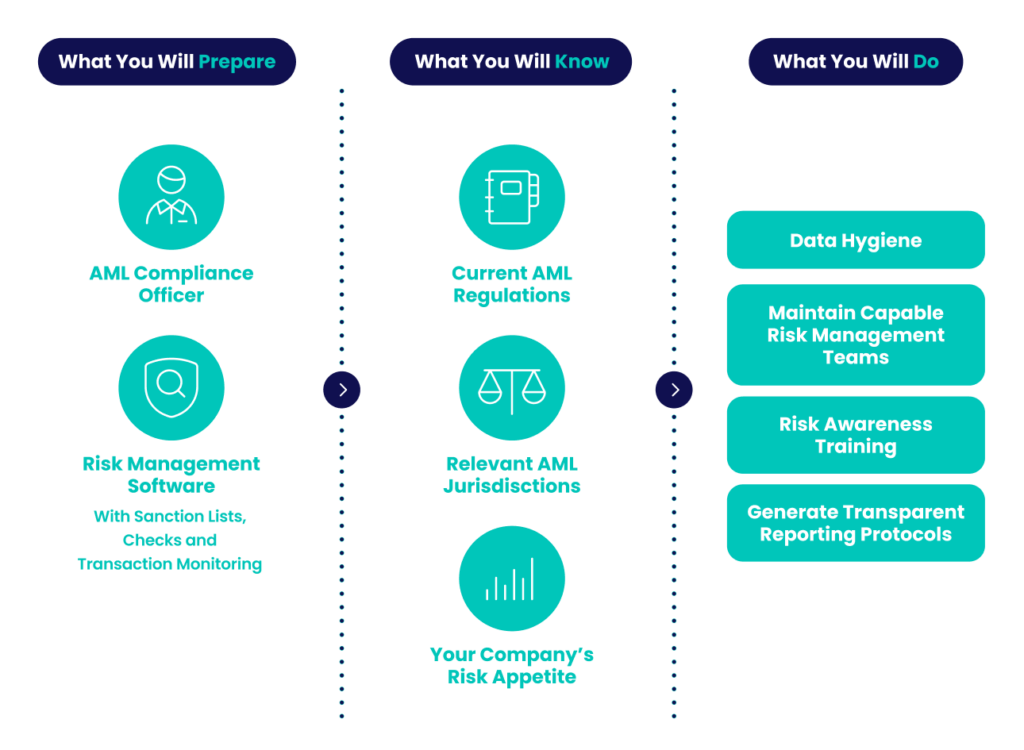

To minimize risks associated with crime, fraud, and non-compliance with Anti-Money Laundering (AML) regulations, establishing a multi-layered sanctions screening process is essential. This involves integrating various elements and expertise across your organization. Here are all the essential elements of effective sanctions screening in AML:

- AML compliance officer: A key role mandated by AML laws, responsible for maintaining the screening process, training staff, and reporting incidents to authorities.

- AML software: Part of a broader risk management platform, this software conducts list checks, assesses risks, monitors transactions, and generates reports or audits.

- Understanding AML responsibilities: Know the specific risks and required sanctions lists, particularly for international compliance (e.g., US, EU, UK).

- Staying updated: Keep up with the latest AML regulatory changes and adjust compliance measures accordingly.

- Defining risk appetite: Clearly define and manage your organization’s tolerance for risk to inform screening procedures and monitoring intensity.

- Data management: Maintain accurate and organized data to support enriched customer profiles and reduce errors in risk assessments.

- Staff training: Regularly train all relevant staff, not just compliance teams, on recognizing and reporting suspicious activities.

- Risk management proficiency: Ensure teams are proficient with risk management software and can adjust monitoring rules as needed.

- Manual review and reporting: Establish clear protocols for manual reviews and documentation when matches against sanctions lists are found, ensuring transparent reporting to the compliance officer.

By following these guidelines, organizations can effectively design and execute an AML sanctions screening process that significantly reduces the risk of non-compliance and enhances overall operational compliance. This approach not only addresses the identification of sanctioned entities but also ensures the implementation of a thorough due diligence process.

Partner with SEON to reduce fraud rates in your business with real-time data enrichment, whitebox machine learning, and advanced APIs.

Ask an Expert

How SEON Facilitates the Sanctions Screening Process

The SEON’s fraud detection platform is a perfect tool to help compliance teams ensure their sanctions screening processes are AML compliant.

SEON addresses these needs by providing a constantly updated portfolio of sanctions lists and other watchlists. In the process of adhering to KYC and Enhanced Due Diligence (EDD) mandates, gathering customer names and addresses, SEON can automatically flag potential hits for manual review.

Moreover, SEON’s real-time digital footprinting and device intelligence provide a deep profile of those possible hits to assist the reviewing team member in identifying the user as a match, or not.

Frequently Asked Questions for Sanctions Screening

Within anti-money laundering mandates, sanctions are restrictions imposed upon entities that are meant to prohibit that entity from furthering their agenda through business. These entities generally have been determined to be malicious or otherwise detrimental – for instance, members of terrorist groups and warmongers.

For companies that fall within the AML perimeter, all new users should be screened against all relevant sanctions lists during the onboarding process. Existing users determined to be risky should also have their transactions monitored for involvement with sanctioned entities, as well as for suspicious behavior associated with corruption.

Depending on the jurisdiction – including any country business is being conducted – certain verticals need to do sanctions screening as part of KYC. Regulated verticals typically include financial institutions, building societies and other money services, gambling institutions, and in some cases high-end retail like art dealers and real estate services.

Sources

- U.S. DEPARTMENT OF THE TREASURY: Civil Penalties and Enforcement Information

- Financial Conduct Authority: 2022 fines

You might be interested in: