SEON Fraud Trends 2024

Fraud will not only expand but evolve in the year ahead, with fraudsters leveraging advanced technologies to execute increasingly sophisticated fraud schemes.

This guide, based on surveys conducted with 316 cross-industry customers and experts, maps out the evolving multifaceted nature of fraud today and outlines strategic approaches to bolster fraud prevention efforts for the near future.

Introduction to the Fraud Landscape in 2024

To navigate the challenges of the increasing complexity and frequency of fraud, SEON has engaged with customers and partners to gather insights on the key challenges and to compile best practices that will inform fraud prevention strategies for the year ahead.

The guide looks at predictions for fraud volume and costs, identifies the types of fraud gaining momentum, spotlights the biggest threats to fraud prevention efforts and offers strategies for investing in a comprehensive fraud prevention and detection solution.

Learn how SEON’s fraud expertise, real-time data and AI-enhanced technology can help your business tackle rising fraud volumes.

Speak to an Expert

Increasing Fraud Volume and Types

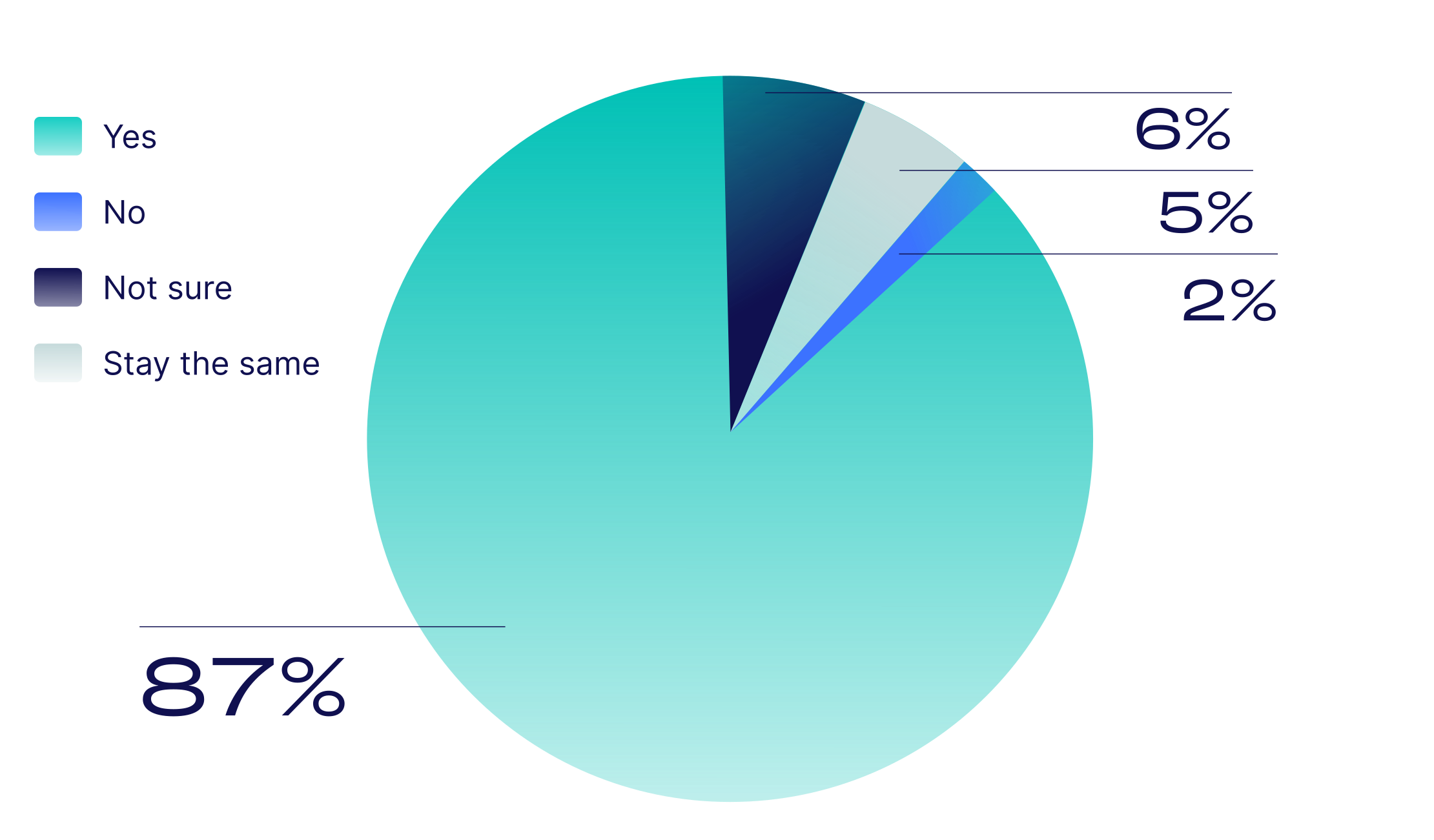

There was near unanimous consensus among industry experts regarding the anticipated uptick in fraud, with 87% predicting an increase. The drivers behind the rise in fraud include the role of innovative technologies like Artificial Intelligence (AI), the emergence of Fraud-as-a-Service (FaaS), the demand for fast, frictionless transactions and growing economic pressures.

Automating fraud detection through AI and machine learning can enhance fraud prevention efforts’ efficiency, precision and safety.

AI’s Dual Role in Fraud Dynamics

AI is expected to take center stage in 2024, both as a tool for fraudsters and as a means of defense. It facilitates more sophisticated fraud threats, such as automated attacks and deepfake technology, which means businesses must adopt equally advanced anti-fraud solutions to counter these attacks.

AI-powered anti-fraud solutions like SEON offer efficient, real-time fraud detection and transparent decision-making through whitebox machine learning. This approach minimizes manual reviews and enhances risk management, ensuring secure and trustworthy customer experiences.

Fraud Types and Prevention Strategies

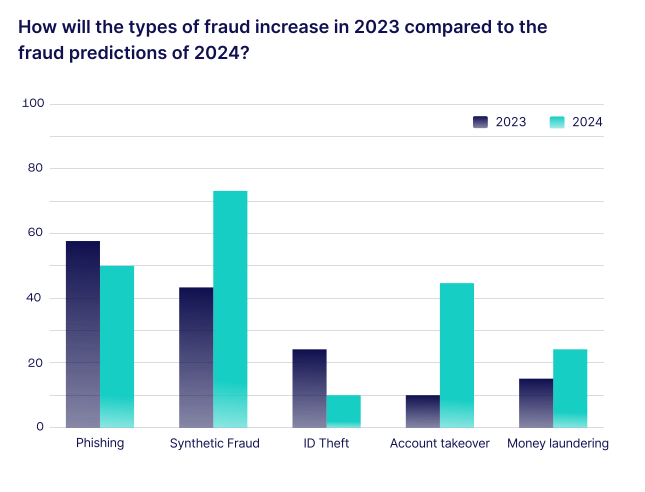

Predictions for 2024 suggest a continued increase in phishing, synthetic fraud, identity theft, account takeovers and money laundering. As a result, many SEON customers are planning to enhance their anti-fraud measures.

Common challenges around investing in anti-fraud solutions include cost and integration concerns. Mapping the existing cost of fraud against projected fraud volumes and implementing API-first solutions with access to a team of experts facilitating deployment can help overcome these obstacles.

SEON’s Perspective on Future Fraud Trends

SEON goes beyond the traditional rule-based systems and offers flexible machine learning models with feedback loops for more intelligent and highly automated fraud detection.

Despite the move toward technology, human intelligence remains crucial: balanced integration of machine learning and human insight to enhance accuracy and maintain necessary oversight in fraud prevention efforts is the key to success.

Sign up to download

In order to download this PDF, please complete the form.

Thanks for submitting the form, click the button below to download our guide.