Registration & Onboarding

Onboard Customers, Not Fraudsters

Filter out fraudsters in real time so genuine customers can register and onboard – quickly and smoothly.

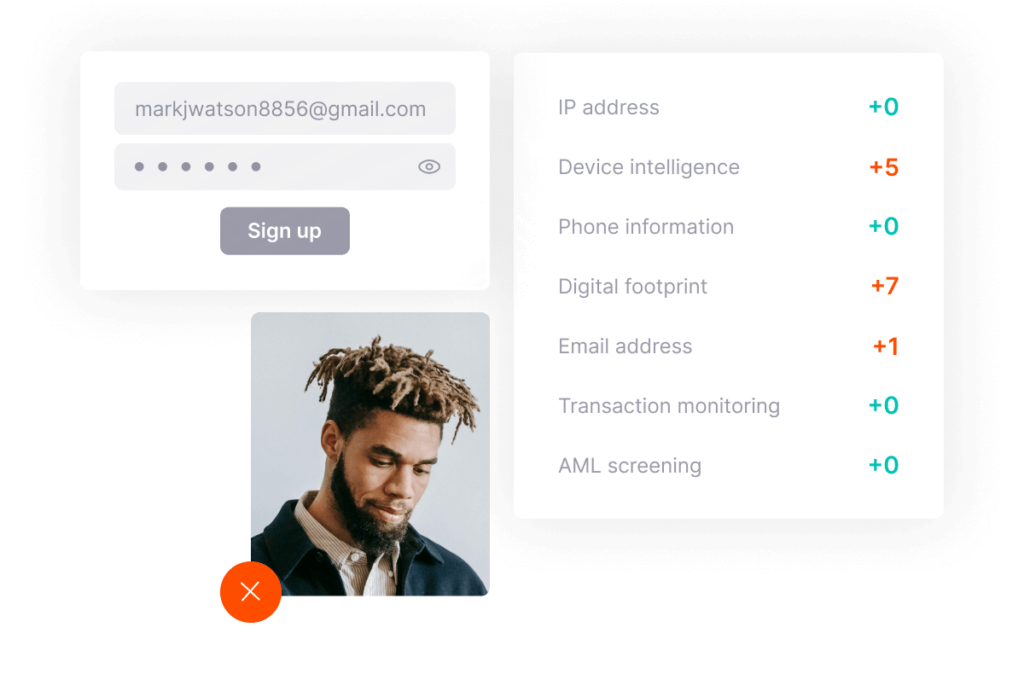

Reduce Fraudulent Signups

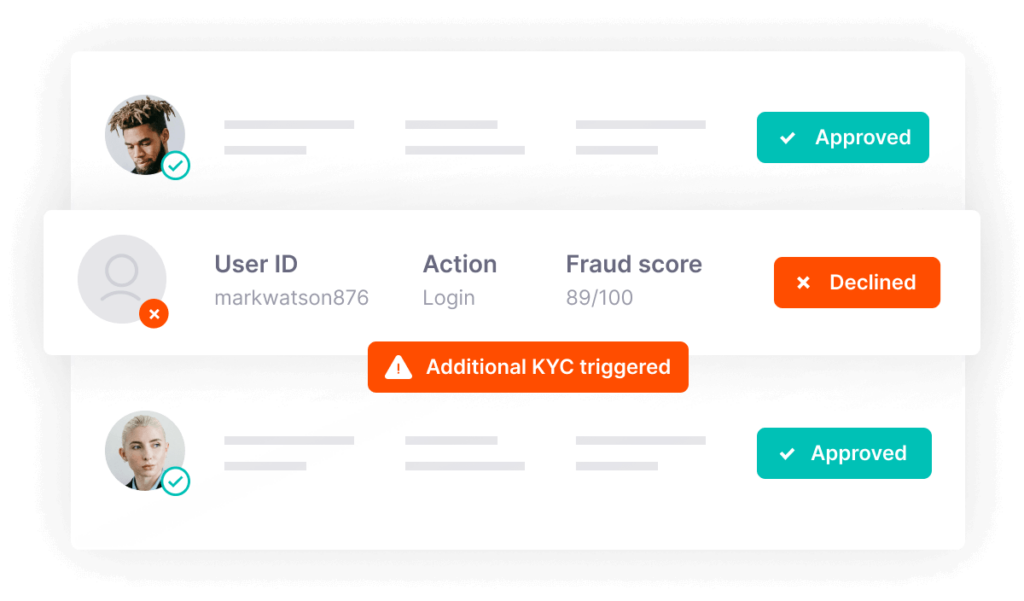

Take a Dynamic Approach

Onboard Smarter with Digital Footprint Analysis

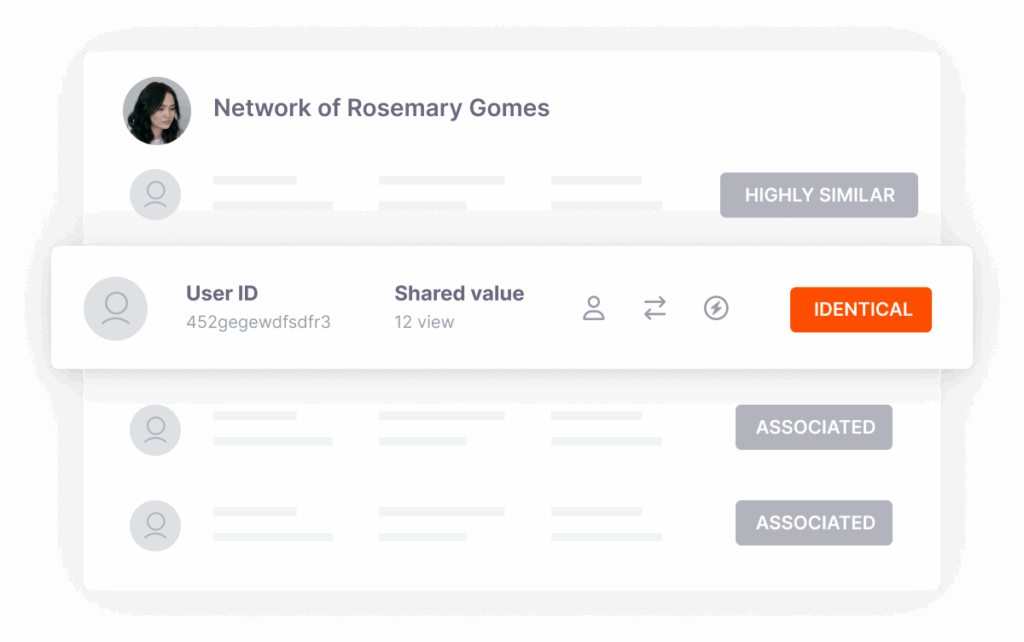

Uncover Hidden Customer Relationships

Discover How Companies Win

“SEON’s digital footprint insights enabled us to improve approval rates for our customers by 5%, significantly enhancing our ability to onboard new customers quickly. This also allowed us to expand our customer base and increase revenue streams while effectively managing credit risk, resulting in notable ROI for our organization.”

Costin Mincovici

Chief Credit Officer, tbi Bank

“Integrating SEON’s digital footprint tools into our KYC process allowed us to implement dynamic friction, triggering additional checks only when needed. For instance, if SEON shows no social media presence is linked to an email, the fraud score increases, prompting extra KYC questions. This approach reduces our KYC costs and helps us screen customers efficiently.”

Kaspars Magaznieks

Head of Fraud, Sun Finance

Choose How to Integrate with SEON

The choice is up to you: integrate directly with SEON’s APIs or through the AWS Marketplace.

Learn More About Registration & Onboarding

-

Download our free guide to secure efficient digital bank onboarding and tackle evolving fraud risks.

-

New account fraud explained: how it happens, red flags, and ways to stop fake or stolen-identity signups during onboarding.

-

Digital onboarding in iGaming made secure. Prevent bonus abuse & fake signups while keeping player signup smooth and instant.

-

See how Hype boosted onboarding with SEON, cutting fraud, costs, and achieving a 90.6% auto-approval rate through smarter risk management.

-

Read how Félix cut fraud to nearly 0% and boosted trust with SEON’s seamless, secure onboarding solutions.

-

Key risks, common tactics, and prevention strategies for open banking fraud in fintech and digital banking.

Explore Related Screening Solutions

AML Transaction Monitoring

AML transaction monitoring solution with real-time detection, customizable rules, and built-in investigations and reporting.

Fraud Prevention

SEON’s fraud prevention solution connects 900+ first-party data signals to detect, stop and prevent fraud in real time across your entire customer journey.

Customer Screening

Use advanced fraud signals to screen and block high-risk customers before AML checks, and automate global screening and ongoing monitoring, all in real time through a single API.

Take the First Step Toward Transformative Fraud Prevention

“SEON significantly enhanced our fraud prevention efficiency, freeing up time and resources for better policies, procedures and rules.”

Chief Compliance Officer, Soft2Bet

Trusted by 5,000+ global organizations:

Book Time With Our Experts

This form may not be visible due to adblockers, or JavaScript not being enabled.