The payment fintech Stripe, which needs little introduction these days, sent shockwaves through the risk industry when it announced a new identity verification product.

It’s called Stripe Identity and, although it’s currently only in private beta at the time of writing, it’s set to integrate seamlessly with your favourite payment system.

But how does it work exactly? And is it enough to reduce the identity fraud cases that plague your business? Here is our opinion on how it can make online shopping very frustrating, what are the risks involved and what are possible alternative paths.

Read more about the importance of identity proofing and what it is.

What Is Stripe Identity Verification?

As the name suggests, Stripe Identity is all about confirming who a user is in the context of a credit card payment or a KYC (know Your Customer) scenario.

By verifying identities linked to cards, businesses can reduce transaction fraud and chargeback rates. For KYC or AML (anti-money laundering), it’s a way of meeting government requirements and blocking the onboarding of fraudsters. Stripe also claims it can work as an authentication tool to reduce account takeovers.

The product has already been deployed by companies such as Discord, Peerspace and Binance.

Interestingly, it was built based on Stripe’s own use, as the company developed an internal architecture to verify merchant identities around the world.

How Does It Work?

From the business side: all you need is a low-code integration to put it in place. The verification flow is fully hosted by Stripe.

- a copy of a government ID

- a live selfie

A Machine Learning program then matches the ID to other third-party records to confirm or deny the identity.

The Pros of Stripe Identity

Clearly, if you already rely on Stripe for online payments (and Radar for chargeback prevention) and need to improve your KYC compliance, Stripe Identity seems like a no-brainer. You pay extra for the verification, but you’re saving on potentially punitive fines from government agencies.

The easy integration with the payment system and other tools (Stripe Tax or Radar, for instance) also makes sense if you’re deep into the Stripe ecosystem.

As for use cases, it should be great for:

- Dating apps that want to reduce romance scams.

- Crypto exchanges that want to avoid AML fines.

- Financial services with stringent KYC requirements.

- Cracking down on scam bots (as seen with Discord).

The Cons

However, there are a few things to consider. The first one has to do with the general identity verification process: all that admin work, even if it’s automated, is rarely cheap.

Now while Stripe Identity averages 1.5 USD per check, which is highly competitive compared with other KYC tools, it can still be prohibitive in an onboarding process that spits out a lot of fraudulent applications – especially the ones that you could have stopped using common sense. You essentially lose money on every sign up that doesn’t go through.

There are also concerns about data security. Unlike with Stripe payment, where the card numbers are never stored by the business, the identity documents do pass through the business’s servers. That is to say, every time you, as a customer, verify your identity with Stripe, the business will have a copy of your government documents and selfie.

While on paper it may seem fine when applying for a bank account, what about a small online store you’ve never heard of? Do you trust them with that kind of information? Considering the neverending list of record-breaking data leaks we hear about every year, it won’t come as a surprise that many users are cautious around handing out their ID documents online.

This brings us to the topic of churn. Identity verification is great, but it’s also a pain for customers. In a world where low friction becomes a battleground for businesses, do you really want to add an extra verification step to their journey? When 39% of online store churn comes from a lengthy checkout process, does it make sense to slow them down even more?

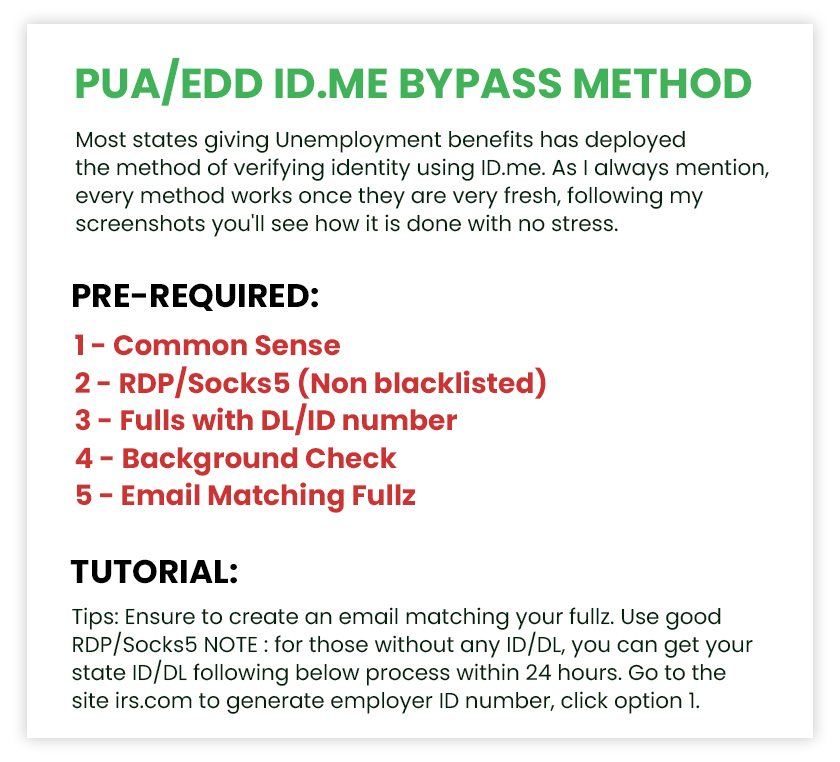

Another issue from a risk standpoint: relying on one tool introduces a single point of failure. As we’ve seen on fraudster forums and Telegram groups, authentication methods such as id.me are welcome by criminals because it means they know exactly what they’re up against.

Last but not least, let’s imagine that you only deploy Stripe Identity for untrustworthy customers. This begs the question: how do you define what an untrustworthy customer is in the first place?

The answer may lie in something we like to call dynamic friction.

Dynamic Verification for Pre-KYC Checks

Dynamic friction is all about using an invisible filter to separate obviously legitimate users from obvious fraudsters. The good news is that it can be done fast, accurately, and it’s very affordable. (For instance, you can read more about how to use a data breach check for user verification or how social KYC is helping ID proof users with zero friction)

As for those who fall in a grey area, that’s where the dynamic part comes into play. Essentially, you can pass them on to the manual review team or ask for extra verification details. This is where it makes sense to use a tool like Stripe Identity – you’re getting your money’s worth with the good users.

The key is to think about the Know Your Customer Validation in different stages and to combine both light and heavy methods.

Finding the Perfect Balance for an Identification Workflow

For customers, extra identification steps can decrease trust and be a good reason to turn towards competitors. For businesses, it can be expensive and lead to a loss of business.

This is why it makes perfect sense for Stripe to bring out a robust, affordable ID proofing service designed to work out-of-the-box and to improve your verification and authentication processes.

While it’s great news for businesses who need that product, it’s not always simply a matter of flicking the Identity switch on and solving all your fraud problems. Risk management is way too complex to be fully automated, which is why we believe the key is to balance light and frictionless identification methods (such as sourcing alternative data for Customer Due Diligence) with heavier KYC solutions like Stripe Identity. For many businesses, a pre-KYC filter or firewall is a great way to get the most from your authentication tools ROI.