Online fraud has been a problem as long as the internet has existed, with criminals quick to make the most of this new frontier. In turn, cybersecurity professionals and companies have been just as quick to develop and implement methods of thwarting fraudulent activity.

As such, the advice surrounding how to protect yourself online is constantly evolving to meet new security standards and avoid the latest schemes from fraudsters.

This has led to a wide variety of security systems becoming popular such as antivirus software for individuals, fraud detection with machine learning platforms, and other solutions such as device fingerprinting to support businesses in the fight against fraud.

Up until recently, the vast majority of internet users had grown up in an analog world and had to learn about online safety later in life. This also meant that they were not the target of digital fraudsters in their youth, which has led to the presumption that most victims of online fraud are elderly folks with little knowledge of the internet.

However, a new generation of people who have grown up in the digital world are now reaching middle age. They are thus more familiar with the use of the internet, having been exposed to it since their earliest days.

This also means that these young people will have been potentially subject to the attentions of online fraudsters. But how well do they avoid becoming the victim?

In this study, we will assess the state of online fraud in the United States, both as a whole and by age group. This will allow us to see just how likely Gen-Z, and younger people in general, are to fall victim to cybercrime, and whether they need any additional support for staying safe online.

The State of Internet Fraud in the USA

Here we can see some basic figures that outline just how much of a problem internet fraud has become in the United States.

The total number of victims of online fraud was almost half a million in 2020, with 465,177 individual cases of online fraud being reported in just one year. This translated into total losses of just under 3.3 billion dollars – approximately the same size as the economy of the entire country of Liberia, which goes to show just how vast these losses are.

On average, this means that each instance of online fraud in the United States is worth approximately $7,000, a large enough sum of money to cause the average person some serious financial hardship.

However, these figures should be taken with a pinch of salt, as they represent all instances of online fraud in the entire country. This includes businesses as well as individuals, which can suffer much greater losses than the average person. These figures will also vary across age groups and different parts of the country, which we will be keen to highlight as we delve deeper into the data.

50-59-Year-Olds Lose the Most to Online Fraud on Average

Here we can see how the average amount that a victim loses to online fraud varies by age group.

The age group that loses the most on average in the USA is the 50-59 category, with average losses of $9,864. This is closely followed by the 60+ age group that saw an average loss of $9,174. The fact that the two oldest age categories had the highest average losses supports the view that older generations are still the most vulnerable when it comes to online fraud.

In contrast, the group with the lowest average losses per fraud victim are 20-29-year-olds, who saw average losses of $2,789. The second-lowest average losses of $3,061 were seen by the Under 20 category, revealing that the youngest two age groups lost the least money per fraud incident. However, this might simply be because young people have fewer financial assets to lose than their elders do, rather than being targeted any less.

Under 20s See the Biggest Rise in Online Fraud Victims

This section investigates just how much incidents of online fraud are increasing across the different age categories. These are annual rates of increase ranked by the 2020 figures, though data for rates of increase in 2019 and 2018 are available for comparison.

Under 20s saw by far the biggest increase in victims in 2020, with numbers more than doubling after a rise of 116.21%. This age group also experienced the largest increase in 2019, although with a much smaller percentage rise of 17.47%. This suggests that online scammers have young people in their sights, and there is work to be done to educate young people about online threats and provide them with the means to protect themselves.

Compared to previous years, 2020 saw much greater increases in the number of fraud victims across every age group, with each one rising by more than 50%. This indicates that there has been a boom in online fraud in recent years, perhaps due to the pandemic, which meant more people are spending more time online.

Average Loss Per Fraud Event Has Decreased Across All Age Groups

By comparing annual data on losses from online scams, we can reveal that in 2020 every age group saw a reduction in their average losses per incident of fraud. The age groups are ranked according to the changes recorded in 2020, but figures for 2019 and 2018 are also available for comparison.

In 2020, every age group saw a drop in the average losses per incident of online fraud, with the Under 20 category seeing the biggest decrease of 92.21%. This huge fall in value is far greater than what any other group experienced, as the second biggest decrease was 28.97%. However, this fall followed a meteoric rise in average losses seen by the Under 20 category in 2019, when values increased by 2,756.10%.

Therefore, it could be surmised that the 2020 decrease was more of a correction of the anomalous 2019 result than an indication of a lower threat to this age category.

Gergo Varga, Product Evangelist at SEON says:

“2020 was an anomaly year. What this says is that fraudsters looked for more lucrative targets, so it’s difficult to draw long-term conclusions. However, the trend is clear in that fraud doesn’t discriminate by age, and that being digital-first doesn’t make you immune to scams.”

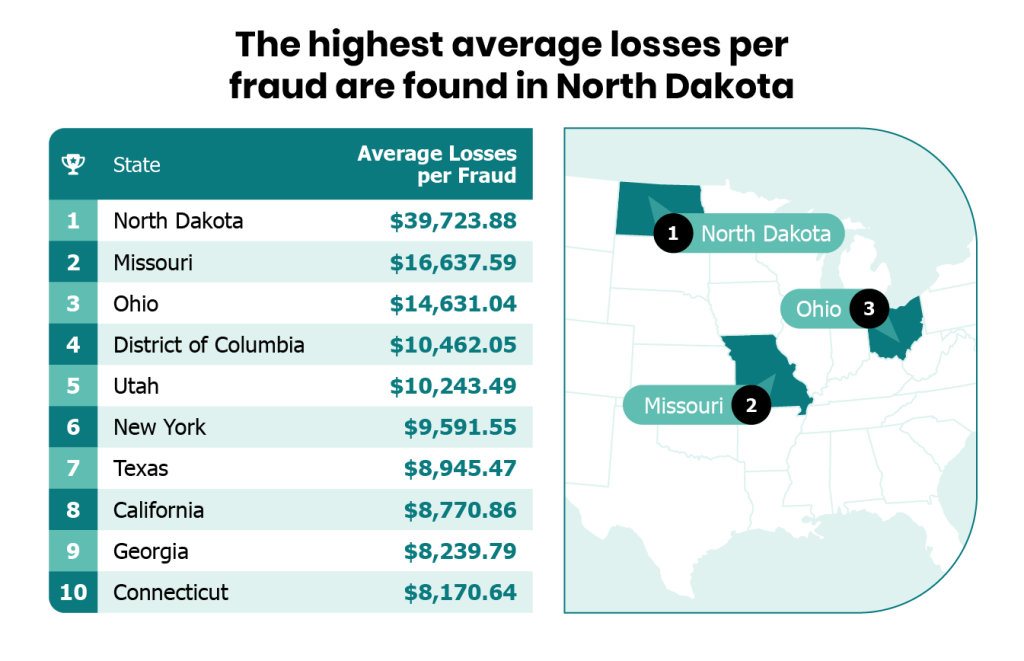

The Highest Average Losses Per Fraud Event Are in North Dakota

Now we turn our attention to a state-by-state comparison of how people are affected by online fraud. These are the top 10 states that experience the highest average losses per instance of online fraud.

North Dakota has by far the highest losses per fraud, with people losing $39,723.88 on average. This is a crippling amount of money for the average person to lose, as the average salary in the USA in 2020 was $56,310.

Missouri and Ohio take second and third place, with average losses of around $16,600 and $14,600 respectively. Below these top three states, the highest average losses are around $10,000, with the vast majority of states seeing much lower figures.

D.O.C. Sees Highest Average Losses Among Young People

Here, we look specifically at the average losses experienced by people under 30 in each state, allowing us to see where in the country young people are being most heavily affected by online fraud.

While technically not a state, the District of Columbia saw the highest losses for young people of any part of the country, with under 30s losing $7,551 per incident of online fraud. Virginia claims a close second place with average losses of $7,293, while Oregon takes third place with losses of $7,044.

These figures show that on average, young people tend to lose less money per incident of fraud than the overall population. This means that either the scams that target them are smaller in scale, or that young people simply have less money to lose than older generations.

Either way, they are still losing sizeable amounts of their own money to criminals, which certainly needs addressing with increased online security measures.

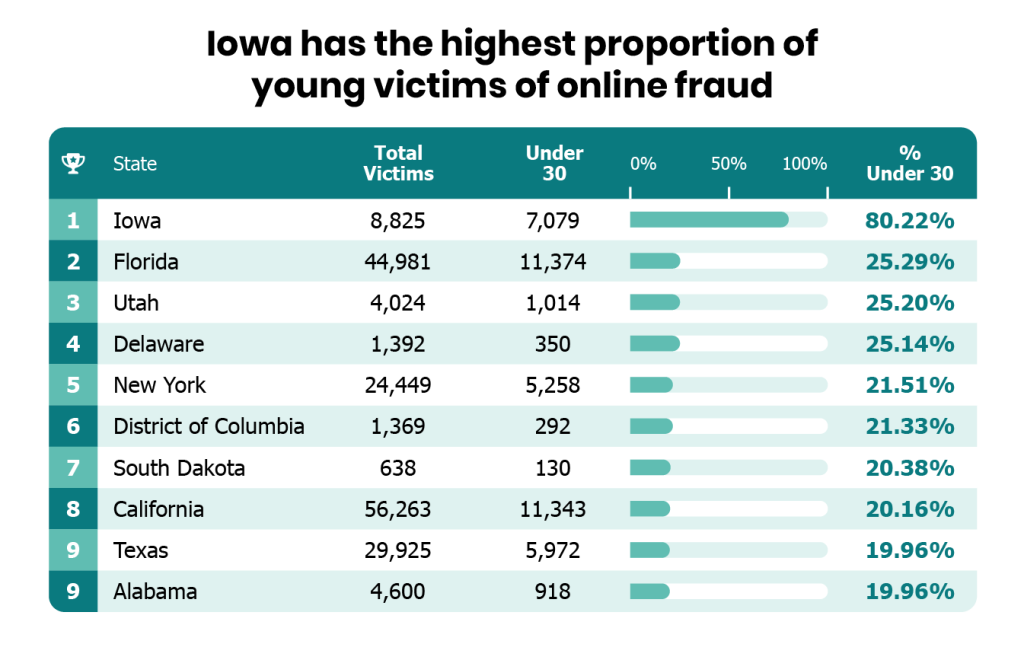

Iowa Has the Highest Proportion of Young Victims of Online Fraud

Here we can see the states that had the highest proportion of victims who are under 30 years of age in 2020.

The state with the highest proportion of young victims of online fraud in 2020 is Iowa, where a huge 80.22% of all victims were below the age of thirty. This is far higher than anywhere else in the country, and suggests a highly targeted scheme in the area that is specifically aimed at young people and their online activity.

Florida was the runner-up with 25.29% of victims being under 30, while Utah claimed third place with 25.20% Also hovering around the same level was Delaware, which saw 25.14% of online fraud victims in the under 30 category.

Young people in Oregon lose the highest proportion of state-wide losses

This section looks at the share of losses in each state that were attributed to victims under 30 years of age. The table below reveals the states where young people are losing a greater proportion of the overall statewide losses.

Young people in Oregon lost the highest proportion of statewide losses with 19.52%. This is followed by Virginia, where 18.56% of losses were attributed to the under 30s, while the District of Columbia took third place on 15.39%.

This data suggests that young people in these states are hit particularly hard by online fraudsters, and would do well to better protect themselves online. Whether they are being specifically targeted more, or are less aware of online dangers, is difficult to tell at this stage.

You can also read SEON’s Gen-Z Global Fraud Report here.

Methodology

We wanted to assess how much young people are affected by online fraud in the United States both at a national level and by state. To do this, we used data from the FBI’s Internet Crime Complaint Center, which gave us in-depth insights into online fraud incidence rates and losses by age group, as well as by state.

We also used information from World Population Review and Intuit to add context by comparing some figures to the average U.S. salary in 2020, while also comparing the national losses to online fraud to the GDP of another nation.