Chargeback fees pose a large problem to businesses, especially as the chargebacks themselves aren’t welcome either.

In this piece, we look at how businesses can prevent and counter both chargebacks and their fees. We’ll break down exactly what chargeback fees are, some examples, and how organizations can be prepared for them.

What Is a Chargeback Fee?

A chargeback fee is a fee that is issued by a card issuer to a merchant when the former issues the latter a chargeback – a forced reversal of a customer’s debit or credit card-based transaction. Depending on a series of factors, chargeback fees can be anywhere from $20 to $100 per chargeback, and a chargeback overall can cost a merchant up to 260% of the item’s sale price.

In theory, chargebacks offer both a deterrent against poor service from retailers and a form of protection for customers who wish to reclaim the money that they feel (for any number of reasons) has been wasted on the merchant’s transaction. They are part of why consumers trust payments – especially card-not-present payments and online payments.

In practice, chargeback fees cut into profits and constitute a pain point for merchants, who have very good reason to want to prevent chargeback fraud as much as possible.

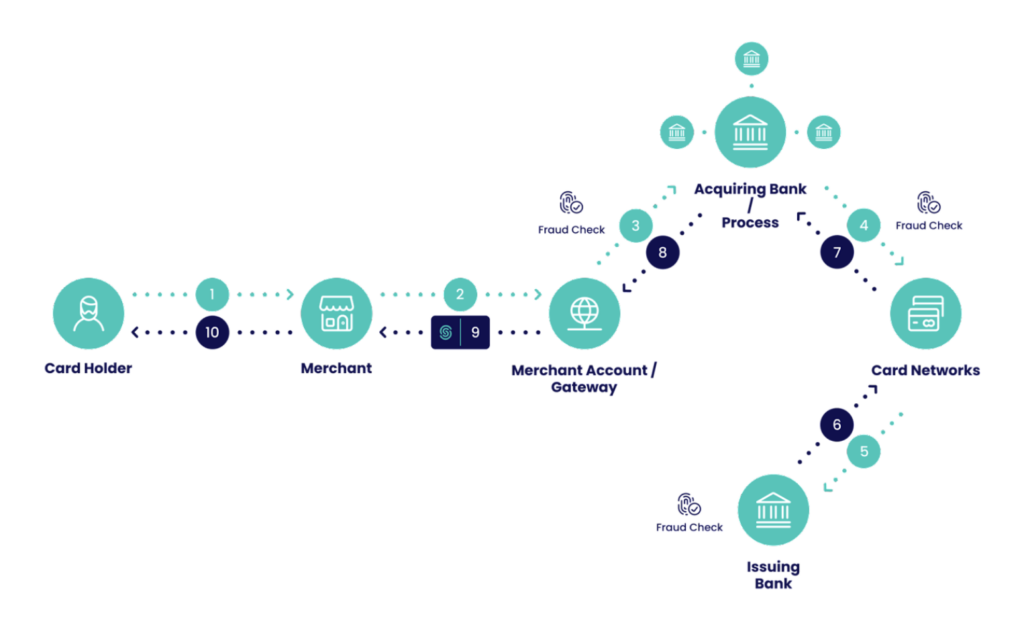

When a customer requests a chargeback, the card issuer will provide the customer with this money and proceed to request from the merchant reimbursement, as well as a chargeback processing or handling fee. In practice, the bank is requesting this to make up for the financial and other resources spent reimbursing the cardholder on behalf of (and at the expense of) the merchant.

Partner with SEON to reduce fraud in your business with real-time data enrichment, machine learning, and advanced APIs.

Ask an Expert

Why Are Chargeback Fees Needed?

First and foremost, chargebacks are needed and intended to protect consumers – whether it’s from fraud, transaction system errors, and so on – while chargeback fees are there to compensate issuing banks for the time and effort involved in the processing and fulfillment of a customer’s chargeback dispute.

They also work as deterrents against merchants who may be offering poor customer service or sub-par products, not putting in place adequate fraud protections, or even partaking in grey-area or fraudulent activity themselves.

Causes of Chargeback Fees

Chargeback fees may be exactly that: a standalone fee for the chargeback itself. However, they may also be based on other expenses, such as those meant to deter poor customer service or fraudulent merchant activity.

Stolen Credit and Debit Cards

Whenever a fraudster steals card data and proceeds to use it, thus engaging in carding, the legitimate cardholder is likely to speak to their bank about reversing this payment, thus resulting in chargeback fees for the merchant.

Human Error

Whether it is down to the cardholder or the merchant (or even both parties), human error must be considered in transactions – especially online transactions. After all, a cardholder only has to click the wrong button on an ecommerce website for them to unintentionally pay for something. This scenario could lead to a chargeback, and therefore a chargeback fee, all of which would occur on legitimate grounds.

Friendly Fraud

Friendly fraud is a type of first-party fraud where the legitime cardholder misrepresents facts in order to abuse the chargeback system, ultimately keeping their purchases as well as receiving their money back. A merchant will thus have to pay the chargeback fee for a perfectly legitimate order fulfillment – which can be combatted by maintaining meticulous, detailed records that prove how everything in the process was as promised, from the item’s quality and condition all the way to delivery.

Fraudulent Merchants

Another obvious example of a chargeback fee would apply if a merchant offers to sell a product or service under false pretenses. For instance, picture a merchant who offers to sell a computer monitor on their website, but then does not produce that monitor once they have received the money from a cardholder, and then ignores the shopper’s requests for a refund. This is considered a valid reason for a chargeback to be issued.

Ignored or Denied Refunds

Sometimes, a shopper may fail to successfully request a refund. This can be because they did not find a way to request this directly from the merchant, or perhaps they were ignored, or a legitimate refund was denied. From there, they are likely to turn to their issuing bank in order to recover their expenses. Any cardholder is expected to attempt to contact the merchant before a dispute can be raised with their card provider. It is only when the cardholder’s complaint and/or request for a refund is met with radio silence, evasion, or simply rejection from the merchant, that the cardholder then becomes eligible to request a chargeback.

System Errors

There are also system errors. Consider for example that the courier’s delivery system could crash and lose the order details, meaning that the order never arrives. There are also instances where the payment gateway encounters a technical fault that means a cardholder’s payment has been completed, but the merchant has not received their order. As a result, a chargeback and chargeback fee may need to be instated.

How Much Does a Chargeback Fee Cost?

A chargeback fee may cost anywhere between $20 to $100 in the US and between £10 and £50 in the UK – with similar fees in other countries. Chargeback costs may vary depending on the policies, preferences, and decision-making of the card provider who issues the chargeback, as well as the agreement that the merchant has with their acquiring bank, and the merchant’s chargeback rate.

A merchant with a high chargeback rate may be more liable to receive one of the higher chargeback fees.

Such a cost also depends on the sector and type of the merchant, especially the extent to which they are considered a risk. In this context, note that “high-risk” means liable to chargebacks, especially (but not necessarily) due to showing signs of allowing or partaking in fraudulent activity.

Types of Chargeback Fees

Defined and charged by issuing banks, chargeback fees include processing and admin fees, transaction fees, operational fees, and so on.

- Processing and handling fees: Because card issuers have to spend resources processing each chargeback request, and sometimes even chargeback recovery requests, merchants are expected to pay one-off per-chargeback fees. Depending on how often chargebacks occur, these can eat into profits.

- Admin costs: Charged by the bank to the merchant, admin fees can either be part of the chargeback’s processing fees or charged separately, but they always intend to cover the time and effort incurred by the issuer’s staff when handling the chargeback request.

- Reclaimed purchases: Of course, the merchant is expected to also give back the amount of money the customer was originally charged, as part of chargeback costs.

- Product cost: When a chargeback occurs, the merchant will not be able to recover the product or service they originally provided, if they did. This means they lose the acquisition cost of these items or services.

- Transaction fees: A transaction fee is a cut that a merchant’s payment processor receives when the former makes a sale. Merchants have to pay the transactional fee to their payment processor whenever they make a transaction. It’s when they undergo a chargeback that merchants must face an unfortunate fact: the money (anywhere between 1.5% to 4% of the payment) was wasted on making an exchange that was later reversed.

- Operational costs: Another example of money lost whenever a chargeback occurs, operational costs may involve shipping and postage fees. As the chargeback reverses all the profit from the purchase, operational costs can thus be considered to be lost to chargebacks as well – as those costs embody the time, money, and effort required to fulfill a transaction that was ultimately rescinded.

- Acquisition costs: Acquisition costs are the costs involved in achieving a sale in the first place, following the merchant’s attempts to market and/or advertise their products. In other words, such expenditure forms the costs spent on achieving the acquisition of a customer’s payment.

- Chargeback rate thresholds: An unfortunate consequence of too many chargebacks is excessive chargeback rates and their consequences. The chargeback rate shows how often a merchant incurs chargebacks and is the product of a merchant’s monthly chargeback cases divided by their total transactions. Chargeback rates help to determine how much a merchant has to pay per (any) transaction, as higher-risk merchants are expected to pay more even for legitimate transactions.

How to Avoid Chargeback Fees

Chargeback fees can be prevented by ensuring that products sold are of high and consistent quality, that fraud prevention measures in place minimize successful payments with fraudulent cards, and that cardholders receive the best customer service possible and are well-informed from the beginning to the end of the transaction.

Of course, to prevent chargeback fees, a merchant must prevent chargebacks! Merchants should act on their knowledge of these three key points:

- They need to offer strong customer service and transparency, including clear Terms and Conditions.

- They have the right to request a chargeback recovery from the bank.

- They deploy efficient fraud prevention software as part of their risk mitigation strategy.

How SEON Detects and Prevents Chargebacks

SEON helps organizations in detecting and preventing chargebacks, as it is well-equipped to recognize signs of fraudulent accounts and transactions.

- Unique customer insights: SEON runs email, phone and IP address-based digital footprinting in real-time to give you actionable information about who your customers truly are. For example, if a cardholder’s email address is not registered on any online platform, this is suspicious, as almost every legitimate user will have some online presence. This will arm the merchant with the capacity to question, or even retrospectively challenge, any transactions or disputes that they receive from such a suspicious account.

- Device fingerprinting: Robust modules also query the user’s hardware and software setup to flag any use of suspicious emulators, virtual machines and other hacker tools, as well as identify links between customers who may appear to be separate, unrelated individuals. The applications are plenty – including multi-accounting fraud and stolen credit card use, also catching those who spoof their device and location for purposes of fraud.

- Fraud scoring: SEON’s fraud scoring system helps merchants to assess how likely it is that any given customer is a fraudster masquerading as a legitimate shopper. It then provides whitebox, granular reporting so a merchant or their fraud analysts can know exactly why someone may appear as fraudulent, as well as adapt these thresholds and rules.

- Dynamic friction: Subject to their risk appetite, merchants can choose to optimize the shopper journey to reward good customers with the lowest-friction experience possible, while still asking some suspicious but not blatantly fraudulent customers for additional verification so as to avoid false positives. At SEON, we call this traffic-lights system dynamic friction.

- Automation plus human input: The merchant is able to change the thresholds granularly based on their business’s needs and preferences. This allows them to use both automation and detailed reporting to enable better manual reviews, so as to assess not only whether chargeback fraud is likely to occur but how likely it is to do so.

Don’t Let Chargeback Fees Ruin Your Business

Chargeback fees – plus chargebacks themselves – bring immense challenges to merchants and their businesses. SEON helps these organizations to know both who and what they’re dealing with whenever a cardholder wishes to make a transaction, or even before then.

All in all, it costs a great deal of money for a merchant to run a business, sell a product, and maintain good relationships and reputations with their customers.

So, when it comes to chargebacks, remember to be transparent with your customers, keep careful records, utilize fraud prevention tools, and know your rights and options.

FAQ

Issuer banks spend resources resolving chargeback requests and disputes, so they are looking to recover some of these in the form of chargeback fees.

They are calculated and charged by the bank to the merchant who incurred the chargeback.

According to their advocates, chargeback fees are in place to act as a deterrent to merchants, giving them ample reason to be meticulous with their fraud prevention, quality control, customer service and overall fulfillment, when handling card not present payments.

You might also be interested in:

Sources

- UK Finance: Chargeback and Section 75

- Value Penguin: Credit Card Chargeback: A Guide For Merchants

- Verifi: How Much is a Chargeback Fee?