AI Fraud Prevention

Detect Fraud Patterns That Human Eyes Can’t

Uncover complex fraud patterns and continuously improve your fraud detection with proven AI-insights from whitebox and blackbox machine learning models.

Book Time With Our Experts

This form may not be visible due to adblockers, or JavaScript not being enabled.

Trusted by the World’s Most Ambitious Companies

UNDERSTAND RISK FASTER

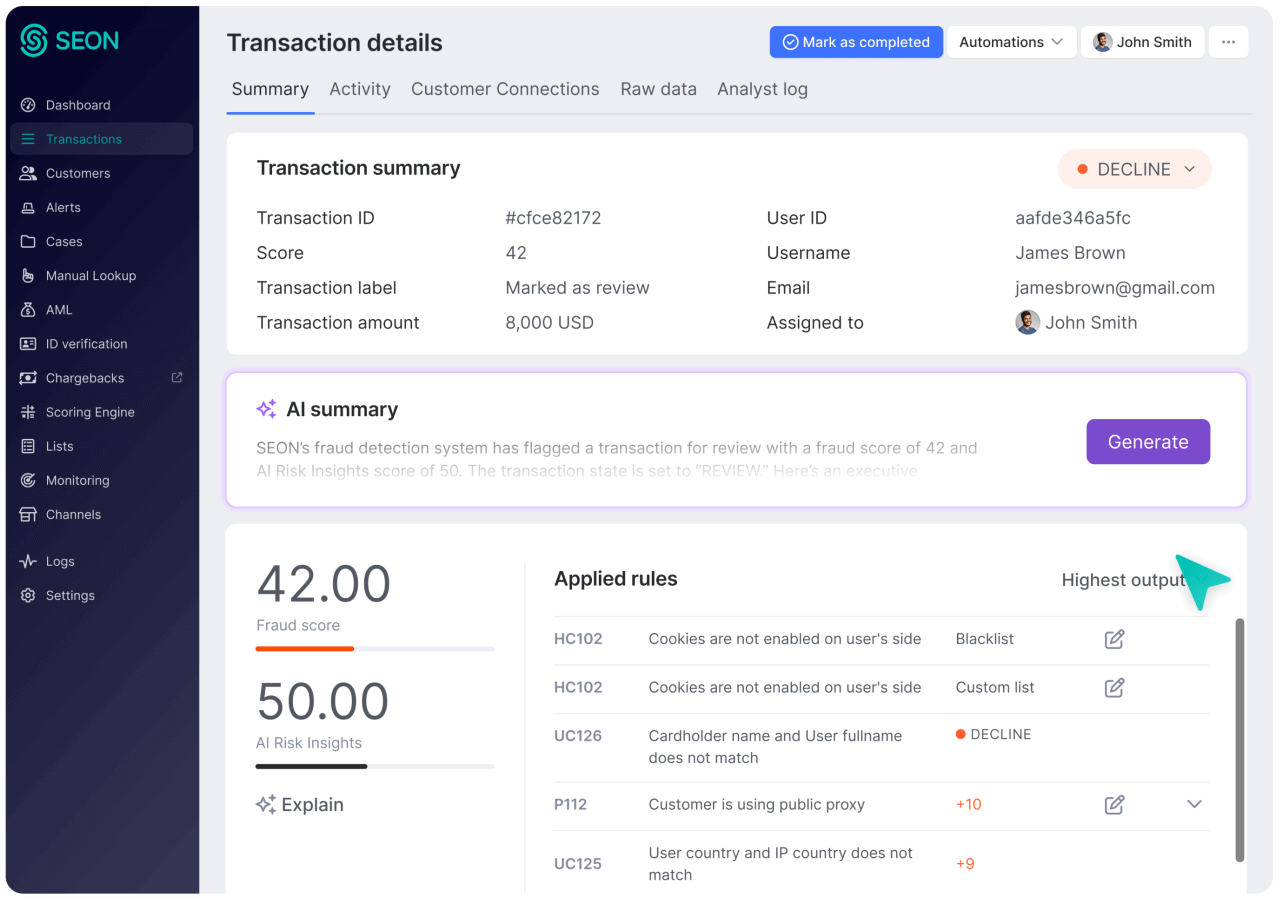

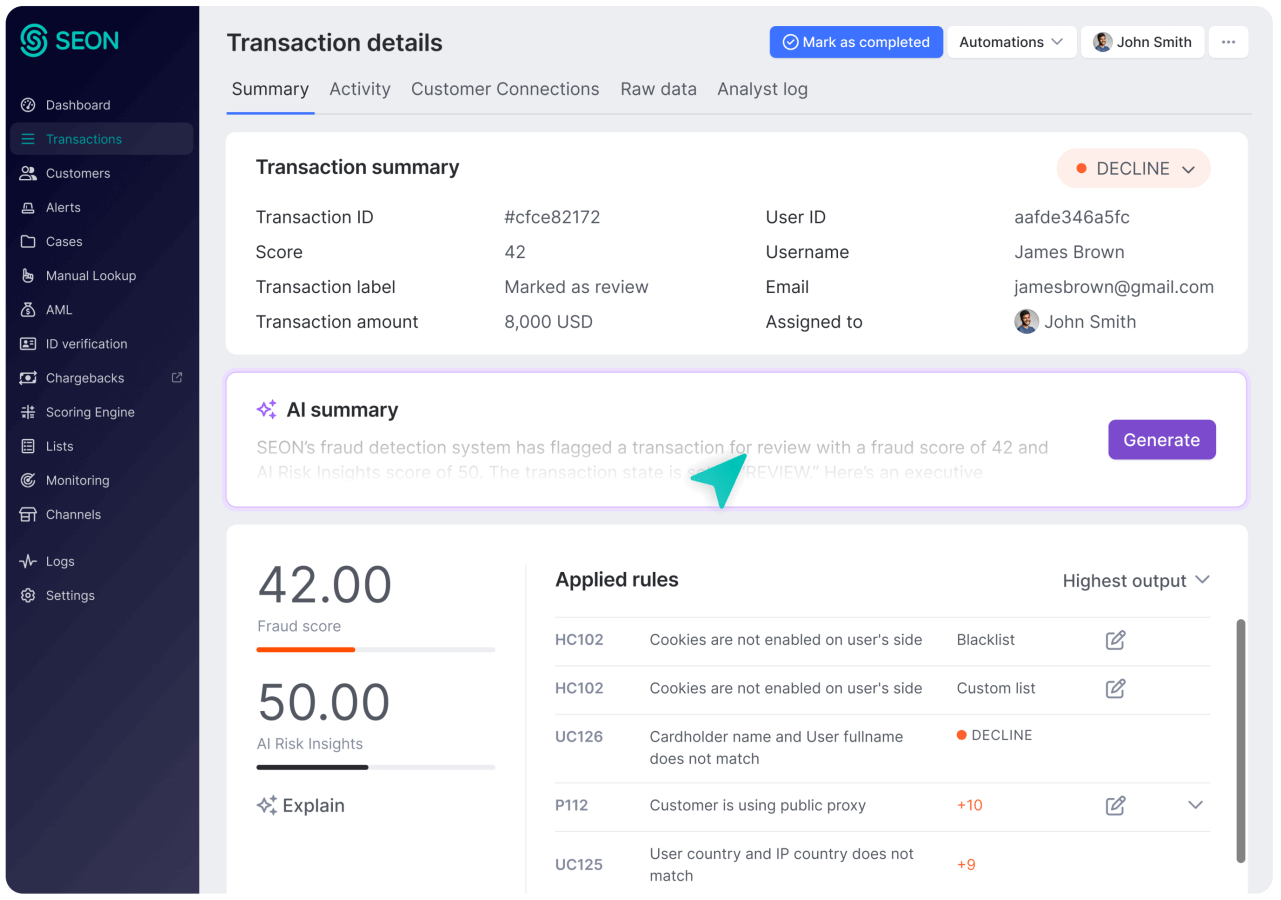

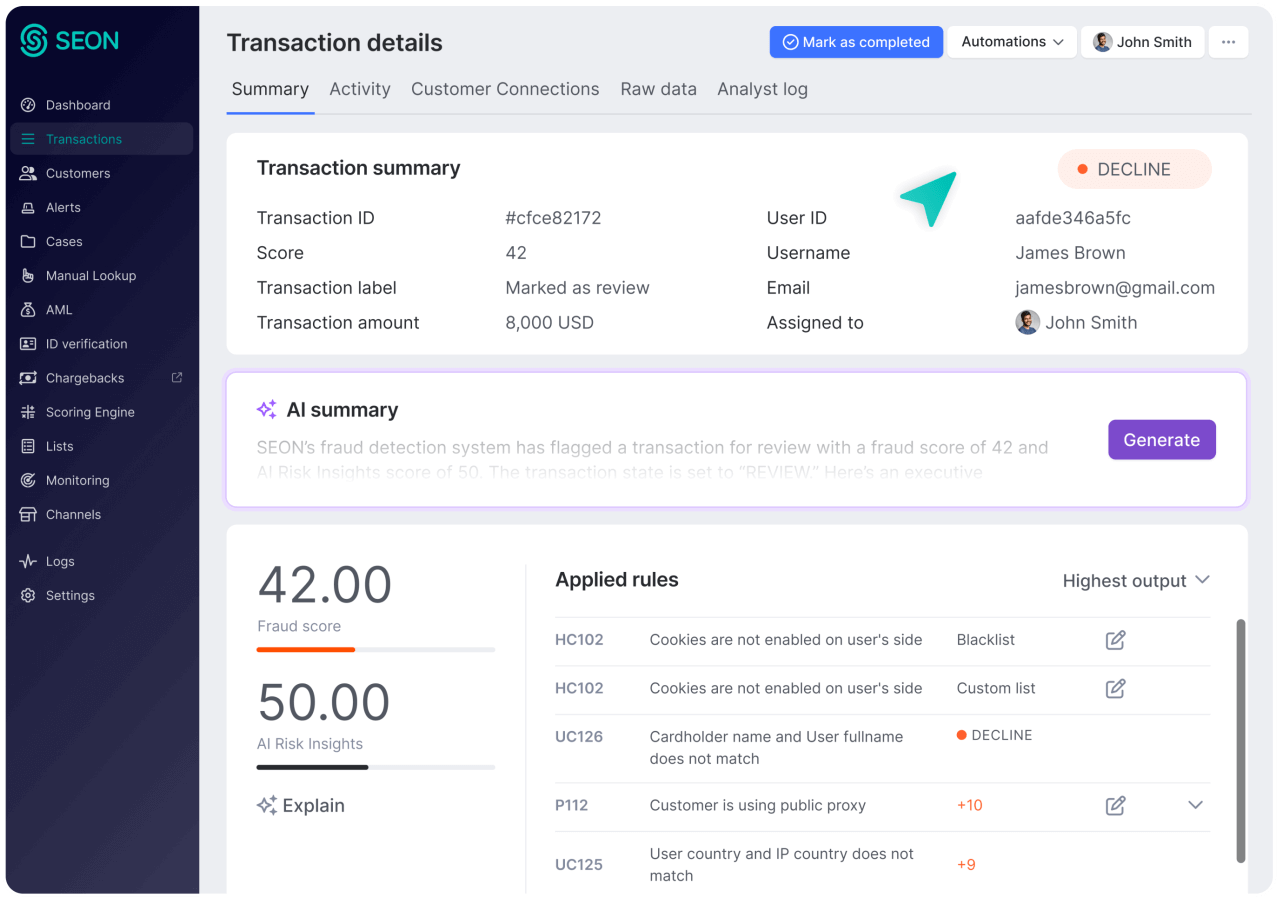

Turn Raw Signals Into Clear Context

Get Started in Days, Not Months

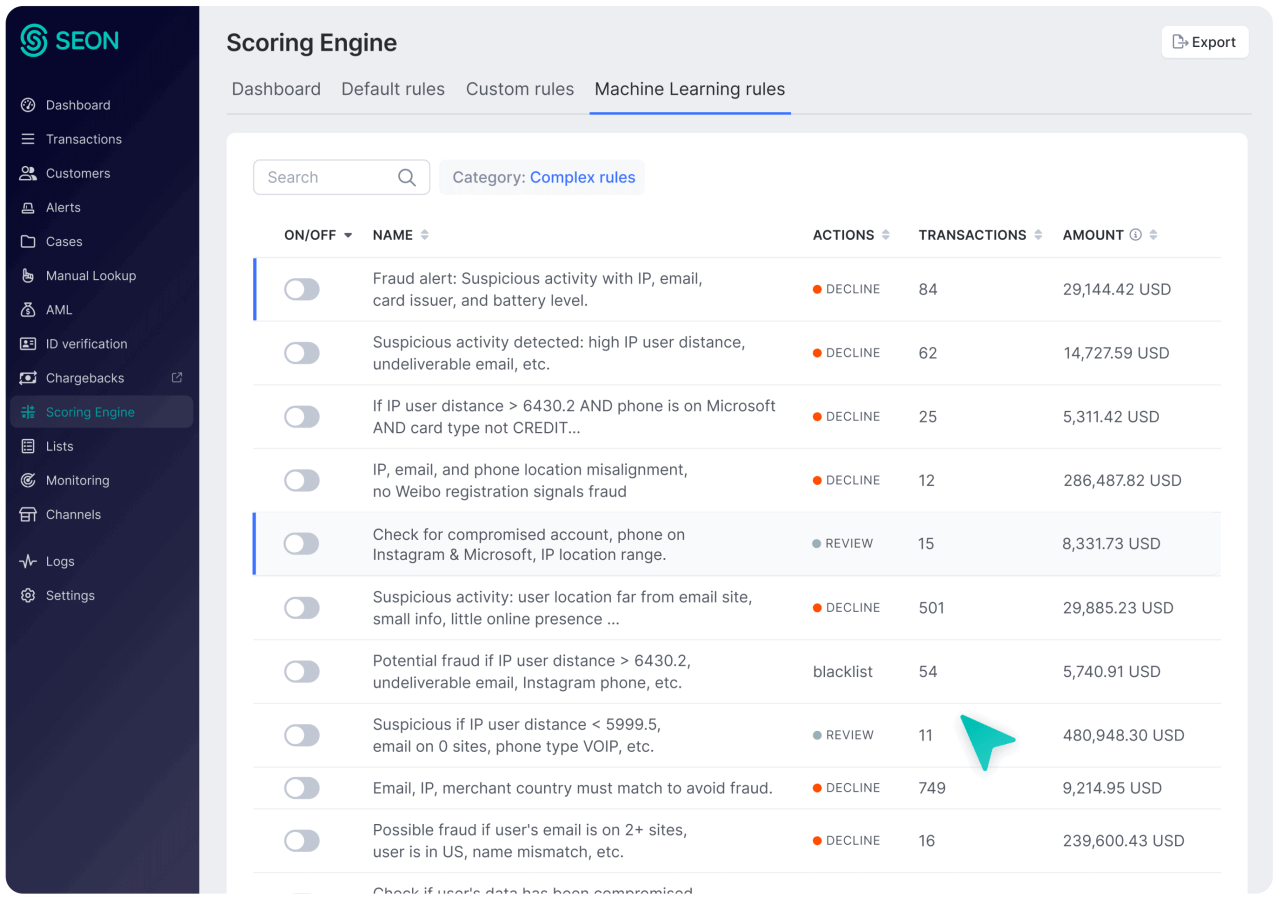

Catch Emerging Threats With AI Rule Suggestions

Get Immediate Insight Into Risky Signals

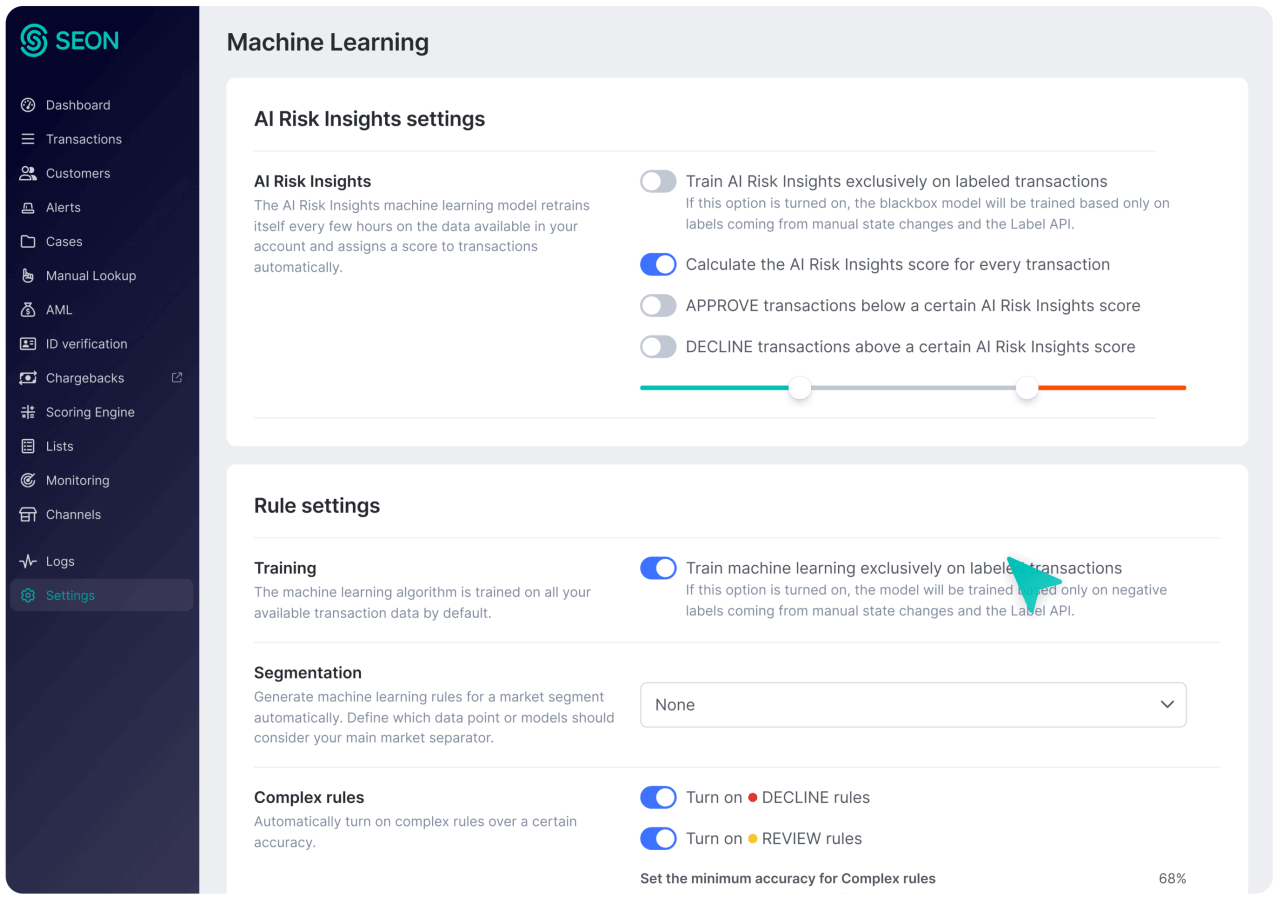

Train Models On Real-World Results

Automate Your Next Move

Discover How Companies Win

“I couldn’t believe how fast the results came. Our chargeback rates dropped by 91% in one month. Moreover, the number of fraud catch rates continued to improve in the following 6 months, which is the benefit of deploying a machine learning algorithm to fine-tune accuracy.”

Gergely Kalman

CEO at Unbuffered

“We saw an immediate 25% drop in fraudulent transactions and when we layered on machine learning, we increased the accuracy of detecting fraud by an additional 15%.”

Lucrecia Vera

Partner, Solventa

Learn More About Machine Learning & AI

-

Learn how AI and machine learning detect and prevent fraud in real time across industries.

-

Blackbox machine learning detects complex fraud patterns but lacks transparency, making it best paired with explainable tools like SEON.

-

Whitebox machine learning enhances fraud prevention with transparent decisions, customizable rules, and improved detection.

Frequently Asked Questions

Yes. SEON lets you tailor every alert trigger and rule to your internal risk appetite, compliance policies and regional obligations all without writing code. You can adjust rule thresholds, select which data signals to use, and define conditions based on fraud, AML, or behavioral insights to fit your evolving needs. You can read more about rule recommendations and AML transaction monitoring here.

Absolutely. SEON surfaces suspicious activity by analyzing transactions in real time using behavioral patterns, customer context and AML signals. This helps teams move beyond batch reviews and take immediate action when needed.

SEON reduces alert fatigue by letting you set highly specific, granular rules and alert triggers for every scenario imaginable that focus on true risk, not noise. By layering fraud signals (like IPs and devices) with AML and transactional data, analysts can better prioritize alerts and avoid wasting time on low-risk activity.

Yes. SEON supports direct filing of SAR, CTR and Form 8300 reports to FinCEN. Reports are pre-filled from case data and include audit trails and submission status, saving time and reducing the risk of manual errors.

You can define transaction thresholds using SEON’s no-code rule and alert trigger builder. Rules and alert triggers can be set by amount, frequency, velocity and even behavioral triggers. Adjust thresholds per user segment, jurisdiction, product or business scenario to stay aligned with your internal controls and regulatory requirements.

The #1 Fraud Prevention and AML Compliance Solution Loved by Fraud & Risk Teams

With over 350 reviews, SEON is the market leader and G2’s best fraud prevention solution.

Take the First Step Toward Transformative Fraud Prevention

“SEON significantly enhanced our fraud prevention efficiency, freeing up time and resources for better policies, procedures and rules.”

Chief Compliance Officer, Soft2Bet

Trusted by 5,000+ global organizations:

4.7

4.9

Schedule your meeting

Connect with a fraud prevention and AML compliance expert on a strategy tailored to your business needs.

This form may not be visible due to adblockers, or JavaScript not being enabled.